Should You Invest In XRP (Ripple) While It's Under $3?

Table of Contents

Understanding the Current Market Sentiment Towards XRP

The cryptocurrency market is notoriously volatile, and XRP is no exception. Current market conditions affecting XRP's price are multifaceted, influenced by broader macroeconomic factors, regulatory uncertainty, and the ongoing Ripple vs. SEC lawsuit. Analyzing recent news and events is crucial for understanding the prevailing investor sentiment – whether it's bullish (optimistic), bearish (pessimistic), or neutral.

- Recent Price Movements and Volatility: XRP's price has experienced significant swings in recent months. Tracking these fluctuations, alongside trading volume, provides insight into market confidence.

- Social Media Sentiment Analysis: Monitoring social media platforms like Twitter and Reddit for discussions and opinions about XRP can offer a sense of public perception and sentiment. However, it's crucial to treat this information with caution, as it can be heavily influenced by speculation.

- Expert Opinions and Predictions: Following the analyses and predictions of experienced cryptocurrency analysts and financial experts can provide valuable context, although it's essential to remember that these are opinions, not guarantees.

The Ripple vs. SEC Lawsuit: Its Impact on XRP Investment

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's price and investment prospects. The SEC alleges that XRP is an unregistered security, a claim that Ripple denies. The outcome of this lawsuit could dramatically affect XRP's future.

- Summary of the Lawsuit's Claims: The SEC argues that Ripple's sale of XRP constitutes an unregistered securities offering, violating federal laws.

- Potential Scenarios and Their Consequences for XRP Investors: A ruling in favor of the SEC could severely devalue XRP, potentially leading to significant losses for investors. Conversely, a favorable ruling for Ripple could trigger a substantial price surge.

- Analysis of Legal Experts' Predictions: Legal experts offer varying opinions on the case's likely outcome, emphasizing the uncertainty inherent in the legal process.

XRP's Technology and Potential for Future Growth

XRP's underlying technology and its potential for future growth are key factors to consider. XRP aims to facilitate fast and cost-effective cross-border payments. RippleNet, Ripple's payment network, utilizes XRP to streamline transactions for financial institutions.

- XRP's Role in Cross-Border Payments: XRP's speed and low transaction fees are attractive features for international payments.

- RippleNet's Growth and Impact: The expansion of RippleNet and its adoption by financial institutions influence XRP's demand and value.

- Potential Future Applications of XRP Technology: Beyond cross-border payments, future applications of XRP's technology could further enhance its value and adoption.

Risk Assessment: Investing in XRP Below $3

Investing in XRP, even at a seemingly low price like under $3, carries substantial risks. It's crucial to carefully assess these before making any investment decisions.

- Volatility Risk: The cryptocurrency market is inherently volatile. XRP's price can fluctuate dramatically in short periods.

- Regulatory Risk (SEC Lawsuit): The outcome of the SEC lawsuit represents a significant regulatory risk. An unfavorable ruling could severely impact XRP's value.

- Market Risk: Broader market conditions, such as economic downturns or shifts in investor sentiment toward cryptocurrencies, can negatively impact XRP's price.

- Opportunity Cost: Investing in XRP means foregoing other potential investment opportunities that may offer higher returns or lower risk.

Alternative Investment Options to Consider

Before investing solely in XRP, explore alternative investment options to diversify your portfolio and mitigate risk.

- Comparison to Other Cryptocurrencies (e.g., Bitcoin, Ethereum): Bitcoin and Ethereum, being more established cryptocurrencies, often display lower volatility than XRP.

- Comparison to Traditional Investment Options: Consider traditional assets like stocks, bonds, and real estate, which may offer greater stability and lower risk.

Conclusion: Should You Invest in XRP (Ripple) While it's Under $3? A Final Verdict

The decision of whether to invest in XRP while it's under $3 is complex and depends on your individual risk tolerance, financial situation, and investment goals. While its current price may seem attractive, the risks associated with the ongoing SEC lawsuit and inherent cryptocurrency market volatility cannot be ignored. Thorough research, careful risk assessment, and diversification are crucial. Ultimately, the decision of whether or not to invest in XRP while it's under $3 is a personal one. Conduct your own thorough research, understand the risks involved, and make an informed decision about your XRP investment strategy.

