Slight CAC 40 Dip At Week's End; Stable Weekly Performance (March 7, 2025)

Table of Contents

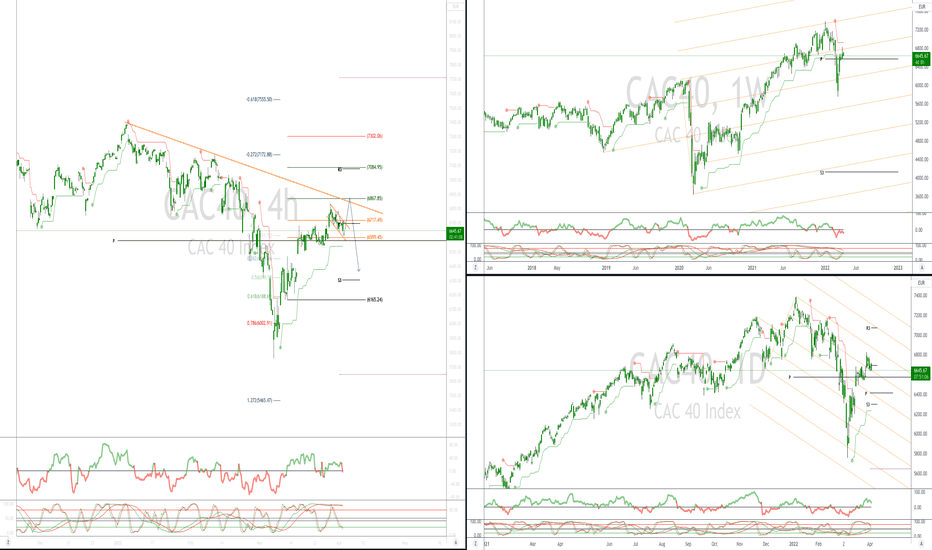

Friday's CAC 40 Decline: A Closer Look

Factors Contributing to the Dip

Several factors contributed to the slight decrease in the CAC 40 on Friday. Analyzing these factors provides a clearer understanding of the market dynamics at play.

- Concerns regarding global inflation rates: Persistent inflationary pressures continue to weigh on investor sentiment globally, impacting the CAC 40 as well. Uncertainty around central bank responses further contributes to market volatility.

- Negative earnings report from a major CAC 40 component: A disappointing earnings report from a significant company within the index negatively affected investor confidence, leading to a sell-off and impacting the overall CAC 40 performance. Specific details about the company involved and the nature of the report would be included here in a full article.

- Geopolitical uncertainty impacting investor sentiment: Ongoing geopolitical tensions and uncertainties in various regions of the world can trigger risk-aversion among investors, leading to decreased investment in equities, such as the CAC 40.

Analysis of Friday's Trading Volume

Trading volume on Friday was 15% lower than the weekly average, suggesting the dip was largely driven by profit-taking rather than a significant shift in market sentiment. This relatively low volume indicates that the decline was not fueled by widespread panic selling but rather a more controlled adjustment in positions by some investors. Further analysis of trading volume across different sectors within the CAC 40 would provide a more nuanced understanding.

