State Treasurers Express Concerns Over Musk's Influence On Tesla

Table of Contents

Financial Instability Concerns Related to Elon Musk's Leadership

Elon Musk's actions directly impact Tesla's financial performance, creating volatility that concerns state treasurers responsible for long-term investments.

Volatile Stock Performance Driven by Musk's Tweets and Actions

Musk's frequent and often unpredictable pronouncements on social media have repeatedly sent Tesla's stock price on roller-coaster rides.

- April 2021: Musk's tweets about Bitcoin's potential caused significant price swings for both Tesla stock and Bitcoin itself. [Source: Bloomberg]

- November 2022: Musk's proposed Twitter poll on selling 10% of his Tesla stake led to a sharp drop in Tesla's share price. [Source: Reuters]

- Numerous other instances: Throughout his tenure, similar impulsive announcements have created significant market volatility, making it difficult for long-term investors to confidently hold Tesla stock.

This volatility poses substantial risks to public pension funds and other state investments that prioritize stability and predictable returns. The unpredictable nature of Tesla's stock price, directly linked to Musk's actions, undermines the ability of state treasurers to effectively manage these crucial public assets. Financial experts warn that such volatility can erode the value of long-term investments and hamper the ability of states to meet their financial obligations.

Impact of Musk's Diversification on Tesla's Focus and Performance

Musk's involvement in ventures like SpaceX and Twitter raises concerns about his capacity to effectively manage Tesla.

- Resource Allocation: The considerable time and resources dedicated to SpaceX and, particularly, the acquisition and management of Twitter, may detract from Tesla's core business, potentially slowing innovation and growth.

- Management Bandwidth: Even with a strong management team at Tesla, the burden of overseeing such a diverse portfolio of companies with demanding needs can spread leadership thin, potentially hindering strategic decision-making.

- Employee Morale: The constant uncertainty created by Musk's shifting priorities might negatively impact employee morale and productivity within Tesla.

These factors contribute to the financial instability that is driving concerns among state treasurers. The risk of Tesla's core business suffering due to Musk's other ventures represents a significant investment concern.

Governance and Ethical Concerns Regarding Tesla's Operations Under Musk

Beyond financial volatility, state treasurers are also concerned about Tesla's governance and ethical practices under Musk's leadership.

Concerns about Transparency and Accountability within Tesla

Allegations of questionable business practices and a lack of transparency surrounding certain Tesla operations further fuel concerns.

- SEC investigations: Tesla has faced scrutiny from the Securities and Exchange Commission (SEC) over previous statements and actions by Musk. [Source: SEC filings]

- Workplace allegations: Reports of alleged workplace misconduct and poor working conditions have also raised ethical questions about Tesla's operations. [Source: Various news reports]

- Lack of independent oversight: Some critics argue that Tesla lacks sufficient independent oversight to ensure responsible corporate governance.

State treasurers are entrusted with safeguarding public funds and are obligated to prioritize ethical and responsible investment practices. The lack of transparency and potential for unethical behavior at Tesla raise serious concerns about the long-term viability of their investment in the company.

Environmental, Social, and Governance (ESG) Investing Considerations

ESG factors play an increasingly important role in investment decisions by state treasurers.

- ESG Principles: Many states are committed to aligning their investments with environmental, social, and governance principles.

- Musk's Leadership Style: Musk's often controversial leadership style and certain aspects of Tesla's operations may not fully align with traditional ESG standards.

- Divestment Potential: Growing concerns over ESG implications could lead some states to consider divesting from Tesla, especially if issues remain unaddressed.

The potential conflict between Tesla’s practices and ESG principles is a significant driver for the concerns expressed by state treasurers.

State Treasurers' Actions and Calls for Change

State treasurers are not simply expressing concerns; they are actively taking steps to address them.

Statements and Public Declarations from State Treasurers

Several state treasurers have publicly voiced their apprehension about Tesla's future under Musk's leadership.

- Public statements: Numerous press releases and public statements from state treasurers highlight concerns about Tesla's financial stability and governance. [Source: State treasurer websites]

- Collective Voice: The collective voice of state treasurers represents a powerful force in the financial world, and their unified concerns put significant pressure on Tesla and Musk.

- Divestment Actions: Some states have already begun to review their investments in Tesla, with some even divesting from the company.

These actions reflect the seriousness with which state treasurers view the situation.

Potential Implications for Tesla's Future and Investor Confidence

The concerns raised by state treasurers could have significant long-term consequences for Tesla.

- Market Value: Continued concerns could negatively impact Tesla's market valuation and investor confidence.

- Future Funding: Challenges in securing future funding and attracting new partners could result from the negative perception surrounding Tesla's governance and financial stability.

- Potential Scenarios: Depending on how Musk and Tesla respond to these concerns, various scenarios are possible, ranging from improved governance and increased investor confidence to further declines in stock price and a damaged reputation.

The ongoing situation demands close monitoring.

