Stock Market Update: Dow Futures Point To Strong Week End

Table of Contents

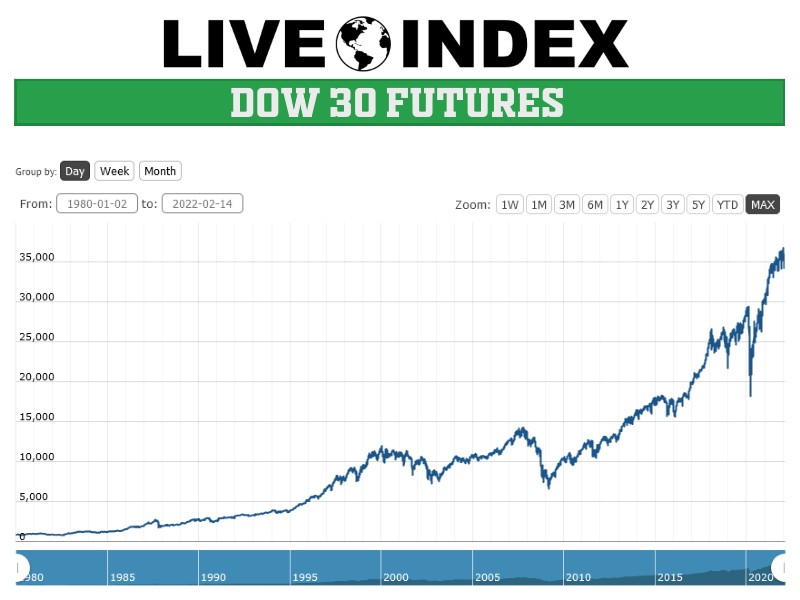

Analyzing Dow Futures Performance

Current Dow Futures Indicators

The current Dow Futures indicators are undeniably bullish. As of [Insert Date and Time], Dow Futures are up X%, trading at Y points, reaching a high of Z points today. This significant increase in trading volume, coupled with the impressive price surge, signals strong market confidence and anticipation of positive developments in the coming days. The substantial increase in Dow Futures points to a robust investor sentiment, suggesting a potentially strong week ahead for the broader market.

- Dow Futures up X%: This percentage represents a substantial gain, indicating strong buying pressure.

- Trading volume Y: High trading volume suggests significant investor participation and interest in the market.

- Highest point Z: Reaching this high point reinforces the positive momentum observed in Dow futures contracts.

Factors Influencing Dow Futures

Several factors contribute to this positive outlook for Dow Futures and the overall market sentiment. These include a combination of positive economic indicators, strong corporate earnings, and easing geopolitical concerns.

- Strong Q3 Earnings Reports: Many major corporations have reported better-than-expected Q3 earnings, boosting investor confidence and fueling market optimism. This positive trend is reflected in the robust performance of Dow Futures.

- Positive Consumer Confidence Index: A rising consumer confidence index points towards increased consumer spending, a crucial driver of economic growth and a positive sign for stock market performance. This fuels further positive sentiment in the Dow Futures market.

- Easing Geopolitical Tensions: Reduced geopolitical uncertainty leads to increased investor confidence and a more favorable investment climate. This stability positively impacts the Dow Futures market.

- Positive Federal Reserve Signals: Recent statements from the Federal Reserve indicating a potential pause or slowdown in interest rate hikes have eased investor concerns about inflation and future economic growth. This stability contributes positively to Dow Futures.

- Technological Advancements: Positive developments in key technology sectors contribute to the overall optimism seen in Dow Futures.

Impact on Major Market Indices

Projected Effects on the Dow Jones Industrial Average

The positive Dow Futures signal strongly suggests a positive impact on the Dow Jones Industrial Average (DJIA) during the upcoming week. Based on the current trajectory of Dow Futures, we can project a potential increase of A% to B% in the DJIA. This translates to a potential increase in the DJIA ranging from [Specific Number] to [Specific Number] points. Investors can anticipate potential gains, but it's crucial to remember that market fluctuations are inevitable.

- Potential DJIA increase of A% to B%: This range reflects a likely positive performance, although the exact extent remains subject to market dynamics.

- Potential range of [Specific Number] to [Specific Number] points: This provides a concrete estimate of potential gains for the DJIA.

Implications for Other Key Indices (S&P 500, Nasdaq)

The positive momentum in Dow Futures is likely to have a ripple effect on other major indices, such as the S&P 500 and Nasdaq. Given the strong correlation between these indices, a positive performance in Dow Futures typically suggests a similar positive outlook for the S&P 500 and Nasdaq. We anticipate a broad market strength, with potential gains particularly noticeable in technology-related sectors.

- Positive correlation expected: The interconnectedness of these major indices suggests a strong positive correlation.

- Potential for gains in the tech sector: The tech sector often responds positively to broad market optimism.

- Broad market strength anticipated: The positive Dow Futures signal suggests a general upswing across various market sectors.

Investment Strategies for the Upcoming Week

Opportunities and Risks

The positive outlook presented by the Dow Futures presents exciting investment opportunities, but it's crucial to approach the market with caution. While the indicators are bullish, the stock market is inherently unpredictable. Risk mitigation strategies are essential.

- Consider sector-specific investments: Focus on sectors showing robust growth and positive trends, aligned with the current market sentiment.

