Six-Month Trend Reversal: Bitcoin Buying Volume Outpaces Selling On Binance

Table of Contents

Binance Data Reveals a Significant Shift in Bitcoin Trading Activity

Our analysis of Binance's Bitcoin trading volume data uses a seven-day rolling average over the past three months, sourced directly from Binance's public API. This methodology helps smooth out daily fluctuations and provides a clearer picture of the overall trend. The data reveals a striking anomaly: for the past four weeks, Bitcoin buying volume has consistently exceeded selling volume.

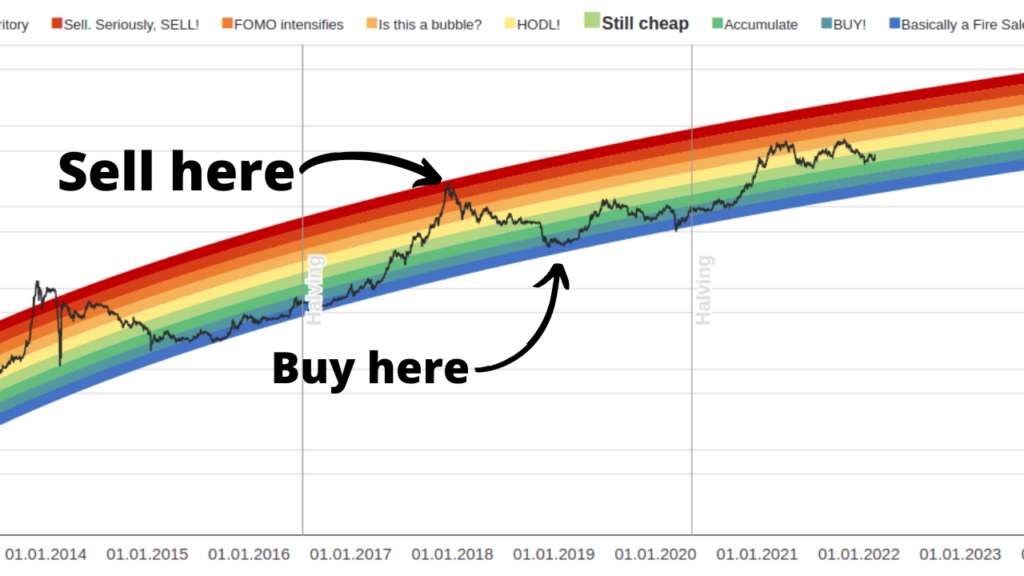

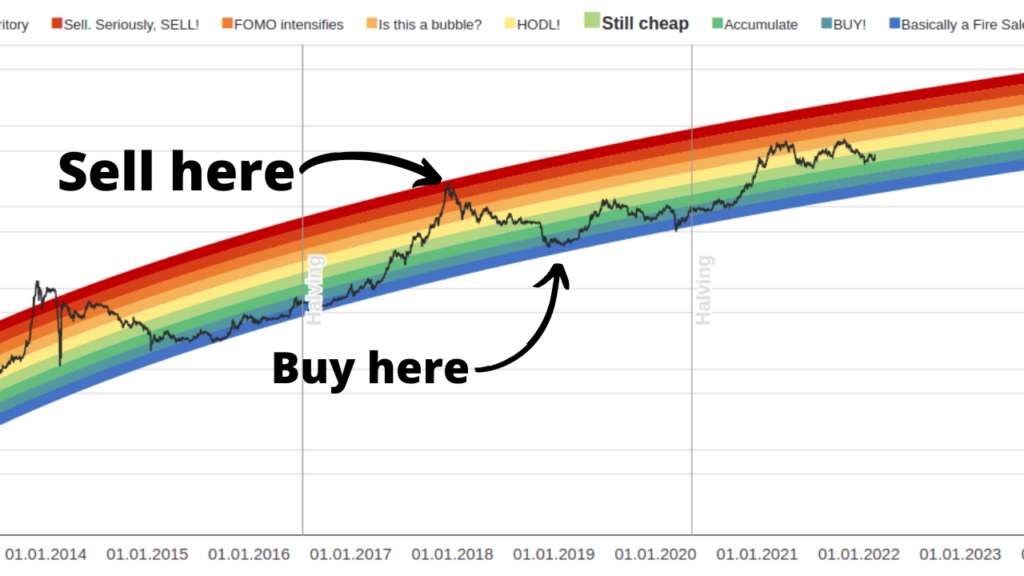

[Insert Chart Here: A clear chart showing Bitcoin buying and selling volume on Binance over the past three months, highlighting the recent trend reversal.]

- Duration of the Trend Reversal: This positive trend in buying volume has persisted for over four weeks, marking a significant departure from the previous six months of bearish dominance.

- Percentage Difference: During peak periods within the past four weeks, buying volume surpassed selling volume by as much as 15%, a considerable margin indicating a notable shift in market sentiment.

- Significant Spikes: Several notable spikes in buying volume have been observed during this period, coinciding with positive news events (detailed below).

Compared to the previous six months, where selling volume consistently outweighed buying volume, this recent surge represents a dramatic and potentially bullish anomaly. The sustained period of higher buying volume significantly strengthens the signal of a potential shift in market dynamics.

Potential Factors Contributing to the Increased Bitcoin Buying Volume

Several factors could be contributing to the increased Bitcoin buying volume on Binance. Let's explore some key potential drivers:

Institutional Investor Activity

The growing adoption of Bitcoin by institutional investors is a significant contributing factor. Large-scale investments from firms like BlackRock and Fidelity have injected significant buying pressure into the market. These institutional players are often long-term holders, indicating a belief in Bitcoin's long-term value proposition.

