Stock Market Preview: Dow Futures Suggest A Strong Finish

Table of Contents

Analyzing Dow Futures and Their Implications

Dow futures contracts are powerful market indicators, offering valuable insights into investor sentiment and potential market movements. Analyzing these futures contracts, alongside technical analysis of price action, allows for a more informed assessment of the market's likely direction. Understanding how changes in futures prices often foreshadow broader market movements is a key skill for any investor.

- Mechanism of Dow Futures: Dow futures contracts represent an agreement to buy or sell the Dow Jones Industrial Average at a specific price on a future date. Changes in these contracts reflect the collective expectations of market participants regarding the future performance of the index.

- Recent Price Movements: A recent upward trend in Dow futures suggests a positive outlook, with prices exceeding previous resistance levels. This bullish signal is a significant factor in our positive stock market forecast.

- Relationship with Other Indices: The correlation between Dow futures and other major indices, such as the S&P 500 and Nasdaq, should be considered. Typically, movements in the Dow futures often mirror broader market trends, providing a holistic view of market sentiment.

- News and Events: Recent positive economic news, such as strong corporate earnings reports or positive government announcements, could be driving the current upward momentum in Dow futures. Conversely, geopolitical events or negative economic data can exert downward pressure.

Key Economic Indicators and Their Influence

Economic indicators play a pivotal role in shaping market performance and influencing investor behavior. Analyzing these indicators is essential for a comprehensive stock market forecast. The relationship between the economy's health and stock market trends is crucial to understand.

- GDP Growth: Robust GDP growth figures often signal strong economic health, boosting investor confidence and driving up stock prices. Conversely, slower growth can lead to market uncertainty.

- Inflation Rate: A stable inflation rate is generally positive for the stock market. High inflation, however, can erode investor confidence and lead to market corrections. The Federal Reserve's actions to manage inflation also heavily influence market sentiment.

- Unemployment Rate: A low unemployment rate usually indicates a healthy economy, fostering positive investor sentiment. High unemployment, on the other hand, can trigger a more cautious approach to the market.

- Interest Rates: Interest rate changes by central banks impact stock valuations and overall market performance. Higher interest rates can decrease stock valuations by increasing borrowing costs and offering higher returns on fixed-income investments.

Sector-Specific Performances and Predictions

Analyzing sector-specific performances provides a more nuanced understanding of market trends beyond the overall index movement. Different sectors respond differently to economic shifts and investor sentiment, leading to varied performance outcomes. Understanding these nuances is essential for developing effective investment strategies.

- Top-Performing Sectors: Based on current trends and Dow futures activity, sectors such as technology, energy, or healthcare may be showing significant strength. Identifying these top performers can offer opportunities for strategic investment.

- Underperforming Sectors: Some sectors may lag behind due to various reasons, such as industry-specific challenges or negative economic news. Careful analysis can help you avoid sectors expected to underperform.

- Investment Strategies: The identification of top- and under-performing sectors can inform your investment strategy. A balanced portfolio that considers the relative performance of different sectors can significantly reduce risk and improve returns.

- Specific Stock Picks: Within the high-performing sectors, specific stocks may exhibit particularly strong growth potential. Thorough due diligence is essential before making any investment decisions.

Factors to Consider Before Investing

While the Dow Futures suggest a positive outlook, responsible investing necessitates a cautious approach and thorough due diligence. Understanding and managing risk is crucial for long-term success.

- Risk Management: Stock market investments carry inherent risks, and potential losses should always be considered. A well-defined risk tolerance is essential.

- Diversification: Diversifying your portfolio across different sectors and asset classes is crucial to mitigate risk. Don't put all your eggs in one basket!

- Due Diligence: Thorough research into any stock before investing is paramount. Understanding a company's financials, its competitive landscape, and its growth potential is crucial.

- Professional Advice: Seeking guidance from a qualified financial advisor can offer valuable support in making informed investment decisions and building a successful long-term portfolio.

Conclusion

This stock market preview suggests a positive outlook for the week ahead, underpinned by strong signals from Dow futures and generally positive economic indicators. This stock market forecast points towards a strong finish, but investors should always exercise caution and conduct their due diligence. Understanding sector-specific trends and implementing effective risk management strategies are key to navigating the market effectively and making sound investment decisions. Stay informed about the latest market developments by regularly checking our stock market preview for updates and insights on Dow futures and broader market trends. Make informed investment decisions based on a thorough understanding of Dow Futures and market trends.

