Stock Market Rally: Rockwell Automation, Angi, BorgWarner, And More

Table of Contents

Rockwell Automation's Strong Performance

Factors Contributing to Rockwell Automation's Stock Rise

Rockwell Automation's impressive stock performance during this stock market rally can be attributed to several key factors. The company is a major beneficiary of the ongoing trend towards automation across various industries.

- Increased demand for automation solutions: Manufacturing, logistics, and other sectors are increasingly adopting automation technologies to improve efficiency, productivity, and competitiveness. This heightened demand directly translates into increased sales and profits for Rockwell Automation.

- Strong Q[Number] earnings report exceeding analyst expectations: Rockwell Automation's recent quarterly earnings report showcased robust financial results, surpassing market analysts' predictions. This positive news fueled investor confidence and contributed to the stock's upward trajectory.

- Positive outlook for future growth in industrial automation: The long-term outlook for the industrial automation sector remains positive, with continued technological advancements and growing adoption rates across industries. This promising future fuels investor optimism regarding Rockwell Automation's growth potential.

- Key Financial Metrics: Specifically, Rockwell Automation reported a [Insert Percentage]% increase in revenue and [Insert Percentage]% growth in earnings per share (EPS) in Q[Number], exceeding analyst expectations by [Insert Percentage]%.

Rockwell Automation Stock Outlook and Investment Implications

While the current stock market rally has boosted Rockwell Automation's share price, investors should consider both the potential risks and future growth prospects.

- Potential Risks: Competition from other automation companies, economic downturns impacting industrial production, and supply chain disruptions are potential factors that could negatively impact Rockwell Automation's performance.

- Technical Indicators: [Discuss relevant chart patterns, such as moving averages or RSI, and their implications for the stock's future price movement].

- Analyst Forecasts: Many analysts predict continued growth for Rockwell Automation, citing its strong market position and innovative product portfolio. However, it's crucial to consider diverse viewpoints before making investment decisions.

Angi's Recovery Amidst Market Volatility

Analysis of Angi's Recent Performance

Angi, formerly known as Angie's List, has demonstrated resilience during periods of market volatility. Its business model, centered around connecting homeowners with service professionals, has shown surprising strength even during economic downturns.

- Business Model Resilience: The demand for home repair and improvement services remains relatively consistent, even during economic uncertainty, contributing to Angi's steady performance.

- Strategic Initiatives: [Discuss any recent mergers, acquisitions, new product launches, or partnerships that have positively impacted Angi's performance and stock price].

- Key Financial Data: Angi reported [Insert Data] in revenue and [Insert Data] in user growth during the recent quarter, indicating positive trends despite market fluctuations.

Investment Considerations for Angi Stock

Investing in Angi presents both opportunities and challenges.

- Risks and Rewards: While the home services market offers stability, competition is fierce. Factors such as seasonal variations in demand and the impact of economic downturns on consumer spending should be considered.

- Competitor Analysis: Angi faces competition from other online platforms and traditional local service providers. A comparative analysis of its competitive advantages is essential for evaluating its investment potential.

- Long-Term Growth Potential: The long-term growth potential of Angi depends on its ability to innovate, expand its service offerings, and maintain a strong market position.

BorgWarner's Position in the Automotive Sector Rally

Factors Driving BorgWarner's Stock Increase

BorgWarner's participation in the stock market rally is largely fueled by its strong position in the burgeoning electric vehicle (EV) market.

- Growth in the EV Market: The global shift towards electric vehicles is significantly boosting demand for BorgWarner's powertrain components and technologies crucial for EV production.

- Positive Industry Outlook: The automotive parts supplier industry is experiencing a period of growth, driven by both traditional vehicle production and the accelerating adoption of electric vehicles.

- Strong Recent Performance: BorgWarner has demonstrated strong financial performance in recent quarters, fueled by increased demand for its products.

- Key Financial Indicators & Market Share: [Include relevant data such as revenue growth, market share in specific EV components, etc.]

Investing in BorgWarner: Opportunities and Challenges

The EV sector presents significant long-term opportunities for BorgWarner, but investors must also consider potential challenges.

- Long-Term Growth Potential (EV Sector): The company's strategic investments in EV technology position it for substantial growth as the global transition to electric vehicles continues.

- Industry Disruptions: Rapid technological advancements and evolving consumer preferences in the automotive industry could present challenges to BorgWarner's market position.

- Competitive Landscape: BorgWarner competes with other major automotive parts suppliers. Analyzing its competitive advantages is crucial for understanding its investment prospects.

Broader Market Context of the Stock Market Rally

Macroeconomic Factors Influencing the Rally

The recent stock market rally is influenced by a complex interplay of macroeconomic factors.

- Interest Rate Changes: [Discuss the impact of recent interest rate decisions by central banks on investor sentiment and market performance].

- Inflation and Economic Growth: [Analyze the relationship between inflation rates, economic growth projections, and the stock market's upward trend].

- Investor Sentiment and Market Volatility: [Discuss current investor sentiment, levels of market volatility, and their influence on the stock market rally].

- Other Growing Sectors: Beyond the companies discussed, other sectors like [mention specific sectors] also experienced significant growth during this stock market rally.

Potential Risks and Future Outlook for the Stock Market

While the current stock market rally is positive, investors should be aware of potential downside risks.

- Potential Downturn Risks: Geopolitical instability, unexpected economic shocks, and shifts in investor sentiment could trigger a market correction.

- Sustainability of Current Conditions: The sustainability of the current market conditions depends on various factors, including the continued strength of economic growth, inflation levels, and geopolitical stability.

