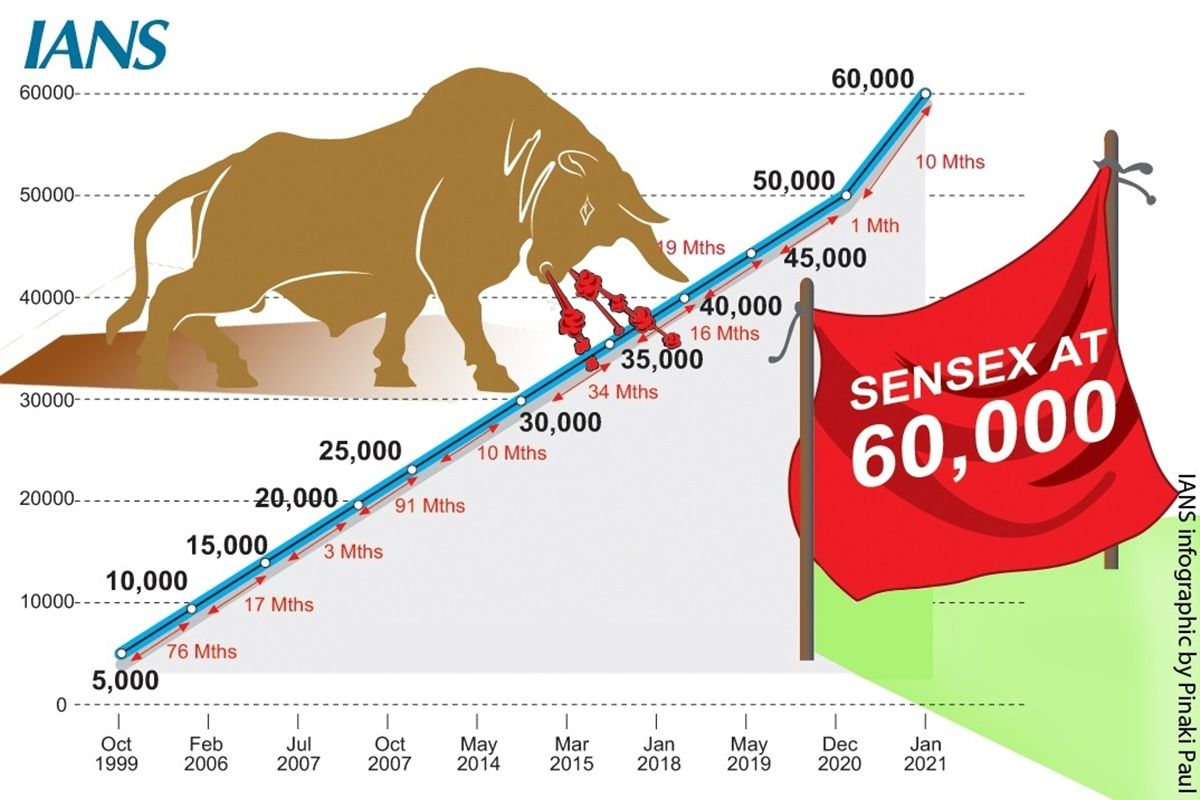

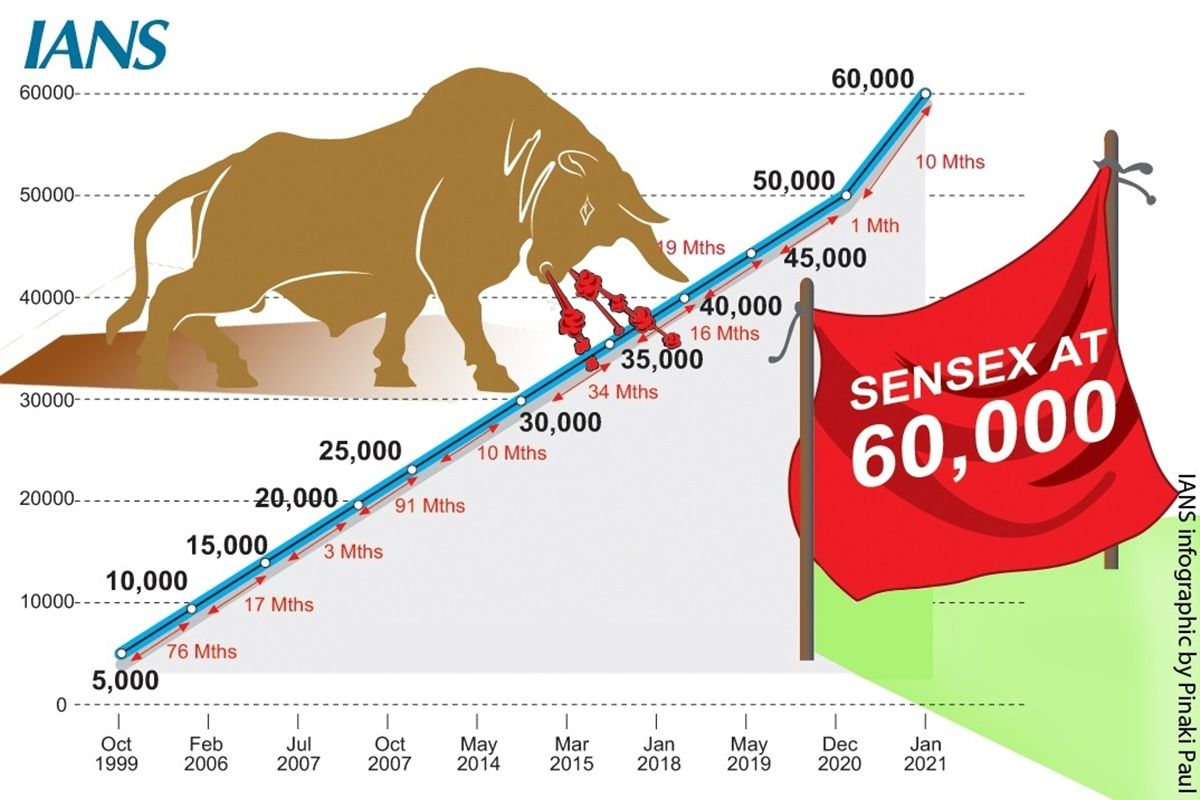

Stock Market Update: Sensex Gains 200, Nifty Crosses 22,600

Table of Contents

Sensex Surge: A Detailed Analysis

The Sensex's impressive 200-point gain reflects a positive market outlook driven by several key factors. This robust performance wasn't just a matter of a few points; it signifies a renewed confidence in the Indian economy. Several contributing factors fueled this upward trajectory. Positive global cues, driven by [mention specific global events like positive economic data from other major markets or easing geopolitical tensions], played a crucial role. Furthermore, strong buying pressure was observed in key sectors, further bolstering the index.

- Sensex Closing Value: [Insert Exact Closing Value]

- Percentage Change: [Insert Percentage Change from Previous Day's Close]

- Top Performing Sectors: The banking, IT, and FMCG sectors emerged as top performers, contributing significantly to the Sensex's rise. The banking sector's strength reflects positive investor sentiment towards the financial sector, driven by [mention any specific news or data related to banking sector].

- Significant Stock Contributors: [List 3-5 top performing stocks and briefly explain their contribution]. These stocks showcased impressive gains, reflecting strong company-specific performance and overall market optimism.

- Economic Indicators: The release of [mention any significant economic indicator released that day, e.g., positive inflation data or strong industrial production figures] further boosted investor confidence, contributing to the market's upward movement.

Nifty Crosses 22,600: Implications and Future Outlook

The Nifty index's crossing of the 22,600 mark is a significant milestone, indicating a strong bullish trend in the Indian stock market. This achievement holds important implications for investors and the overall market sentiment. Technical analysis suggests that [mention specific technical indicators, e.g., breakthrough of a key resistance level] has further strengthened the bullish outlook.

- Nifty Closing Value: [Insert Exact Closing Value]

- Key Technical Levels: Support levels around [mention support levels] and resistance levels around [mention resistance levels] will be crucial to watch in the coming days.

- Investor Sentiment: The overall market sentiment appears bullish, but caution is advised. While the current trend is positive, market volatility can still occur.

- Upcoming Economic Events: Upcoming events like [mention any upcoming economic events, e.g., RBI monetary policy announcement or GDP data release] could significantly impact market performance in the near future.

- Expert Opinions: [Mention any relevant expert opinions or analyst forecasts, citing sources]. It's important to consider diverse perspectives when making investment decisions.

