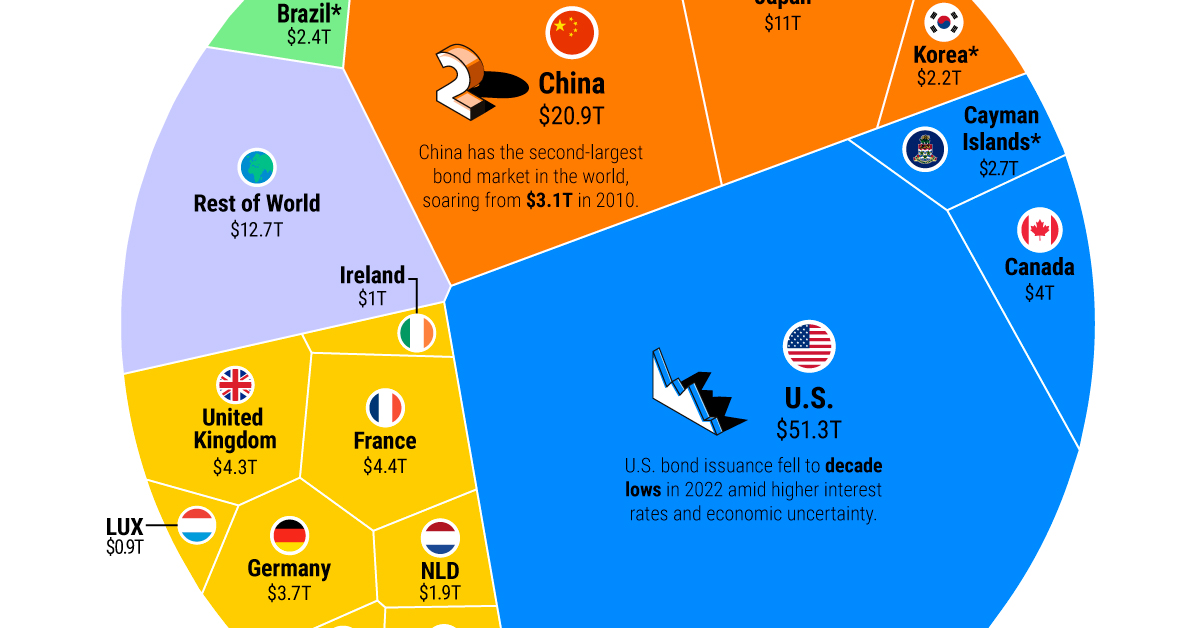

Sovereign Bond Markets: Swissquote Bank's Perspective

Table of Contents

Analyzing Sovereign Bond Yields and Their Determinants

Sovereign bond yields represent the return an investor receives for lending money to a government. These yields are intrinsically linked to interest rates; rising interest rates generally lead to higher bond yields, and vice versa. Several key determinants influence these yields, creating a complex interplay of economic and political factors.

-

Economic Growth and Inflation: Strong economic growth often leads to higher interest rates and, consequently, higher bond yields. Conversely, periods of low or negative growth can push yields down. Inflation plays a crucial role; high inflation erodes the purchasing power of future interest payments, leading investors to demand higher yields as compensation.

-

Government Debt Levels and Fiscal Policy: High levels of government debt can increase the perceived risk associated with sovereign bonds, thus driving up yields. Fiscal policies, such as government spending and taxation, significantly impact debt levels and investor confidence.

-

Central Bank Policies (Monetary Policy): Central banks influence interest rates through monetary policy tools like adjusting reserve requirements and setting benchmark interest rates. These actions directly impact sovereign bond yields, often affecting the entire yield curve.

-

Geopolitical Risks and Global Market Sentiment: Geopolitical events, such as wars, political instability, or trade disputes, can significantly affect investor sentiment and cause fluctuations in sovereign bond yields. Negative news often leads to a "flight to safety," driving demand for bonds issued by perceived safe-haven countries.

[Insert relevant chart/graph here showing a yield curve and trends, possibly including a brief case study of a specific country's sovereign bond yield. For example: "Analysis of German Bund yields shows a clear correlation with ECB monetary policy decisions."]

