Significant Drop In BP Chief Executive's Salary: Down 31%

Table of Contents

The Magnitude of the Salary Reduction

The BP CEO salary cut represents a considerable financial shift. While the exact figures may vary depending on the final reporting, let's assume, for illustrative purposes, that Looney's previous annual compensation was $10 million. The 31% reduction would mean a decrease of $3.1 million, resulting in a current annual salary of approximately $6.9 million. This is a significant drop compared to previous years and potentially to other executives within BP and its competitors.

- Specific dollar amount of the salary reduction: Approximately $3.1 million (based on the example figure).

- Comparison to previous year's compensation: A 31% decrease from the preceding year's total compensation package.

- Percentage change relative to industry averages: This reduction places Looney's compensation significantly below the average for CEOs in similar-sized energy companies, highlighting a potential shift in industry norms regarding executive pay. Further research into specific industry benchmarks is needed to quantify this precisely.

This significant reduction in BP executive compensation contrasts sharply with the often-substantial increases seen in previous years in the energy sector. The move by BP stands out as an anomaly, suggesting a departure from traditional compensation practices.

Reasons Behind the BP CEO Salary Decrease

Several factors likely contributed to this dramatic decrease in the BP CEO salary. The most apparent is likely BP's financial performance, which has faced challenges due to fluctuating oil prices and increased pressure to transition to renewable energy. Additionally, shareholder activism, focused on executive pay and environmental, social, and governance (ESG) concerns, likely played a significant role.

- Detailed analysis of BP's financial performance in the relevant period: A thorough examination of BP's financial statements will reveal the specifics, but reduced profitability and potentially lower stock performance are likely contributing factors.

- Mention any shareholder activism or resolutions related to executive compensation: Activist investors often target excessive executive compensation, particularly in the context of declining company performance or inadequate environmental stewardship.

- Discussion of any external factors impacting BP's profitability: Global economic conditions, geopolitical instability, and the increasing push towards renewable energy sources all create significant external pressures impacting the company's bottom line.

Impact on BP's Overall Compensation Strategy

This significant BP CEO salary cut likely signals a broader shift in BP's compensation strategy. While the base salary reduction is substantial, the impact on overall compensation will depend on how bonuses, stock options, and other forms of remuneration are adjusted. There's a risk that this could negatively impact employee morale, especially if it’s perceived as unfair in comparison to the compensation of other high-level executives.

- Analysis of changes in bonus structures and incentive plans: Further details are needed to assess the changes in performance-based incentives to get a complete picture of the impact.

- Discussion of any changes to long-term incentive plans: Significant alterations to long-term incentive schemes will have a crucial effect on attracting and retaining top talent.

- Potential impact on attracting and retaining top talent: A significant pay reduction could make it challenging for BP to compete for the best talent in a competitive market. This may lead to a "brain drain" within the company.

The long-term consequences of BP's compensation changes require careful monitoring.

Industry-Wide Implications of the BP CEO Salary Cut

The significant decrease in the BP CEO salary could set a precedent for other energy companies. As public and investor pressure on ESG factors increases, similar salary reductions may become more commonplace, particularly if company performance and environmental performance remain closely scrutinized.

- Comparison to CEO compensation in other major oil and gas companies: Analyzing the compensation packages of CEOs at ExxonMobil, Shell, and Chevron will help establish if this salary cut truly sets a trend.

- Analysis of industry trends in executive pay: The oil and gas industry faces increasing scrutiny over its executive pay practices in light of climate change and related concerns.

- Discussion of the role of public pressure and ESG considerations: The pressure from investors and the public to align executive pay with ESG performance plays a vital role in shaping the direction of executive compensation within the energy sector.

Conclusion

The 31% reduction in the BP CEO salary marks a significant event in the energy industry. This substantial cut highlights the impact of company performance, shareholder pressure, and growing ESG concerns on executive compensation. The long-term implications for BP's compensation strategy, employee morale, and the broader oil and gas industry remain to be seen. This salary reduction could signify a potential shift in industry standards or simply be an anomaly.

Call to Action: Stay updated on the latest developments in BP CEO salary and executive compensation trends within the oil and gas industry by subscribing to our newsletter and following our coverage of BP compensation changes. Learn more about executive compensation trends in the energy sector by visiting our website.

