Stock Market Valuation Concerns? BofA Offers A Calming Perspective

Table of Contents

BofA's Key Arguments Against Overvaluation Concerns

BofA's calming perspective on current stock market valuations rests on several key arguments, encouraging a more measured approach to investing.

Considering the Long-Term Perspective

BofA emphasizes the crucial importance of adopting a long-term investment horizon. Short-term market fluctuations are inherent and should not dictate investment decisions.

- Avoid panic selling: Emotional reactions to short-term market dips often lead to poor investment outcomes. Resist the urge to sell based on short-term market movements.

- Focus on fundamentals: Instead of reacting to daily price changes, concentrate on fundamental analysis of companies, their earnings, and their long-term growth potential. This is key to understanding true value.

- Study historical data: Reviewing historical market data reveals cyclical patterns. Understanding these patterns can help you contextualize current valuations and avoid making decisions based on fear. Remember that market corrections are a normal part of the cycle.

The Role of Interest Rates

Interest rate changes significantly impact stock valuations. BofA's analysis likely incorporates a detailed assessment of the interplay between interest rates and equity prices.

- Impact on profitability: Rising interest rates can increase borrowing costs for companies, potentially impacting their profitability and reducing investor confidence. This can affect stock prices.

- Predicting future rates: BofA's economists and analysts likely model future interest rate movements. These predictions influence their overall assessment of market valuations and future growth.

- Bond yields and equity: The relationship between bond yields and equity valuations is crucial. Higher bond yields can make bonds more attractive relative to stocks, potentially influencing equity valuations.

Analyzing Earnings Growth and Future Prospects

BofA's perspective likely incorporates detailed projections for future corporate earnings. Understanding earnings growth is critical for assessing the intrinsic value of stocks.

- Future earnings predictions: BofA's analysts provide detailed predictions for future corporate earnings, sector by sector. This forward-looking approach forms a vital part of their valuation analysis.

- Impact of technological advancements: Technological disruptions and industry trends dramatically shape future earnings growth. BofA accounts for such factors in their analysis.

- Sectoral health assessment: BofA assesses the overall health and growth potential of various sectors. This allows for a more nuanced understanding of which sectors might be overvalued or undervalued.

Factors Contributing to Current Valuation Levels

While BofA might argue against extreme overvaluation, understanding the factors driving current valuation levels is crucial.

Inflation's Influence

Inflation significantly impacts both corporate earnings and investor expectations, influencing stock valuations.

- Consumer spending and business costs: Inflation affects consumer spending power and business costs. These effects cascade through corporate earnings, influencing stock prices.

- Inflation in valuation models: BofA's valuation models undoubtedly incorporate inflation forecasts and their anticipated effects on company profitability.

- Inflationary environment strategies: Understanding how to navigate an inflationary environment is key for investors. BofA likely provides strategies for adapting portfolios to inflationary pressures.

Geopolitical Risks and Uncertainty

Global events introduce uncertainty and volatility into the markets, influencing investor sentiment and valuations.

- Geopolitical risk assessment: BofA's analysts actively assess geopolitical risks and incorporate their potential impact into valuation models.

- Market impact of global events: Specific geopolitical events, such as wars, trade disputes, and political instability, can have significant market impacts.

- Mitigating geopolitical risks: Strategies for mitigating risks associated with geopolitical uncertainty, such as diversification and hedging, are essential for investors.

BofA's Recommendations for Investors

BofA's message isn't just about calming valuation concerns; it also includes practical recommendations for investors.

Diversification Strategies

Portfolio diversification is crucial for mitigating risk. BofA likely advises a diversified approach to investing.

- Asset class diversification: Diversifying across various asset classes, such as stocks, bonds, and real estate, can significantly reduce overall portfolio risk.

- Sectoral and geographic diversification: Spreading investments across different sectors and geographic regions lessens the impact of industry-specific or regional economic downturns.

- Well-balanced portfolio: Building a well-balanced portfolio aligned with your risk tolerance and investment goals is fundamental to long-term success.

Long-Term Investment Approach

BofA reiterates the importance of a long-term investment strategy to weather market fluctuations.

