Should You Invest In This SPAC Stock Challenging MicroStrategy's Dominance?

Table of Contents

Understanding the SPAC's Business Model and Target Acquisition

BACQ's stated goal is to acquire a company operating within the Bitcoin ecosystem, potentially focusing on mining, infrastructure, or innovative applications. Their acquisition strategy centers around identifying undervalued companies with high growth potential within this rapidly evolving market. The management team boasts impressive experience in finance, technology, and the cryptocurrency space, lending credibility to their ambitious plans. Financial projections, while ambitious, suggest a significant return on investment (ROI) if their acquisition strategy is successful.

- Strengths of the SPAC's business model: Experienced management team, focus on a high-growth sector, potential for significant returns.

- Weaknesses and potential risks associated with the acquisition: The success hinges entirely on identifying and acquiring a suitable target company. Delays or failure to complete an acquisition could severely impact investor returns. The inherent volatility of the Bitcoin market presents a significant risk.

- Comparison to MicroStrategy's approach: Unlike MicroStrategy's direct Bitcoin holdings, BACQ aims for indirect exposure through acquiring a Bitcoin-related business. This represents a different risk profile and investment strategy.

Assessing the Competitive Landscape: MicroStrategy vs. the SPAC

MicroStrategy's substantial Bitcoin holdings have made it a recognizable name in the corporate world. Its market capitalization and Bitcoin holdings are significant, establishing a strong presence in the market. BACQ, however, aims to disrupt this dominance by focusing on acquiring a company that provides crucial infrastructure, technology, or services within the Bitcoin ecosystem. This strategy, if successful, could carve out a unique niche and potentially challenge MicroStrategy's market leadership.

- MicroStrategy's market capitalization and Bitcoin holdings: MicroStrategy’s considerable holdings have made it a significant player, setting a benchmark for corporate Bitcoin adoption.

- SPAC's potential to disrupt the market: By acquiring a strategic asset within the Bitcoin ecosystem, BACQ could create a significant competitive advantage.

- Key differences in investment philosophy and risk tolerance: MicroStrategy's approach is relatively straightforward, focusing on direct Bitcoin ownership. BACQ takes a more indirect route, introducing higher risk, but potentially higher reward, related to the success of its acquisition.

Evaluating the Risks and Potential Rewards of Investing in the SPAC

Investing in SPACs inherently carries risks, including potential dilution of shares and uncertainty regarding management's long-term vision. The Bitcoin market's extreme volatility presents a significant risk factor for BACQ. The value of the acquired company, and therefore BACQ's stock price, would be directly impacted by Bitcoin price fluctuations. However, the potential rewards are considerable. Successful acquisition and execution of the business plan could lead to substantial gains for investors.

- Market risk associated with Bitcoin price fluctuations: The price of Bitcoin is notoriously volatile, directly influencing the value of Bitcoin-related businesses.

- Regulatory risks for Bitcoin-focused investments: Changes in regulatory landscapes could significantly impact the profitability and viability of BACQ's target acquisition.

- Potential for high returns if the SPAC's strategy is successful: A successful acquisition and subsequent growth of the target company could yield substantial returns for investors.

- Risk of the SPAC failing to complete its acquisition: If BACQ fails to identify and acquire a suitable target company, the SPAC may liquidate, leading to a loss of investment for shareholders.

Due Diligence: Researching the SPAC Before Investing

Before investing in BACQ or any SPAC, thorough due diligence is crucial. This includes carefully reviewing the SPAC's prospectus, analyzing its financial statements, and assessing the management team's track record and expertise. Investigating the target company's financial health, growth potential, and competitive landscape is equally important. Utilizing reputable financial news sources and independent analyst reports can provide valuable insights.

- Review the SPAC’s prospectus and financial filings. This is crucial to understanding its business plan, risk factors, and financial projections.

- Assess the management team’s experience and reputation. A strong management team is vital for the success of any investment.

- Analyze the target company’s financial health and growth potential. Thorough analysis is essential to ensure the viability of the acquisition.

- Consult with a financial advisor before investing. Professional financial advice can help you make informed decisions aligned with your investment goals and risk tolerance.

Conclusion: Should You Invest in This SPAC Stock Challenging MicroStrategy's Dominance?

