Stock Market Valuation Concerns: BofA's Counterarguments

Table of Contents

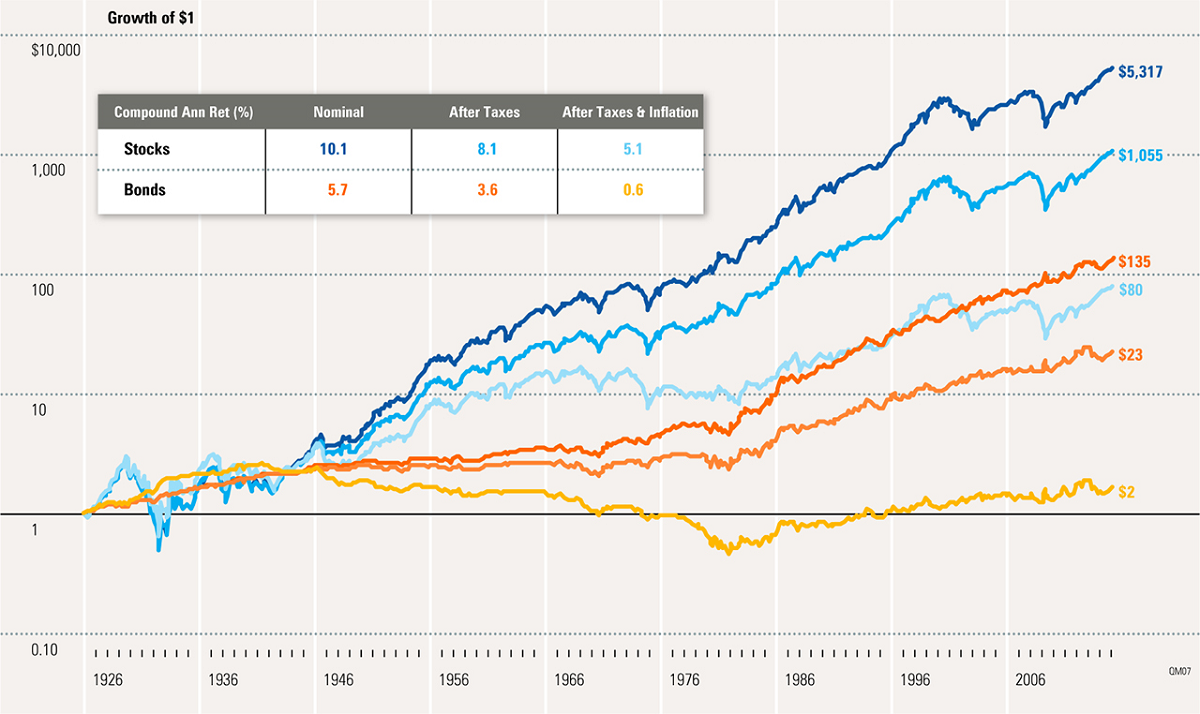

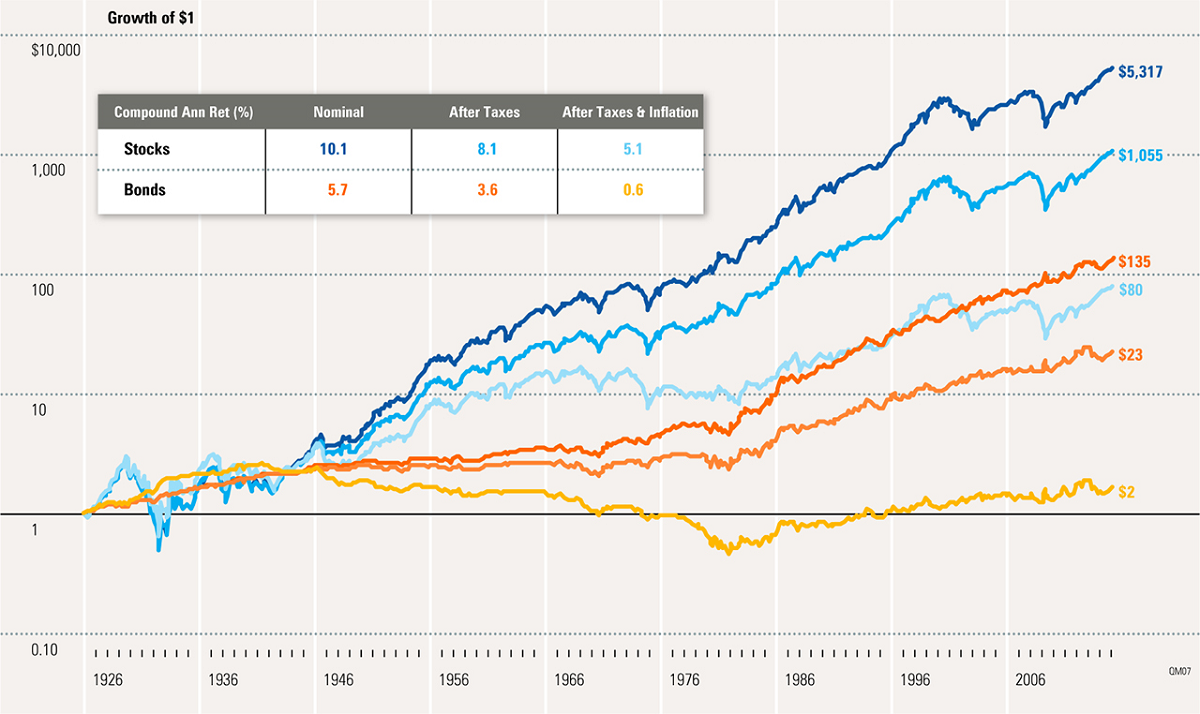

BofA's Argument: Strong Corporate Earnings Despite High Valuations

BofA contends that current high valuations, often reflected in seemingly elevated price-to-earnings ratios (P/E), are justified by robust corporate earnings. They argue that a simple P/E ratio doesn't tell the whole story and ignores crucial factors contributing to overall market health. This perspective suggests that focusing solely on valuation metrics without considering the underlying fundamentals of earnings growth can lead to a skewed understanding of the market's true potential.

