SpaceX Valuation Soars: Musk's Stake Surpasses Tesla Investment By $43 Billion

Table of Contents

The world of private space exploration has witnessed a seismic shift. SpaceX, Elon Musk's ambitious space venture, has experienced a meteoric rise in valuation, surpassing even Musk's investment in Tesla by a staggering $43 billion. This monumental leap has significant implications for the space industry, Musk's overall financial standing, and the future of space travel.

The Meteoric Rise of SpaceX Valuation

Factors Contributing to SpaceX's Increased Value

Several key factors have contributed to SpaceX's astonishing valuation increase:

-

Unparalleled Launch Success: SpaceX's Falcon 9 and Falcon Heavy rockets boast remarkably high success rates, significantly outperforming competitors. This reliability, coupled with cost-effectiveness, has made SpaceX the preferred launch provider for numerous clients. The reusability of the Falcon 9 further reduces launch costs, a game-changer in the industry.

-

Lucrative Government and Commercial Contracts: SpaceX has secured a plethora of high-value contracts. NASA relies heavily on SpaceX for cargo transport to the International Space Station, while the Department of Defense has awarded SpaceX numerous contracts for national security space launches. Major commercial contracts with satellite operators further bolster SpaceX's revenue streams.

-

Reusable Rocket Technology Revolution: SpaceX's pioneering work in reusable rocket technology has dramatically lowered the cost of space access. This innovation is not only financially advantageous but also environmentally responsible, reducing the amount of space debris. Competitors are scrambling to catch up.

-

Starlink's Explosive Growth: SpaceX's Starlink satellite internet constellation is rapidly expanding, aiming to provide global broadband access. With millions of subscribers and projections for massive growth, Starlink is poised to generate billions in revenue, significantly impacting SpaceX valuation.

-

Investor Confidence in the Space Industry: The burgeoning space industry is attracting significant investment, and SpaceX, as a leader in the field, is naturally benefiting from this trend. Recent funding rounds have further fueled the company's valuation.

Comparison with Tesla's Valuation

SpaceX's current valuation significantly surpasses Tesla's market capitalization, marking a $43 billion difference. This remarkable achievement underscores SpaceX's rapid growth and positions it as a dominant force in the space sector. For Elon Musk, this means a diversification of his investment portfolio, reducing his reliance on Tesla's performance for his overall net worth.

Implications for the Space Industry

Increased Competition and Innovation

SpaceX's success has spurred increased investment in the private space sector, attracting new players and fostering intense competition. This heightened competition is driving rapid innovation, pushing the boundaries of technological advancement in rocketry, satellite technology, and space exploration. A new space race, fueled by private enterprise, is undeniably underway.

Accessibility and Cost Reduction in Space Travel

SpaceX is playing a pivotal role in making space travel more accessible and affordable. The company's ambitious Starship program aims to drastically reduce the cost of transporting humans and cargo to Mars and beyond. This could pave the way for commercial space tourism and the establishment of permanent human settlements on other planets.

Future Outlook for SpaceX and its Valuation

Potential Growth Areas

SpaceX's future prospects remain exceptionally promising:

-

Starlink Expansion: Further expansion of Starlink's global coverage and potential applications in other sectors like IoT (Internet of Things) will contribute substantially to future revenue.

-

Starship Progress: Successful development and deployment of Starship will unlock interplanetary travel capabilities, opening new avenues for revenue and further boosting SpaceX's valuation.

-

New Revenue Streams: Space-based manufacturing, resource extraction from asteroids, and other innovative ventures could create significant new revenue streams for SpaceX.

Challenges and Risks

Despite its success, SpaceX faces challenges:

-

Intense Competition: Other private space companies are aggressively pursuing similar goals, creating intense competition.

-

Regulatory Hurdles: Navigating complex regulatory environments and securing necessary approvals for various projects remains crucial.

-

Technical Challenges: Ambitious projects like Starship involve significant technological hurdles that require innovative solutions and risk management.

Conclusion

SpaceX's valuation surge, exceeding even Elon Musk's investment in Tesla by $43 billion, is a testament to the company's groundbreaking achievements in space exploration. The factors driving this phenomenal growth—successful launches, lucrative contracts, reusable rocket technology, and Starlink's expansion—point towards an even brighter future. However, competition and technical challenges remain. Stay tuned for further updates on SpaceX valuation and its impact on the future of space exploration!

