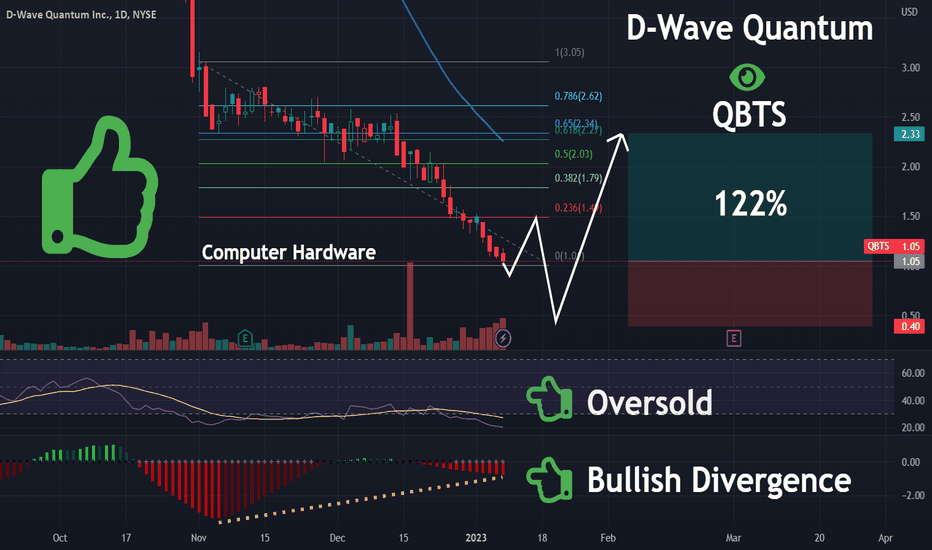

Should You Invest In D-Wave Quantum Inc. (QBTS) Stock Now?

Table of Contents

Understanding D-Wave Quantum Inc. (QBTS) and its Business Model

D-Wave Quantum Inc. (QBTS) is a pioneer in the field of quantum computing, focusing on a unique approach known as quantum annealing. Unlike gate-based quantum computers, which operate using qubits to perform calculations sequentially, D-Wave's systems solve specific optimization problems by leveraging the principles of quantum mechanics to find the lowest energy state of a system. This approach is particularly well-suited for certain types of complex problems found in areas like logistics, finance, and materials science.

D-Wave's target market encompasses various industries that can benefit from advancements in optimization and machine learning. Current clients include major players in fields such as aerospace, automotive, and pharmaceuticals. While the company hasn't yet achieved widespread profitability, its revenue streams are growing, driven by the sale of its quantum computing systems and the provision of cloud-based access to its technology. Significant revenue growth is expected as the quantum computing industry matures.

- Key Partnerships and Collaborations: D-Wave collaborates with prominent organizations such as Volkswagen, Los Alamos National Laboratory, and NASA, signifying its technological credibility and market acceptance.

- Current and Future Product Offerings: D-Wave offers various quantum computing systems with increasing qubit counts and processing power, and continues to invest heavily in research and development to enhance its technology. Future offerings may include improved integration with classical computing systems and expanded software capabilities.

- Competitive Landscape: D-Wave faces competition from other quantum computing companies developing gate-based systems, but its unique annealing approach positions it in a distinct market niche.

Analyzing the Potential Risks of Investing in QBTS Stock

Investing in QBTS stock, like any investment in a growth-stage technology company, involves inherent risks. The quantum computing industry is still in its nascent stages, presenting numerous challenges and uncertainties:

-

Technological Hurdles: Developing and scaling quantum computing technology is exceptionally complex and resource-intensive. Technological setbacks could significantly impact D-Wave's progress and the value of its stock.

-

Market Adoption: The widespread adoption of quantum computing solutions requires substantial time and investment. The market for quantum computing services may take longer to mature than initially anticipated.

-

Competition from Established Tech Giants: Established technology giants like Google, IBM, and Microsoft are also investing heavily in quantum computing research. This fierce competition could hinder D-Wave's market share and growth prospects.

-

Financial Risks: QBTS stock price is highly volatile and subject to fluctuations based on market sentiment, company performance, and technological breakthroughs.

-

Regulatory Risks: Emerging regulations concerning quantum computing and data privacy could significantly impact D-Wave's operations and profitability.

-

Market Sentiment: Investor sentiment towards quantum computing stocks can shift rapidly based on news, technological advancements, and broader market trends, leading to significant price volatility.

Evaluating the Potential Rewards of Investing in QBTS Stock

Despite the inherent risks, investing in QBTS stock presents potentially significant long-term rewards:

-

Long-Term Growth Potential: The quantum computing market is projected to experience explosive growth over the next decade. Successful companies in this field are poised to reap enormous financial benefits.

