Stock Market Update: India's Sensex And Nifty 50 Conclude Day Flat

Table of Contents

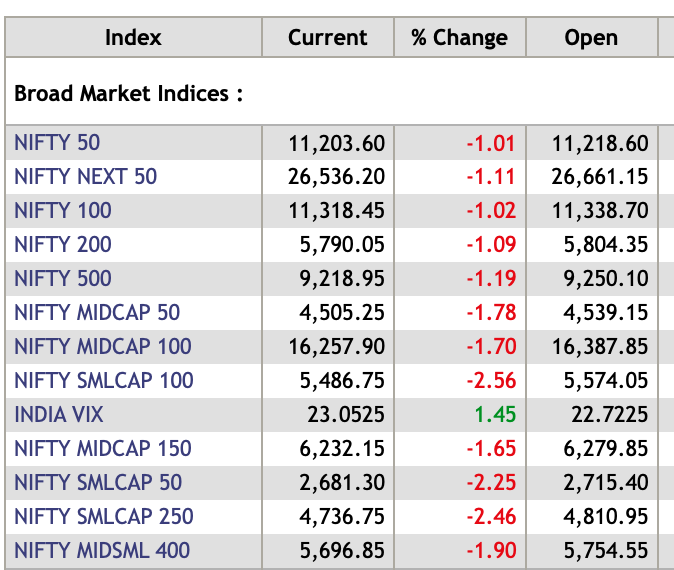

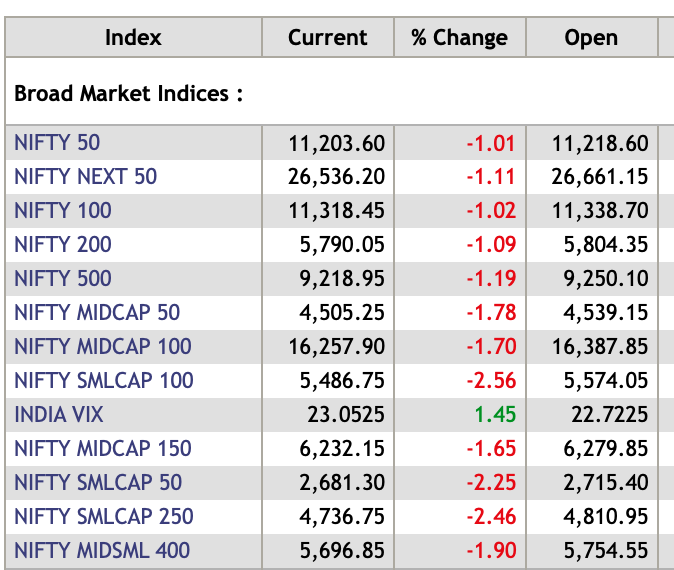

Sensex and Nifty 50 Daily Performance Analysis

Closing Values and Percentage Change

Today, the Sensex closed at [Insert Actual Closing Value Here] points, representing a [Insert Percentage Change Here]% change from yesterday's close. Similarly, the Nifty 50 ended the day at [Insert Actual Closing Value Here] points, showing a [Insert Percentage Change Here]% fluctuation. This relatively stagnant performance, despite considerable global and domestic activity, is noteworthy.

[Insert a simple chart or graph visually depicting the closing values and percentage changes of both Sensex and Nifty 50.]

Trading Volume and Volatility

Trading volume today was [Insert Actual Trading Volume Here], which is [higher/lower/similar] than the recent average daily volume of [Insert Average Daily Volume Here]. Market volatility, as measured by [mention specific volatility index, e.g., VIX equivalent for India], remained relatively [high/low/moderate], suggesting a cautious investor sentiment despite the flat close. This muted response to potential market movers is intriguing and warrants further analysis.

Sector-Wise Performance

The performance across different sectors varied considerably:

- Banking sector: Experienced a slight positive movement, with leading banks showing modest gains.