Sectoral Performance: Winners and Losers

Analyzing sectoral performance provides a granular view of the market's dynamics. While some sectors thrived, others experienced a less favorable day. This disparity offers valuable insights into investment opportunities.

- Sectoral Performance Table:

| Sector | Percentage Change |

|---|---|

| Banking | +[Percentage] |

| IT | +[Percentage] |

| FMCG | +[Percentage] |

| Pharma | +[Percentage] or -[Percentage] |

| Energy | +[Percentage] or -[Percentage] |

| Real Estate | +[Percentage] or -[Percentage] |

(Note: Populate this table with actual data)

- Factors Driving Performance: The strong performance of the banking sector can be attributed to [mention reasons]. Conversely, the underperformance of the [mention underperforming sector] sector might be linked to [mention reasons].

- Exceptional Performers/Underperformers: [Mention specific stocks that performed exceptionally well or poorly within each sector and briefly discuss the reasons why.]

- Implications for Investors: Understanding sectoral performance is crucial for making informed investment decisions. Investors should carefully analyze the underlying factors driving individual sector movements.

Conclusion

Today's stock market update reveals a significant bullish trend, with the Sensex gaining 200 points and the Nifty index surpassing 22,600. This positive momentum is fueled by a combination of global cues, strong sectoral performances, and positive economic indicators. While the market sentiment is currently optimistic, investors should maintain a balanced perspective and remain aware of potential future volatility. The closing values of the Sensex at [closing value] and the Nifty at [closing value] highlight the strong performance. To stay informed on future stock market updates and make sound investment decisions, closely follow market trends and news related to the Sensex and Nifty. Consider subscribing to reputable financial newsletters or following trusted financial news sources for continuous updates. Remember to conduct your own thorough research before making any investment decisions.

Featured Posts

-

Jeanine Pirro Unveiling The Untold Story Of A Fox News Icon

May 10, 2025

Jeanine Pirro Unveiling The Untold Story Of A Fox News Icon

May 10, 2025 -

Bed Antqalh Llahly Almsry Mstwa Fyraty Me Alerby Alqtry

May 10, 2025

Bed Antqalh Llahly Almsry Mstwa Fyraty Me Alerby Alqtry

May 10, 2025 -

The Putin Victory Day Ceasefire A Look At The Details

May 10, 2025

The Putin Victory Day Ceasefire A Look At The Details

May 10, 2025 -

Nouveau Vignoble A Dijon 2 500 M Plantes Aux Valendons

May 10, 2025

Nouveau Vignoble A Dijon 2 500 M Plantes Aux Valendons

May 10, 2025 -

Incredibly Dangerous Months Of Warnings Preceded Latest Newark Air Traffic Control Outage

May 10, 2025

Incredibly Dangerous Months Of Warnings Preceded Latest Newark Air Traffic Control Outage

May 10, 2025