Stock Market News: Dow Futures, Earnings Season & Market Analysis

Table of Contents

Dow Futures: A Glimpse into the Future

Understanding Dow Futures Contracts

Dow futures are contracts obligating the buyer to purchase (or the seller to sell) a specific number of shares in the Dow Jones Industrial Average (DJIA) at a predetermined price on a future date. Understanding these contracts is essential for navigating the market.

- Contract: A legally binding agreement to buy or sell.

- Index: The Dow Jones Industrial Average, a price-weighted average of 30 large, publicly owned companies in the US.

- Hedging: Using futures contracts to mitigate risk. For example, a company expecting to sell a large quantity of stock in the future might buy Dow futures to protect against a potential price drop.

The relationship between Dow futures and the actual Dow Jones Industrial Average is very close. Dow futures prices generally track the index, offering a preview of potential market movements. Traders use them for both speculation (betting on price movements) and hedging.

Current Dow Futures Trends and Predictions

Currently, Dow futures are showing [insert current trend – e.g., a slight upward trend, indicating potential market optimism]. Recent price movements have been influenced by [insert recent events – e.g., positive economic data, concerns about inflation].

- Key Factors Influencing Dow Futures:

- Economic indicators (e.g., GDP growth, inflation rate)

- Geopolitical events (e.g., international conflicts, trade tensions)

- Interest rate changes (e.g., Federal Reserve policy decisions)

Based on current trends, a cautious optimism might be warranted, although unforeseen events could easily shift the market. Disclaimer: These are predictions based on current data and should not be considered financial advice.

Interpreting Dow Futures Signals for Investment Decisions

Dow futures provide valuable insights into market sentiment. By analyzing price movements and volume, investors can gauge market expectations and anticipate potential shifts.

- Gauging Market Sentiment: Rising Dow futures generally indicate positive market sentiment, while falling futures suggest pessimism.

- Anticipating Market Movements: Sharp increases or decreases in Dow futures can signal significant market movements.

Investors can use this information to adjust their investment strategies, potentially buying when futures signal upward trends and considering selling when futures indicate downward pressure.

Earnings Season: A Key Driver of Market Volatility

The Importance of Earnings Reports

Earnings season, when publicly traded companies release their financial results, is a crucial period for investors. These reports provide insights into a company's financial health and future prospects.

- Influence on Stock Prices: Strong earnings typically lead to higher stock prices, while disappointing results can cause prices to fall.

- Investor Confidence: Earnings reports heavily influence investor confidence, impacting overall market sentiment.

- EPS (Earnings Per Share): Comparing reported EPS to analyst expectations is critical in understanding market reactions.

Key Companies Reporting and Market Reactions

[Insert analysis of major companies' earnings reports and market reactions. Include specific examples of companies and their performance, linking their performance to broader market trends. E.g., "Apple's strong Q3 earnings exceeded expectations, sending its stock price soaring and boosting investor confidence in the tech sector."]

Earnings Season's Impact on Market Sectors

Earnings season doesn't impact all sectors equally. Some sectors might outperform others based on the economic climate and industry-specific factors.

- Sector-Specific Trends: The technology sector might be particularly sensitive to interest rate changes, while the energy sector might be more affected by global commodity prices.

Analyzing sector-specific trends can help identify investment opportunities and mitigate risks.

Comprehensive Market Analysis: Identifying Opportunities and Risks

Macroeconomic Factors Affecting the Market

Broader macroeconomic factors significantly influence the stock market's performance.

- Inflation: High inflation erodes purchasing power and can lead to increased interest rates, potentially dampening economic growth and stock prices.

- Interest Rates: Interest rate hikes make borrowing more expensive, potentially slowing economic activity and impacting corporate profits.

- Unemployment: High unemployment indicates weakened consumer demand, which can negatively affect corporate earnings and stock prices.