Assessing Sovereign Credit Ratings and Risk

Sovereign credit ratings, assigned by agencies like Moody's, S&P, and Fitch, are crucial indicators of a government's ability to repay its debt. These ratings categorize countries into different risk classes, from AAA (highest quality) to D (default). Higher credit ratings generally translate to lower borrowing costs for the government and lower yields for investors. Factors impacting these ratings include:

-

Political Stability and Governance: Strong and stable political institutions are essential for maintaining investor confidence. Political risk, including corruption or potential regime change, can negatively affect credit ratings.

-

Economic Diversification and Structural Reforms: Economies with a diverse range of industries and proactive structural reforms tend to demonstrate greater resilience and attract higher credit ratings.

-

External Debt Sustainability: The level of a country's external debt relative to its GDP is a critical factor influencing credit ratings. High levels of external debt can signal increased risk of default.

Swissquote Bank provides clients with access to real-time credit rating information through our sophisticated trading platforms and research tools.

Strategies for Investing in Sovereign Bond Markets

Investing in sovereign bond markets offers various strategies tailored to individual investor profiles and risk tolerances.

-

Buy-and-Hold Strategies: This long-term approach focuses on accumulating bonds and holding them until maturity, benefiting from consistent interest payments and potential capital appreciation.

-

Active Trading Strategies: These short-term strategies aim to profit from short-term fluctuations in bond prices, often employing techniques like leveraging and arbitrage. This approach requires a high level of market expertise and risk tolerance.

-

Diversification: Diversifying investments across different sovereign bonds with varying maturities and credit ratings is crucial for risk mitigation. This strategy helps to reduce the impact of losses in any single bond.

Risk management and thorough due diligence are paramount when investing in sovereign bond markets. Understanding the specific risks associated with each bond and employing appropriate risk mitigation techniques is essential. Swissquote Bank provides various tools and resources, including comprehensive market analysis and advanced trading platforms, to facilitate informed investment decisions.

Swissquote Bank's Expertise in Sovereign Bond Markets

Swissquote Bank possesses extensive experience in trading sovereign bonds, offering clients access to a wide range of global sovereign debt markets. Our commitment to providing superior market access is underpinned by:

-

Advanced Trading Platforms: Our platforms offer seamless execution capabilities and real-time market data, ensuring efficient and transparent trading.

-

Comprehensive Research and Analysis Tools: We provide in-depth research reports, market analyses, and sophisticated tools to support informed investment decisions.

-

Dedicated Investment Advice and Portfolio Management: Our expert advisors provide personalized guidance and support, tailoring portfolio strategies to meet individual client needs.

Swissquote Bank's unique approach emphasizes transparency, client education, and the provision of cutting-edge technology to empower investors in the complex world of sovereign bond investment.

Conclusion: Navigating Sovereign Bond Markets with Swissquote Bank

The sovereign bond markets are influenced by a complex interplay of economic, political, and market factors. Understanding sovereign bond yields, credit ratings, and employing effective risk management strategies are essential for successful investment. Diversification across different bonds and maturities is crucial for mitigating risk. Swissquote Bank offers a comprehensive suite of services, from advanced trading platforms to expert advice, to help you navigate these markets effectively. Learn more about accessing the global sovereign bond market through Swissquote Bank's advanced trading platforms and expert analysis – visit [link to relevant page]. Explore the opportunities in sovereign debt markets and benefit from our expertise in sovereign bond investment.

Featured Posts

-

Anadolu Ajansi Ndan Gazze Deki Ramazan Oezel Haberleri

May 19, 2025

Anadolu Ajansi Ndan Gazze Deki Ramazan Oezel Haberleri

May 19, 2025 -

Billy Ray Cyrus Et Nytt Kapittel Etter Skilsmisse Og Toffe Ar Med Elizabeth Hurley

May 19, 2025

Billy Ray Cyrus Et Nytt Kapittel Etter Skilsmisse Og Toffe Ar Med Elizabeth Hurley

May 19, 2025 -

Muere Juan Aguilera El Legado Del Primer Tenista Espanol En Ganar Un Masters 1000

May 19, 2025

Muere Juan Aguilera El Legado Del Primer Tenista Espanol En Ganar Un Masters 1000

May 19, 2025 -

Paul Craig Vs Rodolfo Bellato Fight Scrapped Ufc Vegas 106 Update

May 19, 2025

Paul Craig Vs Rodolfo Bellato Fight Scrapped Ufc Vegas 106 Update

May 19, 2025 -

Residents Launch Legal Fight To Preserve London Green Space

May 19, 2025

Residents Launch Legal Fight To Preserve London Green Space

May 19, 2025