SSE Cuts Spending: £3 Billion Reduction Amidst Economic Slowdown

Table of Contents

Reasons Behind SSE's £3 Billion Spending Reduction

The £3 billion reduction in SSE's capital expenditure is a response to a confluence of factors that have significantly impacted the energy sector's financial landscape. The primary drivers for these cost reduction measures include:

-

Increased Inflation and Rising Interest Rates: Soaring inflation and subsequent interest rate hikes have dramatically increased the cost of borrowing, making large-scale energy projects significantly more expensive to finance. This has forced SSE, like many other businesses, to re-evaluate its investment strategy and prioritize projects with a higher likelihood of short-term profitability. The cost reduction strategy focuses on ensuring the long-term financial health of the company.

-

Uncertainty in the Energy Market Due to Geopolitical Factors: The global energy market remains volatile due to ongoing geopolitical instability. The war in Ukraine, in particular, has created significant uncertainty surrounding energy supply and pricing, impacting investment decisions across the board. This uncertainty makes long-term planning difficult and increases the risk associated with large-scale energy projects.

-

Pressure from Investors to Improve Profitability and Reduce Debt: Investors are increasingly demanding higher returns and improved financial performance from energy companies. SSE, like its competitors, faces pressure to demonstrate profitability and reduce its debt levels. This has led to a focus on cost-cutting measures and a more cautious approach to investment. Maintaining investor confidence is crucial for attracting future funding.

-

Potential Impact of Government Regulations and Policies: The evolving regulatory landscape in the UK energy sector adds another layer of complexity to investment planning. Changes in government policy and regulations can significantly impact the viability of specific projects, requiring SSE to carefully consider potential risks and uncertainties before committing capital. Understanding the future regulatory environment is vital for effective investment decisions.

Impact on Specific SSE Projects and Investments

The £3 billion spending cut will inevitably impact various projects within SSE's investment portfolio. While specific details haven't been fully disclosed, it's expected that some projects will experience delays, and others might be cancelled entirely. This could include:

