Stock Market Today: Dow, S&P 500 Live Updates For May 30

Table of Contents

Dow Jones Industrial Average Performance

Opening Bell and Early Trading

The Dow Jones Industrial Average opened at 33,820.12, down 0.8% from yesterday's closing price of 34,066.40. Early trading showed increased volatility, with a significant dip in the first hour followed by a period of slight recovery. This initial downward trend suggests continued concerns stemming from yesterday’s inflation figures. The percentage change reflects a negative market sentiment at the opening bell. This volatility underscores the market's sensitivity to economic news and the uncertainty surrounding future interest rate hikes.

Key Movers & Shakers

Several companies within the Dow experienced notable price swings this morning. These movements are indicative of the broader market reaction to current economic conditions.

- Company A: +2% due to unexpectedly strong Q2 earnings guidance.

- Company B: -4% following a disappointing sales report and lowered future projections.

- Company C: -1% mirroring a general downturn in the technology sector.

- Company D: +1.5% benefiting from positive industry news related to new regulations.

Sector-Specific Performance

The technology sector is showing weakness today, mirroring the broader market downturn, while the energy sector is performing relatively better, possibly due to rising oil prices. The financial sector remains largely flat. This divergence in sector performance indicates that the market reaction is not uniform and reflects specific sensitivities within each industry.

S&P 500 Index Performance

Overall Market Trend

The S&P 500 is currently trading down 0.7%, mirroring the negative trend seen in the Dow. This indicates a widespread negative sentiment across the broader market. Increased volatility is observed, signaling uncertainty among investors. The percentage decrease reflects concerns relating to inflation and potential interest rate increases.

Broad Market Indicators

Trading volume is slightly above average, suggesting increased investor activity. The advance-decline ratio is negative, with more stocks declining than advancing, reinforcing the bearish sentiment. The VIX volatility index, a measure of market fear, is up, further supporting the notion of heightened uncertainty.

Impact of Economic News

The release of yesterday's unexpectedly high inflation data directly impacts the S&P 500's performance today. Investors are reacting to the possibility of further interest rate hikes, leading to a more risk-averse approach and causing downward pressure on stock prices.

Factors Influencing the Market Today

Global Economic Factors

Geopolitical instability continues to exert pressure on the market, creating an environment of uncertainty. International trade tensions also remain a significant concern, impacting investor confidence. Currency fluctuations further add to the complexity of the current market dynamics.

