Stock Market Today: Trump's Tariff Threat & UK Trade Deal Impact

Table of Contents

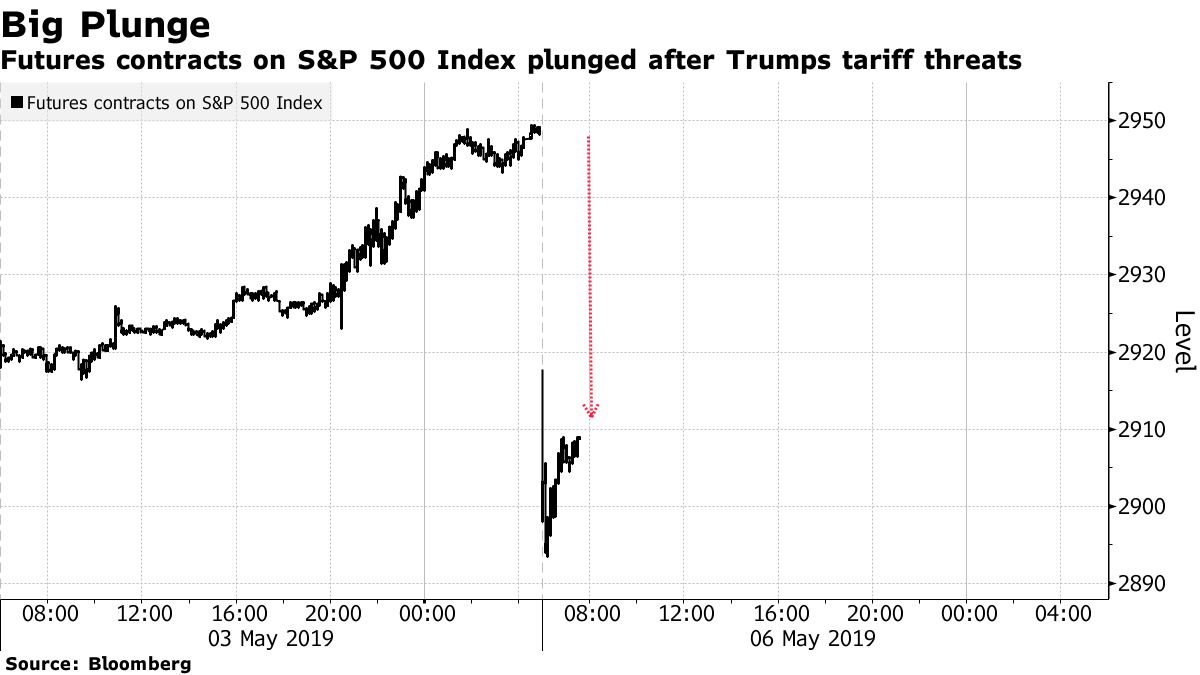

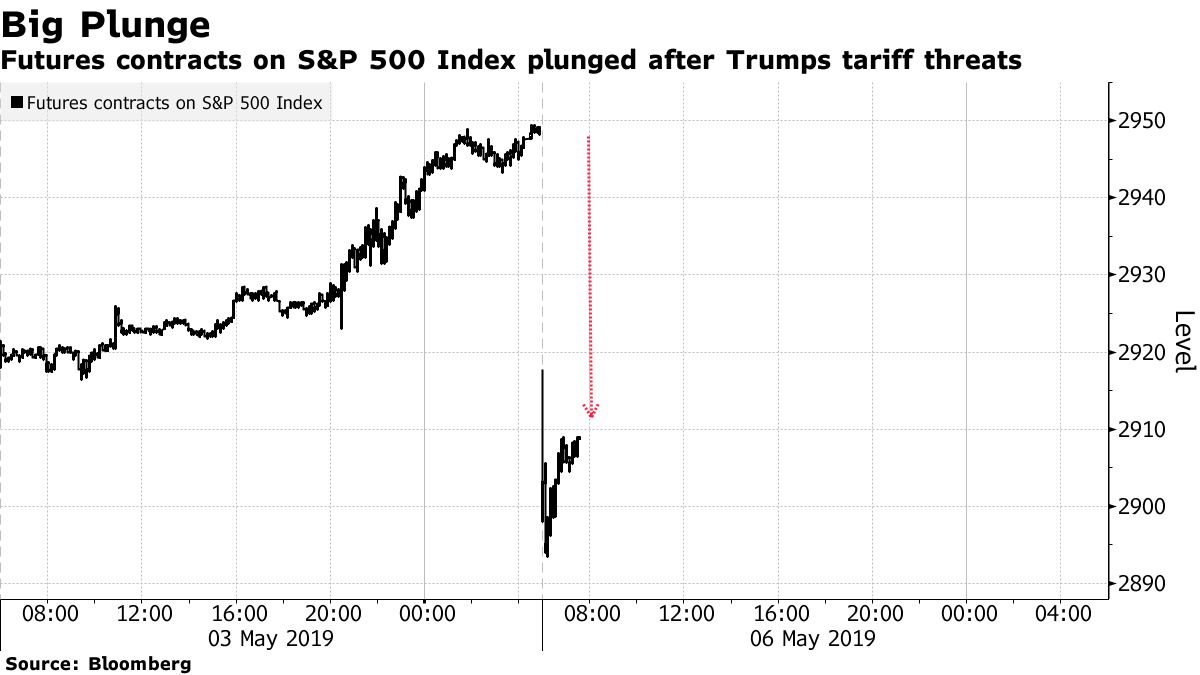

Trump's Tariff Threats and Their Ripple Effects on the Stock Market Today

Trump's tariff policies, while no longer in active implementation in their entirety, continue to cast a long shadow over global trade and the Stock Market Today. The ripple effects of these past trade disputes are still felt in various sectors.

