Stock Market Rally: A Risky Gamble For Investors?

Table of Contents

Understanding the Current Stock Market Rally

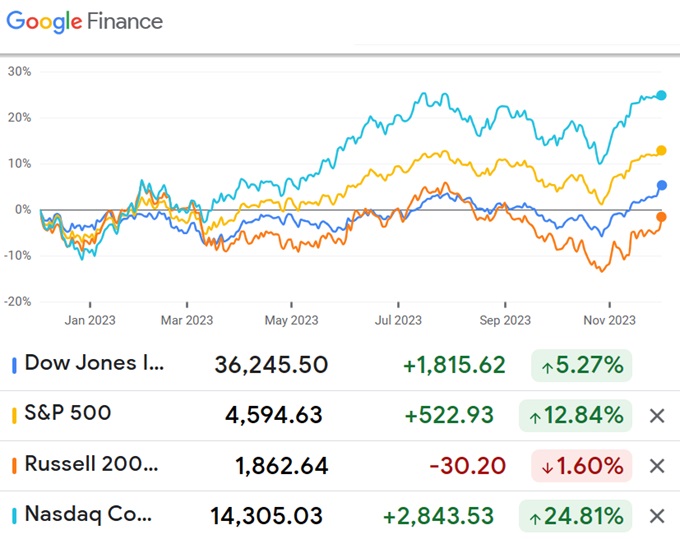

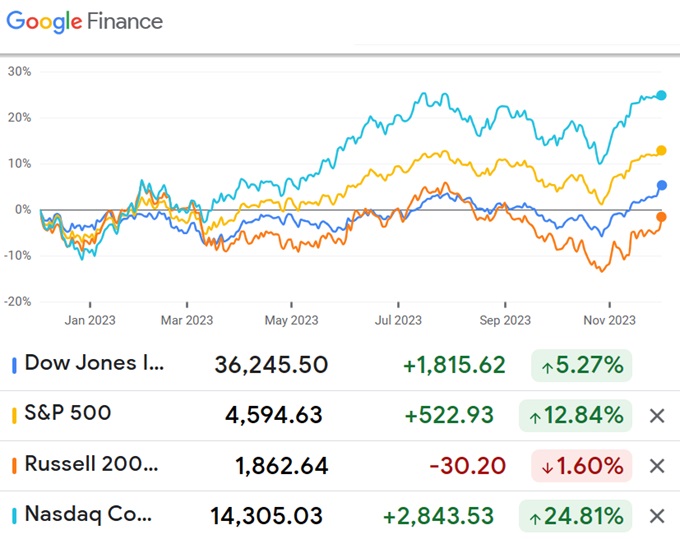

The stock market has experienced a significant rally recently, with major indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all showing substantial gains. This upward trend isn't occurring in a vacuum; several factors contribute to this positive market sentiment. Interest rate cuts by central banks, aimed at stimulating economic activity, have injected liquidity into the market. Positive economic indicators, such as improved employment figures and increased consumer spending, further bolster investor confidence. Finally, a wave of optimism and positive investor sentiment plays a crucial role in fueling the rally.

- Analyzing recent performance of major market sectors: While the overall market is up, performance varies across sectors. Technology stocks, for example, often lead during periods of rapid growth, while more cyclical sectors may lag behind. Analyzing sector-specific performance is vital for strategic investment decisions.

- Discussing the role of inflation in the market's movement: Inflation's impact is complex. While moderate inflation can be positive, high inflation erodes purchasing power and can lead to central bank intervention, potentially impacting the stock market rally. Monitoring inflation rates and the Federal Reserve's response is crucial.

- Examining the influence of geopolitical events: Geopolitical instability, trade wars, and international conflicts can significantly impact investor sentiment and market volatility. Understanding the potential impact of global events is crucial for navigating the current stock market rally.

Identifying Potential Risks in a Stock Market Rally

While a stock market rally offers the potential for substantial gains, it's crucial to acknowledge the inherent risks. The very nature of a rally often involves a degree of overvaluation, increasing the potential for corrections or even crashes. Market bubbles, characterized by rapid asset price increases driven by speculation rather than fundamentals, can lead to dramatic and sudden collapses.

- High valuations of certain stocks/sectors: During a rally, some stocks and sectors become overvalued, exceeding their intrinsic worth. Identifying these overvalued assets is crucial to avoid potential losses during a market correction.

- Increased market volatility and its impact: Rapid price swings are common during rallies, increasing the risk for investors. This volatility can lead to significant losses if not properly managed.

- The risk of over-leveraging and margin calls: Using borrowed money (leverage) to amplify returns also amplifies losses during a downturn. Margin calls, where brokers demand additional funds to cover losses, can force investors to sell assets at unfavorable prices.

- Potential for unforeseen economic shocks (e.g., recession): Unexpected economic downturns can quickly reverse a stock market rally, leading to significant losses. Staying informed about economic indicators and potential risks is essential.

Evaluating Investment Strategies During a Stock Market Rally

Navigating a stock market rally requires a thoughtful investment strategy focused on diversification and risk management. Diversification, spreading investments across various asset classes, reduces reliance on any single investment's performance, mitigating potential losses.

- Importance of diversification across asset classes: Diversification across stocks, bonds, real estate, and other asset classes reduces overall portfolio risk. Different asset classes tend to react differently to market conditions.

- Strategies for managing risk (e.g., stop-loss orders, hedging): Stop-loss orders automatically sell an asset when it reaches a predetermined price, limiting potential losses. Hedging involves offsetting potential losses in one investment with a corresponding gain in another.

- The role of dollar-cost averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market price. This strategy mitigates the risk of investing a lump sum at a market peak.

- Analyzing individual company fundamentals before investing: Don't just chase the market. Thorough due diligence, including examining financial statements and understanding a company's business model, is crucial for long-term success.

The Importance of Due Diligence

Before making any investment decisions, thorough research is paramount. Relying solely on market hype can be detrimental. Utilize available resources to make informed decisions:

- Utilizing financial news and analysis websites: Stay informed through reputable financial news sources and utilize analytical tools to assess market trends and individual company performance.

- Consulting with financial advisors: A qualified financial advisor can offer personalized advice tailored to your risk tolerance and investment goals.

- Understanding your own risk tolerance: Know your comfort level with potential losses. A conservative investor may prefer less risky investments, while a more aggressive investor may tolerate higher risk for potentially higher returns.

Conclusion

The current stock market rally presents both exciting opportunities and significant risks. Navigating this environment requires a careful assessment of potential risks, a well-diversified portfolio, and a thorough understanding of your own investment goals and risk tolerance. A cautious approach, coupled with diligent research and professional advice, is crucial for maximizing potential gains while minimizing losses.

Don't let the excitement of a stock market rally cloud your judgment. Conduct thorough research and develop a sound investment strategy to successfully navigate the complexities of this dynamic market. Learn more about managing your risk during a stock market rally by [link to relevant resource/further reading].

Featured Posts

-

Hegseth Faces Backlash Over Leaked Signal Chat And Pentagon Accusations

Apr 22, 2025

Hegseth Faces Backlash Over Leaked Signal Chat And Pentagon Accusations

Apr 22, 2025 -

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 22, 2025

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 22, 2025 -

Wall Streets Flight To Safety Why Netflix Thrives In The Big Tech Downturn

Apr 22, 2025

Wall Streets Flight To Safety Why Netflix Thrives In The Big Tech Downturn

Apr 22, 2025 -

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 22, 2025

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 22, 2025 -

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 22, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 22, 2025