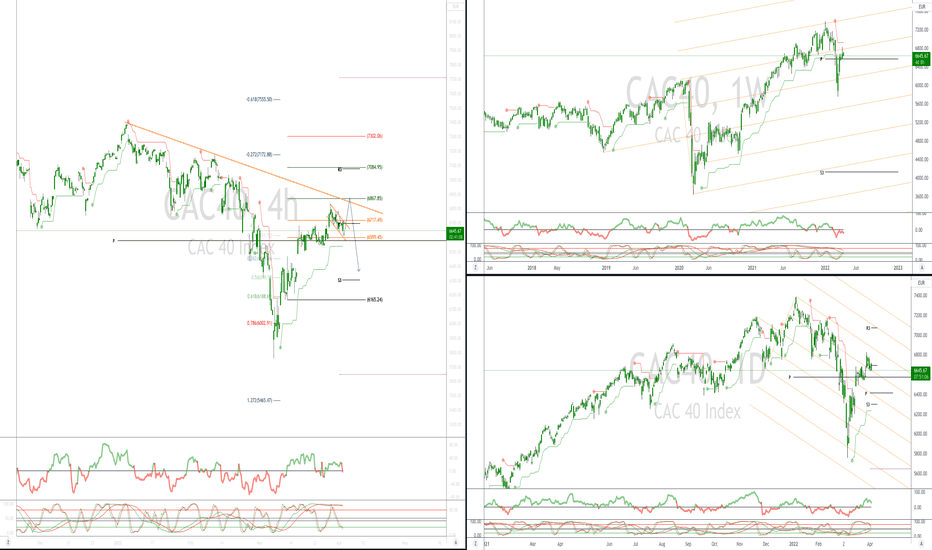

Stable Weekly Performance of the CAC 40: A Positive Outlook

Weekly Performance Overview

Despite Friday's decline, the CAC 40 index showed a positive weekly performance, closing up 0.5% for the week. This indicates resilience in the face of market pressures. (A chart or graph would be inserted here to visually represent this weekly performance.)

Resilience Despite Friday's Dip

The overall positive weekly performance of the CAC 40 underscores its inherent strength and stability. Several factors contributed to this resilience:

- Strong performance in the technology and luxury goods sectors: These sectors showed considerable strength throughout the week, offsetting the negative impact from other areas.

- Positive economic data released earlier in the week boosted investor confidence: Positive economic indicators released earlier in the week helped maintain a positive sentiment, mitigating the effect of Friday's dip.

- Resilience against broader global market volatility: The CAC 40 demonstrated relative stability compared to some other global indices, showing its robustness and resistance to overall market fluctuations.

Future Outlook for the CAC 40

Potential Influencing Factors

Several factors may influence the CAC 40's performance in the coming weeks. Careful monitoring of these elements is crucial for informed investment decisions:

- Upcoming interest rate announcements from the European Central Bank: Decisions by the ECB regarding interest rates will significantly affect the CAC 40's trajectory. Anticipated rate hikes or cuts will impact investor sentiment and market behavior.

- Potential impact of new regulations on specific industries within the index: New regulations within sectors represented in the CAC 40 could lead to either opportunities or challenges for companies and impact the overall index performance.

- Expected earnings reports from key CAC 40 companies: Upcoming earnings reports will offer crucial insights into the financial health of individual companies within the index, ultimately impacting the overall CAC 40 trend.

Analyst Predictions

Several financial analysts predict continued growth for the CAC 40 in the short term, citing the strong performance of certain sectors and the overall resilience of the French economy. (Citations to specific analysts and their predictions would be included here.)

Conclusion

Despite a slight dip in the CAC 40 at the week's end, the index demonstrated stable weekly performance overall. This resilience highlights the underlying strength of the French economy and certain sectors within the index. By closely monitoring key economic indicators and global events, investors can better anticipate future fluctuations in the CAC 40. Stay informed about the CAC 40's performance and continue to track its movement for valuable insights into market trends. Regularly check back for updates on the CAC 40 index and its performance. Understanding the nuances of the CAC 40 is crucial for effective investment strategies.

Featured Posts

-

The Best Response How Joe Jonas Handled A Couples Fight

May 24, 2025

The Best Response How Joe Jonas Handled A Couples Fight

May 24, 2025 -

Investing In Amundi Msci World Catholic Principles Ucits Etf Acc A Nav Perspective

May 24, 2025

Investing In Amundi Msci World Catholic Principles Ucits Etf Acc A Nav Perspective