- Diversify portfolio: Spread investments across different asset classes to reduce overall risk.

- Set stop-loss orders: Protect investments by setting stop-loss orders to limit potential losses.

Advice for Different Investor Profiles

Investment strategies should be tailored to individual risk tolerance and financial goals.

- Conservative Investors: Focus on dividend stocks and blue-chip companies for stability and income generation.

- Moderate Investors: Adopt a balanced approach, diversifying across different asset classes with a moderate allocation to growth stocks.

- Aggressive Investors: Consider growth stocks and emerging markets for higher potential returns, but with increased risk.

Conclusion

In summary, the strong performance of Dow Futures signals a potentially strong week ahead for the stock market. Positive economic indicators, robust corporate earnings, and easing geopolitical tensions are contributing to this positive outlook. While this presents exciting opportunities, investors should adopt a cautious approach, diversifying their portfolios and employing risk management strategies. Monitor Dow Futures closely and stay tuned for our next Stock Market Update to stay informed about market developments and make informed investment decisions based on the latest Stock Market Update and Dow Futures data. Remember to make informed investment decisions based on your individual risk tolerance and financial goals.

Featured Posts

-

New Business Hot Spots Across The Nation An Interactive Map

Apr 26, 2025

New Business Hot Spots Across The Nation An Interactive Map

Apr 26, 2025 -

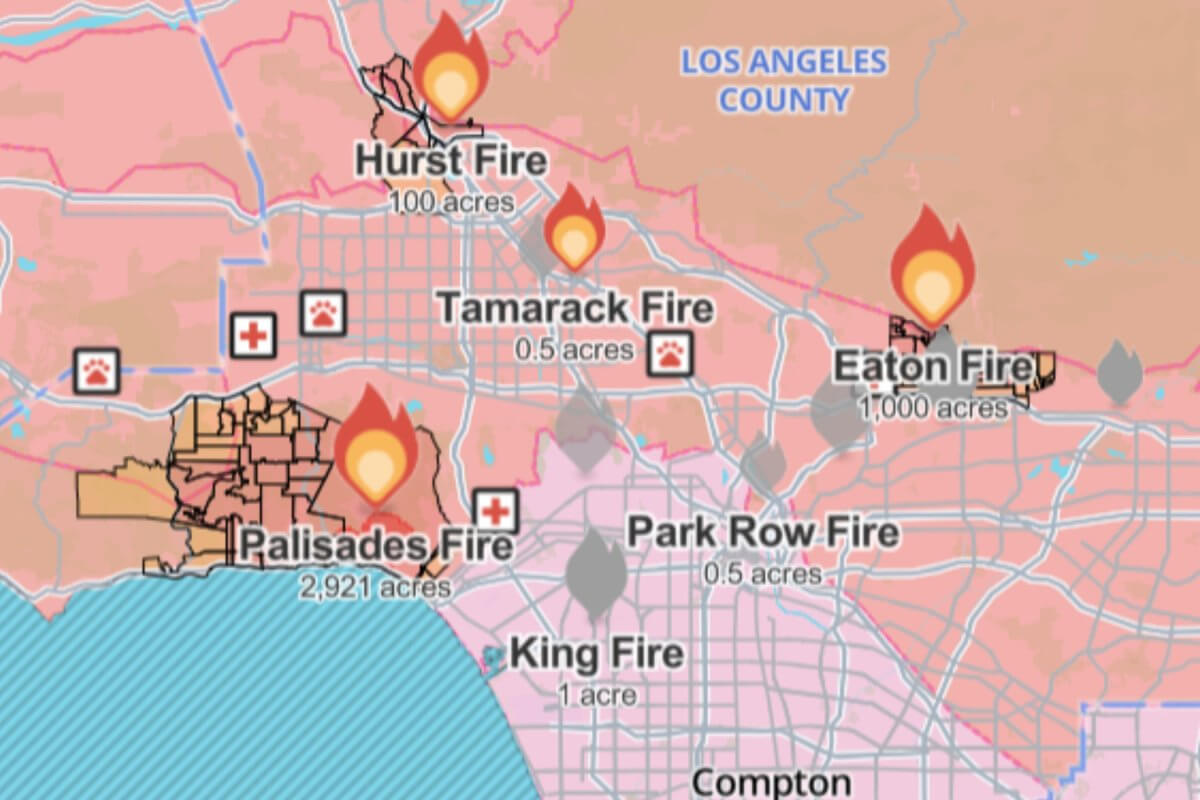

The Los Angeles Wildfires A Disturbing Trend In Disaster Related Betting

Apr 26, 2025

The Los Angeles Wildfires A Disturbing Trend In Disaster Related Betting

Apr 26, 2025 -

Los Angeles Wildfires A Reflection Of Societal Attitudes Towards Gambling And Risk

Apr 26, 2025

Los Angeles Wildfires A Reflection Of Societal Attitudes Towards Gambling And Risk

Apr 26, 2025 -

Microsoft Activision Deal Ftc Files Appeal Against Court Ruling

Apr 26, 2025

Microsoft Activision Deal Ftc Files Appeal Against Court Ruling

Apr 26, 2025 -

The Real Reason Behind Jennifer Aniston And Chelsea Handlers Friendship Split

Apr 26, 2025

The Real Reason Behind Jennifer Aniston And Chelsea Handlers Friendship Split

Apr 26, 2025