Featured Posts

-

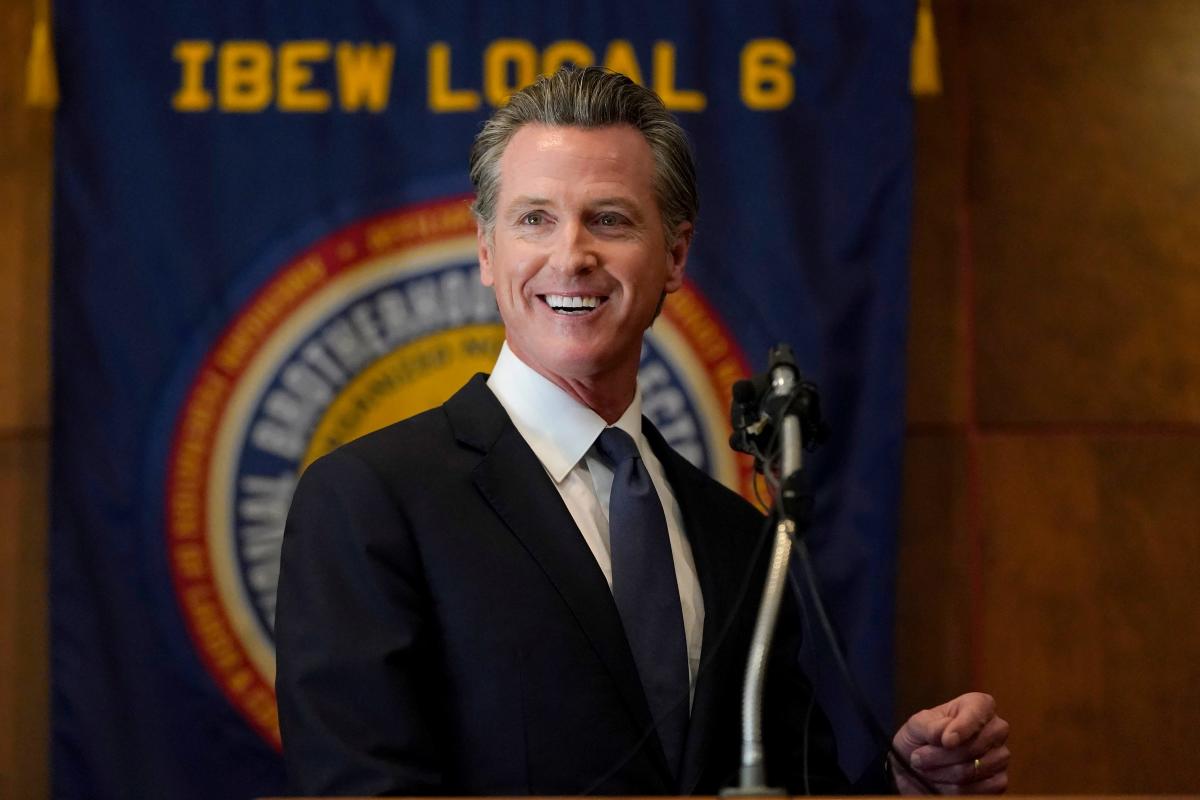

California Politics Explodes Newsoms Confrontation With Democrats

Apr 26, 2025

California Politics Explodes Newsoms Confrontation With Democrats

Apr 26, 2025 -

Hollywood Nepotism A Thunderbolt Stars Unfiltered Confession

Apr 26, 2025

Hollywood Nepotism A Thunderbolt Stars Unfiltered Confession

Apr 26, 2025 -

Help With Todays Nyt Spelling Bee Feb 26th Puzzle 360

Apr 26, 2025

Help With Todays Nyt Spelling Bee Feb 26th Puzzle 360

Apr 26, 2025 -

Mission Impossible 7 The Making Of The Plane Scene

Apr 26, 2025

Mission Impossible 7 The Making Of The Plane Scene

Apr 26, 2025 -

Ray Epps Defamation Lawsuit Against Fox News Details Of The January 6th Allegations

Apr 26, 2025

Ray Epps Defamation Lawsuit Against Fox News Details Of The January 6th Allegations

Apr 26, 2025