Significant Asset Reduction At Schroders: Q1 Market Impact

Table of Contents

Market Volatility and its Impact on Schroders' Assets Under Management (AUM)

The first quarter of the year was marked by considerable market volatility, driven by a confluence of macroeconomic factors. High inflation, aggressive interest rate hikes by central banks globally, and persistent geopolitical uncertainty created a challenging backdrop for investors. These conditions directly impacted Schroders' investment strategies and, consequently, client portfolios.

- Impact of rising interest rates on bond markets: The rapid increase in interest rates led to a decline in bond values, affecting portfolios heavily invested in fixed-income securities. This negatively impacted Schroders' AUM, particularly in its bond-focused strategies.

- Effect of inflation on investor sentiment and risk appetite: High inflation eroded purchasing power and fueled investor anxiety, leading to a more risk-averse sentiment. This resulted in decreased investment activity and capital outflows from various asset classes.

- Geopolitical events and their influence on global markets: Ongoing geopolitical instability, including the war in Ukraine and rising tensions in other regions, created further uncertainty and volatility in global markets, impacting investor confidence and investment decisions across all asset classes managed by Schroders. This uncertainty significantly contributed to the negative impact on Schroders' investment performance.

Outflows and Net Redemptions: Client Behavior and Portfolio Shifts

The market volatility directly influenced client behavior, resulting in significant net redemptions and asset outflows from Schroders. Clients, reacting to the uncertain market conditions, shifted their investment strategies, favoring safer, more conservative options.

- Breakdown of net redemptions across different asset classes: While precise figures might vary pending official reports, it's likely that equity funds experienced the most significant outflows, followed by less liquid alternative investments. Bond funds also faced pressure due to rising interest rates, contributing to the overall reduction in AUM.

- Potential reasons for client withdrawals: Risk aversion was a key driver for client withdrawals. Investors, seeking to protect their capital in an uncertain environment, opted for less volatile investments, even at the cost of potential returns. Some might have also shifted investments to alternative asset managers perceived as having a stronger track record in volatile markets.

- Impact of competitive pressures from other asset managers: The challenging market conditions intensified competition among asset management firms. Some competitors might have presented more compelling strategies or achieved better relative performance, potentially attracting clients away from Schroders.

Schroders' Response to the Asset Reduction: Strategic Initiatives and Outlook

In response to the significant asset reduction, Schroders has likely implemented several strategic initiatives to mitigate losses and position itself for future growth. While details may emerge through subsequent reports and investor calls, potential actions include:

- Specific cost-cutting measures: These could involve streamlining operations, reducing personnel, and optimizing investment management processes to improve efficiency and profitability.

- New product launches or investment initiatives: Schroders might have launched new investment products tailored to the current market conditions, focusing on strategies that appeal to a risk-averse investor base seeking stability and capital preservation.

- Schroders' long-term strategy for regaining lost assets: A key aspect of their response will likely involve clearly communicating their long-term investment strategy and building confidence amongst existing and potential clients. This might involve adjusting their investment approach to better reflect current market realities and focusing on specific niche areas where they can gain a competitive advantage.

Comparison to Competitors: Schroders' Performance in the Broader Market Context

To fully understand the Significant Asset Reduction at Schroders, it's essential to compare its Q1 performance to its peers in the asset management industry. While precise comparative data requires further analysis of other firms' Q1 reports, the overall market downturn likely impacted several large asset managers. Analyzing industry-wide trends and market benchmarks will offer a clearer perspective on Schroders' relative performance during this volatile period. This comparative analysis will reveal whether Schroders' experience was unique or reflected broader industry challenges.

Conclusion: Understanding the Significant Asset Reduction at Schroders: Q1 Market Impact

The Significant Asset Reduction at Schroders in Q1 was primarily driven by market volatility stemming from inflation, rising interest rates, and geopolitical uncertainty. This volatility impacted client behavior, leading to significant net redemptions and outflows. Schroders is likely responding through cost optimization, new product launches, and a revised long-term investment strategy. Analyzing Schroders' performance within the broader asset management industry context reveals that while the firm faced substantial challenges, these difficulties were also widespread. Understanding this event is vital for investors and market analysts. We encourage readers to continue following Schroders' performance and further research the impact of Q1 market volatility on the broader asset management industry, including a detailed analysis of Schroders' Asset Management Performance and further exploration of Analyzing Schroders' Q1 Asset Reduction.