-

Market Leadership Potential: If D-Wave successfully establishes itself as a market leader in quantum annealing or expands its capabilities to other areas, the potential returns for investors could be substantial.

-

Drivers of Stock Price Appreciation: Technological advancements, successful partnerships, increased market adoption, and positive financial performance would likely drive QBTS stock price appreciation.

-

Potential for Disruptive Innovations: D-Wave's ongoing research and development efforts could yield significant breakthroughs with far-reaching implications across many industries.

-

Expected Market Share Growth: As the quantum computing market grows, D-Wave is expected to capture a significant share, particularly in the annealing segment.

-

Impact of Successful Partnerships: Successful collaborations with industry leaders will likely translate into increased revenue and market credibility, thereby positively impacting the QBTS stock price.

Comparing QBTS Stock to Other Quantum Computing Investments

Several other publicly traded companies are involved in quantum computing, each with its own strengths and weaknesses. A thorough comparison is crucial before making an investment decision. While a comprehensive comparison is beyond the scope of this article, a few key competitors include IonQ (IONQ) and Rigetti Computing (RGTI). Investors should carefully research the business models, financial performance, technological approaches, and risk profiles of these companies to make informed comparisons.

- Key Competitors: IonQ (IONQ), Rigetti Computing (RGTI), and others.

- Comparison Table: A detailed comparison table including market capitalization, revenue, profitability, and risk profiles of these competitors would be beneficial but requires in-depth financial analysis.

- Relative Strengths and Weaknesses: Each company offers unique technological approaches and targets different market segments. Comparing their strengths and weaknesses is essential for determining the most suitable investment.

Practical Considerations for Investing in QBTS Stock

Investing in QBTS stock requires a long-term perspective and a thorough understanding of the inherent risks. It's essential to adopt a well-diversified investment strategy to mitigate potential losses.

-

Investment Strategy: Consider QBTS stock as a small portion of a larger diversified portfolio, appropriate for investors with a high-risk tolerance and a long-term investment horizon.

-

Diversification and Risk Management: Don't put all your eggs in one basket. Diversify your investments across different asset classes to mitigate risk.

-

Professional Advice: Consult a qualified financial advisor before making any investment decisions, particularly in high-risk sectors like quantum computing.

-

Suggested Allocation: A small percentage (e.g., 1-5%) of a well-diversified portfolio could be allocated to QBTS stock, depending on your risk tolerance.

-

Due Diligence: Conduct extensive due diligence before investing, including studying financial reports, analyzing competitor landscapes, and assessing market trends.

-

Risk Tolerance: Assess your risk tolerance carefully. Investing in QBTS stock is only appropriate for investors comfortable with substantial price fluctuations and potential losses.

Conclusion: Should You Invest in D-Wave Quantum Inc. (QBTS) Stock Now? – A Final Verdict

Investing in D-Wave Quantum (QBTS) presents both compelling opportunities and considerable risks. The long-term potential of quantum computing is undeniable, but the industry is still in its early stages, making QBTS stock inherently volatile. While D-Wave holds a unique position in the market with its quantum annealing technology, the competition is fierce, and success is not guaranteed. For risk-averse investors, QBTS may be too volatile. However, growth-focused investors with a long-term horizon and a high-risk tolerance may find the potential rewards of investing in QBTS stock compelling.

Remember to conduct your own thorough research, consult with a financial advisor, and consider QBTS as part of a well-diversified investment strategy. While investing in QBTS stock carries inherent risks, the potential rewards in the burgeoning quantum computing sector are undeniable. Conduct your own thorough research and decide if D-Wave Quantum fits your investment strategy and risk tolerance for quantum computing investment.

Featured Posts

-

The Versatile Cassis Blackcurrant From Jams To Juices And Beyond

May 21, 2025

The Versatile Cassis Blackcurrant From Jams To Juices And Beyond

May 21, 2025 -

L Essor Des Tours Nantaises Et L Activite Croissante Des Cordistes

May 21, 2025

L Essor Des Tours Nantaises Et L Activite Croissante Des Cordistes

May 21, 2025 -

Market Reaction Dow Futures And Dollar Slip Post Moodys Downgrade

May 21, 2025

Market Reaction Dow Futures And Dollar Slip Post Moodys Downgrade

May 21, 2025 -

March 20 2025 Nyt Mini Crossword Solutions And Clues

May 21, 2025

March 20 2025 Nyt Mini Crossword Solutions And Clues

May 21, 2025 -

Peppa Pigs Mums Lavish Gender Reveal At Iconic London Location

May 21, 2025

Peppa Pigs Mums Lavish Gender Reveal At Iconic London Location

May 21, 2025