Stock Market Soars: S&P 500, Nasdaq, And Dow Gains Fuelled By Tariff Relief

Table of Contents

S&P 500 Surge: A Deep Dive into the Gains

The S&P 500 experienced a remarkable increase, climbing by X% (replace X with actual percentage) in the recent trading period. This robust growth wasn't uniform across all sectors; certain areas benefited disproportionately from the tariff relief.

- Technology: The tech sector was a major contributor, exhibiting significant growth fueled by reduced import costs and increased consumer confidence.

- Consumer Discretionary: Companies in this sector saw a boost as consumer spending increased, spurred by lower prices on imported goods.

- Financials: Improved economic forecasts and increased investor confidence positively impacted financial institutions, leading to considerable gains.

The easing of trade tensions significantly boosted investor confidence, encouraging them to invest more aggressively. Companies like [Example Company 1] and [Example Company 2] showed particularly strong gains, largely due to their reliance on international trade and the positive impact of tariff reductions on their profit margins. This surge underscores the strong correlation between trade policy and stock market performance.

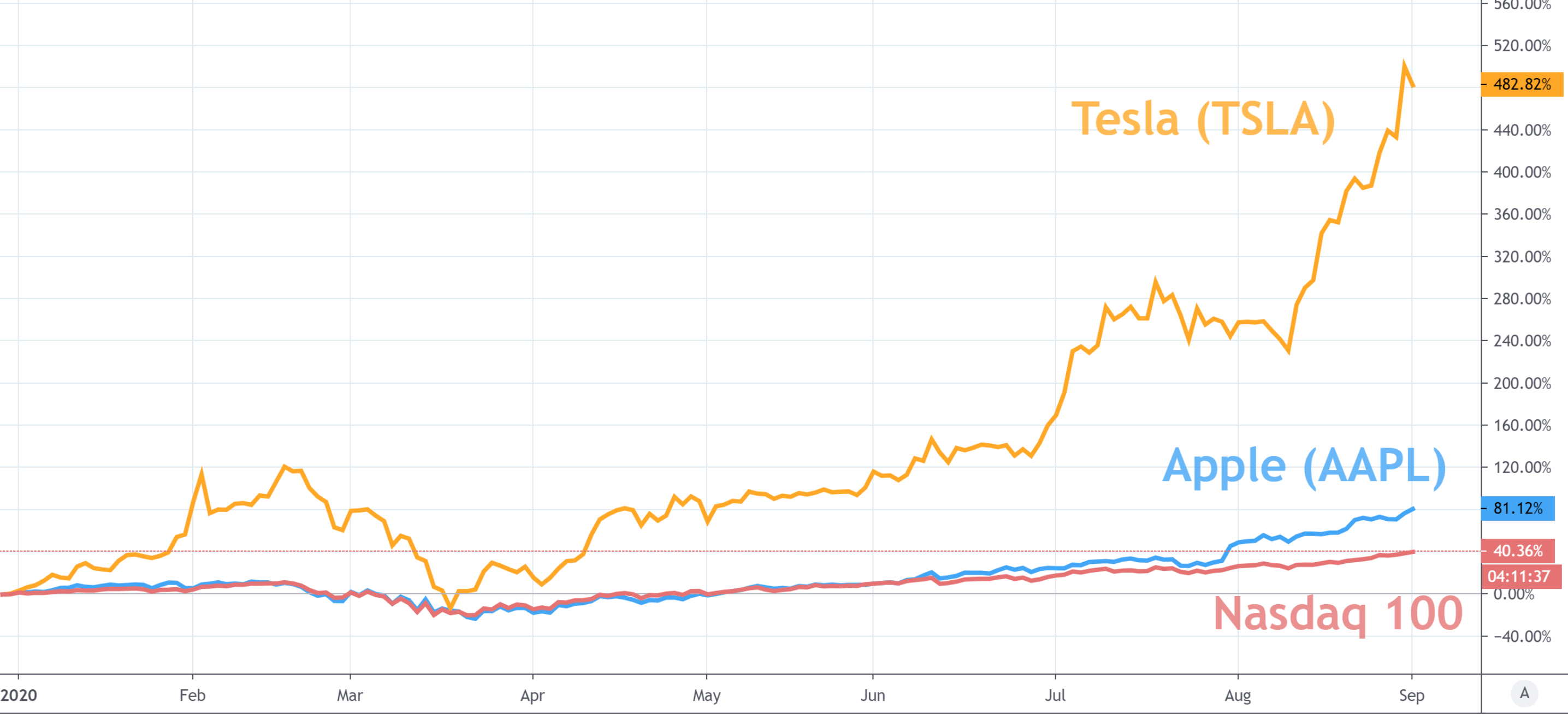

Nasdaq's Stellar Performance: Tech Sector Takes the Lead

The Nasdaq Composite mirrored the overall market upward trend, experiencing a Y% (replace Y with actual percentage) increase. The technology sector, a significant component of the Nasdaq, was the driving force behind this stellar performance.

