Stock Market Valuation Concerns: A BofA Perspective

Table of Contents

BofA's Assessment of Current Market Valuation

BofA Global Research regularly publishes reports analyzing market valuations, providing investors with crucial data to inform their decisions. Their assessment considers a range of factors and utilizes several key valuation metrics.

Price-to-Earnings (P/E) Ratio Analysis

BofA's analysis of current P/E ratios involves comparing them to historical averages across various sectors and the overall market. This provides context to determine whether current valuations are inflated or represent genuine value.

-

High P/E ratios in the tech sector – BofA's concerns: BofA often flags the tech sector as one that shows elevated P/E ratios compared to historical norms and other sectors. This warrants caution, as these valuations might be susceptible to corrections if growth expectations are not met. BofA's reports often delve into the specific companies driving these high valuations and analyze the sustainability of their growth trajectories.

-

Low P/E ratios in the energy sector – BofA's outlook: In contrast, BofA might highlight sectors like energy as exhibiting relatively low P/E ratios, presenting potential value opportunities. This often depends on various factors such as commodity prices and future demand projections. BofA's analysis often considers the impact of geopolitical factors and energy transition policies on the sector's valuation.

-

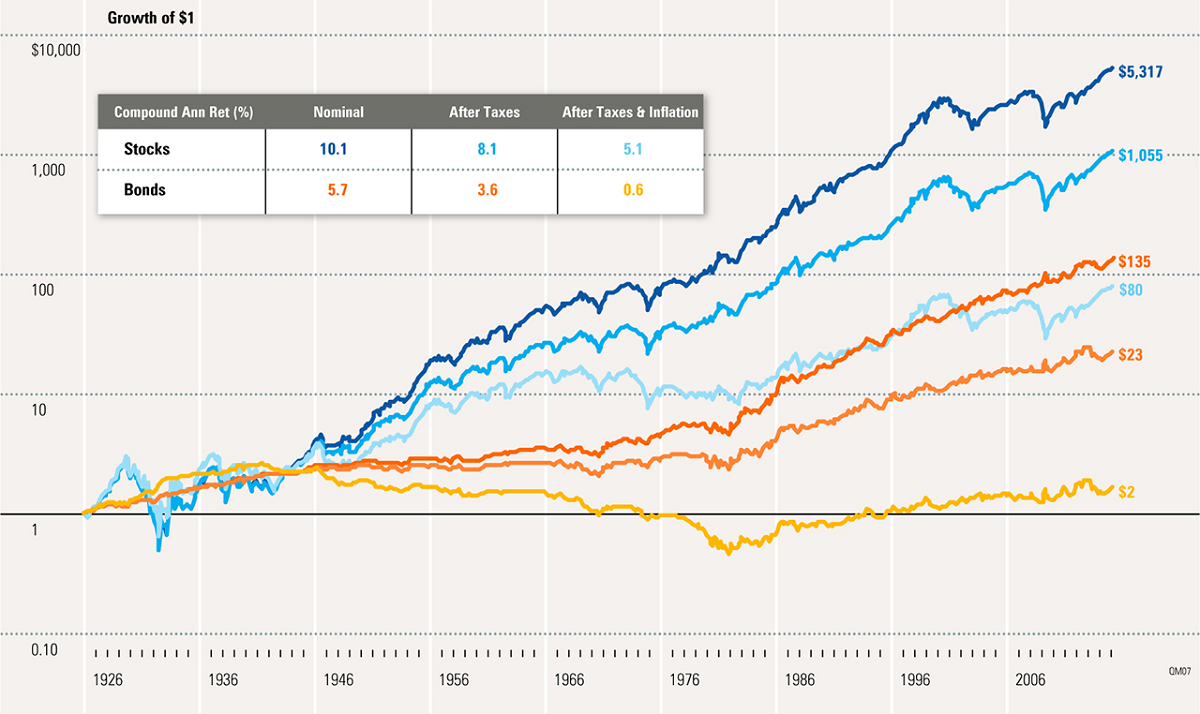

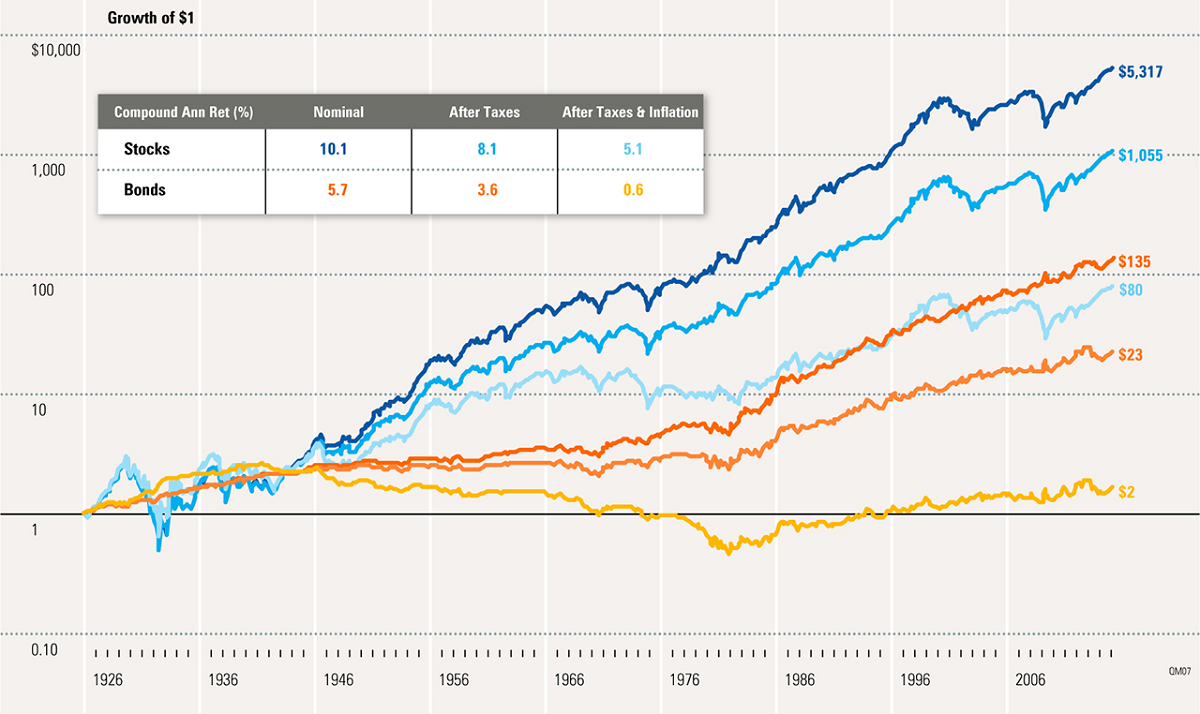

Comparison of current P/E with historical market peaks and troughs (BofA data): BofA's reports frequently use charts and graphs illustrating the current P/E ratio compared to previous market peaks and troughs. This historical context allows investors to gauge whether valuations are approaching historically overvalued or undervalued levels, helping to manage stock market valuation concerns.

Other Key Valuation Metrics

BofA's valuation assessment goes beyond P/E ratios. They utilize other key metrics such as Price-to-Sales (P/S), Price-to-Book (P/B), and dividend yield to paint a more complete picture.

-

BofA's interpretation of P/S ratios across different market segments: P/S ratios provide a useful alternative for valuing companies, especially those with negative earnings. BofA analyzes P/S ratios across different market segments, considering the unique characteristics of each sector.

-

Significance of the P/B ratio in determining intrinsic value (BofA perspective): The Price-to-Book (P/B) ratio compares a company's market capitalization to its book value. BofA uses this metric to assess whether a company's market valuation accurately reflects its underlying assets and net worth.

-

Dividend yield analysis and its implications for future returns (BofA insights): Dividend yield is a crucial metric for income-focused investors. BofA analyzes dividend yields across different sectors and uses them in conjunction with other valuation metrics to assess future return potential, particularly important when addressing stock market valuation concerns.

