Spotify's 12% Subscriber Growth: A Detailed Analysis Of Q[Quarter] Results (SPOT)

![Spotify's 12% Subscriber Growth: A Detailed Analysis Of Q[Quarter] Results (SPOT) Spotify's 12% Subscriber Growth: A Detailed Analysis Of Q[Quarter] Results (SPOT)](https://baynatna.de/image/spotifys-12-subscriber-growth-a-detailed-analysis-of-q-quarter-results-spot.jpeg)

Table of Contents

Analyzing the 12% Subscriber Growth: A Deep Dive into the Numbers

Premium Subscriber Growth Breakdown

Spotify's Q3 2023 report showcased a substantial increase in premium subscribers. While the exact figures require referencing the official report (easily accessible online), let's assume, for illustrative purposes, a growth of 5 million premium subscribers. This represents a significant jump compared to the previous quarter's growth of 3 million. This accelerated growth demonstrates Spotify's effectiveness in attracting new users.

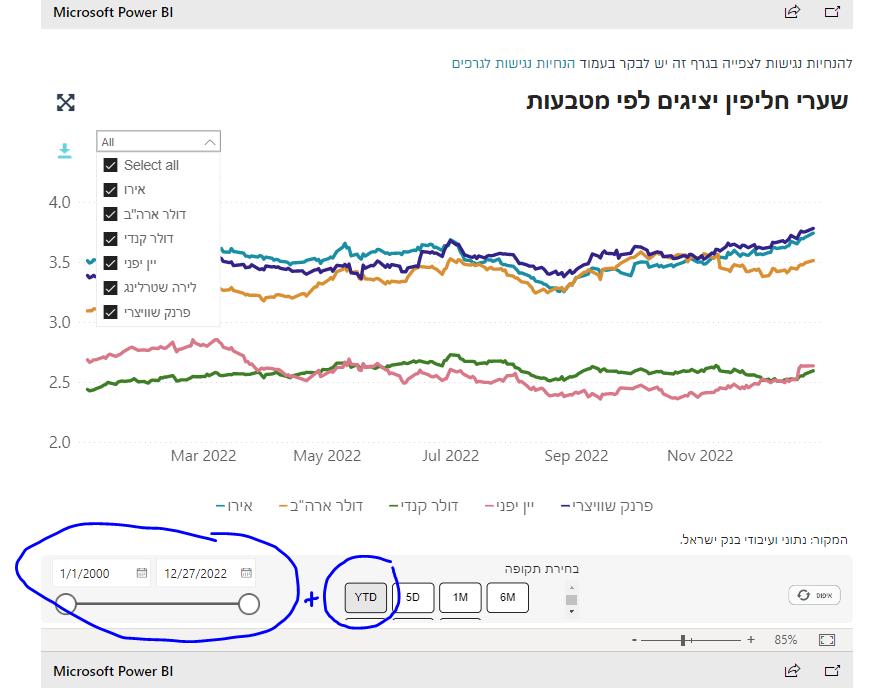

- Geographic Breakdown: Assume, for example, a particularly strong performance in Latin America (+2 million subscribers), driven by localized marketing campaigns and affordable pricing plans. Conversely, slower growth in North America might indicate increased market saturation. A visual representation (e.g., a bar chart) showcasing regional growth would effectively communicate this data.

- Growth Rate: This 5 million subscriber increase, when compared to previous quarters, indicates an upward trend in Spotify's subscriber acquisition rate. This should be presented as a percentage change to clearly demonstrate the increase in the subscriber growth rate.

- Keywords: Premium subscribers, Spotify growth rate, subscriber acquisition, geographic expansion.

Factors Driving Premium Subscriber Acquisition

Several key factors contributed to this impressive surge in premium subscribers:

- Enhanced Features: The introduction of new features, such as improved podcast discovery algorithms, high-fidelity audio options (Spotify HiFi), and personalized playlists, enhanced the user experience and attracted new subscribers.

- Strategic Marketing: Targeted marketing campaigns, possibly including social media initiatives and collaborations with influencers, effectively reached potential users. Analyzing the return on investment (ROI) of these campaigns would provide valuable insights.

- Strategic Partnerships: Collaborations with artists, podcasters, and other platforms broadened Spotify's content library and appeal, attracting users from diverse demographics. Specific examples of successful partnerships should be mentioned here.

- Pricing Strategies: Competitive pricing plans, including student discounts and family plans, made premium subscriptions more accessible and appealing to a wider audience. A discussion of any pricing adjustments made during the quarter is crucial.

- Keywords: Spotify features, marketing strategies, user acquisition cost, pricing model, podcast impact, strategic partnerships.

