Should You Invest In Palantir Before May 5th? A Data-Driven Analysis

Table of Contents

Palantir's Recent Financial Performance and Growth Trajectory

Understanding Palantir's recent financial performance is crucial for any investment decision. Analyzing Palantir's revenue growth, profitability, and overall stock performance provides a strong foundation for assessing its future potential. Key areas to examine include:

-

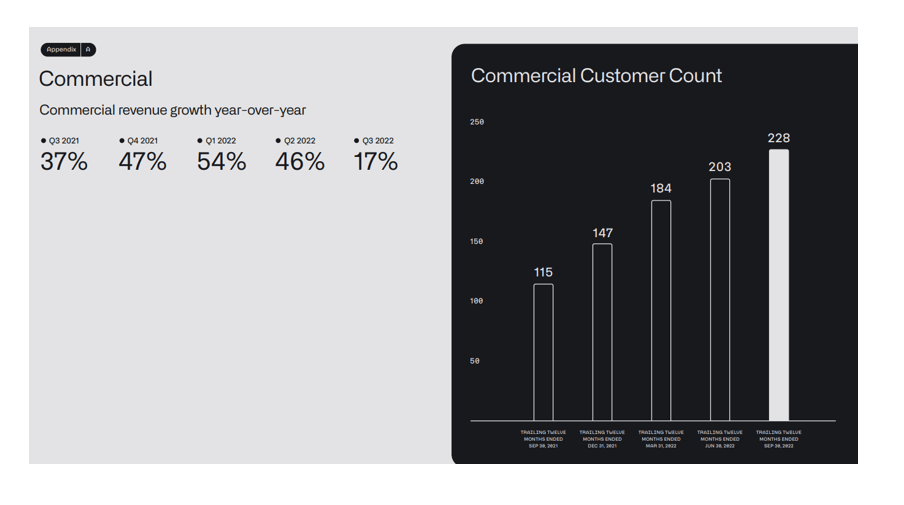

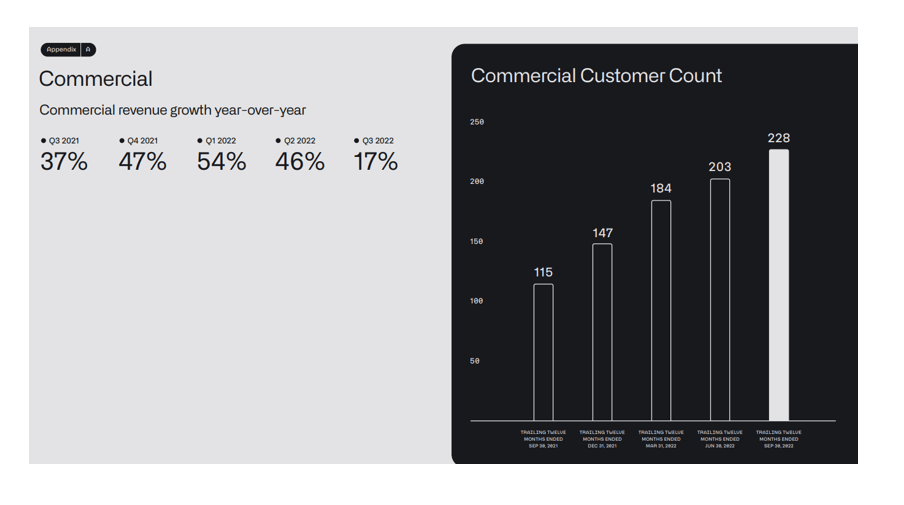

Revenue Growth: Palantir has shown consistent revenue growth in recent quarters. Examining the year-over-year and quarter-over-quarter growth rates will reveal the trajectory of the company's top-line performance. Analyzing the contribution from both government and commercial sectors is vital for understanding the sustainability of this growth. A deeper dive into the breakdown of revenue streams can highlight key drivers of growth and potential vulnerabilities.

-

Profitability: Assessing Palantir's profitability involves examining its operating margins and net income. Improving profitability indicates the company's ability to translate revenue into profit. Analyzing the trend of these metrics over time can illuminate the effectiveness of its cost management strategies and operational efficiency. Look for signs of consistent improvement as a positive indicator for future Palantir share price appreciation.

-

Key Performance Indicators (KPIs): Beyond basic financial statements, monitoring KPIs such as customer acquisition cost, customer churn rate, and average revenue per user (ARPU) provides a more nuanced understanding of Palantir's operational performance. These metrics offer insights into the health of its customer base and the long-term sustainability of its business model.

-

Government Contracts & Commercial Partnerships: A significant portion of Palantir's revenue stems from government contracts. Analyzing the size and duration of these contracts, as well as the company's success in securing new commercial partnerships, is essential for predicting future revenue streams. Diversification across these sectors reduces risk and indicates strong potential for sustained Palantir stock growth.

