Stock Market Valuation Concerns? BofA Offers Investors Reassurance

Table of Contents

BofA's Assessment of Current Market Valuations

Bank of America's recent report delves into the complexities of current stock market valuations, providing a nuanced view that moves beyond simple "overvalued" or "undervalued" labels. Their assessment considers a range of factors, including projected earnings growth, interest rate environments, and macroeconomic trends.

Identifying Areas of Overvaluation

BofA's research points to specific sectors showing signs of potential overvaluation. This isn't a blanket condemnation, but rather a cautious assessment encouraging investors to proceed with prudence.

-

Technology Sector (Specific Sub-sectors): Certain segments of the tech sector, particularly those with high growth expectations but limited profitability, are flagged as potentially overvalued due to high Price-to-Earnings (P/E) ratios and unsustainable growth projections. BofA's data indicates a significant disconnect between current valuations and projected future earnings in these areas.

-

Certain Consumer Discretionary Stocks: Some companies in the consumer discretionary sector, particularly those heavily reliant on consumer spending, show elevated valuations compared to their historical averages and projected growth, according to BofA's analysis. This is partly attributed to concerns about potential economic slowdown.

-

Specific Real Estate Investment Trusts (REITs): BofA highlights that certain REITs, especially those concentrated in specific geographic locations or property types, may be facing overvaluation concerns due to potential interest rate hikes impacting borrowing costs and potentially reducing demand.

BofA's report supports these assessments with detailed financial modeling and comparative analysis, emphasizing the need for thorough due diligence before investing in these sectors.

Identifying Undervalued Opportunities

While some sectors show signs of overvaluation, BofA's research also identifies potential undervalued opportunities within the market. These sectors often present compelling investment cases based on strong fundamentals and attractive valuations relative to their growth potential.

-

Energy Sector (Renewable & Traditional): BofA notes that certain segments within the energy sector, both renewable and traditional, are showing strong fundamentals and comparatively lower valuations. This is driven by factors such as increased demand and supply constraints, presenting a compelling investment case for long-term investors.

-

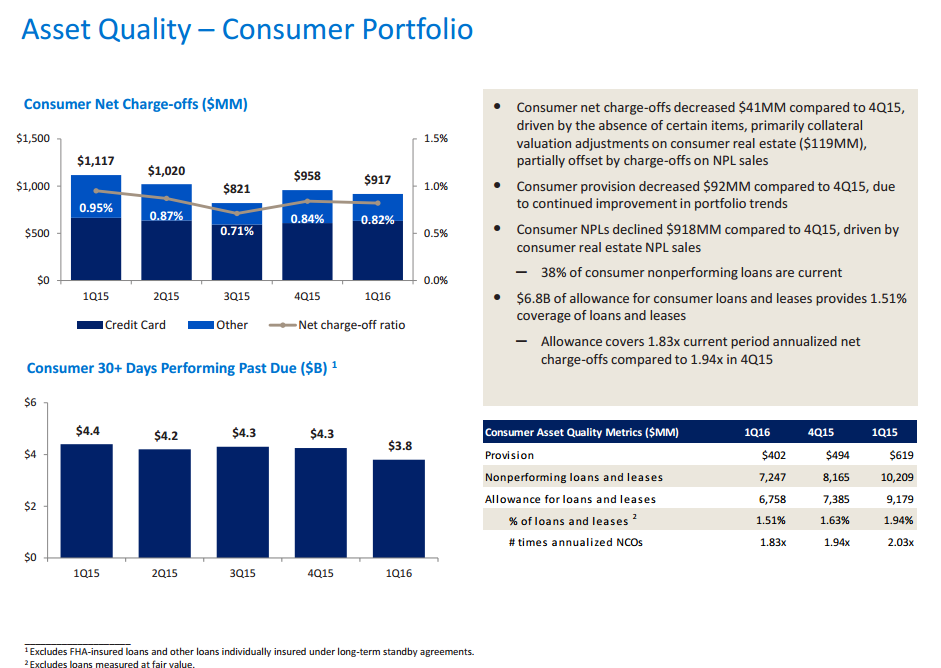

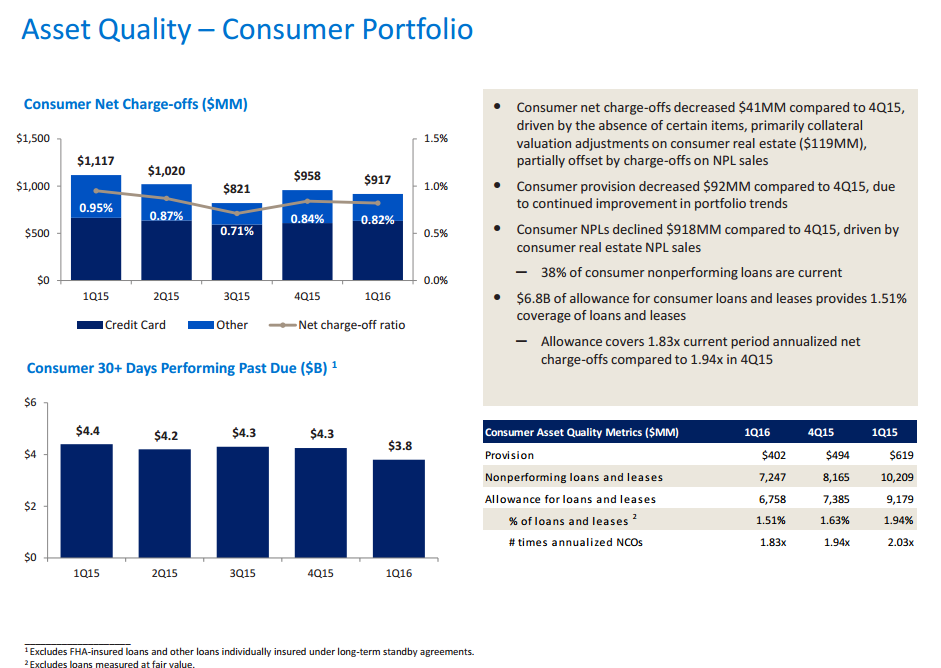

Select Financials: Specific financial institutions with robust balance sheets and demonstrated resilience to economic downturns are identified as potentially undervalued. BofA's analysis suggests that these institutions are positioned to benefit from a rising interest rate environment.

