Stock Market Analysis: Dow Futures, China's Economy, And The Tariff Situation

Table of Contents

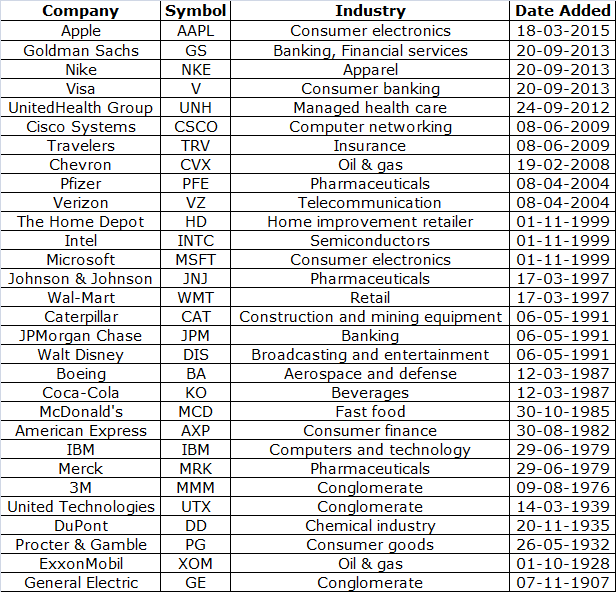

Dow Futures: A Leading Indicator

Dow Jones Industrial Average futures contracts are derivative instruments whose prices are based on the expected future value of the Dow Jones Industrial Average (DJIA). These futures serve as a powerful leading indicator, offering valuable insights into market sentiment and potential price movements before they affect the actual DJIA. Analyzing Dow futures allows investors to anticipate market direction and adjust their strategies accordingly.

- How Dow Futures Contracts Work: Investors buy or sell contracts representing a specific number of DJIA shares at a predetermined price for a future date. This allows them to hedge against risk or speculate on price movements.

- Relationship to the DJIA: Dow futures prices generally move in tandem with the DJIA. However, futures can be more volatile due to leverage and speculation. Analyzing the divergence between futures and the actual index can reveal valuable market signals.

- Monitoring Price Movements and Volume: Significant price changes and unusual volume spikes in Dow futures can indicate major shifts in investor sentiment, potentially foreshadowing substantial movements in the broader market. Technical analysis tools are commonly used for this type of analysis.

- Technical Analysis and Dow Futures: Chart patterns, indicators like moving averages and Relative Strength Index (RSI), and candlestick analysis help identify potential trends and turning points in Dow futures, providing valuable trading signals.

- Impact of News Events: Unexpected news, such as economic data releases, geopolitical events, or corporate announcements, can significantly impact Dow futures prices, offering immediate reactions to market-moving information.

China's Economy: A Global Powerhouse

China's economy plays a pivotal role in the global economic landscape. Its growth trajectory directly impacts global markets, including the US stock market. Any significant slowdown or unexpected surge in the Chinese economy creates a chain reaction, influencing everything from commodity prices to global supply chains.

- Key Economic Indicators: Monitoring China's Gross Domestic Product (GDP) growth rate, inflation levels, consumer spending patterns, and industrial production provides crucial insights into its economic health.

- Government Policies: Changes in Chinese government policies, such as monetary or fiscal policies, can significantly influence economic growth and market sentiment. Understanding these policy shifts is vital for predicting market behavior.

- Trade Relations and the US-China Trade War: The ongoing trade relationship between the US and China significantly affects both economies. Tariff increases or trade negotiations can create significant market volatility and impact investor confidence.

- Global Supply Chain Disruptions: China’s role in global manufacturing and supply chains means disruptions to its economy have a significant cascading effect on businesses worldwide.

- Future Growth Scenarios: Analysts continuously evaluate various scenarios for future Chinese economic growth, incorporating factors like technological advancements, demographic shifts, and government initiatives. This analysis is crucial for informed long-term investment strategies.

The Tariff Situation: Navigating Trade Uncertainty

The ongoing trade disputes and tariff increases have introduced a significant level of uncertainty into global markets. These trade wars impact not only specific industries but also broader economic growth and market sentiment. Navigating this uncertainty requires careful analysis and strategic planning.

- Sector-Specific Impacts: Tariffs disproportionately affect certain sectors of the US economy, creating winners and losers. Some industries may benefit from increased protectionism while others face challenges due to higher input costs.

- Consumer Prices and Business Profitability: Tariffs directly impact consumer prices through increased import costs. Businesses facing higher input costs may see reduced profitability, potentially leading to job losses or price increases.

- International Trade Agreements: The existence and enforcement of international trade agreements help to mitigate the negative effects of tariffs and promote global economic stability.

- Trade Negotiation Outcomes: The outcome of ongoing trade negotiations significantly influences market stability. Uncertainty surrounding these talks often fuels market volatility.

- Investor Strategies for Trade Uncertainty: Investors can adopt strategies to mitigate the risks associated with trade uncertainties, such as diversification across various asset classes and geographical regions, hedging strategies, and careful risk assessment.

Conclusion

Analyzing Dow futures, understanding China's economic performance, and monitoring the ongoing tariff situation are all critical components of effective stock market analysis. These factors are deeply interconnected, and changes in one area often have significant ramifications for the others. Continuous monitoring of these key indicators, combined with a well-defined investment strategy, is crucial for navigating the complexities of the global market and making informed investment decisions. To stay ahead of market shifts and optimize your investment strategy, regularly follow market analysis focusing on Dow futures, the Chinese economy, and tariff developments. Subscribe to our newsletter for in-depth stock market analysis and expert insights – navigate the market with confidence!

Featured Posts

-

Europa League Preview Brobbeys Strength A Key Factor

Apr 26, 2025

Europa League Preview Brobbeys Strength A Key Factor

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two Big Game Spot Breakdown

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Big Game Spot Breakdown

Apr 26, 2025 -

Jorgenson Defends Paris Nice Victory

Apr 26, 2025

Jorgenson Defends Paris Nice Victory

Apr 26, 2025 -

Fusion Portfolio Expands Welcomes Dong Duong Hotel In Hue

Apr 26, 2025

Fusion Portfolio Expands Welcomes Dong Duong Hotel In Hue

Apr 26, 2025 -

Exposition Photographique Galerie Le Labo Du 8 Pierre Terrasson

Apr 26, 2025

Exposition Photographique Galerie Le Labo Du 8 Pierre Terrasson

Apr 26, 2025