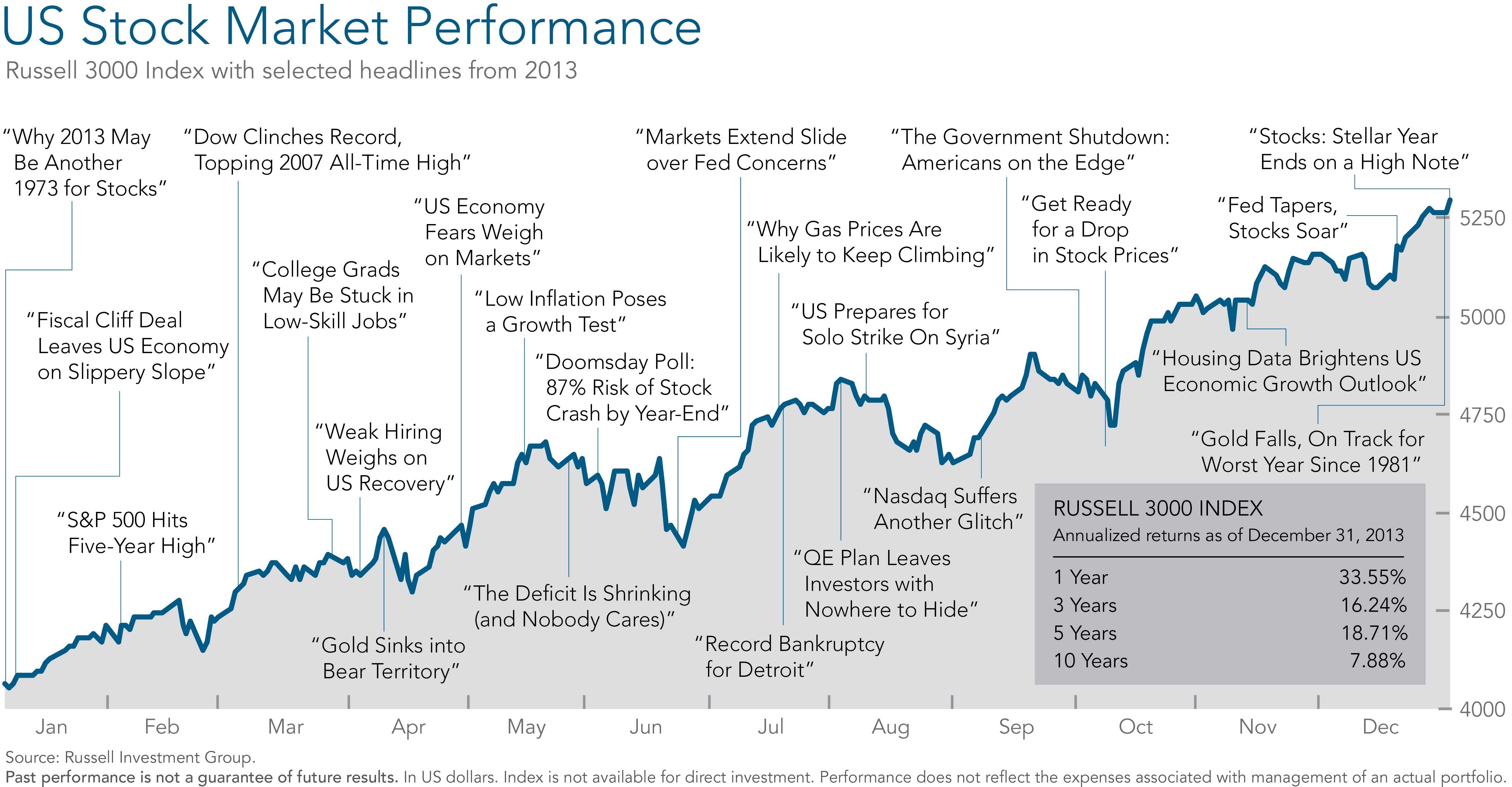

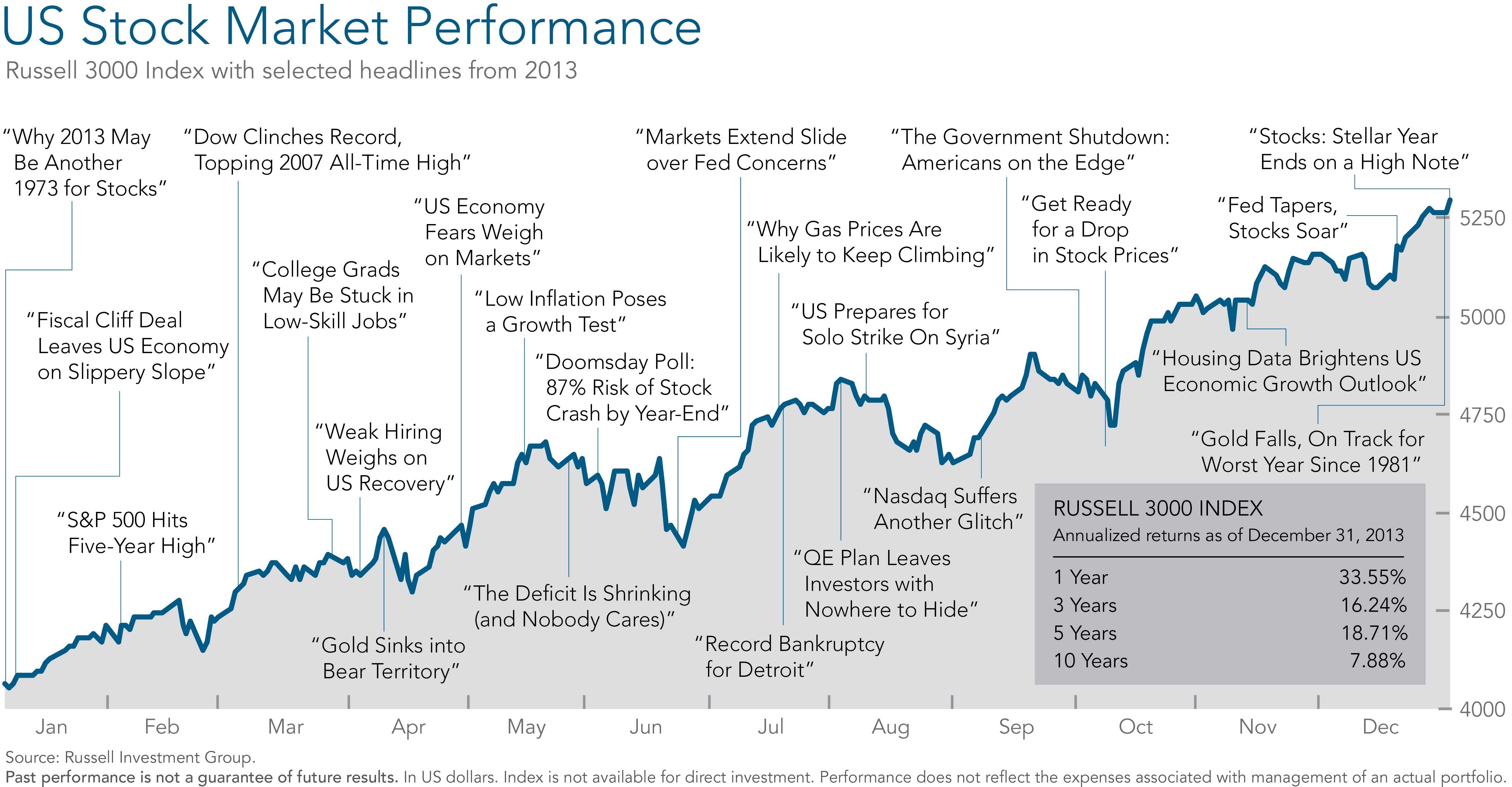

Technical Analysis of Market Trends

Technical analysis uses charts and indicators to identify patterns and predict future price movements.

- Moving Averages: These smooth out price fluctuations, revealing underlying trends.

- RSI (Relative Strength Index): This measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): This identifies changes in momentum by comparing two moving averages.

[Include charts and graphs to illustrate technical indicators and trends.]

Investment Strategies for Navigating Current Market Conditions

Based on the analysis, investors should consider various strategies based on their risk tolerance.

- Diversification: Spreading investments across different asset classes and sectors reduces overall portfolio risk.

- Value Investing: Identifying undervalued companies with strong fundamentals.

- Growth Investing: Focusing on companies with high growth potential.

Conclusion

Understanding stock market news, especially Dow futures and earnings season, is crucial for informed investment decisions. Analyzing Dow futures provides a glimpse into future market movements, while closely following earnings reports allows for a nuanced understanding of individual company performance and sector-specific trends. Considering macroeconomic factors and employing technical analysis further enhance the decision-making process. By regularly assessing these factors and employing suitable investment strategies, investors can effectively navigate the complexities of the market and potentially maximize returns. Stay ahead of the curve by regularly checking for updates on stock market news, including Dow futures and earnings season analysis, to optimize your investment strategy. Return to this site for regular updates and insightful market analysis.

Featured Posts

-

2025

Apr 30, 2025

2025

Apr 30, 2025 -

Coronation Streets Daisy A Look At Her Early Stripping Career

Apr 30, 2025

Coronation Streets Daisy A Look At Her Early Stripping Career

Apr 30, 2025 -

Best Cruise Lines In The Usa For 2024

Apr 30, 2025

Best Cruise Lines In The Usa For 2024

Apr 30, 2025 -

Guardians Rally In Extras To Defeat Royals In Season Opener

Apr 30, 2025

Guardians Rally In Extras To Defeat Royals In Season Opener

Apr 30, 2025 -

Where To Watch Untucked Ru Pauls Drag Race Season 17 Episode 8 For Free

Apr 30, 2025

Where To Watch Untucked Ru Pauls Drag Race Season 17 Episode 8 For Free

Apr 30, 2025