Featured Posts

-

Marvel Avengers Crossword Clue Nyt Mini Crossword Answers For May 1st

May 21, 2025

Marvel Avengers Crossword Clue Nyt Mini Crossword Answers For May 1st

May 21, 2025 -

Puede Javier Baez Recuperar Su Productividad

May 21, 2025

Puede Javier Baez Recuperar Su Productividad

May 21, 2025 -

Saskatchewan Politics And The Costco Controversy A Panel Analysis

May 21, 2025

Saskatchewan Politics And The Costco Controversy A Panel Analysis

May 21, 2025 -

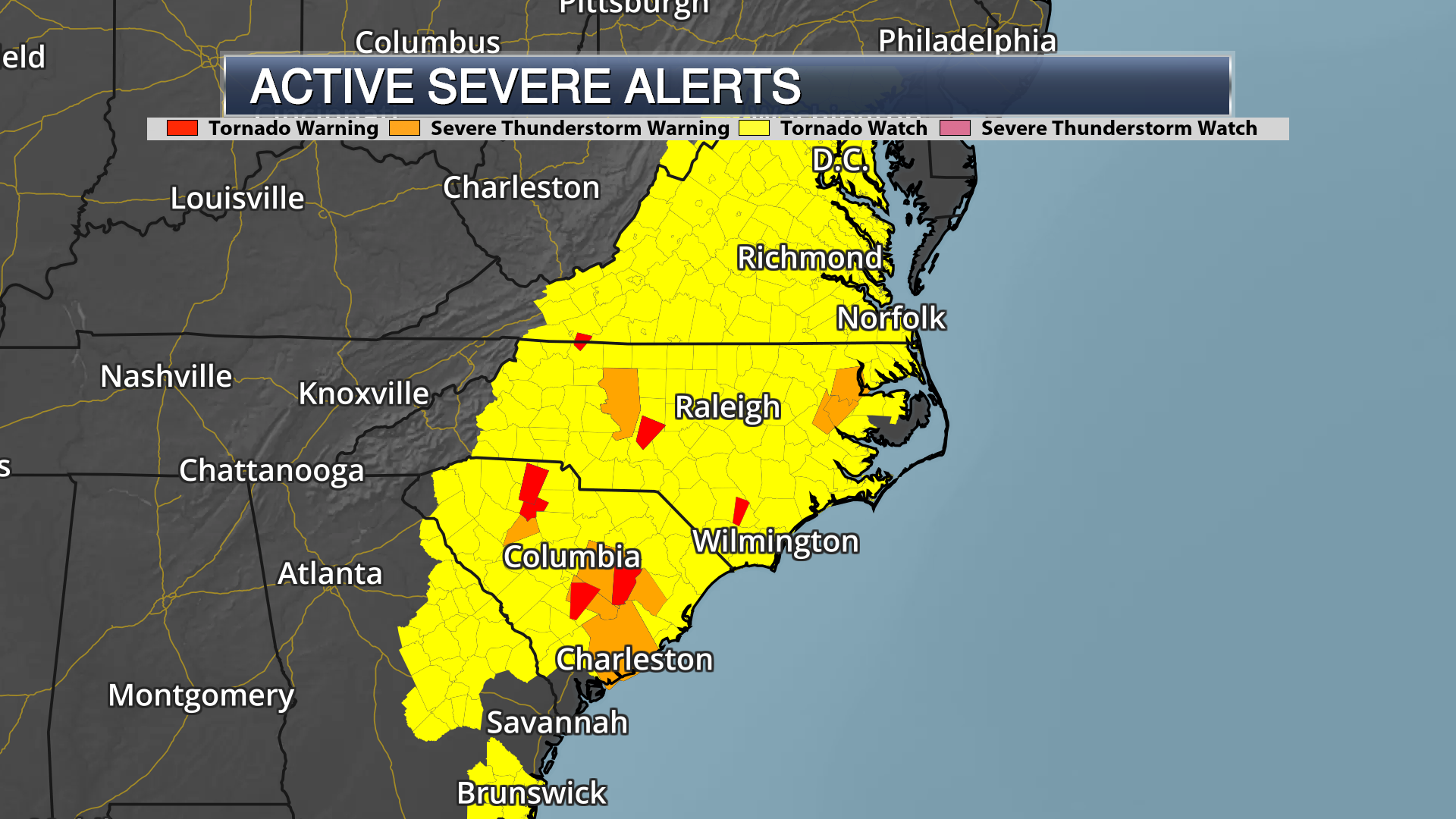

Severe Weather Alert High Storm Chance Overnight Monday Potential

May 21, 2025

Severe Weather Alert High Storm Chance Overnight Monday Potential

May 21, 2025 -

Heres How Michael Strahan Landed A Major Interview Amidst A Ratings Battle

May 21, 2025

Heres How Michael Strahan Landed A Major Interview Amidst A Ratings Battle

May 21, 2025