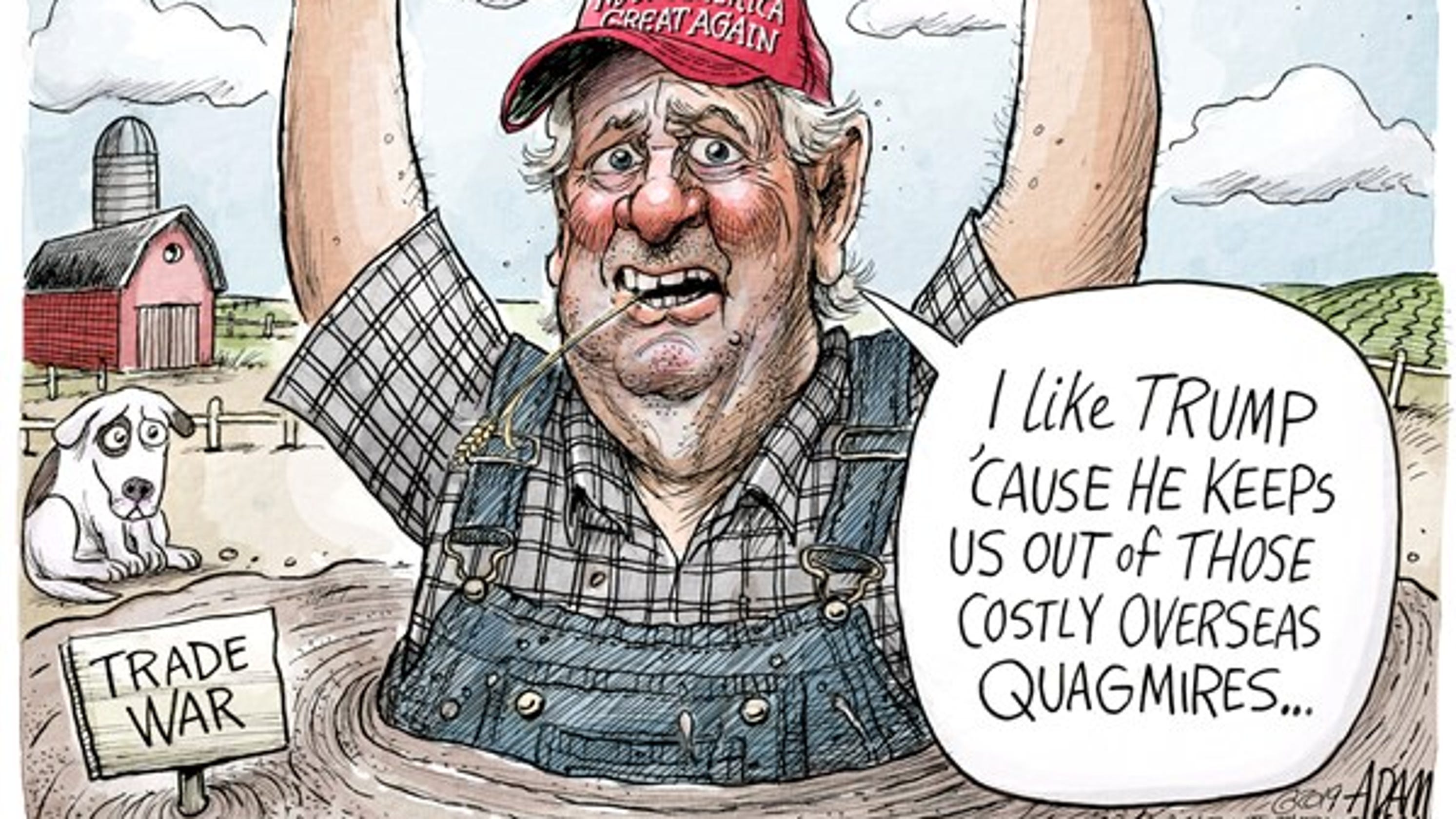

Stock Market Reaction: Analyzing Trump's 80% Tariff On China And The UK Trade Agreement

Table of Contents

Immediate Stock Market Reaction to the 80% Tariff

Initial Volatility and Market Decline

The announcement of an 80% tariff on Chinese goods would likely trigger an immediate and sharp decline in major stock market indices. We can anticipate:

- A sharp drop in the Dow Jones Industrial Average and S&P 500, potentially exceeding historical declines seen during similar trade disputes.

