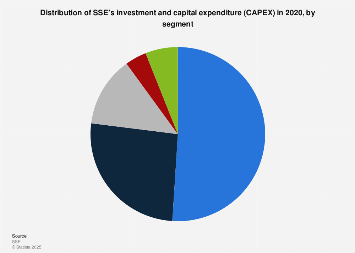

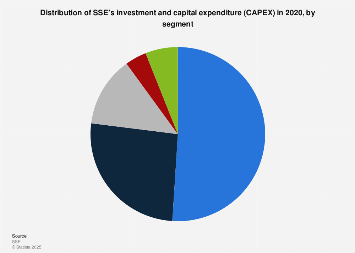

SSE Responds To Slowing Growth With £3 Billion Spending Reduction

Table of Contents

Reasons Behind SSE's £3 Billion Spending Reduction

SSE's decision to slash its spending by £3 billion is multifaceted, driven by a confluence of factors impacting the energy industry's profitability and outlook.

Impact of Inflation and Rising Costs

Soaring inflation has significantly impacted SSE's bottom line. The company is experiencing a severe "profit margin squeeze" due to increased operational costs across various areas.

- Material Costs: The price of essential materials used in energy production and infrastructure projects has skyrocketed, increasing the cost of new projects and maintenance.

- Labor Costs: Wage inflation and the increasing difficulty in recruiting skilled labor add further pressure on operational budgets.

- Regulatory Changes: New environmental regulations and compliance costs add to the financial burden on energy companies like SSE.

These escalating costs necessitate stringent cost-control measures, and the £3 billion spending reduction is a direct response to this pressure. The keywords "inflation," "cost inflation," "operational costs," "profit margin squeeze," and "energy price inflation" accurately reflect this challenging economic reality.

Slowing Demand and Market Uncertainty

The UK economy is experiencing a slowdown, impacting energy demand. Decreased consumer spending and reduced industrial activity translate to lower energy consumption, affecting SSE's revenue projections.

- Decreased Consumer Spending: Households are cutting back on non-essential spending, impacting energy consumption patterns.

- Reduced Industrial Activity: A slowdown in manufacturing and other industrial sectors leads to decreased energy demand from businesses.

This market uncertainty introduces considerable "investment risk," making energy companies more cautious about large-scale projects. Keywords like "energy demand," "economic slowdown," "market uncertainty," "investment risk," and "consumer spending" accurately describe this challenging market environment.

Focus on Renewable Energy Investments

Despite the overall spending reduction, SSE is prioritizing investments in renewable energy sources. This reflects a strategic shift towards sustainable energy and aligns with broader global efforts to achieve net-zero targets.

- Offshore Wind Farms: SSE is continuing its investment in large-scale offshore wind farm projects, anticipating significant long-term returns from green energy sources.

- Solar and Hydro Projects: Investments in solar and hydro power projects are also being prioritized, diversifying SSE's renewable energy portfolio.

This focus on "renewable energy," "sustainable energy," "green energy," "ESG investments," and "net-zero targets" demonstrates SSE's commitment to long-term sustainability while navigating short-term economic challenges.

Impact of the Spending Reduction on SSE's Operations and Future Plans

The £3 billion spending cut will undoubtedly have consequences for SSE's operations and future trajectory.

Job Security and Potential Layoffs

The spending reduction raises concerns about job security within SSE. While the company hasn't announced widespread layoffs, there's a possibility of staff reductions in some areas to align with the reduced budget. The impact on "job security," "job cuts," "layoffs," "staff reductions," and "employee relations" will be closely monitored.

Project Delays and Cancellations

Some projects may experience delays or even cancellations as a result of the spending cuts. This could impact SSE's growth strategy and its ability to meet long-term targets. Specific projects affected remain unclear, creating uncertainty regarding the implications for "project delays," "project cancellations," "capital expenditure cuts," "investment deferrals," and "growth strategy."

Investor Reaction and Market Outlook for SSE

The announcement of the £3 billion spending reduction had a noticeable impact on the market.

Stock Market Response

SSE's share price experienced fluctuations following the announcement, reflecting investor sentiment regarding the company's future prospects. The "stock market reaction," "share price," "investor sentiment," "market capitalization," and "financial performance" will continue to be closely watched.

Analyst Predictions and Future Prospects

Analysts offer varied predictions for SSE's future performance. Some express concerns about the potential impact of the spending cuts on long-term growth, while others believe that the focus on renewable energy and cost-cutting measures will ultimately benefit the company. The ongoing assessment of "analyst predictions," "future prospects," "financial outlook," "long-term strategy," and "profitability" will shape investor confidence.

Conclusion: Navigating the Challenges: SSE's £3 Billion Spending Reduction and the Path Forward

SSE's £3 billion spending reduction is a significant response to a challenging economic environment characterized by inflation, slowing energy demand, and market uncertainty. The decision highlights the need for strategic cost control and a renewed focus on renewable energy investments. While the cuts may lead to project delays, potential job losses, and short-term market volatility, SSE's commitment to sustainable energy positions the company for long-term growth. To stay informed about SSE's performance and the wider energy market, subscribe to our updates, follow SSE's news, and continue researching the impact of SSE's spending reduction on the energy sector. Stay tuned for further analysis on "SSE news," "energy market analysis," "SSE spending cuts," and the "energy sector outlook."

Featured Posts

-

Bidens Health Details On Last Prostate Cancer Screening In 2014

May 22, 2025

Bidens Health Details On Last Prostate Cancer Screening In 2014

May 22, 2025 -

Blake Lively And Taylor Swifts Friendship Subpoena Report Sparks Tension

May 22, 2025

Blake Lively And Taylor Swifts Friendship Subpoena Report Sparks Tension

May 22, 2025 -

Superalimentos Por Que Este Supera Al Arandano En Beneficios Para La Salud

May 22, 2025

Superalimentos Por Que Este Supera Al Arandano En Beneficios Para La Salud

May 22, 2025 -

Wordle April 26 2025 Answer Hints And Tips For Puzzle 1407

May 22, 2025

Wordle April 26 2025 Answer Hints And Tips For Puzzle 1407

May 22, 2025 -

Man Achieves Fastest Australia Foot Crossing

May 22, 2025

Man Achieves Fastest Australia Foot Crossing

May 22, 2025