Solana's Trading Volume Lags Behind XRP As ETF Anticipation Builds

Table of Contents

XRP's Trading Volume Surge Driven by ETF Expectations

The impending approval of a Bitcoin ETF is expected to be a watershed moment for the entire cryptocurrency market. Its impact extends far beyond Bitcoin itself, influencing the performance of other digital assets. This is particularly evident in the recent surge of XRP trading volume.

The Bitcoin ETF Impact

The approval of a Bitcoin ETF would represent a significant step towards greater regulatory clarity and institutional acceptance of cryptocurrencies. This increased legitimacy could lead to a substantial influx of institutional investment, boosting liquidity and potentially driving price appreciation across the altcoin space. XRP, with its established position as a payment-focused cryptocurrency, is well-positioned to benefit from this wave of institutional interest.

- Increased regulatory clarity and institutional acceptance: A Bitcoin ETF would signal a positive shift in regulatory sentiment, encouraging more institutional investors to enter the market.

- Potential for higher liquidity and price appreciation in the altcoin market: Increased trading volume and investment in Bitcoin could spill over into other cryptocurrencies, including XRP.

- XRP's established position as a payment-focused cryptocurrency attracting investor interest: XRP's existing infrastructure and use cases make it an attractive option for institutions seeking exposure to the payment sector within the crypto market.

- Analysis of XRP price and trading volume charts showcasing recent growth: Recent data reveals a clear correlation between the growing anticipation for a Bitcoin ETF and the increase in XRP's price and trading volume.

Solana's Trading Volume Underperformance Despite Technological Advantages

Solana boasts impressive technological strengths, yet its trading volume lags behind XRP's. This underperformance, despite its advantages, warrants a closer look.

Solana's Technological Strengths

Solana's architecture offers significant advantages: fast transaction speeds, low fees, and robust smart contract capabilities make it a compelling platform for decentralized applications (dApps).

Factors Affecting Solana's Trading Volume

Several factors contribute to Solana's relatively lower trading volume compared to XRP:

- Increased competition in the layer-1 space: The layer-1 blockchain landscape is highly competitive, with numerous projects vying for market share.

- Less institutional adoption compared to XRP: Despite its technological merits, Solana has seen less institutional adoption than XRP to date.

- Impact of past network outages and vulnerabilities on investor confidence: Past instances of network instability have eroded investor trust, affecting trading volume.

- Analysis of Solana price and trading volume charts highlighting underperformance: Data analysis clearly shows Solana's underperformance in trading volume compared to XRP, even during periods of positive market sentiment.

Comparing Solana and XRP: A Detailed Analysis

Understanding the disparity between Solana and XRP requires a detailed comparison.

Market Capitalization and Market Share

XRP currently holds a significantly larger market capitalization and market share than Solana, reflecting a greater level of investor confidence and established market presence.

Use Cases and Target Audience

Solana and XRP target different markets. Solana focuses on providing a high-throughput platform for dApps and DeFi applications, while XRP emphasizes payment solutions and cross-border transactions. This difference in focus contributes to their varying levels of adoption and trading volume.

- Detailed comparison of trading volume data from reputable sources: Data from CoinMarketCap and CoinGecko reveal a considerable gap in daily trading volume between XRP and Solana.

- Discussion of the different functionalities and ecosystems of each coin: Their distinct use cases and target audiences explain why they appeal to different investor groups.

- Analysis of investor sentiment and community engagement surrounding both projects: Sentiment analysis of social media and online forums indicates higher overall investor confidence in XRP compared to Solana.

Future Outlook for Solana Trading Volume

While Solana's current trading volume lags behind XRP, several factors could drive future growth.

Potential Catalysts for Growth

Several potential catalysts could boost Solana's trading volume:

- Potential partnerships and integrations: Strategic partnerships with major players in the crypto space could significantly increase adoption.

- Development of new decentralized applications (dApps) on the Solana network: A thriving dApp ecosystem will attract more users and developers, boosting network activity and trading volume.

- Overcoming network scalability issues and improving security: Addressing past network issues and enhancing security will rebuild investor confidence.

Challenges and Risks

However, challenges remain:

- Continued competition within the layer-1 space.

- The need for increased institutional adoption and broader awareness of Solana's capabilities.

Conclusion

The contrast between XRP's surge in trading volume fueled by Bitcoin ETF anticipation and Solana's relatively stagnant performance highlights the complex dynamics of the cryptocurrency market. While XRP benefits from its established position and association with potential ETF-related growth, Solana faces challenges related to competition, past network issues, and lower institutional adoption. However, Solana's strong technological foundation and potential for future growth remain noteworthy. Stay updated on the latest trends in Solana trading volume and the broader crypto market, conducting thorough research before investing in any cryptocurrency. Monitor Solana trading volume and consider its long-term potential, keeping in mind the inherent risks involved in digital asset investments.

Featured Posts

-

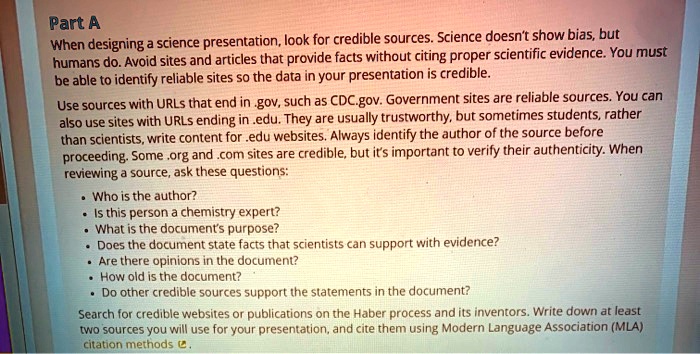

Crypto News How To Identify Reliable And Trustworthy Sources

May 08, 2025

Crypto News How To Identify Reliable And Trustworthy Sources

May 08, 2025 -

6 Million Verdict Against Soulja Boy In Sexual Assault Lawsuit

May 08, 2025

6 Million Verdict Against Soulja Boy In Sexual Assault Lawsuit

May 08, 2025 -

2025 Los Angeles Angels Games Your Guide To Streaming Options

May 08, 2025

2025 Los Angeles Angels Games Your Guide To Streaming Options

May 08, 2025 -

Thousands Face Benefit Cuts Dwps April 5th Changes Explained

May 08, 2025

Thousands Face Benefit Cuts Dwps April 5th Changes Explained

May 08, 2025 -

Lahwr Myn Bhy Dhwm Py Ays Ayl Trafy Ka Dwrh

May 08, 2025

Lahwr Myn Bhy Dhwm Py Ays Ayl Trafy Ka Dwrh

May 08, 2025