SSE's £3 Billion Spending Cut: Impact Of Economic Slowdown

Table of Contents

H2: The Reasons Behind SSE's Spending Cut

SSE's dramatic budget cuts are a direct response to a confluence of economic pressures. The current economic uncertainty, characterized by high inflation and rising interest rates, has significantly increased the cost of borrowing and investment. This makes previously viable energy projects less attractive, impacting profitability and return on investment.

- Increased inflation and rising interest rates: The soaring cost of materials, labor, and financing has made large-scale infrastructure projects considerably more expensive. This increase directly impacts the feasibility of many of SSE's planned investments.

- Uncertainty in the energy market: Geopolitical instability and fluctuating energy prices create a volatile investment climate, making long-term planning and forecasting exceptionally difficult. This uncertainty increases the risk associated with substantial capital expenditure.

- Shareholder pressure: In the face of economic headwinds, shareholders are demanding improved profitability and greater financial prudence. SSE's decision reflects a need to appease investors concerned about the financial risks associated with large-scale investments during uncertain times.

- Potential changes in government regulations: Shifts in government policy and regulatory frameworks can significantly impact the viability of energy projects. Uncertainty around future regulations may have contributed to SSE's decision to reduce its spending commitment.

- Increased costs of materials and labor: The global supply chain disruptions and skills shortages have pushed up the cost of essential resources, making project development more expensive and less profitable.

H2: Impact on SSE's Infrastructure Development

The £3 billion spending cut will inevitably impact SSE's ambitious infrastructure development plans. This reduction will likely result in delays or cancellations of several key projects, slowing down the vital transition to a cleaner energy future.

- Delays or cancellations of renewable energy projects: Projects involving wind farms, solar parks, and other renewable energy sources are particularly vulnerable to these cost pressures. Delays could affect the UK's renewable energy targets.

- Reduced investment in grid infrastructure: Upgrades and expansions to the electricity grid are crucial for integrating renewable energy sources and ensuring a reliable energy supply. Reduced investment in this area poses significant risks.

- Impact on smart grid technologies: The rollout of smart grid technologies, designed to optimize energy distribution and reduce waste, may also be affected by the budget cuts, hindering the efficiency of the energy system.

- Potential delays in meeting carbon reduction targets: The reduced investment in renewable energy and grid infrastructure could jeopardize the UK's commitments to reducing carbon emissions and achieving net-zero targets.

- Reduced employment opportunities: The scaling back of projects will inevitably lead to fewer job opportunities within SSE and across its supply chain.

H2: Wider Implications for the UK Energy Sector

SSE's spending cut has wider implications for the UK energy sector and the nation's energy security. The slowdown in investment could hinder the UK's ability to meet its energy demands and achieve its climate goals.

- Potential impact on the UK's energy security: Reduced investment in energy infrastructure could compromise the UK's energy security and leave it more vulnerable to energy price volatility and supply disruptions.

- Slowdown in the energy transition: The delays in renewable energy projects will hinder the UK's transition to a low-carbon energy system, potentially jeopardizing its climate commitments.

- Potential job losses: The reduction in investment will likely lead to job losses across the energy sector, impacting both SSE's workforce and the wider supply chain.

- Negative impact on the investment climate: SSE's decision could create a negative ripple effect, discouraging further investment in the UK energy sector and potentially hindering future growth.

- Ripple effect on associated industries and regional economies: The energy sector's slowdown will have knock-on effects on associated industries and the regional economies dependent on energy-related employment.

H2: Potential Mitigation Strategies and Future Outlook

While the situation is challenging, several mitigation strategies could help alleviate the impact of SSE's spending cut. A proactive approach involving government support, cost optimization, and strategic partnerships is crucial.

- Government support and investment incentives: Targeted government support and investment incentives could encourage further investment in the energy sector, mitigating some of the negative impacts of the economic slowdown.

- Cost optimization and efficiency improvements: SSE and other energy companies need to explore strategies for cost optimization and efficiency improvements to maximize the value of their remaining investments.

- Strategic partnerships: Strategic partnerships between energy companies could help share risks and costs, enabling the continuation of crucial infrastructure projects.

- Long-term planning and strategic investment decisions: Long-term strategic planning is essential to navigate economic uncertainty and make informed investment decisions that align with the UK's energy transition goals.

3. Conclusion:

SSE's £3 billion spending cut represents a significant challenge for the UK energy sector. The economic slowdown, coupled with increased costs and regulatory uncertainty, has forced the company to reassess its investment plans, leading to potential delays in renewable energy projects, grid infrastructure upgrades, and job losses. This situation highlights the need for government support, strategic partnerships, and innovative cost-saving measures to ensure the UK's energy security and its ability to meet its climate goals. Learn more about the impact of SSE's spending cuts and stay updated on the evolving energy landscape by visiting SSE's website and following industry news. Understanding how the economic slowdown affects SSE's investment plans is crucial for navigating the future of the UK energy sector.

Featured Posts

-

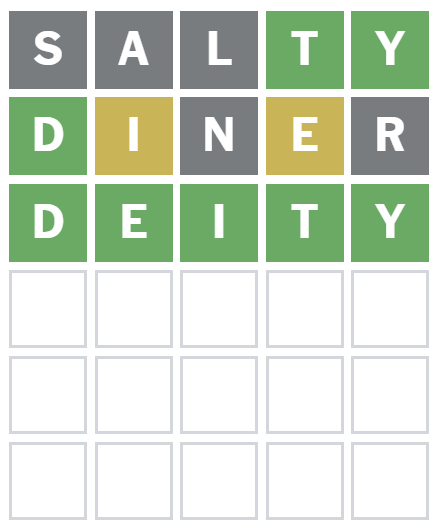

Wordle March 2nd 1352 Hints Clues And Answer

May 22, 2025

Wordle March 2nd 1352 Hints Clues And Answer

May 22, 2025 -

Wordle 1356 Thursday March 6th Answer And Clues

May 22, 2025

Wordle 1356 Thursday March 6th Answer And Clues

May 22, 2025 -

Core Weave Crwv Stock Jim Cramers Perspective And Market Analysis

May 22, 2025

Core Weave Crwv Stock Jim Cramers Perspective And Market Analysis

May 22, 2025 -

Half Dome Secures Abn Group Victorias Media Business

May 22, 2025

Half Dome Secures Abn Group Victorias Media Business

May 22, 2025 -

New Trailer Julianne Moore Stars In The Dark Comedy Series Siren

May 22, 2025

New Trailer Julianne Moore Stars In The Dark Comedy Series Siren

May 22, 2025