-

Competitive Landscape: Comparing Palantir's performance against competitors in the data analytics market, such as Tableau, Qlik, and Microsoft, helps assess its competitive positioning and market share. Identifying its unique strengths and weaknesses relative to its rivals is crucial for gauging its long-term prospects.

Analyzing the Impact of the Upcoming Earnings Report (May 5th)

The May 5th earnings report will be a pivotal event for Palantir. Analyst expectations, potential market reactions, and historical trends all play a role in predicting the post-earnings impact on the Palantir share price.

-

Analyst Expectations: Reviewing pre-earnings estimates from various financial analysts provides a benchmark against which to measure actual results. Understanding the range of expectations helps gauge the potential market reaction to a beat or miss.

-

Market Reactions: Historically, how has Palantir's stock price reacted to previous earnings reports? Analyzing this historical data can give insights into potential volatility surrounding the May 5th announcement. Consider the factors influencing these past reactions to help you anticipate the potential range of responses.

-

Catalysts & Headwinds: Are there any significant catalysts (e.g., new contract wins, product launches) or headwinds (e.g., increased competition, economic slowdown) that could influence the earnings report and subsequent market reaction? Identifying these factors is crucial for informed speculation.

-

Post-Earnings Guidance: Pay close attention to the company's guidance for future quarters. This forward-looking statement provides insight into Palantir's expectations for future revenue growth and profitability, significantly influencing investor sentiment and the Palantir stock price.

Disclaimer: Predicting stock market movements is inherently uncertain. Any analysis, including this one, is subject to inherent risks and should not be considered financial advice.

Evaluating the Risks and Rewards of Investing in Palantir

Investing in Palantir, like any investment, involves both risks and rewards. A thorough assessment of these factors is crucial before committing your capital.

-

Risks: Key risks include competition from established players and emerging startups in the data analytics space, potential regulatory changes affecting government contracts, and general market volatility. Geopolitical events and economic downturns can also impact the demand for Palantir's services.

-

Rewards: The potential rewards include significant capital appreciation if Palantir continues its growth trajectory. The company's innovative technology and strong customer base suggest a potential for long-term growth. Furthermore, the increasing demand for data analytics services globally presents a favorable market environment.

-

Competitive Advantages: Palantir’s proprietary software and strong relationships with government and commercial clients provide a competitive edge. Evaluating these advantages against competitors will help you weigh the long-term prospects.

-

Strategic Initiatives: Analyzing Palantir’s strategic initiatives, such as investments in research and development and expansion into new markets, offers insights into its future growth strategy. These initiatives can be indicators of future success or potential challenges.

-

Risk-Reward Assessment: Ultimately, the decision depends on your personal risk tolerance and investment horizon. Consider your individual financial situation before investing in Palantir.

Alternative Investment Strategies Considering the May 5th Deadline

Waiting until after the May 5th earnings report is one strategy, but other options exist.

-

Alternative Data Analytics Stocks: Explore other publicly traded companies in the data analytics sector that might offer similar growth potential with potentially lower risk. Diversification is key to mitigating overall portfolio risk.

-

Diversification Strategies: Don't put all your eggs in one basket. Diversifying your portfolio across different sectors and asset classes minimizes risk and optimizes potential returns.

-

Waiting for the Earnings Report: A conservative approach might involve waiting to see the May 5th earnings report before making an investment decision in Palantir stock. This allows you to make a more informed decision based on the actual financial results and future guidance.

Conclusion

This analysis examined Palantir's recent performance, the upcoming May 5th earnings report, and market conditions to help determine whether investing in Palantir before May 5th is advisable. While Palantir offers significant growth potential, investors must carefully consider the associated risks. Understanding the company's financial health, competitive landscape, and future growth prospects is paramount for making an informed investment decision.

Call to Action: Ultimately, the decision of whether or not to invest in Palantir before May 5th depends on your individual risk tolerance and investment goals. Conduct your own thorough due diligence and consider consulting a financial advisor before making any investment decisions regarding Palantir stock or any other security. Remember to always research thoroughly before investing in Palantir.

Featured Posts

-

Elon Musks Net Worth A Comparative Analysis Of Trumps First 100 Days

May 10, 2025

Elon Musks Net Worth A Comparative Analysis Of Trumps First 100 Days

May 10, 2025 -

Growth Opportunities Pinpointing The Countrys Best Business Locations

May 10, 2025

Growth Opportunities Pinpointing The Countrys Best Business Locations

May 10, 2025 -

West Bengal Board Madhyamik Result 2025 Merit List Announcement

May 10, 2025

West Bengal Board Madhyamik Result 2025 Merit List Announcement

May 10, 2025 -

Spring Fashion Inspiration Dakota Johnson And Melanie Griffith

May 10, 2025

Spring Fashion Inspiration Dakota Johnson And Melanie Griffith

May 10, 2025 -

Trumps Tariff Policy A 10 Baseline Exceptions Possible

May 10, 2025

Trumps Tariff Policy A 10 Baseline Exceptions Possible

May 10, 2025