Featured Posts

-

Epic Games Takes Fortnite Offline Update 34 40 Server Maintenance

May 03, 2025

Epic Games Takes Fortnite Offline Update 34 40 Server Maintenance

May 03, 2025 -

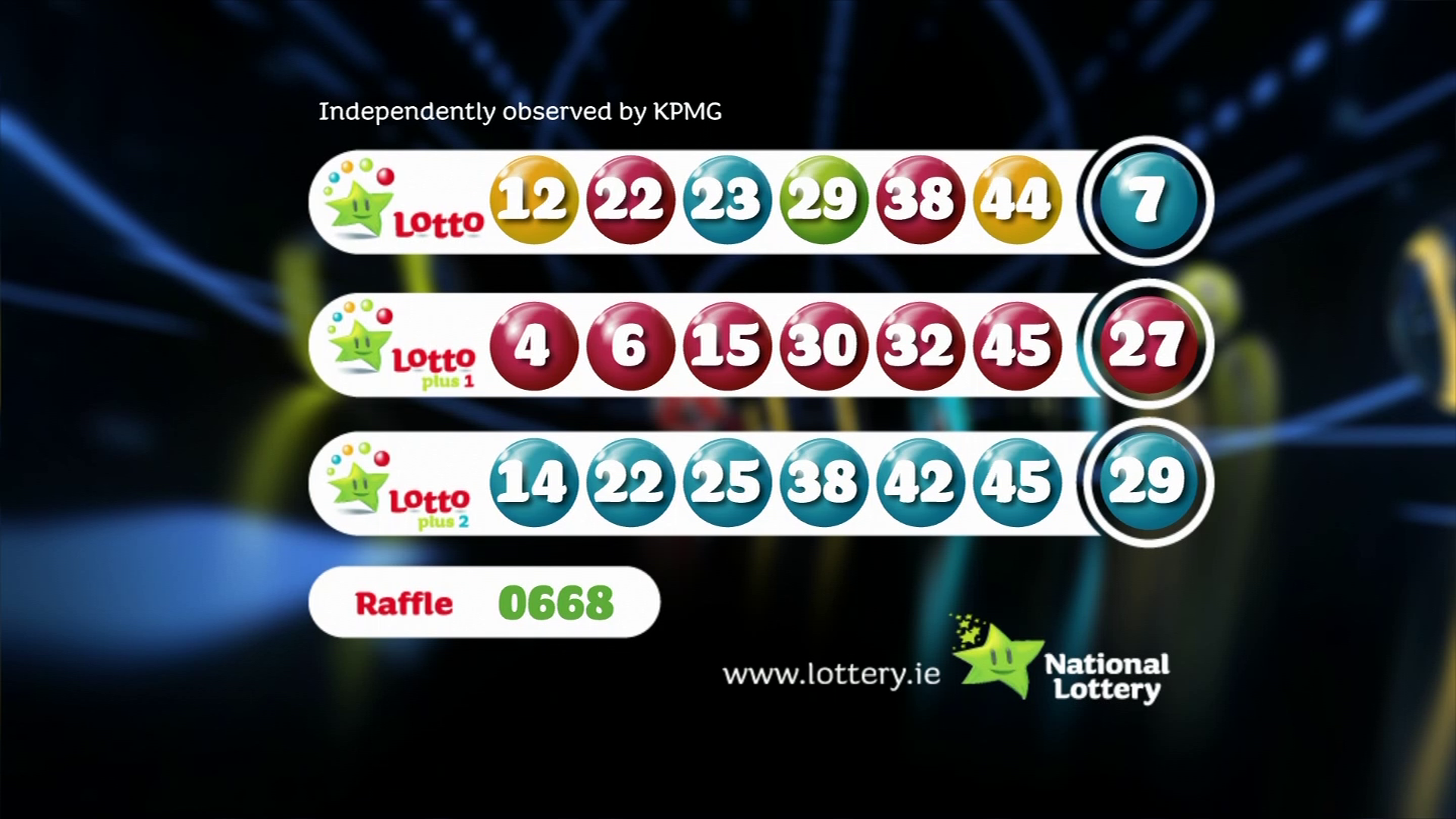

Lotto Plus 1 And Lotto Plus 2 Results Check The Winning Numbers

May 03, 2025

Lotto Plus 1 And Lotto Plus 2 Results Check The Winning Numbers

May 03, 2025 -

The Trump Tariffs And The Limits Of Judicial Review