- Increased market uncertainty and investor anxiety, leading to significant sell-offs as investors react to the perceived risk.

- A "flight to safety," as investors move their capital towards less risky assets like government bonds and other low-yield securities.

- For example, a hypothetical scenario might see the Dow Jones dropping by 5-10% within the first trading day, and the NASDAQ experiencing a similar or even more pronounced decline, depending on the sector-specific impacts.

Sector-Specific Impacts

The impact of the 80% tariff wouldn't be uniform across all sectors. Some would be hit harder than others:

- Technology Sector: This sector would likely experience a significant negative impact due to its heavy reliance on Chinese manufacturing and supply chains for components and finished goods. Companies with significant exposure to the Chinese market would see their stock prices decline substantially.

- Retail Sector: Consumers would face significantly increased prices on goods imported from China, leading to decreased consumer spending and subsequently impacting retail sector profits. Retailers heavily reliant on imported goods would be particularly vulnerable.

- Manufacturing Sector: This sector would experience a mixed reaction. Companies heavily reliant on Chinese imports might face increased costs, while those that compete with Chinese goods might see increased demand and potentially higher profits. The impact would be highly industry-specific.

Impact of the UK Trade Agreement on the Stock Market Reaction

Mitigating Effects or Exacerbating Factors?

The simultaneous signing of a UK trade agreement could potentially mitigate some of the negative impacts of the China tariffs, or, conversely, exacerbate existing anxieties.

- Positive impacts might be seen in sectors benefiting from increased trade with the UK, such as financial services and pharmaceuticals. These sectors could see a boost in investor confidence and a rise in stock prices.

- However, trade diversion—the shifting of trade flows away from China and towards the UK—could lead to further uncertainty and negatively impact stock market sentiment in some sectors.

- The UK trade deal might offer a "safe haven" for some investors seeking to diversify their portfolios away from the more volatile China-related investments. This would affect specific stocks differently.

Uncertainty and Investor Sentiment

Uncertainty plays a crucial role in shaping investor behavior:

- Investor confidence levels would likely plummet immediately following the tariff announcement, only to potentially recover partially if the UK trade agreement is perceived as a positive counterbalance.

- Media coverage and analyst predictions would have a significant impact on market sentiment, potentially exacerbating both positive and negative reactions.

- Key economic indicators, such as the consumer confidence index, would also play a crucial role in determining the overall stock market reaction and subsequent recovery.

Long-Term Implications and Future Market Trends

Inflationary Pressures

The 80% tariff would likely create significant inflationary pressures:

- Increased import costs from China would translate directly into higher prices for consumers.

- Central banks might respond by raising interest rates to combat inflation, potentially slowing economic growth.

- This would negatively impact consumer spending and could trigger a broader economic slowdown.

Geopolitical Risks and Market Volatility

The trade dispute with China would significantly increase geopolitical uncertainty:

- China might retaliate with its own tariffs or trade restrictions, further destabilizing global markets.

- The long-term impact on global trade relations would likely lead to increased market volatility and uncertainty for an extended period.

Restructuring and Adaptation

Companies will be forced to adapt to the new trade environment:

- Many might explore reshoring—bringing manufacturing back to their home countries—or diversifying their supply chains to reduce reliance on China.

- This restructuring could lead to new investment opportunities in areas such as automation and domestic manufacturing.