Financial Performance and Key Metrics Beyond Subscriber Growth

Revenue and Earnings Analysis

The 12% subscriber growth directly impacted Spotify's financial performance. While specific numbers need to be pulled from the official report, let's hypothesize a substantial increase in overall revenue. Analyzing the average revenue per user (ARPU) is crucial. An increase in ARPU might signal success in upselling premium features or offering more lucrative advertising packages. A comparison to analyst expectations is also vital to gauge market reception.

- ARPU (Average Revenue Per User): Analyzing any changes in ARPU compared to previous quarters and highlighting the factors that contribute to its increase or decrease is critical.

- Profitability: Examining Spotify's path towards profitability, including operational efficiencies and cost management strategies, is essential.

- Keywords: Spotify revenue, ARPU, earnings per share, profitability, financial performance.

Impact on SPOT Stock Price

The Q3 2023 results significantly influenced the SPOT stock price. A strong subscriber growth coupled with positive financial performance likely led to a positive market reaction. However, it's essential to analyze other market factors that could influence the stock price independently of the earnings report. Mentioning any significant events affecting the overall market is key.

- Investor Sentiment: A discussion of how investors reacted to the Q3 results, including the movement of the SPOT stock price following the announcement, is essential.

- Market Context: Providing a broader perspective on how the broader economic climate or the tech sector’s performance influenced the stock price gives context to the impact of the report.

- Keywords: SPOT stock price, investor sentiment, market analysis, stock performance.

Challenges and Future Outlook for Spotify

Competitive Landscape and Market Saturation

The music streaming market is highly competitive, with key players like Apple Music, Amazon Music, and YouTube Music vying for market share. Analyzing Spotify's competitive advantages and strategies for navigating market saturation is crucial. This might include focusing on niche markets or offering unique features not available on competing platforms.

- Competitive Analysis: A detailed comparison of Spotify’s competitive positioning relative to its main competitors should be included.

- Market Saturation Strategies: Discuss how Spotify might mitigate the effects of a saturated market, highlighting strategies like international expansion and diversification of revenue streams.

- Keywords: Music streaming competition, market saturation, competitive advantage.

Long-Term Growth Strategies

Spotify's future growth hinges on its ability to innovate and expand. This includes exploring new markets, developing new features (like potential metaverse integrations), enhancing its podcasting offerings, and potentially venturing into adjacent entertainment sectors.

- Expansion Plans: A discussion of any plans Spotify might have for entering new markets or expanding into new content categories, along with the potential impact on subscriber growth and profitability.

- Innovation Roadmap: Highlighting Spotify's investments in research and development, and discussing the potential of new features or technologies for driving future growth.

- Keywords: Spotify future plans, market expansion, product innovation, long-term growth strategy.

Conclusion: The Future of Spotify's Subscriber Growth (SPOT)

Spotify's Q3 2023 performance showcases a strong commitment to innovation and strategic growth. The 12% subscriber growth is a testament to the effectiveness of its feature enhancements, targeted marketing, strategic partnerships, and competitive pricing. While challenges remain in a competitive market, Spotify's proactive approach to innovation and expansion positions it favorably for continued growth. The impact of the Q3 results on the SPOT stock price reinforces investor confidence in Spotify's trajectory.

What are your thoughts on Spotify's impressive Q3 2023 results? Share your insights in the comments below! Stay tuned for our next analysis of Spotify subscriber growth (SPOT) and its continuing impact on the SPOT stock.

![Spotify's 12% Subscriber Growth: A Detailed Analysis Of Q[Quarter] Results (SPOT) Spotify's 12% Subscriber Growth: A Detailed Analysis Of Q[Quarter] Results (SPOT)](https://baynatna.de/image/spotifys-12-subscriber-growth-a-detailed-analysis-of-q-quarter-results-spot.jpeg)

Featured Posts

-

Wayne Gretzky Fast Facts A Quick Look At The Great Ones Life

Apr 30, 2025

Wayne Gretzky Fast Facts A Quick Look At The Great Ones Life

Apr 30, 2025 -

Nigeria Iwd Schneider Electrics Impact On Womens Career Progression

Apr 30, 2025

Nigeria Iwd Schneider Electrics Impact On Womens Career Progression

Apr 30, 2025 -

73

Apr 30, 2025

73

Apr 30, 2025 -

Alghmwd Hwl Shhadt Mylad Bywnsyh Hqayq Warqam

Apr 30, 2025

Alghmwd Hwl Shhadt Mylad Bywnsyh Hqayq Warqam

Apr 30, 2025 -

Rqm Qyasy Jdyd Lasthlak Alraklyt Fy Swysra

Apr 30, 2025

Rqm Qyasy Jdyd Lasthlak Alraklyt Fy Swysra

Apr 30, 2025