Featured Posts

-

The Impact Of The Ukraine War On Global And European Military Spending

May 01, 2025

The Impact Of The Ukraine War On Global And European Military Spending

May 01, 2025 -

La Flaminia Sale In Classifica Dal Quinto Al Secondo Posto

May 01, 2025

La Flaminia Sale In Classifica Dal Quinto Al Secondo Posto

May 01, 2025 -

Dont Fall Victim Identifying And Avoiding Fake Steven Bartlett Content

May 01, 2025

Dont Fall Victim Identifying And Avoiding Fake Steven Bartlett Content

May 01, 2025 -

Anaheim Ducks Fall To Dallas Stars Despite Leo Carlssons Two Goals

May 01, 2025

Anaheim Ducks Fall To Dallas Stars Despite Leo Carlssons Two Goals

May 01, 2025 -

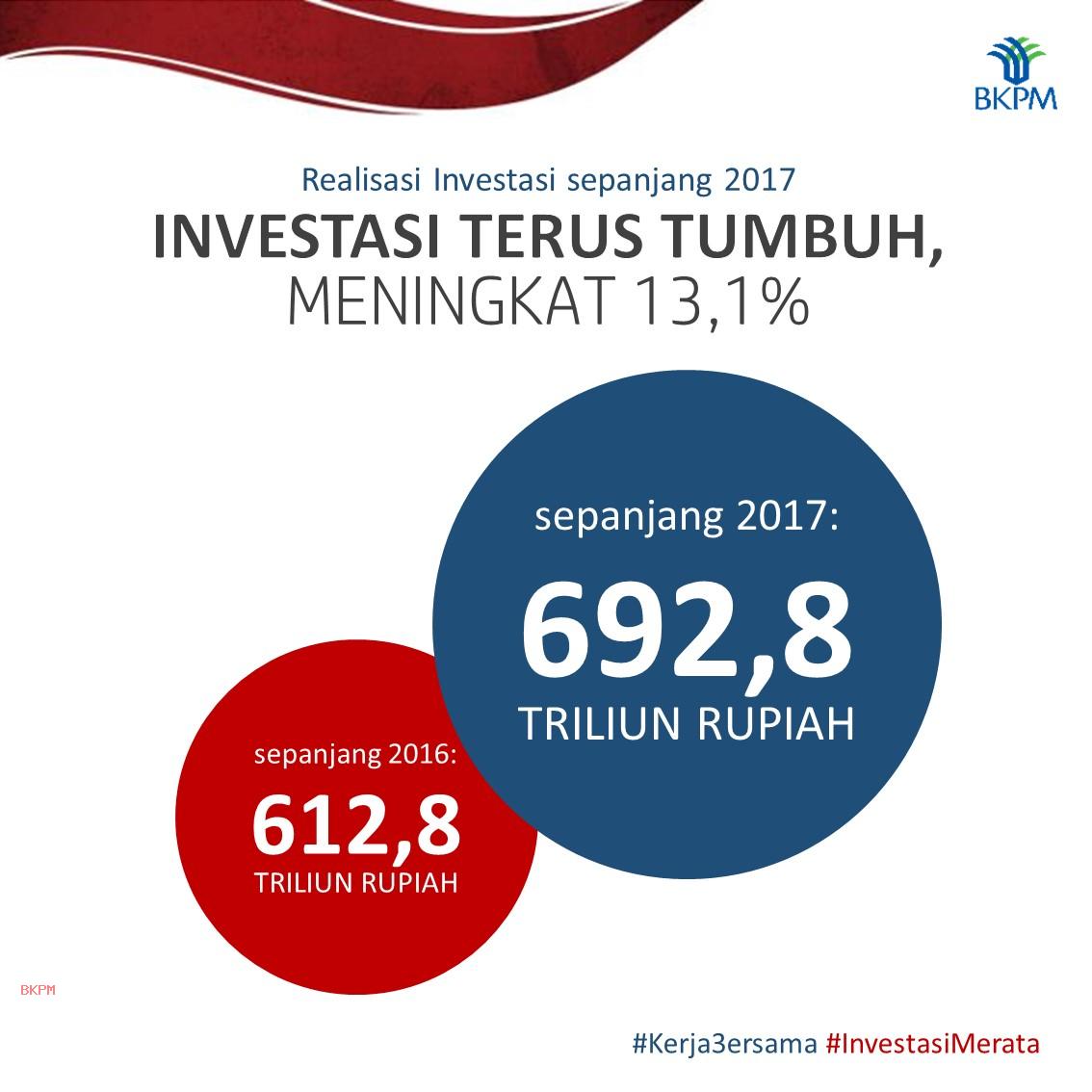

Investasi Pekanbaru Target Bkpm Rp 3 6 Triliun Tahun 2024

May 01, 2025

Investasi Pekanbaru Target Bkpm Rp 3 6 Triliun Tahun 2024

May 01, 2025