Southeast Asian Solar Imports Face Massive US Tariffs: A 3,521% Duty Increase

Table of Contents

H2: The 3,521% Tariff: A Deep Dive

H3: Magnitude of the Tariff Increase:

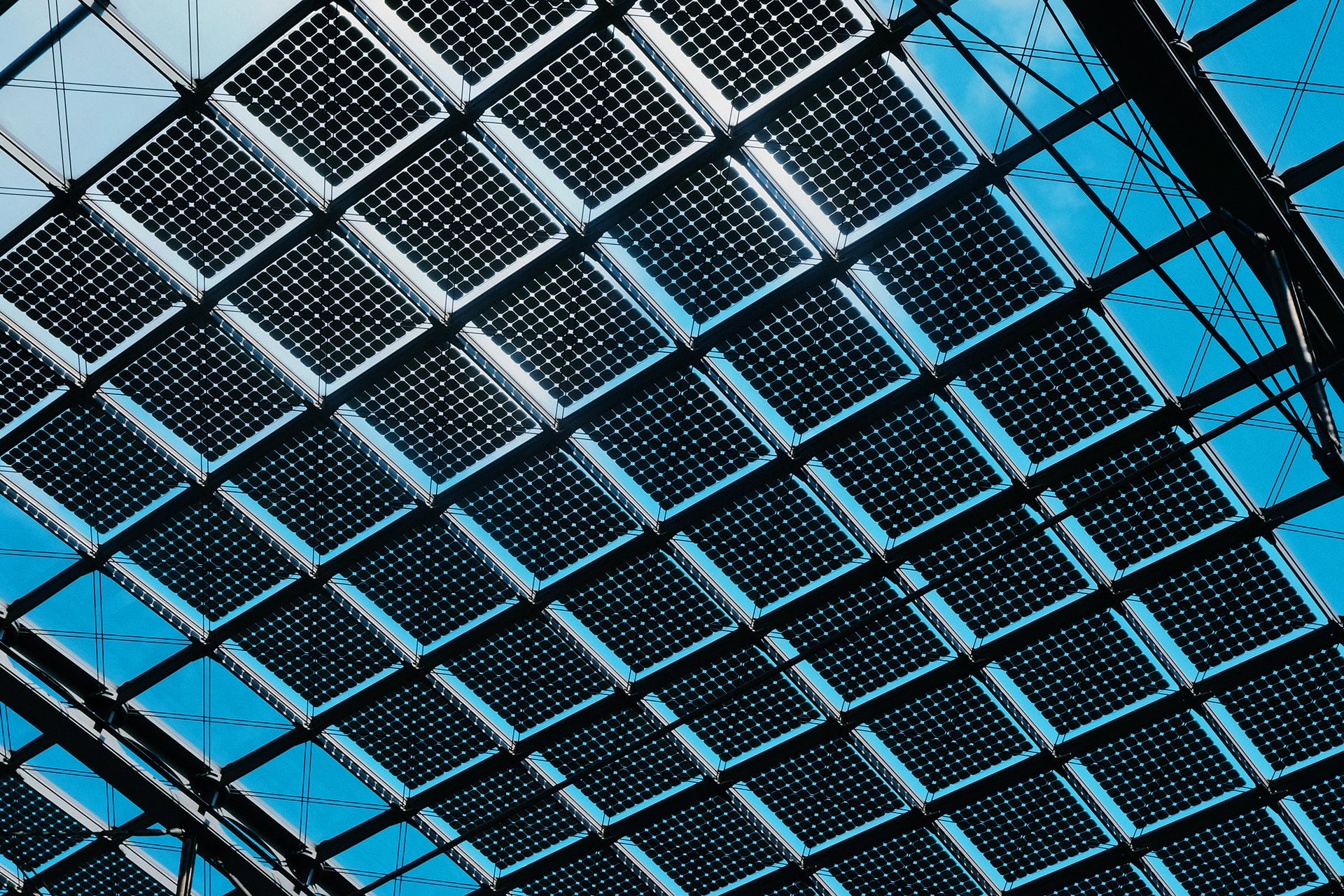

The sheer scale of the 3,521% tariff is unprecedented in the history of US solar import regulations. This dwarfs previous tariffs, dramatically increasing the cost of solar panels imported from Southeast Asia. To put it in perspective, previous tariffs on solar imports typically ranged from a few percentage points to a few hundred percent. This massive increase will almost certainly lead to a significant rise in the overall cost of solar energy projects across the United States.

- Specific examples: Tariffs on solar cells could increase by over 3,000%, while tariffs on modules might see similar increases, depending on the specific components and origin.

- Comparison to previous rates: The previous highest tariffs were significantly lower, impacting specific manufacturers and components, not the entire Southeast Asian solar market.

- Potential impact on project costs: This tariff increase translates directly to higher costs for residential, commercial, and utility-scale solar projects, potentially making solar energy less competitive with fossil fuels.

H3: Targeted Countries:

This tariff primarily targets solar panel imports from several key Southeast Asian countries that have become major players in the global solar supply chain.

- List of countries impacted: Cambodia, Malaysia, Thailand, Vietnam, and potentially others.

- Current role in the global supply chain: These nations are crucial links in the global manufacturing process, providing significant quantities of solar cells and modules to the US market.

- Potential retaliatory measures: The affected countries might retaliate with tariffs on US goods, escalating trade tensions and further complicating the global solar market.

H3: Reasons Behind the Tariff Imposition:

The Department of Commerce justifies these tariffs by alleging circumvention of prior anti-dumping and countervailing duties levied on Chinese solar manufacturers. The argument is that Southeast Asian companies are acting as intermediaries, effectively circumventing existing trade restrictions.

