Should You Invest In XRP (Ripple)? Weighing The Risks And Rewards

Table of Contents

Understanding XRP and Ripple's Technology

What is XRP?

XRP is a cryptocurrency designed to facilitate fast and inexpensive international transactions. Unlike Bitcoin or Ethereum, which rely on complex mining processes, XRP operates on a unique consensus mechanism, enabling significantly faster transaction speeds and lower fees. It acts as a bridge currency, enabling seamless conversions between different fiat currencies and other cryptocurrencies within the RippleNet network.

- Speed: XRP transactions are processed in a matter of seconds, significantly faster than many other cryptocurrencies.

- Low Transaction Fees: The cost of sending XRP is minimal compared to traditional banking fees or other cryptocurrencies.

- Scalability: XRP's network is designed for high scalability, meaning it can handle a large volume of transactions without compromising speed or efficiency.

- RippleNet Integration: XRP is intrinsically linked to RippleNet, Ripple's global payment network used by banks and financial institutions for cross-border payments.

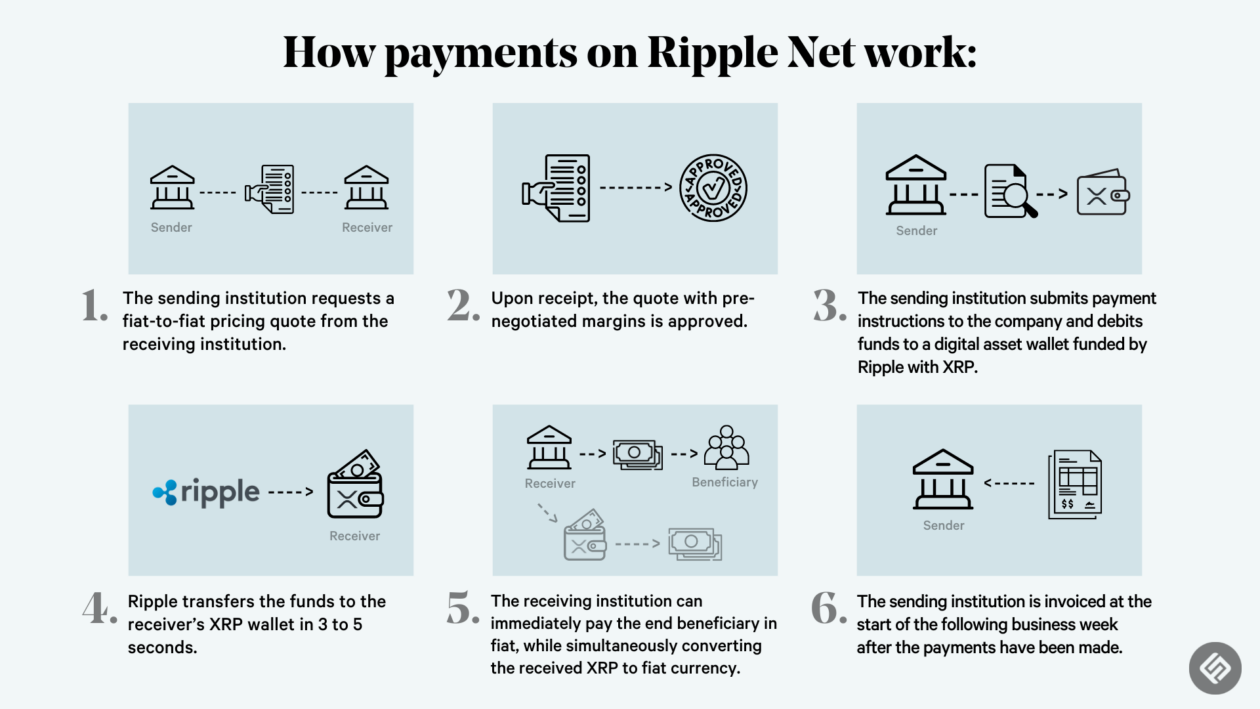

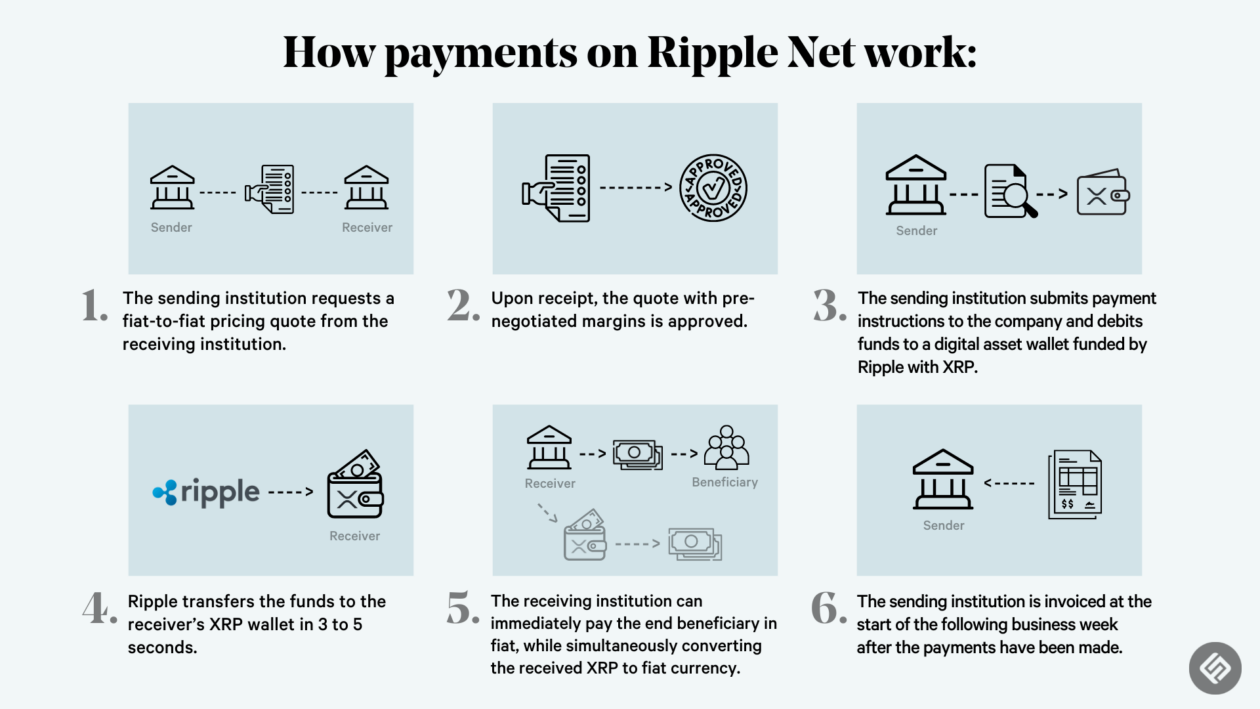

RippleNet and its Impact on XRP

RippleNet utilizes XRP to provide a fast, efficient, and cost-effective solution for international payments. By leveraging XRP's speed and low fees, RippleNet aims to disrupt the traditional banking system. The wider adoption of RippleNet by financial institutions could significantly increase demand for XRP, potentially driving its price upwards.

- Key Partners: RippleNet boasts partnerships with numerous major banks and financial institutions globally, including Santander, SBI Holdings, and many others. These partnerships represent significant potential for XRP adoption.

- Success Stories: Numerous successful implementations of RippleNet showcase the real-world applications and potential of XRP in facilitating international payments. These successful case studies contribute positively to XRP price prediction models.

- Increased XRP Demand: As RippleNet expands its reach and adoption grows, the demand for XRP as a bridge currency is likely to increase, potentially impacting its price positively.

Assessing the Market Position of XRP

XRP's Market Capitalization and Price Volatility

XRP's market capitalization fluctuates, placing it among the top cryptocurrencies by market cap, although its position can change rapidly. However, XRP's price has historically exhibited significant volatility, influenced by various factors.

- Market Cap Comparison: Comparing XRP's market capitalization to other major cryptocurrencies like Bitcoin and Ethereum provides valuable context for assessing its relative size and potential.

- Price Fluctuation Factors: News related to regulations (especially the SEC lawsuit), overall market sentiment, technological advancements within the Ripple ecosystem, and general cryptocurrency market trends all significantly influence XRP's price fluctuations. This directly impacts XRP price prediction efforts.