Featured Posts

-

100 Days Of Losses How Tech Billionaires Paid For Trumps Inauguration

May 09, 2025

100 Days Of Losses How Tech Billionaires Paid For Trumps Inauguration

May 09, 2025 -

Palantir Stock Current Market Analysis And Investment Recommendations

May 09, 2025

Palantir Stock Current Market Analysis And Investment Recommendations

May 09, 2025 -

Draisaitl Hellebuyck And Kucherov Vie For The 2023 Hart Trophy

May 09, 2025

Draisaitl Hellebuyck And Kucherov Vie For The 2023 Hart Trophy

May 09, 2025 -

Riski Novogo Naplyva Ukrainskikh Bezhentsev V Germaniyu Vliyanie Politiki S Sh A

May 09, 2025

Riski Novogo Naplyva Ukrainskikh Bezhentsev V Germaniyu Vliyanie Politiki S Sh A

May 09, 2025 -

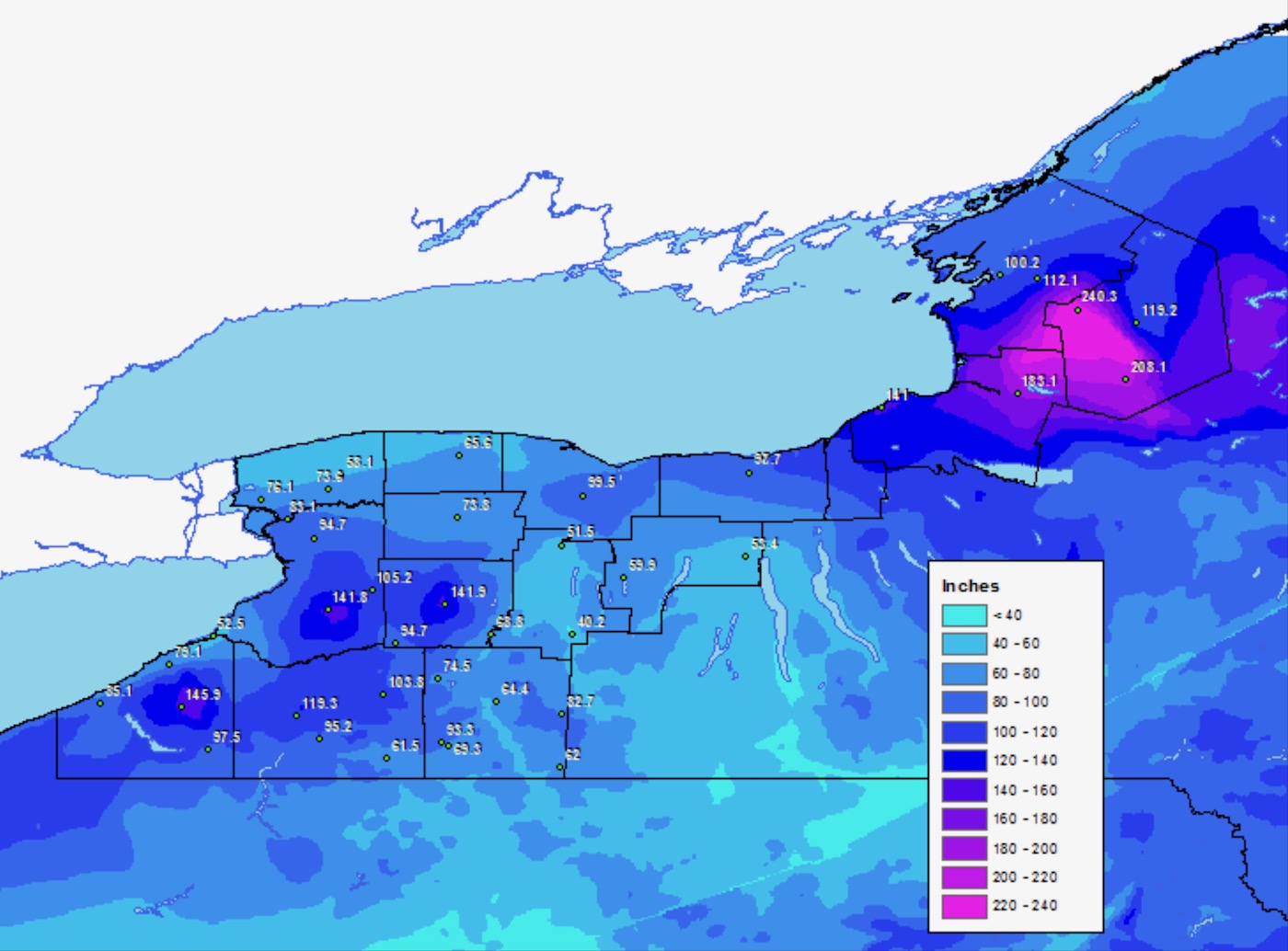

Snow Alert Significant Snowfall Expected In Western Manitoba

May 09, 2025

Snow Alert Significant Snowfall Expected In Western Manitoba

May 09, 2025