Potential Market Corrections and BofA's Predictions

BofA's analysts continuously monitor macroeconomic factors that could trigger market corrections. Understanding these potential triggers is vital for navigating stock market valuation concerns.

Identifying Potential Triggers for a Correction

Several factors can influence market corrections. BofA's analysis includes:

-

BofA's prediction of inflation's impact on stock valuations: High inflation erodes purchasing power and can lead to interest rate hikes. BofA analyzes the potential impact of inflation on company earnings and its consequences for stock valuations.

-

Interest rate sensitivity of different stock market sectors (BofA's analysis): Rising interest rates can make borrowing more expensive, impacting company profitability and stock valuations. BofA's analysis often highlights sectors most sensitive to interest rate changes.

-

Geopolitical risk assessment and its influence on market sentiment (BofA's perspective): Geopolitical events can significantly influence investor sentiment and market volatility. BofA incorporates geopolitical risks into its analysis to assess their potential impact on market valuations.

BofA's Strategies for Mitigating Risk

BofA offers several strategies to help investors manage risks associated with potential market corrections:

-

Diversification strategies recommended by BofA to reduce portfolio volatility: Diversification across different asset classes and sectors is a cornerstone of risk management. BofA's recommendations often include specific diversification strategies tailored to different investor profiles.

-

Hedging techniques to protect against market downturns (BofA suggestions): Hedging involves using financial instruments to offset potential losses. BofA's analysts suggest various hedging techniques to mitigate downside risk during market corrections.

-

Sector rotation strategies based on BofA's valuation assessments: Sector rotation involves shifting investments between sectors based on their relative valuations and growth prospects. BofA's valuation analysis guides investors in making informed sector rotation decisions.

Opportunities Within the Current Market Landscape (BofA's View)

Despite the stock market valuation concerns, BofA identifies potential opportunities:

Undervalued Sectors and Stocks

BofA's research often points out specific sectors and stocks that they believe are undervalued relative to their intrinsic value or future growth potential. These are presented as potential investment opportunities for risk-tolerant investors. Their reports often detail the reasoning behind these valuations and the potential catalysts for future price appreciation.

Long-Term Growth Prospects

BofA maintains a long-term outlook on the market and identifies sectors with promising growth potential. Their analysis considers factors such as technological advancements, demographic trends, and regulatory changes to assess which sectors offer the most promising long-term growth prospects, helping investors manage their stock market valuation concerns.

Conclusion

This article explored stock market valuation concerns through the lens of Bank of America's analysis. We examined BofA's perspective on key valuation metrics, potential market corrections, and strategies for mitigating risk. BofA's insights provide valuable context for investors navigating the current market environment. Understanding these concerns is crucial for making informed investment decisions.

Call to Action: Stay informed about stock market valuation concerns and consult with a financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial goals. Regularly review BofA's market reports and analysis for the latest insights into stock market valuation and potential investment opportunities. Understanding and proactively managing valuation risks is key to long-term investment success.

Featured Posts

-

Video Replay Loeil De Philippe Caveriviere Invite Philippe Tabarot 24 04 2025

May 30, 2025

Video Replay Loeil De Philippe Caveriviere Invite Philippe Tabarot 24 04 2025

May 30, 2025 -

Trump Firma Orden Ejecutiva Para Combatir La Reventa De Entradas De Ticketmaster

May 30, 2025

Trump Firma Orden Ejecutiva Para Combatir La Reventa De Entradas De Ticketmaster

May 30, 2025 -

The Reason For Fewer Excessive Heat Warnings A Detailed Analysis

May 30, 2025

The Reason For Fewer Excessive Heat Warnings A Detailed Analysis

May 30, 2025 -

Japans Electric Future Kg Motors Mibot Takes Center Stage

May 30, 2025

Japans Electric Future Kg Motors Mibot Takes Center Stage

May 30, 2025 -

Pegula Vs Alexandrova Charleston Open Final Showdown

May 30, 2025

Pegula Vs Alexandrova Charleston Open Final Showdown

May 30, 2025