SSE's £3 Billion Spending Cut: A Response To Economic Slowdown

Table of Contents

The Economic Context: Why the Spending Cut?

The current economic climate is undeniably tough, significantly impacting energy companies like SSE. High inflation, rising interest rates, and reduced consumer spending have created a perfect storm of challenges. This has led to a reassessment of investment priorities across numerous industries. For SSE, the implications are particularly stark.

-

Increased borrowing costs: Securing financing for large-scale energy projects has become significantly more expensive, making many projects less financially viable. The increased cost of capital directly impacts the return on investment (ROI) calculations, pushing previously attractive ventures into the red.

-

Reduced consumer demand: The cost-of-living crisis has forced consumers to cut back on discretionary spending, including energy consumption where possible. This reduced demand directly impacts profitability for energy providers like SSE, making large-scale investments harder to justify.

-

Uncertainty surrounding future energy prices and regulations: The volatility in global energy markets creates significant uncertainty in predicting future revenue streams. Changes in government policy and environmental regulations also add to the complexity, making long-term planning increasingly difficult. This uncertainty further contributes to the hesitation in committing to large-scale projects.

-

Global economic slowdown: The broader global economic slowdown is impacting investment decisions across all sectors. Investors are more risk-averse, making it harder for companies like SSE to secure the necessary funding for ambitious projects. This cautious approach to investment is a significant driver behind the SSE spending cut.

Details of SSE's £3 Billion Spending Cut

The £3 billion reduction in capital expenditure affects several key areas of SSE's operations. While precise percentage reductions for each sector haven't been publicly detailed, it's clear that renewable energy projects and network upgrades are significantly impacted.

-

Renewable energy projects: Several wind farm and other renewable energy projects have either been delayed or cancelled outright. The specifics of these projects haven't been fully disclosed, but this represents a setback for SSE's ambitious renewable energy targets.

-

Network infrastructure development: Plans for upgrading and expanding the electricity transmission and distribution networks are also affected. These upgrades are crucial for integrating new renewable energy sources and ensuring grid stability, but the SSE spending cut has inevitably impacted the timelines and scale of these projects.

-

Potential job losses and restructuring: While not explicitly stated, a spending cut of this magnitude will likely lead to some job losses or restructuring within SSE. The precise impact on employment remains unclear, but it's a serious concern for employees and the wider economy.

-

Revised timelines for key projects: Many projects are now expected to be completed significantly later than originally planned. This delay directly impacts SSE's ability to meet its long-term strategic goals, including its commitment to net-zero emissions.

Impact on SSE's Future Strategy and Growth

The SSE spending cut will undoubtedly have long-term consequences for the company's growth targets and its ambitions in the renewable energy sector.

-

Revised targets for renewable energy generation capacity: The delays and cancellations of renewable energy projects will inevitably lead to revised targets for future generation capacity. This represents a significant challenge to SSE's stated commitment to investing in renewable energy sources.

-

Potential delays in achieving net-zero targets: The reduced investment in renewable energy will almost certainly delay SSE's ability to achieve its net-zero emission targets. This delay could have reputational and regulatory consequences for the company.

-

Impact on SSE's market share and competitiveness: The reduced investment compared to competitors could potentially impact SSE's market share and competitiveness in the long term. Competitors that continue to invest may gain an advantage in the growing renewable energy market.

-

Potential for future investment: Once the economic climate improves, and market conditions become more favorable, SSE will likely revisit its investment plans. However, the current situation highlights the significant risks associated with large-scale energy projects in an uncertain economic environment.

Investor and Consumer Reactions to the SSE Spending Cut

The announcement of the SSE spending cut has generated a mixed reaction from investors and consumers.

-

Stock market reaction: The initial stock market reaction was largely negative, reflecting investor concerns about the impact of the spending cut on SSE's future profitability and growth prospects. However, the long-term impact remains to be seen.

-

Analyst commentary and predictions: Analysts have offered mixed predictions, with some expressing concern about the long-term consequences, while others suggest that the cut is a necessary response to the current economic realities.