Impact on Specific Sectors

Tariffs have a disproportionate impact on different sectors. The technology sector, for instance, felt the pinch due to increased costs of imported components and retaliatory tariffs from other nations. The manufacturing sector, heavily reliant on global supply chains, also experienced significant disruptions. Agriculture, a sector directly targeted by some tariffs, faced reduced export opportunities and price volatility.

- Technology: Increased costs for imported semiconductors impacted companies like Apple and Qualcomm, leading to reduced profit margins and stock price fluctuations.

- Manufacturing: Companies dependent on imported raw materials, such as Ford and General Motors, saw increased production costs and a decline in competitiveness.

- Agriculture: American farmers experienced reduced exports of soybeans and other agricultural products to China, resulting in lower income and impacting related businesses.

- Impact on Indices: The Dow Jones Industrial Average, S&P 500, and Nasdaq all experienced periods of volatility directly correlated with tariff announcements and escalations.

The lingering uncertainty surrounding future trade policies continues to negatively impact investor confidence, leading to market volatility and cautious investment strategies. Keywords like "tariff impact," "market volatility," and "investor confidence" reflect the ongoing concern.

Global Trade Tensions and Their Influence

The impact of Trump's tariffs extended far beyond US borders. Global trade tensions escalated, leading to retaliatory tariffs and a general climate of uncertainty. This interconnectedness means that trade disputes in one region can quickly trigger consequences across the globe, creating a domino effect on the Stock Market Today.

- The EU responded with tariffs on American goods, impacting various sectors and creating a transatlantic trade war.

- China retaliated with tariffs on agricultural products, severely impacting American farmers.

- The interconnected nature of global supply chains meant disruptions in one area frequently resulted in knock-on effects elsewhere, leading to widespread market uncertainty.

This global trade war, fueled by tariff disputes and protectionist policies, added to the overall market uncertainty and contributed to significant fluctuations in the Stock Market Today.

UK Trade Deal Uncertainty and its Impact on the Stock Market Today

The UK's departure from the European Union and the subsequent negotiations for new trade deals continue to impact the Stock Market Today. The lack of clarity around the specifics of these deals has created considerable market volatility.

Post-Brexit Trade Relations

The nature of the UK's future trade relationships will significantly affect various sectors. A comprehensive and beneficial trade agreement could boost economic growth and investor confidence. Conversely, a less favorable outcome could lead to disruptions in supply chains and negatively impact UK businesses and the global stock market.

- Financial Services: The uncertainty surrounding access to the EU market for financial services firms has led to a cautious approach by investors.

- Automotive: The automotive industry, a major exporter from the UK, is highly sensitive to trade barriers and import tariffs.

- Potential Benefits: Access to new markets and reduced trade barriers with non-EU countries could positively impact certain sectors.

- Potential Drawbacks: Increased trade barriers with the EU could lead to supply chain disruptions and negatively impact growth.

Investor Sentiment and Market Volatility

The uncertainty surrounding the UK's trade deals has directly influenced investor sentiment and caused considerable market volatility. Investors are hesitant to commit significant capital until there's greater clarity about the future trade landscape.

- Fluctuations in the value of the British pound directly impact global stock markets and investments.

- Investor confidence in UK-based companies has been affected by Brexit-related uncertainties.

- Data reveals a clear correlation between periods of heightened Brexit uncertainty and increased stock market volatility.

The ongoing uncertainty surrounding the UK’s post-Brexit trade relationships continues to be a major factor in the Stock Market Today, influencing both investor sentiment and market performance.

Conclusion

In summary, the Stock Market Today is significantly influenced by the lingering effects of Trump's tariff threats and the ongoing uncertainty regarding the UK's post-Brexit trade deals. Both factors contribute to market volatility and impact investor confidence. These events highlight the interconnectedness of global markets and the sensitivity of stock prices to geopolitical and economic events. Understanding these factors is crucial for investors navigating the current market landscape. Stay updated on the Stock Market Today and consult with financial advisors before making any investment decisions. Monitoring the Stock Market Today for further developments related to these critical issues is crucial for informed investing.

Featured Posts

-

Driver Strikes And Kills Two On Elizabeth City Road

May 10, 2025

Driver Strikes And Kills Two On Elizabeth City Road

May 10, 2025 -

Nhls Next Generation 9 Players Who Could Surpass Ovechkins Goal Record

May 10, 2025

Nhls Next Generation 9 Players Who Could Surpass Ovechkins Goal Record

May 10, 2025 -

Air Traffic Controller Warnings Newark System Failure And Prior Safety Incidents

May 10, 2025

Air Traffic Controller Warnings Newark System Failure And Prior Safety Incidents

May 10, 2025 -

John Roberts A Misidentification And His Response

May 10, 2025

John Roberts A Misidentification And His Response

May 10, 2025 -

The La Wildfires And The Ethics Of Disaster Related Betting

May 10, 2025

The La Wildfires And The Ethics Of Disaster Related Betting

May 10, 2025