Significant Saudi Regulatory Shift: Unlocking A Booming ABS Market

Table of Contents

New Regulatory Framework for ABS Issuance in Saudi Arabia

The Saudi Arabian Monetary Authority (SAMA) has implemented groundbreaking changes to the regulatory framework governing ABS issuance. These adjustments streamline the process, reduce costs, and foster a more transparent and efficient market. This is a key driver of the burgeoning ABS market in Saudi Arabia.

Key changes include:

- Streamlined Approval Process: The previously complex and time-consuming approval process for ABS issuance has been significantly simplified, reducing bureaucratic hurdles and accelerating the time-to-market for new offerings. This improved efficiency directly contributes to the growth of the Saudi ABS market.

- Relaxed Capital Requirements for Issuers: Reduced capital requirements incentivize a wider range of businesses to utilize ABS as a financing tool, fostering greater participation and market depth. This lowers the barrier to entry for many Saudi businesses looking for alternative financing options.

- Clarified Legal Framework for ABS Transactions: The updated legal framework provides clarity and certainty for all parties involved in ABS transactions, reducing legal risks and increasing investor confidence. A clear legal framework is essential for the sustainable growth of any financial market.

- Increased Investor Protection Measures: Enhanced investor protection measures build trust and encourage greater participation in the market. This strengthens the credibility of the Saudi ABS market in the eyes of both domestic and international investors.

Increased Investor Confidence and Participation

The regulatory reforms have significantly boosted investor confidence in the Saudi ABS market. These improvements are attracting a considerable influx of both domestic and international capital. The improved regulatory environment is a primary factor behind the rising interest in this previously underutilized asset class.

This increased participation is fueled by:

- Higher Transparency and Disclosure Standards: Improved transparency and disclosure requirements provide investors with more comprehensive information, enabling better informed investment decisions. Greater transparency is a cornerstone of a healthy and robust ABS market.

- Stronger Regulatory Oversight: Robust regulatory oversight instills confidence in the market's integrity and stability, attracting investors seeking secure and reliable investment opportunities. Strong regulatory oversight mitigates risks and promotes market stability.

- Improved Risk Management Frameworks: Enhanced risk management frameworks minimize potential risks, safeguarding investor capital and encouraging greater investment. This builds trust and confidence within the investor community.

- Potential for Higher Returns: The growing demand for ABS, coupled with the potential for higher returns compared to traditional financing options, attracts both institutional and individual investors to the Saudi ABS market. This creates a positive feedback loop, further accelerating market growth.

Growth Opportunities for Saudi Businesses

The flourishing Saudi ABS market presents significant growth opportunities for businesses across various sectors. Accessing cheaper and more flexible financing becomes readily available through ABS issuance, facilitating expansion and diversification.

Key benefits for Saudi businesses include:

- Access to Cheaper and More Flexible Financing: ABS provides a cost-effective alternative to traditional bank financing, offering more flexible terms and conditions. This access to capital empowers businesses to pursue growth opportunities.

- Improved Liquidity Management: ABS can help businesses improve their liquidity management by converting illiquid assets into cash, providing greater financial flexibility. Improved liquidity management is critical for sustainable business growth.

- Opportunities for Expansion and Diversification: Access to capital through ABS allows Saudi businesses to pursue expansion and diversification strategies, boosting their competitiveness and contributing to overall economic growth. The ABS market provides much-needed support for business development.

- Examples of Specific Industries Utilizing ABS: Sectors like real estate, infrastructure, and consumer finance are already leveraging ABS to unlock significant funding opportunities. The application of ABS is expected to extend further, across other segments of the Saudi economy.

The Role of Technology in the Saudi ABS Market

Technology is playing a pivotal role in enhancing the efficiency and transparency of the Saudi ABS market. Fintech innovations and the potential of blockchain technology are transforming the way ABS transactions are conducted.

The benefits of technology integration include:

- Faster and More Secure Transactions: Technology-driven solutions streamline the transactional process, making it faster and more secure. This accelerates the overall speed and efficiency of ABS transactions.

- Reduced Operational Costs: Automation and digitization reduce operational costs associated with ABS issuance and trading. Lower costs lead to greater affordability and market accessibility.

- Improved Data Management: Advanced data management systems enhance data accuracy and accessibility, leading to more informed investment decisions. Data-driven decision-making is increasingly important in modern financial markets.

