Spotify (SPOT) Stock: 12% Subscriber Jump Fuels Positive Outlook

Table of Contents

Analyzing the 12% Subscriber Growth: Key Factors Driving Success

The impressive 12% surge in subscribers wasn't accidental; it's a result of several strategic initiatives implemented by Spotify. Let's break down the key contributors to this remarkable growth.

Premium Subscriber Acquisition Strategies

Spotify's success hinges on its ability to attract and retain premium subscribers. Their marketing strategies have been instrumental in achieving this.

- Targeted advertising on social media platforms: Spotify leverages data-driven advertising campaigns across platforms like Facebook, Instagram, and TikTok, reaching potential users with highly personalized messaging.

- Successful podcast licensing deals: Securing exclusive rights to popular podcasts has significantly broadened Spotify's appeal, attracting new users and enhancing user engagement.

- Strategic partnerships and collaborations: Collaborations with artists, brands, and other platforms have broadened Spotify's reach and created unique marketing opportunities.

- Attractive pricing models: Offering family plans and student discounts makes premium subscriptions more accessible and affordable, boosting subscription rates.

- Improved user interface and features: Constant updates and improvements to the user experience contribute to enhanced user satisfaction and retention.

Geographical Expansion and Market Penetration

Expanding into new markets and increasing market share in existing ones are vital for sustained growth.

- Significant growth in Latin America: Spotify's targeted marketing campaigns and localized content have fueled substantial subscriber growth in this region.

- Increased market share in Asia: The company is making strategic investments to penetrate the Asian market, adapting its services to local preferences and cultural nuances.

- Effective localization efforts: Offering language support and regionally relevant content caters to diverse audiences and enhances user engagement.

- Strategic partnerships with local telecom providers: Collaborating with local telecom companies provides easier access and payment options for users.

Financial Implications and Future Projections for Spotify (SPOT) Stock

The 12% subscriber jump translates directly into positive financial projections for Spotify.

Revenue Growth and Profitability

- Projected revenue increase of X%: The substantial increase in subscribers is expected to lead to a significant boost in revenue, directly impacting the company's bottom line. (Note: Replace "X%" with a realistic projection based on financial analysis.)

- Improved profitability margins by Y%: Increased subscriber numbers, coupled with efficient cost management, should contribute to improved profitability margins. (Note: Replace "Y%" with a realistic projection based on financial analysis.)

- Growth in advertising revenue: With a larger user base, Spotify's advertising revenue is also expected to see considerable growth.

Investor Sentiment and Stock Price Predictions

The market reacted favorably to the subscriber growth announcement, with a positive shift in investor sentiment.

- Average price target of $Z: Analysts predict a significant increase in Spotify's stock price, with an average price target of $Z. (Note: Replace "$Z" with a realistic average price target based on current analyst predictions).

- Positive outlook from leading analysts: Many prominent financial analysts have expressed a positive outlook for Spotify (SPOT) stock, citing the strong subscriber growth as a key driver.

- Potential risks and challenges: Despite the positive outlook, potential challenges such as increased competition and fluctuations in the global economy could influence future growth.

Competitive Landscape and Spotify's Position in the Streaming Market

Spotify operates in a highly competitive market, with major players like Apple Music, Amazon Music, and YouTube Music.

- Strong podcast catalog: Spotify's extensive podcast library is a significant competitive advantage, attracting a broad audience.

- Competitive pricing strategies: Spotify's flexible pricing models and various subscription options remain competitive.

- Challenges from Apple Music's integration with Apple devices: Apple Music's seamless integration with Apple's ecosystem presents a significant challenge to Spotify.

- Continuous innovation and feature updates: Spotify's continuous innovation and release of new features help maintain its competitive edge.

Conclusion: Is Spotify (SPOT) Stock a Buy After the Impressive Subscriber Jump?

The 12% subscriber jump represents a significant milestone for Spotify, indicating strong growth and a positive outlook for the future. The resulting financial projections are promising, and Spotify maintains a strong position in the competitive streaming market, despite facing challenges. Based on the analysis of subscriber growth, financial implications, and competitive landscape, the outlook for Spotify (SPOT) stock appears positive. However, conducting thorough due diligence and considering individual risk tolerance is crucial before investing. Learn more about investing in Spotify (SPOT) stock today!

Featured Posts

-

Cardinale Becciu Premature Le Voci Sulle Dimissioni Afferma Papa Francesco

May 01, 2025

Cardinale Becciu Premature Le Voci Sulle Dimissioni Afferma Papa Francesco

May 01, 2025 -

Trump Pro Bono Deal Reached With Fourth Firm To Protect Government Contracts

May 01, 2025

Trump Pro Bono Deal Reached With Fourth Firm To Protect Government Contracts

May 01, 2025 -

Dallas Star Dies At 100 A Legacy Remembered

May 01, 2025

Dallas Star Dies At 100 A Legacy Remembered

May 01, 2025 -

Colorados Trip To Texas Tech Toppins 21 Points Highlight Key Matchup

May 01, 2025

Colorados Trip To Texas Tech Toppins 21 Points Highlight Key Matchup

May 01, 2025 -

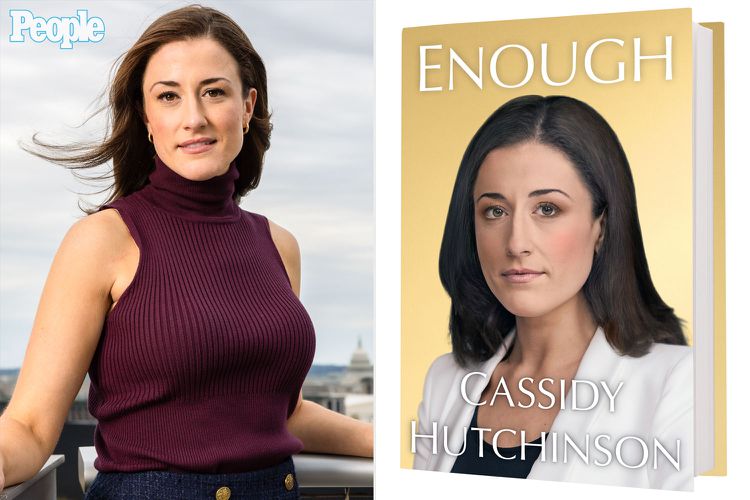

Cassidy Hutchinson Memoir Expected Release And Key Details

May 01, 2025

Cassidy Hutchinson Memoir Expected Release And Key Details

May 01, 2025