- Key arguments presented by the Department of Commerce: Allegations of Chinese companies utilizing Southeast Asian factories to avoid existing tariffs, thus creating an unfair competitive advantage.

- Evidence presented to support the claims: The investigation likely included a review of trade flows, manufacturing processes, and ownership structures within the implicated companies. However, the specifics of the evidence have yet to be fully publicized.

- Counterarguments from impacted businesses and countries: Impacted businesses and Southeast Asian governments strongly dispute the claims, arguing that the investigation lacked sufficient evidence, and that the tariff constitutes unfair protectionism that harms consumers and clean energy initiatives.

H2: Impacts on the US Solar Industry

H3: Increased Solar Project Costs:

The 3,521% tariff will undeniably increase the cost of solar projects across the US.

- Projected increase in solar energy costs: The cost of solar installations is expected to rise significantly, potentially making solar less attractive to consumers and businesses.

- Impact on residential, commercial, and utility-scale solar projects: All types of solar projects will experience cost increases, potentially leading to delays or cancellations, especially in sectors with tight budgets.

- Potential delays or cancellations of projects: Many projects that were already underway or in the planning stages might be delayed, scaled back, or even canceled due to the higher cost of imported panels.

H3: Job Creation vs. Job Losses:

The tariff's impact on American jobs is complex and potentially contradictory.

- Job losses in the solar installation sector: The higher cost of solar panels will likely slow down the growth of the solar installation sector, resulting in job losses.

- Potential for increased domestic manufacturing and job creation: Proponents argue the tariff will encourage the growth of domestic solar manufacturing, creating jobs in the long term. However, this relies heavily on the ability of US manufacturers to quickly scale up production to meet demand.

- Long-term economic effects: The long-term economic consequences remain uncertain and depend on various factors including government support for domestic manufacturing and the speed of adjustments within the solar industry.

H3: Impact on Clean Energy Goals:

The tariffs pose a significant threat to the US's commitment to renewable energy and climate change goals.

- Potential setbacks in achieving renewable energy targets: The increased cost of solar energy might make it harder to achieve ambitious renewable energy targets.

- Impact on greenhouse gas emissions reduction: Delayed deployment of solar energy projects could lead to increased greenhouse gas emissions.

- Potential solutions and alternatives: Diversifying import sources, boosting domestic manufacturing, and accelerating innovation are key strategies to mitigate these negative impacts.

H2: Potential Solutions and Alternatives

H3: Negotiations and Trade Disputes:

The tariffs could lead to protracted negotiations and trade disputes.

- Potential trade negotiations between the US and Southeast Asian nations: Diplomatic efforts to resolve the issue through negotiations are likely.

- WTO dispute settlement mechanisms: The affected countries could challenge the tariffs through the World Trade Organization’s dispute settlement system.

- Potential retaliatory tariffs: Retaliatory tariffs from Southeast Asian nations on US goods are a very real possibility.

H3: Boosting Domestic Solar Manufacturing:

The US needs to prioritize investments in domestic solar manufacturing.

- Government subsidies and tax credits: Financial incentives to stimulate domestic production are crucial.

- Investments in research and development: Funding to improve efficiency and reduce the cost of domestic solar panel production is essential.

- Strengthening supply chains: Building a resilient and reliable domestic supply chain for solar components is vital for long-term sustainability.

H3: Diversifying Solar Imports:

Exploring alternative sources of solar panels is critical to mitigate the impact of the tariffs.

- Potential alternative sources of solar panels: Countries like India, Australia, and others could become potential sources for solar panels.

- Geopolitical considerations: Diversifying imports can mitigate reliance on single countries or regions, enhancing supply chain security.

- Supply chain diversification strategies: Developing diverse and robust supply chains requires careful planning and long-term investment.

3. Conclusion:

The 3,521% tariff on Southeast Asian solar imports presents a major challenge for the US solar industry and the broader clean energy transition. While the stated goal is to protect domestic industry, the drastic price increases risk slowing renewable energy adoption, hindering the achievement of climate goals, and ultimately harming consumers. Finding solutions is paramount. Strategies like boosting domestic solar manufacturing, negotiating with Southeast Asian nations, and diversifying import sources are vital to mitigate the harmful effects of these tariffs. Continued vigilance and engagement with developments concerning Southeast Asian solar imports US tariffs are crucial for the future of clean energy in the United States.

Featured Posts

-

Jw 24 Byan Thnyt Mn Alshykh Fysl Alhmwd Llardn Beyd Astqlalha

May 30, 2025

Jw 24 Byan Thnyt Mn Alshykh Fysl Alhmwd Llardn Beyd Astqlalha

May 30, 2025 -

Peluncuran Kawasaki Vulcan S 2025 Di Indonesia Motor Cruiser Modern

May 30, 2025

Peluncuran Kawasaki Vulcan S 2025 Di Indonesia Motor Cruiser Modern

May 30, 2025 -

Fans Outraged 100 000 Sign Petition To Strip Jon Jones Of Title

May 30, 2025

Fans Outraged 100 000 Sign Petition To Strip Jon Jones Of Title

May 30, 2025 -

Gorillaz 25th Anniversary Exhibition And Special Shows Announced

May 30, 2025

Gorillaz 25th Anniversary Exhibition And Special Shows Announced

May 30, 2025 -

Ticketmaster Caida 8 De Abril Problemas Soluciones Y Noticias De Grupo Milenio

May 30, 2025

Ticketmaster Caida 8 De Abril Problemas Soluciones Y Noticias De Grupo Milenio

May 30, 2025