XRP's Trading Volume and Liquidity

XRP enjoys relatively high liquidity across major cryptocurrency exchanges, making it relatively easy to buy and sell. High liquidity is crucial for investors as it minimizes slippage and allows for easier entry and exit from positions.

- Major Exchanges: XRP is listed on many prominent cryptocurrency exchanges, ensuring wide accessibility and significant trading volume.

- Trading Volume: High trading volume indicates strong market interest and contributes to XRP's overall liquidity.

- Liquidity Importance: High liquidity is a key factor for investors, reducing the risk of significant price fluctuations when buying or selling large amounts of XRP.

Navigating the Regulatory Landscape for XRP

The SEC Lawsuit and its Implications

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price and future. The lawsuit alleges that XRP is an unregistered security, potentially leading to significant consequences for Ripple and XRP holders.

- Arguments and Potential Outcomes: Understanding the arguments presented by both the SEC and Ripple is crucial for evaluating the potential outcomes of the lawsuit. Various possible outcomes range from a complete dismissal to a ruling that significantly impacts XRP’s status.

- Regulatory Uncertainty: The uncertainty surrounding the outcome of the lawsuit creates significant risk for XRP investors. The regulatory status of XRP varies considerably across different jurisdictions, adding further complexity.

Regulatory Uncertainty and Investment Risk

Regulatory uncertainty is a major risk factor in the cryptocurrency market, and XRP is particularly vulnerable. Changes in regulatory frameworks can drastically affect XRP's price and trading activity.

- Impact of Regulatory Changes: New regulations or rulings can significantly influence XRP's price, either positively or negatively, highlighting the importance of staying informed about regulatory developments.

- Diversification Strategies: Diversifying your investment portfolio can help mitigate the risk associated with regulatory uncertainty. This is crucial for any investment in XRP.

Exploring the Future Potential of XRP

Long-Term Growth Prospects for XRP

The long-term growth potential of XRP hinges on several factors, including increased adoption by financial institutions, technological advancements within the Ripple ecosystem, and positive regulatory outcomes.

- Potential Scenarios: Various scenarios for XRP's future are possible, depending on the outcome of the SEC lawsuit, the continued adoption of RippleNet, and the broader development of the cryptocurrency market.

- Future Developments: Keeping abreast of future partnerships, technological improvements, and overall market trends is crucial for assessing XRP's long-term growth potential. This information directly impacts XRP price prediction efforts.

Potential Risks and Challenges for XRP

Despite its potential, XRP faces significant risks and challenges. Competition from other cryptocurrencies, technological limitations, and the ongoing legal battle represent substantial hurdles.

- Technological Competition: The cryptocurrency space is highly competitive, and the emergence of newer, faster, or more efficient technologies could negatively impact XRP's market share.

- Legal Risks: The outcome of the SEC lawsuit remains a significant risk factor, potentially leading to a significant drop in XRP's value or even delisting from exchanges.

Conclusion

Investing in XRP (Ripple) presents both significant potential rewards—faster transactions, potential for substantial growth driven by financial institution adoption, and cost-effectiveness—and considerable risks—price volatility, regulatory uncertainty, and the ongoing SEC lawsuit. A thorough understanding of these factors is critical before making any investment decision. Thoroughly research and understand the risks involved before investing in XRP or any other cryptocurrency. Conduct your own due diligence and consider consulting a financial advisor before investing in XRP. Remember, only invest what you can afford to lose. Weigh the potential benefits and risks of XRP carefully before deciding whether it's the right investment for you.

Featured Posts

-

Rihannas Engagement The Ring And The Red Heels

May 07, 2025

Rihannas Engagement The Ring And The Red Heels

May 07, 2025 -

Anthony Edwards And Ayesha Howard Custody Battle Resolved

May 07, 2025

Anthony Edwards And Ayesha Howard Custody Battle Resolved

May 07, 2025 -

The Karate Kid Part Iii A Retrospective Review

May 07, 2025

The Karate Kid Part Iii A Retrospective Review

May 07, 2025 -

Golden States Offensive Prowess Against Houstons Defensive Strength

May 07, 2025

Golden States Offensive Prowess Against Houstons Defensive Strength

May 07, 2025 -

Alex Ovechkins Florida Workout Partner Revealed Darius Kasparaitis

May 07, 2025

Alex Ovechkins Florida Workout Partner Revealed Darius Kasparaitis

May 07, 2025