- Expert Opinions: [Include expert opinions and forecasts on the future direction of the stock market, acknowledging differing viewpoints].

Conclusion: Understanding the Stock Market Rally and its Implications

The recent stock market rally has significantly boosted the share prices of Rockwell Automation, Angi, and BorgWarner, each for different reasons related to their industry position and financial performance. Rockwell Automation benefited from increased demand for automation solutions; Angi showed resilience in a volatile market; and BorgWarner capitalized on the growth of the EV sector. Understanding the factors driving this stock market rally, including macroeconomic conditions and the specific performance of individual companies, is crucial for informed investment decisions. However, investors must also carefully consider potential risks before committing capital. Conduct thorough due diligence before making any investment decisions and remember to diversify your portfolio. Navigating a stock market rally successfully requires a nuanced understanding of market dynamics and individual company fundamentals.

Featured Posts

-

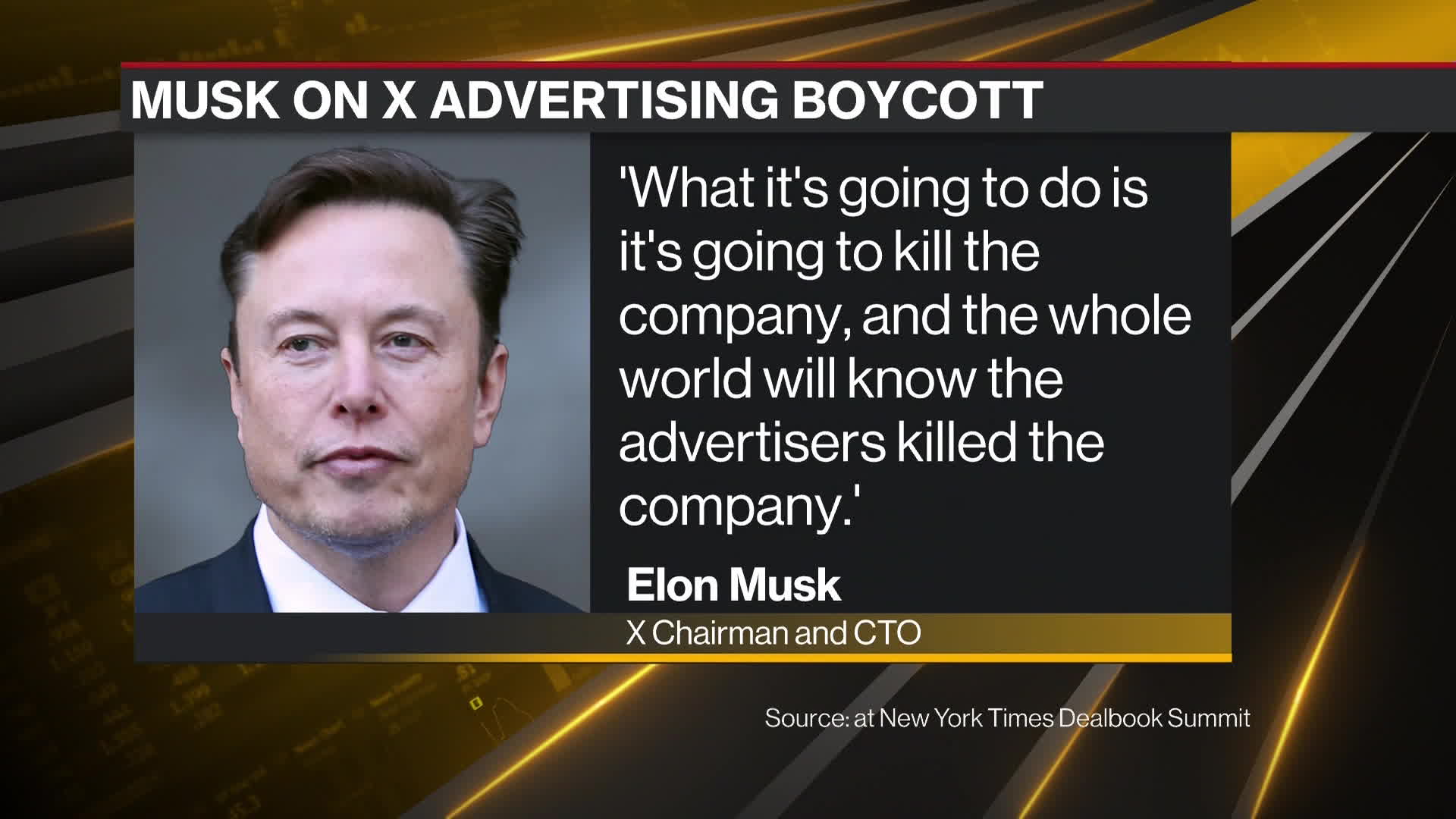

Musks Boycott Claims Nestle Shell And Others Respond

May 17, 2025

Musks Boycott Claims Nestle Shell And Others Respond

May 17, 2025 -

Successfully Buying A Home While Paying Off Student Loans

May 17, 2025

Successfully Buying A Home While Paying Off Student Loans

May 17, 2025 -

Analysis Trumps China Tariffs A 30 Hold Until Late 2025

May 17, 2025

Analysis Trumps China Tariffs A 30 Hold Until Late 2025

May 17, 2025 -

Vodic Za Ujedinjene Arapske Emirate Kultura Hrana I Aktivnosti

May 17, 2025

Vodic Za Ujedinjene Arapske Emirate Kultura Hrana I Aktivnosti

May 17, 2025 -

Latest Police Blotter Reports Austintown And Boardman

May 17, 2025

Latest Police Blotter Reports Austintown And Boardman

May 17, 2025