-

Healthcare (Specific Sub-sectors): BofA highlights opportunities within the healthcare sector, specifically mentioning companies with strong pipelines of innovative products and services, potentially representing undervalued growth opportunities. These companies may show lower valuations despite promising future prospects.

BofA's report provides a detailed breakdown of these undervalued sectors, emphasizing the importance of careful selection and understanding the underlying drivers of their valuations.

BofA's Strategies for Managing Valuation Risks

Navigating market volatility requires a proactive approach to risk management. BofA recommends several strategies to mitigate risks associated with potentially overvalued sectors.

Diversification Strategies

Diversification remains a cornerstone of effective investment strategies. BofA emphasizes spreading investments across various asset classes to reduce the overall impact of any single sector's underperformance.

-

Asset Allocation: BofA suggests a balanced portfolio approach, diversifying across stocks, bonds, real estate, and alternative investments. The optimal allocation depends on individual risk tolerance and investment goals.

-

Geographic Diversification: Investing in international markets can further reduce risk exposure to any single national economy. BofA encourages investors to explore global opportunities to balance their portfolios.

-

Sector Diversification: Reducing concentration within specific sectors is crucial. BofA advises against over-exposure to sectors identified as potentially overvalued.

Risk Management Techniques

BofA highlights several specific risk management techniques to help investors navigate the complexities of market valuations.

-

Dollar-Cost Averaging (DCA): Investing a fixed amount at regular intervals, regardless of market fluctuations, helps mitigate the risk of investing a lump sum at a market peak. BofA suggests this as a valuable long-term strategy.

-

Stop-Loss Orders: Setting stop-loss orders can help limit potential losses by automatically selling an asset if it falls below a predetermined price. BofA recommends careful consideration of stop-loss levels.

-

Portfolio Rebalancing: Regularly rebalancing your portfolio back to your target asset allocation can help prevent overexposure to any one asset class or sector and helps capture profits from winning positions. BofA advocates regular rebalancing as a key element of risk management.

Long-Term Outlook and Economic Factors

BofA's analysis incorporates macroeconomic predictions to provide a comprehensive outlook on stock market valuations.

BofA's Macroeconomic Predictions

BofA's economists offer insights into key economic indicators, helping investors understand the broader context for stock market valuations.

-

Inflation Expectations: BofA’s predictions for inflation will influence interest rate expectations and ultimately impact corporate earnings and valuations.

-

Interest Rate Forecasts: Changes in interest rates directly affect borrowing costs for companies and investors, influencing investment decisions and market valuations. BofA provides its forecast, highlighting potential implications.

-

GDP Growth Projections: BofA's projections for GDP growth are crucial in gauging the overall health of the economy and predicting corporate profits.

These predictions are compared against other leading economic forecasts, providing a comprehensive context for investors.

Impact on Investment Decisions

BofA's macroeconomic predictions directly influence recommended investment strategies.

-

Adjusting Portfolio Allocation: Based on BofA's outlook, investors may adjust their portfolio allocation to favor sectors expected to perform well in the predicted economic environment.

-

Long-Term Investment Horizon: BofA emphasizes the importance of maintaining a long-term investment horizon to weather short-term market fluctuations. Short-term market volatility shouldn't dictate long-term strategic decisions.

-

Seeking Professional Advice: BofA encourages consulting with financial advisors to tailor investment strategies based on individual circumstances and risk tolerance.

Conclusion

BofA's analysis provides a balanced perspective on current stock market valuations, highlighting both potential overvaluation in certain sectors and promising opportunities in others. Their strategic recommendations, encompassing diversification, risk management techniques, and a long-term perspective, equip investors to navigate market uncertainties. The integration of macroeconomic predictions further enhances the comprehensiveness of their guidance. Don't let stock market valuation concerns keep you from making informed investment decisions. Review BofA's insights and take control of your financial future. Learn more about BofA's full report and consult a financial advisor to create a personalized investment strategy aligned with your risk tolerance and financial objectives.

Featured Posts

-

Kentucky Derby 2025 Online Where To Watch Pricing And Access

May 05, 2025

Kentucky Derby 2025 Online Where To Watch Pricing And Access

May 05, 2025 -

Westbrook Enters Nba History Books During Jazz Nuggets Matchup

May 05, 2025

Westbrook Enters Nba History Books During Jazz Nuggets Matchup

May 05, 2025 -

Formula 1s Ubiquitous Presence The Role Of Ceo Stefano Domenicali

May 05, 2025

Formula 1s Ubiquitous Presence The Role Of Ceo Stefano Domenicali

May 05, 2025 -

Analyzing Fleetwood Macs Most Popular Songs Reasons For Continued Success

May 05, 2025

Analyzing Fleetwood Macs Most Popular Songs Reasons For Continued Success

May 05, 2025 -

Oscars 2024 Addressing The Emma Stone And Margaret Qualley Feud Rumors

May 05, 2025

Oscars 2024 Addressing The Emma Stone And Margaret Qualley Feud Rumors

May 05, 2025