- Increased Transparency and Traceability: Blockchain technology, in particular, offers increased transparency and traceability of ABS transactions, fostering trust and accountability. Blockchain’s potential to enhance transparency is a significant development for the Saudi ABS market.

Conclusion: Navigating the Future of Saudi Arabia's ABS Market

The Significant Saudi Regulatory Shift: Unlocking a Booming ABS Market has created a dynamic and promising environment for investors and businesses alike. The streamlined regulatory framework, increased investor confidence, and the integration of technology are key factors contributing to the market’s exponential growth. The long-term implications for the Saudi Arabian economy are significant, with ABS expected to become a cornerstone of financing for years to come. To learn more about the exciting Saudi ABS market opportunities and explore the potential of investing in Saudi ABS, we encourage you to explore relevant resources [link to relevant resources, if available]. Understanding the ABS market in Saudi Arabia could unlock substantial returns and contribute to the Kingdom's continued economic prosperity.

Featured Posts

-

Investing In Our Children Building A Future Free From Mental Health Struggles

May 02, 2025

Investing In Our Children Building A Future Free From Mental Health Struggles

May 02, 2025 -

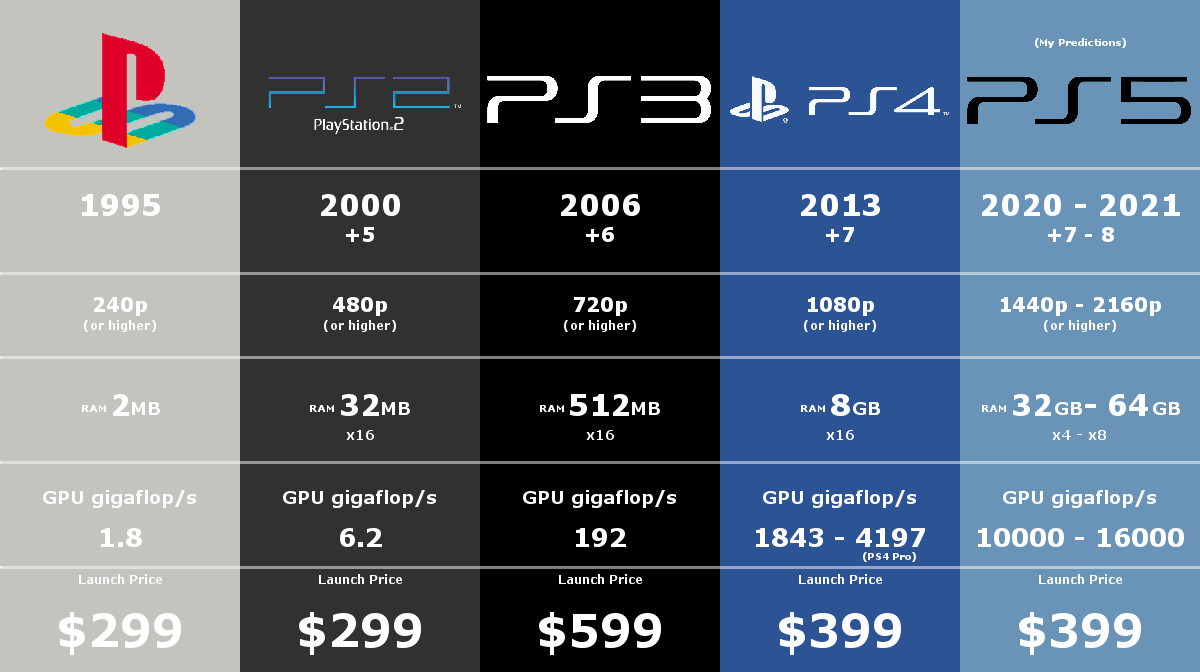

Ps 5 Vs Xbox Series X S Us Sales Showdown

May 02, 2025

Ps 5 Vs Xbox Series X S Us Sales Showdown

May 02, 2025 -

Verdeeldstation Oostwold Bewoners Teleurgesteld Over Onafwendbare Komst

May 02, 2025

Verdeeldstation Oostwold Bewoners Teleurgesteld Over Onafwendbare Komst

May 02, 2025 -

La Laport 3 20

May 02, 2025

La Laport 3 20

May 02, 2025 -

2027 Metais Sanchajuje Duris Atvers Hario Poterio Parkas

May 02, 2025

2027 Metais Sanchajuje Duris Atvers Hario Poterio Parkas

May 02, 2025