- IT sector: Remained relatively unchanged, reflecting a global tech sector that's currently showing mixed signals.

- FMCG sector: Saw minor negative movement, possibly influenced by inflation concerns and changing consumer spending habits.

- Pharmaceutical sector: [Insert Performance and Brief Reason]

- Energy sector: [Insert Performance and Brief Reason]

Factors Influencing the Flat Market

Global Market Trends

Global market trends played a significant role in today's flat market. The [mention specific US index, e.g., Dow Jones, S&P 500] experienced [describe the movement - increase, decrease, or sideways movement], influencing investor sentiment globally. Furthermore, [mention any significant global economic news or geopolitical events that potentially influenced the Indian market]. These external factors contributed to a sense of uncertainty that dampened significant movements in either direction.

Domestic Economic News

Domestically, the recent inflation data released by [mention the relevant authority] showed [describe the inflation data], potentially impacting investor confidence. Announcements from the Reserve Bank of India (RBI), regarding [mention specific RBI policy or announcement], may also have played a role in the market's flat performance. Additionally, [mention any other significant government policies or announcements].

Investor Sentiment and Trading Activity

Overall investor sentiment appears to be cautiously optimistic, with many investors adopting a 'wait-and-see' approach. Foreign Institutional Investors (FIIs) showed a [net inflow/net outflow/neutral stance] of [Insert Amount/Value], while Domestic Institutional Investors (DIIs) demonstrated a [net inflow/net outflow/neutral stance] of [Insert Amount/Value]. This mixed activity further supports the idea of a market in a period of consolidation.

Implications for Investors

Short-Term Outlook

The short-term outlook for the Indian stock market remains uncertain given today's flat close. The cautious investor sentiment and the influence of both global and domestic factors suggest a period of consolidation is likely. Short-term traders should exercise caution and carefully monitor market developments.

Long-Term Investment Strategies

For long-term investors, this presents an opportunity to re-evaluate their portfolios and ensure adequate diversification. Risk management strategies, such as dollar-cost averaging, remain crucial in navigating market volatility. A long-term perspective is key to weathering short-term fluctuations.

Specific Investment Recommendations (Optional)

[Only include specific investment advice if you are a qualified financial advisor. Otherwise, omit this section.]

Conclusion: Understanding India's Sensex and Nifty 50's Flat Performance – What's Next?

Today's flat performance of the Sensex and Nifty 50 highlights the complex interplay of global and domestic factors influencing the Indian stock market. The mixed investor sentiment and the relatively muted response to potential market movers indicate a period of uncertainty. Investors should prioritize informed decision-making, carefully analyzing market trends and seeking professional financial advice if needed. Stay updated on the latest Sensex and Nifty 50 movements by following our daily stock market updates for insights into India's market performance. Monitor your portfolio and adapt your investment strategy based on the latest Sensex and Nifty 50 trends. [Include links to related resources here].

Featured Posts

-

Anchorage Welcomes Iditarod 2025 Ceremonial Start Draws Huge Crowds

May 09, 2025

Anchorage Welcomes Iditarod 2025 Ceremonial Start Draws Huge Crowds

May 09, 2025 -

Daycare Decisions Expert Advice And Practical Considerations For Busy Families

May 09, 2025

Daycare Decisions Expert Advice And Practical Considerations For Busy Families

May 09, 2025 -

Elizabeth Line Strike Dates And Affected Routes February And March 2024

May 09, 2025

Elizabeth Line Strike Dates And Affected Routes February And March 2024

May 09, 2025 -

New Evidence Emerges In Wynne Evans Strictly Scandal Case

May 09, 2025

New Evidence Emerges In Wynne Evans Strictly Scandal Case

May 09, 2025 -

Colapintos Impact Jolyon Palmers Perspective On Doohans Alpine Trajectory

May 09, 2025

Colapintos Impact Jolyon Palmers Perspective On Doohans Alpine Trajectory

May 09, 2025