-

Consumer concerns: Consumers are concerned about the potential impact on energy prices and the reliability of the energy supply. Delays in network upgrades could lead to disruptions and potential price increases.

-

Implications for future energy bills: The long-term impact of the SSE spending cut on energy bills remains uncertain. While the immediate impact may be limited, future price increases are a possibility, depending on the success of other projects and the ongoing economic situation.

Conclusion

SSE's £3 billion spending cut is a direct and significant response to the current economic slowdown. The challenges posed by inflation, rising interest rates, reduced consumer demand, and global economic uncertainty have forced the company to reassess its investment priorities. This decision will inevitably have long-term consequences for SSE's growth trajectory, its renewable energy ambitions, and its competitiveness within the energy sector. The impact on consumers, through potentially delayed projects and potentially higher energy bills, is another major concern.

Call to Action: Stay informed about the ongoing developments related to the SSE spending cut and its wider implications for the energy sector. Follow [link to SSE's investor relations page] for updates on their financial performance and future plans. For further analysis of the UK energy market and its response to the economic slowdown, keep checking back for more articles on [your website/publication name] exploring related keywords such as "SSE financial results," "UK energy market outlook," and "impact of inflation on energy companies."

Featured Posts

-

Jonathan Groffs Just In Time Performance A Tony Awards Prediction

May 23, 2025

Jonathan Groffs Just In Time Performance A Tony Awards Prediction

May 23, 2025 -

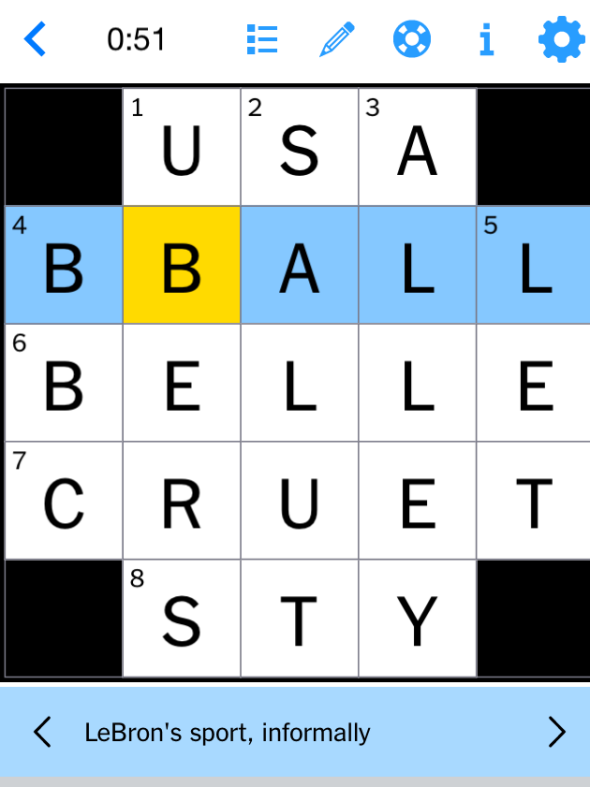

Nyt Mini Crossword Solution April 8 2025 Tuesday

May 23, 2025

Nyt Mini Crossword Solution April 8 2025 Tuesday

May 23, 2025 -

Rdwd Alfel Ela Emlyt Washntn Hl Athart Srkht Rwdryghyz Tdamna Ealmya Mn Ajl Alhryt Lflstyn

May 23, 2025

Rdwd Alfel Ela Emlyt Washntn Hl Athart Srkht Rwdryghyz Tdamna Ealmya Mn Ajl Alhryt Lflstyn

May 23, 2025 -

Bjk Cup Finals Kazakhstan To Face Australias Opponents

May 23, 2025

Bjk Cup Finals Kazakhstan To Face Australias Opponents

May 23, 2025 -

University Of Maryland Commencement A World Renowned Amphibian Speaks

May 23, 2025

University Of Maryland Commencement A World Renowned Amphibian Speaks

May 23, 2025