BACQ presents a potentially high-reward, high-risk investment opportunity in the Bitcoin market. While its strategy of acquiring a Bitcoin-related business offers a different approach compared to MicroStrategy's direct holdings, it carries inherent risks associated with SPACs and the volatile nature of Bitcoin. The success hinges critically on the successful acquisition and subsequent performance of the target company. Before making any investment decisions regarding this SPAC stock challenging MicroStrategy's dominance in the Bitcoin market, conduct thorough research and carefully consider all relevant factors. Remember, investing in SPACs requires careful consideration and should align with your individual risk tolerance and investment objectives.

Featured Posts

-

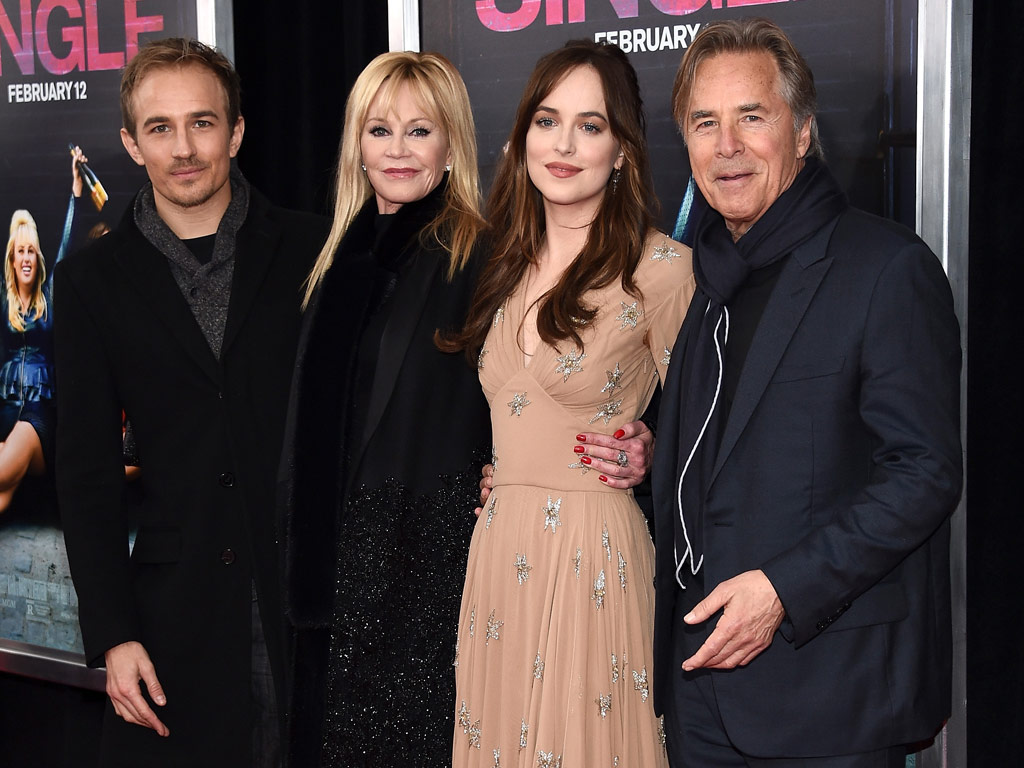

Dakota Johnson And Melanie Griffith Shine At Materialists Screening

May 09, 2025

Dakota Johnson And Melanie Griffith Shine At Materialists Screening

May 09, 2025 -

14 Edmonton Area Schools A Speedy Construction Plan Unveiled

May 09, 2025

14 Edmonton Area Schools A Speedy Construction Plan Unveiled

May 09, 2025 -

S Sh A I Noviy Potok Bezhentsev Iz Ukrainy Vzglyad Iz Germanii

May 09, 2025

S Sh A I Noviy Potok Bezhentsev Iz Ukrainy Vzglyad Iz Germanii

May 09, 2025 -

Gjysmefinalet E Liges Se Kampioneve Psg Dominon Formacionet

May 09, 2025

Gjysmefinalet E Liges Se Kampioneve Psg Dominon Formacionet

May 09, 2025 -

Lisa Rays Complaint Against Air India Airline Denies Claims

May 09, 2025

Lisa Rays Complaint Against Air India Airline Denies Claims

May 09, 2025