-

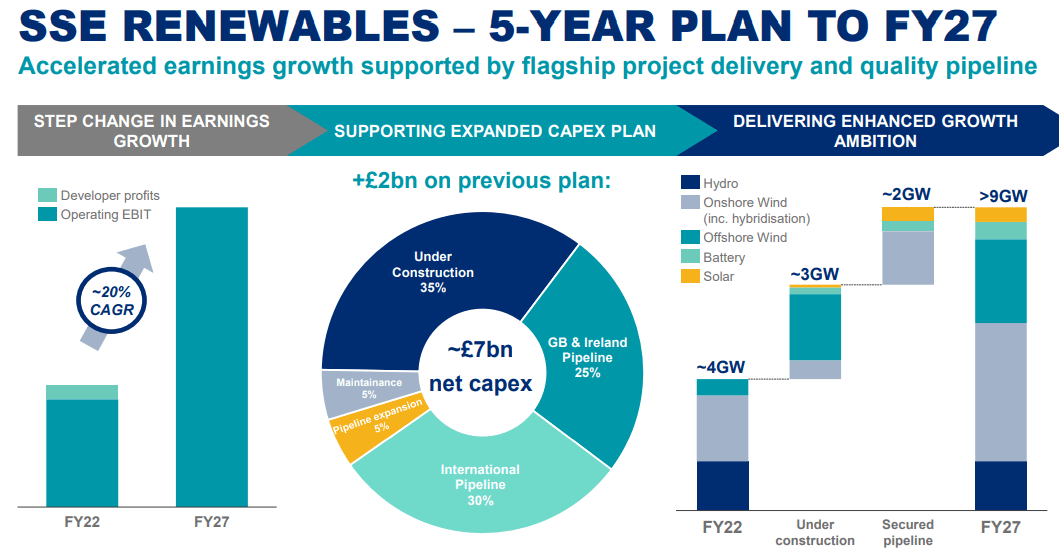

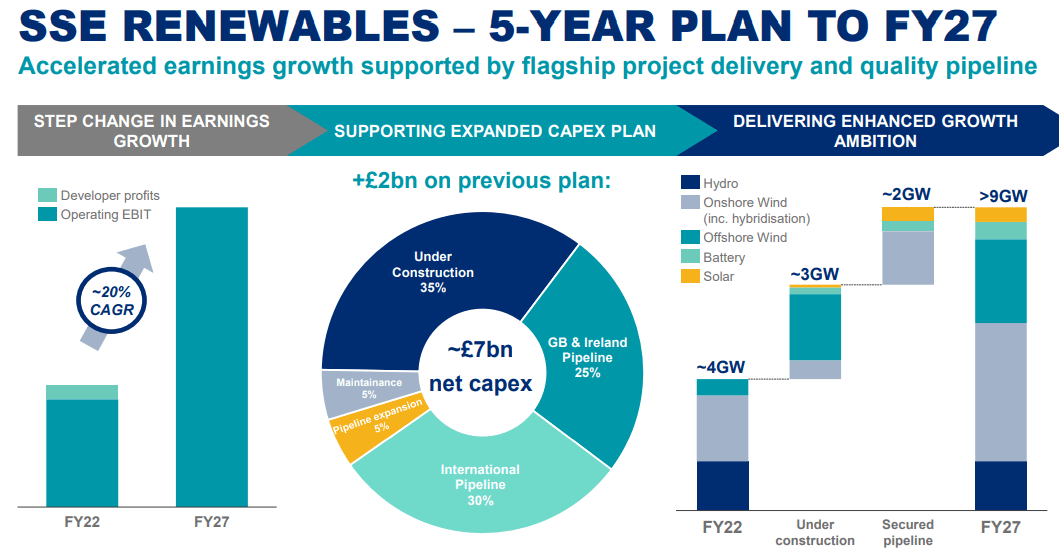

Renewable Energy Projects: Some renewable energy projects, such as wind farms and hydropower schemes, might face delays or even cancellations. This could temporarily slow down the UK’s transition to cleaner energy. The capital expenditure reduction necessitates a thorough review of all ongoing renewable energy investments.

-

Network Infrastructure Upgrades: Upgrades to the electricity network infrastructure, crucial for supporting the integration of renewable energy sources, could also be impacted. This could lead to short-term efficiency losses and potentially hamper the wider energy transition goals. Project delays need careful management to minimize any disruption to the network’s performance.

The financial impact on each affected project will vary. SSE will likely prioritize projects that offer the quickest return on investment, while others with longer lead times or higher risk profiles might be postponed or cancelled altogether. The implementation of the cuts will likely be phased, prioritizing projects deemed essential while delaying or cancelling less critical ones.

Long-Term Implications for SSE and the Energy Sector

SSE's decision to significantly reduce its spending has broad implications for both the company and the wider UK energy sector.

-

Potential Impact on SSE's Growth and Market Share: The spending cuts could temporarily hinder SSE's growth and potentially impact its market share, especially if competitors continue to invest aggressively in new projects. Maintaining a competitive position while streamlining operations is a key challenge.

-

Effect on Job Security and Employment Within the Company: The reduction in capital expenditure might lead to job losses or hiring freezes within the company, raising concerns about employment security for SSE employees. The company will need to carefully manage the impact of the spending cuts on its workforce.

-

Wider Implications for the UK Energy Sector: SSE's decision reflects a wider trend within the UK energy sector, highlighting the difficulties in securing funding for large-scale energy projects in the current economic climate. This could hamper the UK's progress towards its renewable energy targets.

-

Potential for Future Investment and Expansion Once the Economic Climate Improves: SSE has emphasized that this is a strategic response to short-term economic headwinds and that the company plans to resume a more ambitious investment strategy once the economic climate improves. Future investment will likely be focused on higher-return projects that align with a more sustainable business model.

Analyst Reactions and Market Response to the SSE Spending Cuts

The announcement of SSE's £3 billion spending cut has prompted a mixed reaction from financial analysts and market experts. Some analysts view the decision as a prudent and necessary response to the current economic challenges, emphasizing the importance of maintaining financial stability. Others express concerns about potential delays in crucial energy projects, potentially impacting the UK's energy transition goals.

-

Analyst Quotes: [Insert quotes from reputable financial analysts here, if available. Replace this placeholder with actual quotes and citations.]

-

Stock Market Reaction: [Insert information about the stock market's reaction to the announcement. This section should include details on stock price changes and trading volume.]

-

Overall Market Sentiment: The overall market sentiment appears to be one of cautious optimism, with investors recognizing the need for cost-cutting measures while hoping that the move will ultimately strengthen SSE's long-term financial position. The market response suggests a need for transparency and clear communication from SSE regarding its future investment strategies.

Conclusion: SSE Cuts Spending: A Necessary Response to Economic Headwinds?

SSE's £3 billion spending reduction is a significant event reflecting the challenging economic conditions impacting the UK energy sector. Driven by inflation, geopolitical uncertainty, investor pressure, and regulatory changes, these cost-cutting measures will likely lead to project delays and potential cancellations. While this might temporarily impact SSE's growth and the UK's energy transition efforts, it's arguably a necessary strategic move to ensure the company's long-term financial stability. The long-term impact remains to be seen, but the company's commitment to resuming ambitious investment once the economic climate improves is a positive sign. To stay informed about further developments regarding SSE's financial strategy and the wider impact of these SSE budget cuts on the energy market, subscribe to our updates or follow SSE's official news releases. Keep an eye on SSE investment decisions for insights into the company’s future direction.

Featured Posts

-

The Complete Guide To Escaping To The Country

May 24, 2025

The Complete Guide To Escaping To The Country

May 24, 2025 -

Auto Dealers Intensify Fight Against Electric Vehicle Regulations

May 24, 2025

Auto Dealers Intensify Fight Against Electric Vehicle Regulations

May 24, 2025 -

Buffetts Departure Whats Next For Berkshire Hathaways Apple Investment

May 24, 2025

Buffetts Departure Whats Next For Berkshire Hathaways Apple Investment

May 24, 2025 -

Bipartisan Senate Resolution Celebrates Canada U S Partnership

May 24, 2025

Bipartisan Senate Resolution Celebrates Canada U S Partnership

May 24, 2025 -

Essential Accessories Every Ferrari Owner Needs

May 24, 2025

Essential Accessories Every Ferrari Owner Needs

May 24, 2025