Conclusion

The hypothetical 80% tariff on Chinese goods and the simultaneous UK trade agreement would create a complex and volatile situation for global stock markets. The immediate stock market reaction would likely involve significant declines and sector-specific impacts. While the UK agreement might offer some mitigation, long-term uncertainties remain concerning inflation, geopolitical risks, and the need for economic restructuring. Understanding the nuances of these interconnected events is crucial for investors navigating the complexities of the stock market reaction. Further research and careful monitoring of economic indicators are essential for making informed investment decisions in this dynamic environment. Stay informed on future developments in the stock market reaction to trade policies to mitigate potential losses and capitalize on emerging opportunities.

Featured Posts

-

R5

May 10, 2025

R5

May 10, 2025 -

Representative Ocasio Cortez Attacks Fox News For Trump Coverage

May 10, 2025

Representative Ocasio Cortez Attacks Fox News For Trump Coverage

May 10, 2025 -

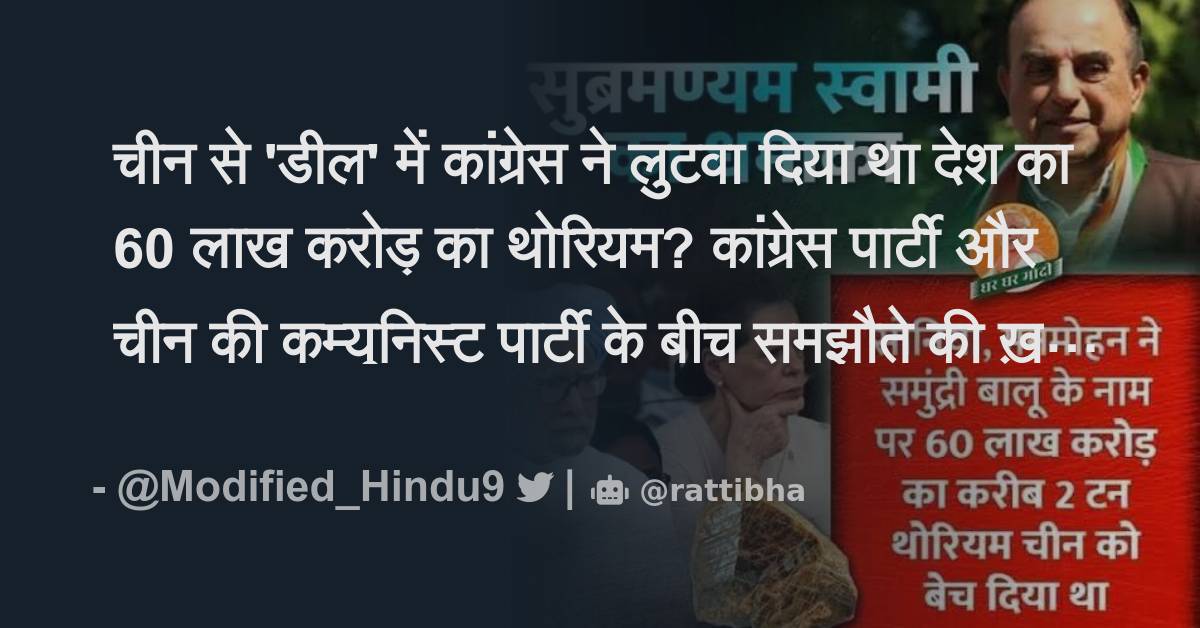

High Potential The Best Victim For Season 2 A Deep Dive Into Season 1

May 10, 2025

High Potential The Best Victim For Season 2 A Deep Dive Into Season 1

May 10, 2025 -

Dijon 2026 Les Ecologistes Preparent Leur Campagne Municipale

May 10, 2025

Dijon 2026 Les Ecologistes Preparent Leur Campagne Municipale

May 10, 2025 -

Leon Draisaitls 100 Point Milestone Oilers Edge Islanders In Overtime

May 10, 2025

Leon Draisaitls 100 Point Milestone Oilers Edge Islanders In Overtime

May 10, 2025