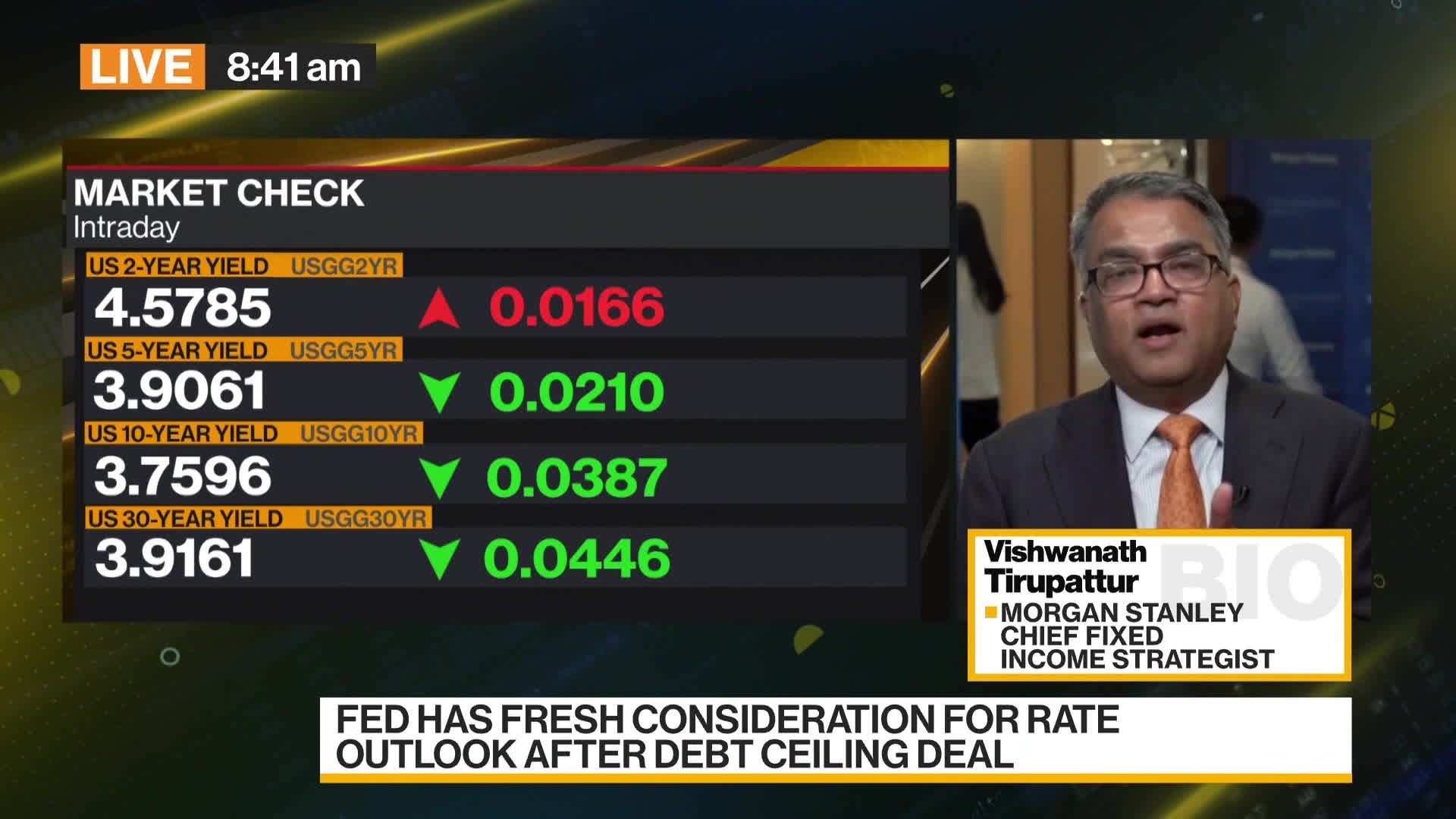

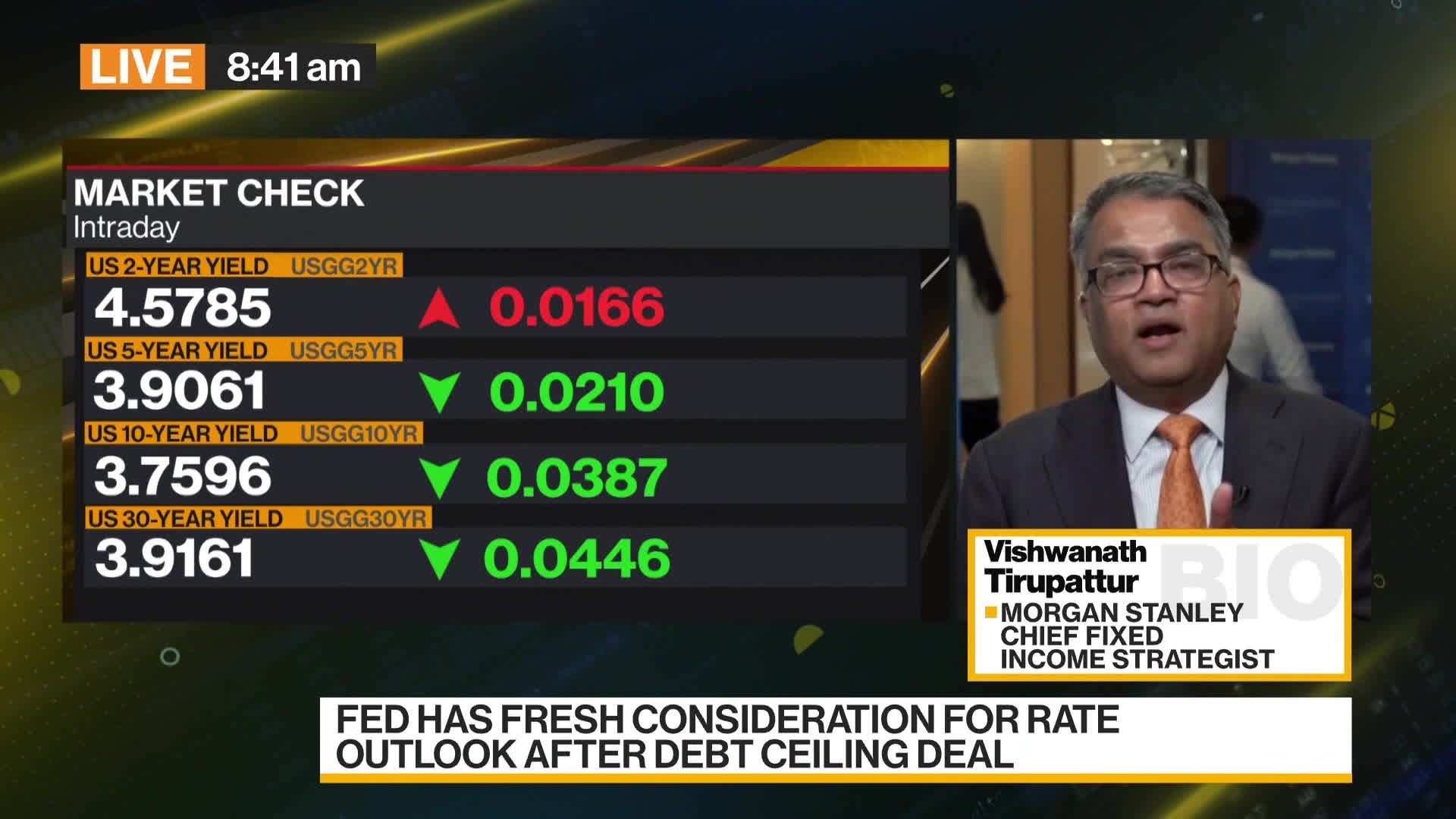

Interest Rate Expectations

The market is closely monitoring the Federal Reserve's actions and anticipating further interest rate hikes in response to persistent inflation. This expectation creates uncertainty and risk aversion, influencing investors' decisions.

Inflation Concerns

- High inflation erodes purchasing power, impacting consumer spending and corporate profits.

- The Federal Reserve's aggressive approach to combating inflation is causing volatility in the stock market.

- Uncertainty surrounding the future trajectory of inflation remains a significant market driver.

Stock Market Today: Key Takeaways and Next Steps

The Dow Jones and S&P 500 are currently experiencing a downturn largely influenced by yesterday's inflation data and the anticipation of further interest rate hikes. Global economic factors, including geopolitical tensions, and sector-specific performances contribute to the overall market movement. The increased volatility and negative market sentiment highlight the need for cautious investment strategies.

For a more detailed and nuanced understanding of these market movements, follow our regular updates. Stay updated on the stock market with our daily stock market analysis and check our live Dow and S&P 500 updates for the latest information. Check back frequently for continued analysis and to stay ahead of the curve in this dynamic market environment. Follow our daily stock market analysis for insightful commentary and informed decision-making.

Featured Posts

-

Showers Expected On Election Day In Northeast Ohio

May 31, 2025

Showers Expected On Election Day In Northeast Ohio

May 31, 2025 -

Canelo Vs Golovkin Live Stream Get The Results And Play By Play Here

May 31, 2025

Canelo Vs Golovkin Live Stream Get The Results And Play By Play Here

May 31, 2025 -

Former Nypd Commissioner Bernard Kerik Dies At 69 A Legacy Remembered

May 31, 2025

Former Nypd Commissioner Bernard Kerik Dies At 69 A Legacy Remembered

May 31, 2025 -

Munguias Doping Allegation A Response To Adverse Test Results

May 31, 2025

Munguias Doping Allegation A Response To Adverse Test Results

May 31, 2025 -

Tain Offers Temporary Space To Rogart Veterinary Practice After Fire

May 31, 2025

Tain Offers Temporary Space To Rogart Veterinary Practice After Fire

May 31, 2025