Conclusion: State Treasurers Express Concerns Over Musk's Influence on Tesla - A Call to Action

State treasurers' concerns regarding Elon Musk's influence on Tesla highlight significant risks related to financial instability, governance issues, and ESG considerations. These concerns underscore the importance of responsible investing and the crucial role state treasurers play in safeguarding public funds. If these concerns are not adequately addressed, the consequences for Tesla could be severe, impacting its market value, future funding, and overall reputation. We urge readers to stay informed about this evolving situation and to actively engage in discussions surrounding Elon Musk's leadership of Tesla and the implications of the "State Treasurers Expressing Concerns Over Musk's Influence on Tesla." The long-term implications are profound, and continued scrutiny is essential.

Featured Posts

-

Karen Reads Second Murder Trial Opening Statements Begin

Apr 23, 2025

Karen Reads Second Murder Trial Opening Statements Begin

Apr 23, 2025 -

Canadian Immigration To Us Plummets Impact Of Trump Administration Policies

Apr 23, 2025

Canadian Immigration To Us Plummets Impact Of Trump Administration Policies

Apr 23, 2025 -

Bmw And Porsche In China A Market Analysis And Future Outlook

Apr 23, 2025

Bmw And Porsche In China A Market Analysis And Future Outlook

Apr 23, 2025 -

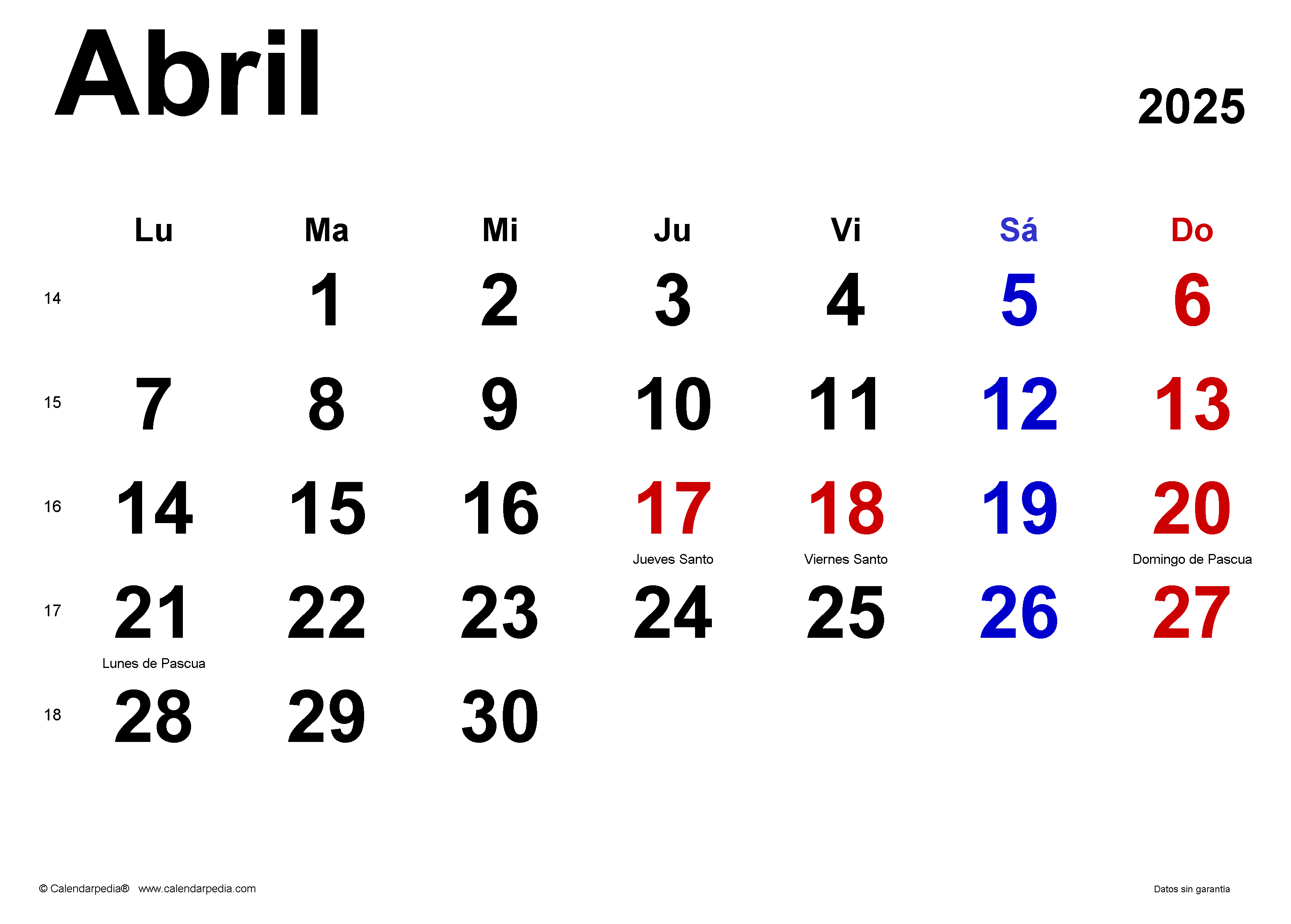

Calendario Laboral Espana 2024 Viernes Santo Y Puente De Abril

Apr 23, 2025

Calendario Laboral Espana 2024 Viernes Santo Y Puente De Abril

Apr 23, 2025 -

Lane Thomas A Strong Start To His Guardians Spring Training

Apr 23, 2025

Lane Thomas A Strong Start To His Guardians Spring Training

Apr 23, 2025