Stellantis' New CEO: Antonio Filosa's Challenge Of Corporate Restructuring

Table of Contents

The Legacy of Carlos Tavares and the Need for Change

Carlos Tavares' tenure as Stellantis CEO was marked by significant achievements, including the successful merger of Fiat Chrysler Automobiles (FCA) and Groupe PSA. He streamlined operations and improved profitability. However, challenges remain. Stellantis, despite its size and diverse portfolio of brands (including Jeep, Ram, Peugeot, Citroën, and Fiat), needs significant restructuring to maintain its global competitiveness. Key areas requiring attention include:

- Overlapping platforms and redundant models: The merger resulted in a multitude of platforms and vehicle models, leading to inefficiencies in production and resource allocation. Consolidating these platforms and rationalizing model lines is crucial for cost reduction and improved profitability.

- Inefficient manufacturing processes: Optimizing manufacturing processes across Stellantis' numerous global plants is paramount. This involves streamlining workflows, adopting advanced manufacturing technologies, and improving supply chain management.

- Software integration challenges: Stellantis faces the challenge of integrating diverse software systems across its various brands. A unified software architecture is essential for delivering seamless connected car experiences and developing advanced driver-assistance systems (ADAS) and autonomous driving capabilities.

- Market share competition in key segments: Stellantis needs to strengthen its market position in key segments, particularly in the rapidly growing electric vehicle (EV) market. This requires aggressive investment in EV technology and the development of compelling new EV models.

The pressure on Filosa to deliver significant change is immense, given the competitive landscape and the need for Stellantis to remain a major player in the global automotive industry. His success will depend on his ability to address these legacy issues effectively.

Filosa's Restructuring Strategy: Key Initiatives

While specific details of Filosa's restructuring strategy are still emerging, several key initiatives are likely to be central to his approach:

- Mergers and acquisitions to streamline operations: Further consolidation within Stellantis' portfolio through strategic mergers or acquisitions could streamline operations and reduce redundancies. This might involve focusing on specific market niches or technologies.

- Investment in electric vehicle (EV) technology and infrastructure: Significant investments in EV technology, battery production, and charging infrastructure are essential for Stellantis to compete effectively in the rapidly expanding EV market. This includes developing innovative EV platforms and models.

- Focus on software development and autonomous driving capabilities: Developing in-house software expertise and investing in autonomous driving technologies are crucial for future competitiveness. This requires significant investment in R&D and talent acquisition.

- Optimization of supply chains and manufacturing facilities: Improving supply chain resilience and optimizing manufacturing processes across Stellantis' global network are essential for reducing costs and enhancing efficiency. This may involve strategic partnerships and the adoption of lean manufacturing principles.

- Cost-cutting measures and increased efficiency: Implementing cost-cutting measures across all aspects of the business, while maintaining quality and brand image, will be a critical element of Filosa's restructuring efforts. This may involve workforce adjustments and operational streamlining.

The success of these initiatives will depend on careful planning, effective execution, and the ability to mitigate potential risks, such as employee resistance and potential market disruptions.

The Impact of Global Market Conditions on Restructuring

Stellantis' restructuring efforts are significantly impacted by the challenging global market conditions:

- The semiconductor shortage: The ongoing semiconductor chip shortage continues to constrain production and impact Stellantis' ability to meet demand, hindering the successful implementation of restructuring plans.

- Rising inflation, material costs, and fluctuating energy prices: These factors significantly increase the cost of production, putting pressure on profitability and requiring careful cost management.

- Government regulations (e.g., emission standards): Stringent emission regulations necessitate significant investments in cleaner technologies and compliance strategies, adding complexity to the restructuring process.

- The competitive landscape: Intense competition from established automakers and new EV entrants requires Stellantis to innovate aggressively and maintain a strong market position.

These external factors add complexity and uncertainty to Filosa’s already challenging task.

Challenges and Potential Roadblocks

Filosa will face numerous challenges in his restructuring efforts:

- Internal resistance to change: Implementing significant changes within a large, complex organization like Stellantis will inevitably encounter resistance from employees and established interests. Effective communication and change management strategies will be crucial.

- Balancing short-term financial goals with long-term strategic objectives: Finding the right balance between achieving short-term profitability and investing in long-term strategic goals such as EV technology is a delicate balancing act.

- Managing a vast global workforce: Effectively managing a large and geographically dispersed workforce across numerous brands and countries requires strong leadership, clear communication, and a well-defined strategy.

- Disrupting established brand identities: Changes to product lines or manufacturing processes could potentially harm established brand identities if not handled carefully.

Overcoming these roadblocks requires strong leadership, effective communication, and a clear vision for the future of Stellantis.

Success Metrics for Filosa's Restructuring

The success of Filosa's restructuring efforts will be measured by several key performance indicators (KPIs):

- Increased profitability and market share: Improved profitability and increased market share across key segments will be fundamental measures of success.

- Improved operational efficiency: Reductions in manufacturing costs, streamlined supply chains, and improved productivity will demonstrate enhanced operational efficiency.

- Successful launch of new EV models: The successful launch and market acceptance of new electric vehicles will be crucial for future growth.

- Enhanced brand perception and customer loyalty: Maintaining strong brand identities while adapting to market changes will be key to sustaining customer loyalty.

- Stronger employee morale and engagement: Maintaining a positive and engaged workforce will be critical to the success of the restructuring initiatives.

These KPIs will be tracked and evaluated regularly to monitor progress and make necessary adjustments to the restructuring strategy.

Conclusion

Antonio Filosa's task of restructuring Stellantis is enormous, demanding a multi-faceted approach encompassing operational efficiency, technological innovation, and strategic market positioning. Success will hinge on effectively navigating global economic uncertainties and internal organizational dynamics. The Antonio Filosa Stellantis Restructuring process will require careful planning and execution, as well as strong leadership and communication. Understanding the challenges and strategies involved is vital for anyone interested in the future of the automotive industry. Stay tuned for further updates on Antonio Filosa's progress in leading Stellantis through this critical period of Antonio Filosa Stellantis Restructuring. Continue following industry news and analysis to stay informed about the Stellantis restructuring under Filosa's leadership.

Featured Posts

-

Verkeersongeval A67 Grashoek Man Uit Venlo Overleden

May 29, 2025

Verkeersongeval A67 Grashoek Man Uit Venlo Overleden

May 29, 2025 -

Americas Moto Gp Marquezs Pole Position Maintains Perfect Start

May 29, 2025

Americas Moto Gp Marquezs Pole Position Maintains Perfect Start

May 29, 2025 -

Otts 1 Thriller 2 Hours 10 Minutes Of Spine Chilling Suspense

May 29, 2025

Otts 1 Thriller 2 Hours 10 Minutes Of Spine Chilling Suspense

May 29, 2025 -

Unlocking Shiny Pokemon In Pokemon Tcg Pocket

May 29, 2025

Unlocking Shiny Pokemon In Pokemon Tcg Pocket

May 29, 2025 -

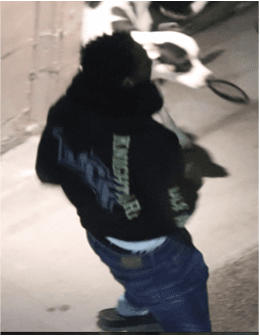

Seattle Cid Shooting Man Shot Twice Near Notorious Intersection

May 29, 2025

Seattle Cid Shooting Man Shot Twice Near Notorious Intersection

May 29, 2025