- Apple: [Insert data on Apple's performance and link to tariff relief].

- Microsoft: [Insert data on Microsoft's performance and link to tariff relief].

- Amazon: [Insert data on Amazon's performance and link to tariff relief].

Reduced trade tensions significantly benefited the tech sector by easing supply chain disruptions and improving prospects for future growth. The lessened uncertainty surrounding international trade allowed investors to focus on the underlying strength of these technology giants, further fueling the upward trend. This positive investor sentiment suggests a strong outlook for the tech sector in the coming months.

Dow Jones Industrial Average: A Positive Outlook for Blue-Chip Stocks

The Dow Jones Industrial Average also experienced a robust increase of Z% (replace Z with actual percentage), reflecting broad-based gains across its blue-chip components. The positive impact of tariff relief was evident in the improved profitability and investor confidence in these established companies.

- Boeing: [Insert data on Boeing's performance and link to tariff relief].

- Caterpillar: [Insert data on Caterpillar's performance and link to tariff relief].

- Walmart: [Insert data on Walmart's performance and link to tariff relief].

This growth within the Dow Jones reflects not only sector-specific benefits but also points towards a broader positive outlook for the US economy. The long-term implications for these blue-chip companies are significant, suggesting continued growth provided the current positive trade environment persists. Reduced uncertainty allows for more strategic planning and investment.

The Impact of Tariff Relief on Investor Sentiment

The reduction in trade tensions and subsequent tariff relief played a pivotal role in shaping investor sentiment. The market shifted noticeably from a climate of caution to one of increased optimism. This is clearly evidenced by:

- Increased Risk Appetite: Investors showed a greater willingness to take on risk, allocating capital to previously more volatile sectors.

- Capital Inflows: A significant influx of investment capital into the market followed the tariff relief announcement, further driving up prices.

- Improved Economic Forecasts: Positive economic forecasts, fueled by the reduced trade uncertainty, further contributed to the improved investor sentiment.

Conclusion: Navigating the Soaring Stock Market

The recent stock market soar, marked by significant gains in the S&P 500, Nasdaq, and Dow Jones Industrial Average, is undeniably linked to tariff relief. This positive development has significantly boosted investor confidence, leading to increased market activity and growth. While potential risks always exist, the current market climate presents substantial opportunities. To capitalize on this market surge, it's crucial to stay informed about market trends and consider a well-defined investment strategy. Consult with a financial advisor to develop a robust plan that aligns with your risk tolerance and financial goals. Don't miss out on the potential for stock market growth – act strategically and make informed decisions to benefit from the current positive market climate.

Featured Posts

-

Draymond Green Moses Moody And Buddy Hield Join The Nba All Star Festivities

Apr 24, 2025

Draymond Green Moses Moody And Buddy Hield Join The Nba All Star Festivities

Apr 24, 2025 -

Tarantinov Tajni Film Zasto Izbjegava Ovaj Projekt S Travoltom

Apr 24, 2025

Tarantinov Tajni Film Zasto Izbjegava Ovaj Projekt S Travoltom

Apr 24, 2025 -

White House Cocaine Incident Secret Service Investigation Concludes

Apr 24, 2025

White House Cocaine Incident Secret Service Investigation Concludes

Apr 24, 2025 -

Ray Epps Defamation Lawsuit Against Fox News January 6th Falsehoods

Apr 24, 2025

Ray Epps Defamation Lawsuit Against Fox News January 6th Falsehoods

Apr 24, 2025 -

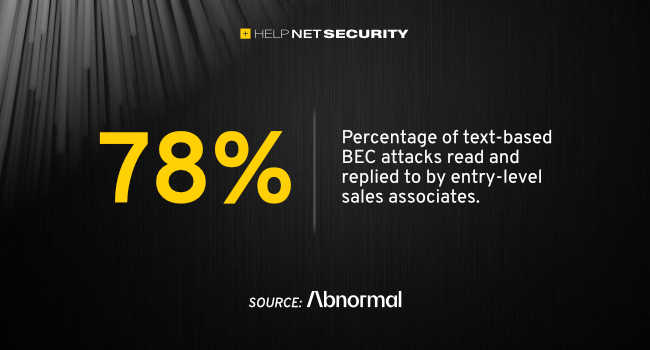

Cybercriminals Office 365 Exploit Nets Millions Investigation Reveals

Apr 24, 2025

Cybercriminals Office 365 Exploit Nets Millions Investigation Reveals

Apr 24, 2025