Retail Investor Sentiment

A shift in retail investor sentiment is also playing a role. Recent positive news surrounding Bitcoin, including regulatory clarity in some jurisdictions and increased adoption by mainstream payment processors, has likely boosted investor confidence. This renewed optimism is translating into increased retail participation in the market.

Macroeconomic Factors

Macroeconomic conditions are also influencing Bitcoin's price and trading volume. With persistent inflation in many economies, investors are seeking alternative assets, and Bitcoin's scarcity and inflation-hedging potential are becoming increasingly attractive. Concerns about fiat currency debasement continue to fuel demand for Bitcoin.

Technological Developments

Recent developments within the Bitcoin network, such as the ongoing scaling solutions and layer-2 advancements, have also contributed to renewed confidence. These technological improvements enhance Bitcoin's efficiency and scalability, making it a more attractive investment.

Implications of the Trend Reversal for Bitcoin Price

The increased buying volume on Binance holds significant implications for Bitcoin's price. Historically, sustained periods of higher buying volume have often preceded price increases.

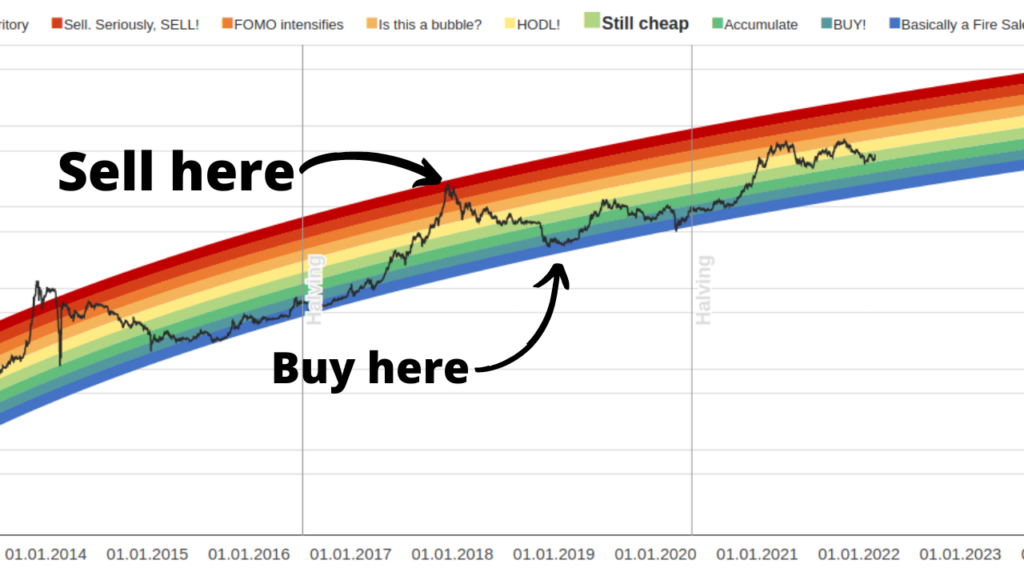

[Insert Chart Here: A chart illustrating historical correlation between Bitcoin buying volume and price movements.]

- Possible Price Targets: Based on technical analysis, considering current support and resistance levels, a short-term price target of [insert price target] is plausible. However, this is purely speculative.

- Resistance Levels: Bitcoin might encounter resistance at key psychological levels such as [insert price levels]. Overcoming these resistance levels will be crucial for confirming a sustained upward trend.

- Other Market Indicators: It’s vital to consider other market indicators alongside trading volume, such as the Bitcoin dominance index, on-chain metrics (e.g., network activity, transaction fees), and overall market sentiment.

Risks and Cautions

While increased buying volume is a bullish signal, it doesn't guarantee sustained price increases. The cryptocurrency market remains highly volatile, and several factors could reverse the current trend.

- Market Volatility: Bitcoin's price is inherently volatile and subject to rapid and unpredictable swings.

- Regulatory Risks: Changes in regulatory landscapes can significantly impact Bitcoin's price and trading activity.

- Market Manipulation: The possibility of market manipulation, though difficult to definitively prove, should always be considered.

Conclusion

The recent data from Binance showing a six-month trend reversal in Bitcoin, with buying volume exceeding selling volume, presents a compelling bullish signal. While it's crucial to remain cautious and acknowledge inherent market risks, this shift suggests a potential change in market sentiment. Several factors, including institutional adoption, evolving retail investor confidence, and macroeconomic conditions, may be contributing to this positive trend.

Call to Action: Stay informed about the evolving Bitcoin market dynamics. Monitor Binance's trading volume data and other market indicators closely to make informed decisions about your Bitcoin investments. Understanding the nuances of Bitcoin buying and selling volume is crucial for navigating this exciting and volatile market. Continue to follow our updates for further analysis of the Bitcoin buying volume trends on Binance and beyond.

Featured Posts

-

Can Ripple Xrp Hit 3 40 Analyzing The Potential

May 08, 2025

Can Ripple Xrp Hit 3 40 Analyzing The Potential

May 08, 2025 -

Ps Zh Aston Villa Istoriya Protistoyan U Yevrokubkakh

May 08, 2025

Ps Zh Aston Villa Istoriya Protistoyan U Yevrokubkakh

May 08, 2025 -

Bitcoin Investment Is A 1 500 Increase In 5 Years Realistic

May 08, 2025

Bitcoin Investment Is A 1 500 Increase In 5 Years Realistic

May 08, 2025 -

Wildfire Betting In Los Angeles A Growing Concern

May 08, 2025

Wildfire Betting In Los Angeles A Growing Concern

May 08, 2025 -

Six Month Trend Reversal Bitcoin Buying Volume Outpaces Selling On Binance

May 08, 2025

Six Month Trend Reversal Bitcoin Buying Volume Outpaces Selling On Binance

May 08, 2025