May 03, 2025

The Trump Tariffs And The Limits Of Judicial Review

May 03, 2025 -

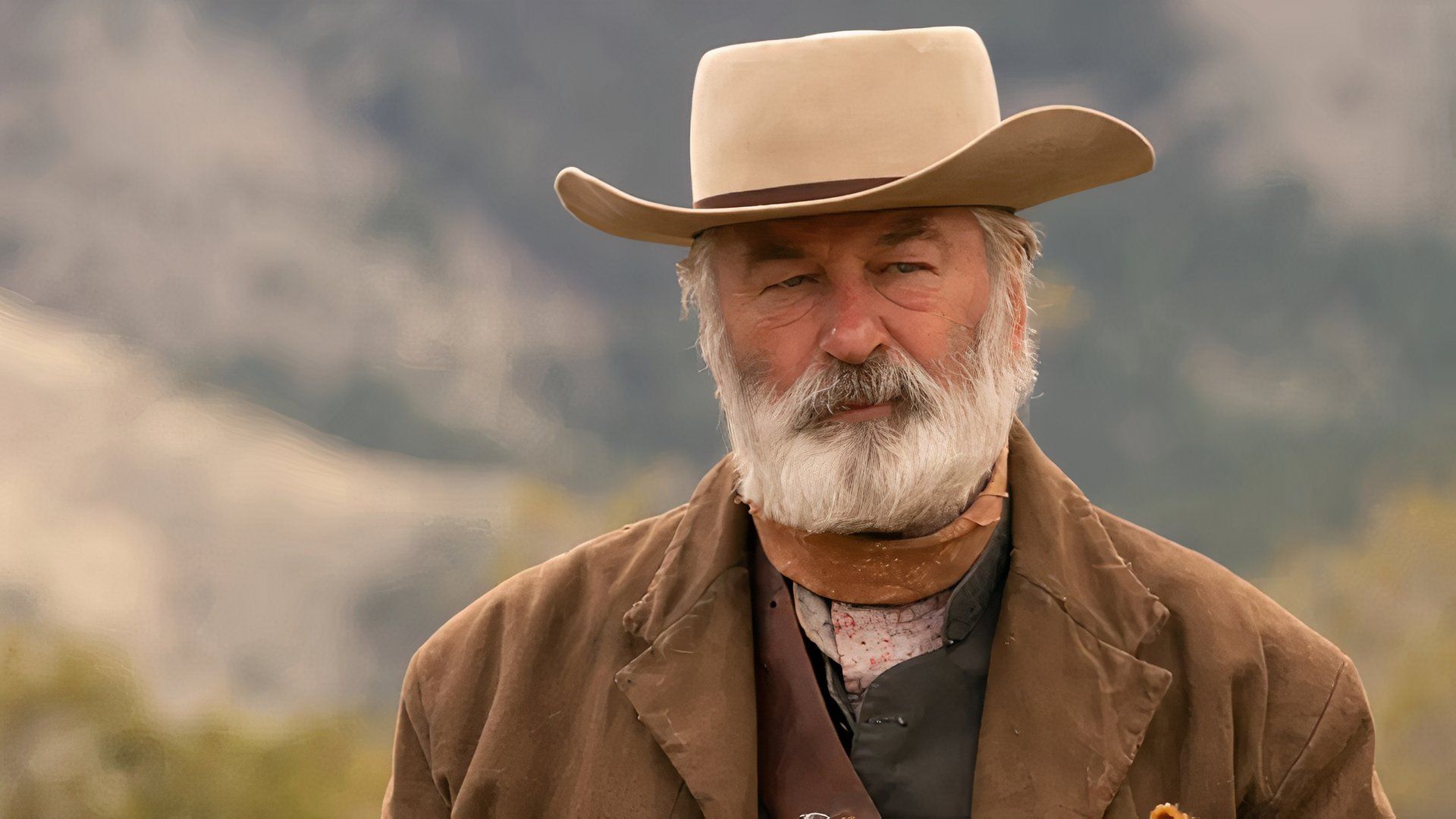

Alec Baldwins Rust A Film Review Following The On Set Tragedy

May 03, 2025

Alec Baldwins Rust A Film Review Following The On Set Tragedy

May 03, 2025 -

11 High School Lacrosse Players Surrender In Syracuse Hazing Case

May 03, 2025

11 High School Lacrosse Players Surrender In Syracuse Hazing Case

May 03, 2025