- Buy-and-hold strategy: A buy-and-hold strategy involves purchasing assets and holding them for an extended period, ignoring short-term market volatility.

- Ignoring short-term noise: Focusing on long-term fundamentals and ignoring short-term market noise is crucial for successful long-term investing.

- Patience and discipline: Patience and discipline are essential qualities for successful long-term investors.

Conclusion

While concerns about stock market valuation are understandable, BofA's analysis offers a more balanced view. By considering long-term growth potential, understanding interest rate dynamics, and acknowledging the influences of inflation and geopolitical risks, investors can make more informed decisions. Remember, a well-diversified portfolio and a long-term investment strategy are vital in navigating market volatility. Don't let short-term fluctuations derail your long-term financial goals. Understand your risk tolerance and, if needed, consult a financial advisor for personalized guidance on managing your stock market valuation concerns.

Featured Posts

-

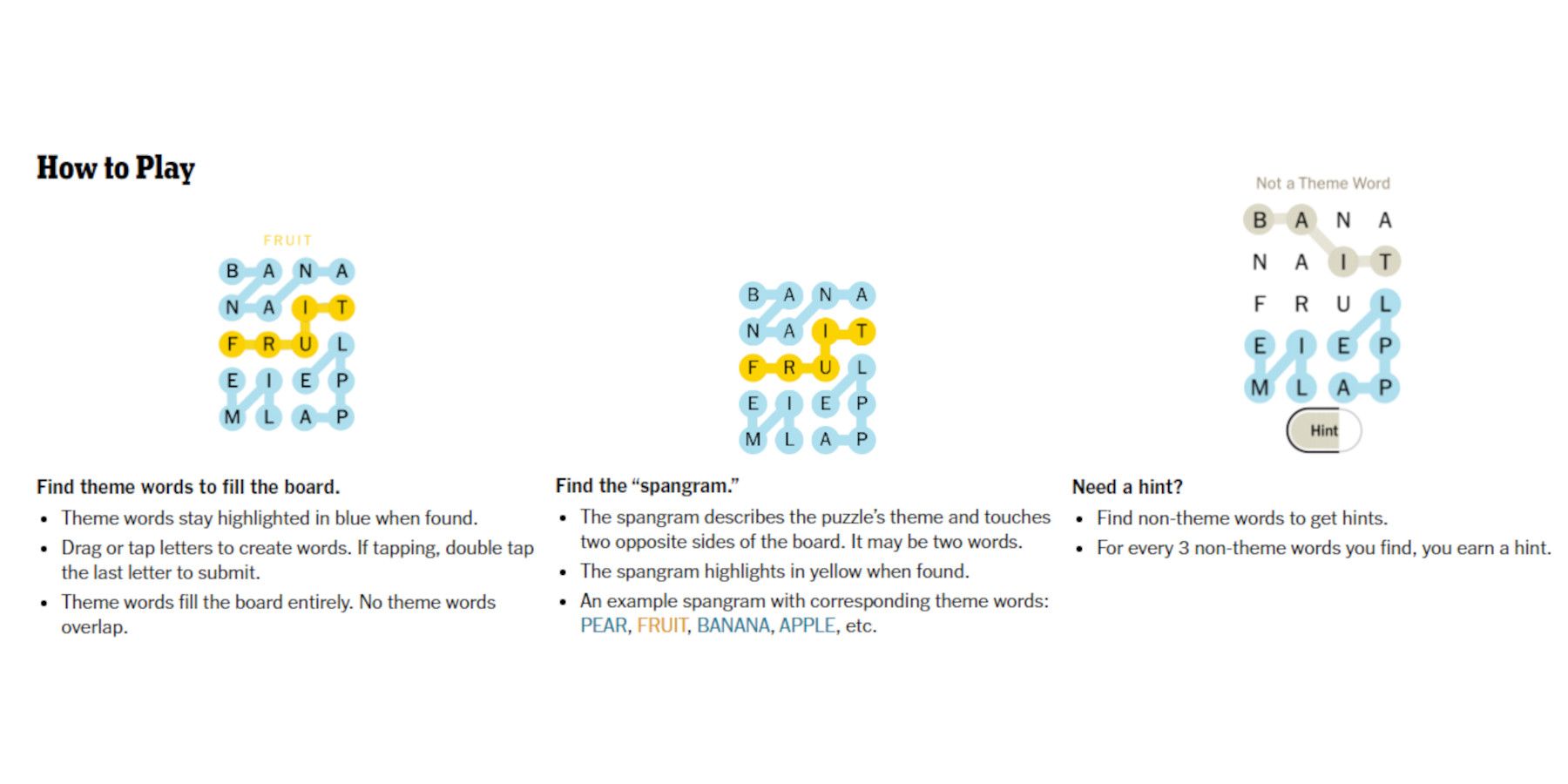

Nyt Strands Puzzle Hints And Answers For March 3 2025

Apr 29, 2025

Nyt Strands Puzzle Hints And Answers For March 3 2025

Apr 29, 2025 -

Porsche Pardavimu Augimas Lietuvoje 2024 Metais 33

Apr 29, 2025

Porsche Pardavimu Augimas Lietuvoje 2024 Metais 33

Apr 29, 2025 -

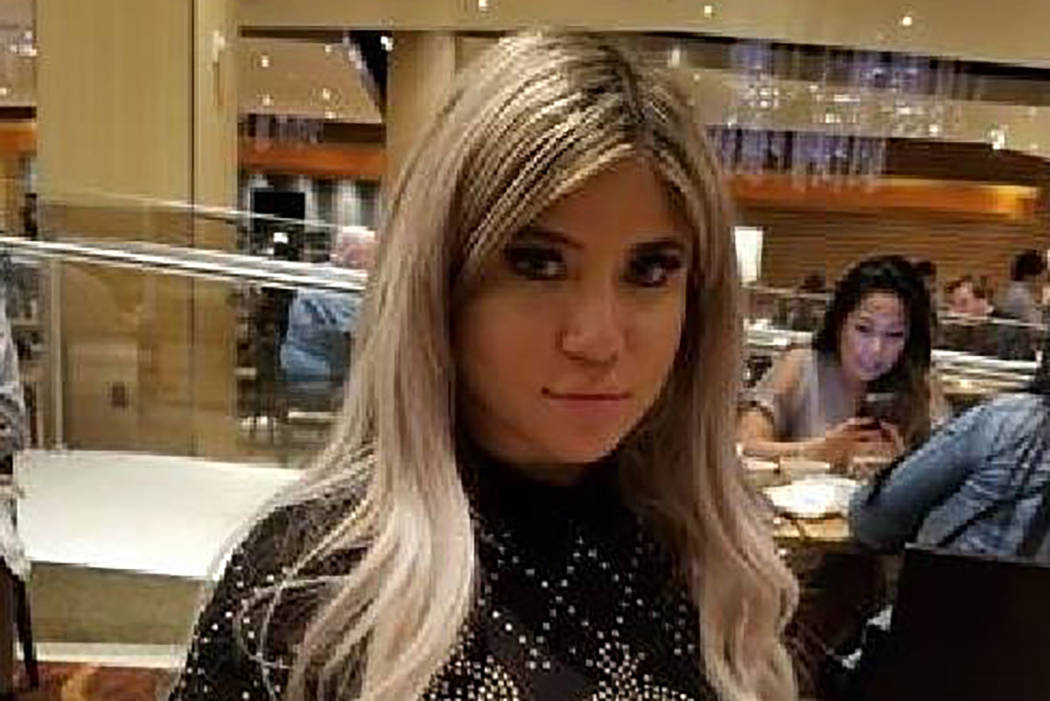

Missing In Las Vegas The Case Of The British Paralympian

Apr 29, 2025

Missing In Las Vegas The Case Of The British Paralympian

Apr 29, 2025 -

Past Tragedy Weighs Heavy As Louisville Residents Shelter In Place

Apr 29, 2025

Past Tragedy Weighs Heavy As Louisville Residents Shelter In Place

Apr 29, 2025 -

Kentuckys Severe Weather Awareness Week What The Nws Wants You To Know

Apr 29, 2025

Kentuckys Severe Weather Awareness Week What The Nws Wants You To Know

Apr 29, 2025