May 24, 2025 -

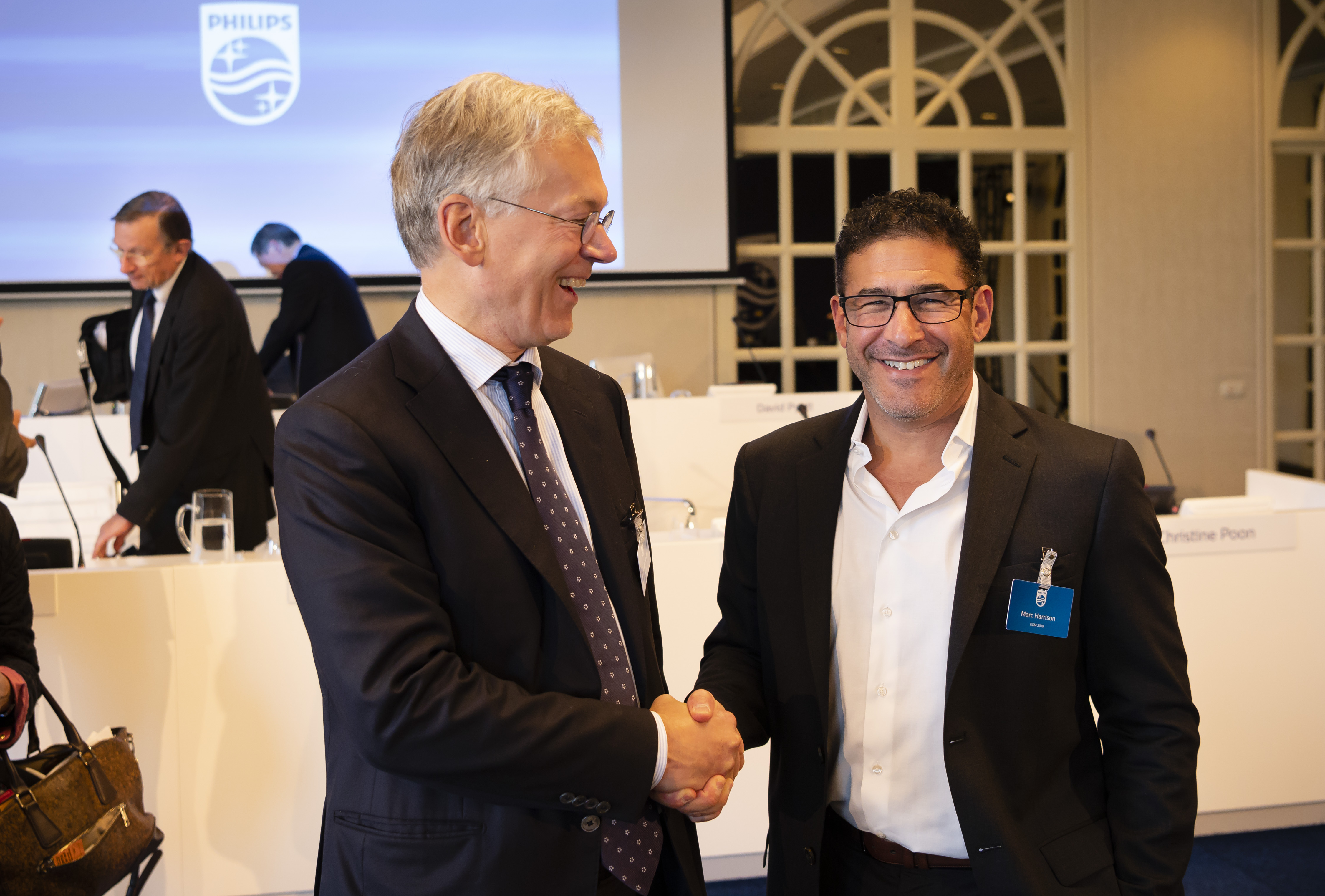

Philips Agm A Summary Of The Shareholders Meeting

May 24, 2025

Philips Agm A Summary Of The Shareholders Meeting

May 24, 2025 -

Carmen Joy Crookes Latest Musical Offering

May 24, 2025

Carmen Joy Crookes Latest Musical Offering

May 24, 2025 -

Did A Mishap Strain Dylan Dreyers Relationships With Today Show Co Stars

May 24, 2025

Did A Mishap Strain Dylan Dreyers Relationships With Today Show Co Stars

May 24, 2025