-

Highlighting Sectors with Strong Earnings Growth: BofA likely points to specific sectors, such as technology, healthcare, and certain segments of the consumer discretionary sector, exhibiting impressive earnings growth despite broader economic uncertainties. These sectors, often driven by innovation and strong consumer demand, contribute significantly to overall market performance and justify higher valuations in their respective segments.

-

Impact of Robust Profit Margins on Valuation Metrics: Strong profit margins, even in a challenging economic environment, are a key component of BofA's argument. These margins demonstrate the efficiency and pricing power of companies, supporting higher valuations despite potential macroeconomic headwinds. Analyzing profit margins alongside P/E ratios provides a more comprehensive view of a company's financial health and its ability to withstand economic pressures.

-

BofA's Projections for Future Earnings Growth: BofA's analysis likely incorporates projections for future earnings growth, indicating a belief that current high valuations are not only justified by present performance but also by the anticipated future growth trajectory of many companies. These projections, based on various economic and industry-specific models, influence their overall outlook on stock market valuation.

-

Relevant Statistics and Data: To support their argument, BofA likely cites specific data points, including revenue growth figures, profit margin trends, and forward-looking earnings estimates from various sectors. These data points, drawn from their extensive research and analysis, form the bedrock of their counterargument to the prevailing valuation concerns.

Addressing Inflationary Pressures and Interest Rate Hikes

Inflation and rising interest rates are significant factors impacting stock valuations. BofA acknowledges these pressures but offers a nuanced perspective.

-

Market Already Pricing in Rate Hikes: BofA's analysis likely suggests that the market has already, at least partially, priced in the anticipated interest rate hikes by the Federal Reserve. This implies that the impact of future rate increases might be less dramatic than initially feared, as investors have already factored these expectations into their investment strategies and valuations.

-

Inflation's Long-Term Effects on Corporate Profits: BofA's assessment likely acknowledges the potential negative effects of inflation on corporate profits. However, their analysis probably differentiates between temporary inflationary pressures and long-term trends. They may argue that companies with strong pricing power can mitigate the negative impact of inflation on their profit margins.

-

Strategies for Navigating Inflationary Pressures: BofA may propose specific strategies for investors to navigate inflationary pressures. This could involve focusing on companies with pricing power, strong balance sheets, and a history of weathering economic downturns. Diversification and strategic asset allocation would also likely be highlighted as key strategies.

-

Data Supporting Claims on Inflation and Interest Rates: BofA's argument is supported by detailed analysis of inflation data (CPI, PPI), interest rate projections, and their impact on various sectors and industries. This data-driven approach enhances the credibility of their counterarguments to prevailing concerns about stock market valuation.

The Role of Technological Innovation and Future Growth Potential

BofA emphasizes the crucial role of technological innovation in driving future growth and justifying current valuations.

-

Technologies Driving Growth: BofA likely highlights specific technologies, such as artificial intelligence, cloud computing, biotechnology, and renewable energy, as key drivers of growth and justification for higher valuations in related sectors. These technologies represent significant long-term growth opportunities.

-

Long-Term Potential and Impact on Corporate Earnings: The long-term potential of these technologies is a significant aspect of BofA's argument. They might showcase how these innovations can lead to increased productivity, efficiency gains, and the creation of entirely new markets, ultimately boosting corporate earnings and justifying higher valuations.

-

Accounting for Future Growth in Valuation Models: BofA's valuation models likely incorporate projections for future growth driven by technological advancements. This contrasts with simpler valuation methods that focus solely on current earnings, providing a more comprehensive and future-oriented assessment of stock market valuation.

-

Examples of Companies Benefiting from Technological Advancements: BofA likely provides specific examples of companies successfully leveraging these technological advancements to boost their earnings and market share. These examples serve as case studies illustrating the link between innovation and higher valuations.

Geopolitical Factors and Their Influence on Market Valuation

Geopolitical risks are acknowledged by BofA as a factor influencing market valuations. However, their analysis incorporates a balanced perspective.

-

Impact of Geopolitical Events: BofA likely analyzes specific geopolitical events, such as the war in Ukraine or trade tensions between major economies, and assesses their potential impact on the market. This involves evaluating both short-term and long-term effects on different sectors.

-

Accounting for Geopolitical Risks in Market Outlook: BofA's market outlook accounts for these geopolitical risks by incorporating probabilities and potential outcomes into their models. This demonstrates a proactive approach to incorporating uncertainty into their analysis and valuation strategies.

-

Strategies for Mitigating Geopolitical Risks: BofA may suggest strategies for mitigating geopolitical risks, such as diversification across different geographical regions and sectors. This emphasizes the importance of a well-diversified investment portfolio to reduce exposure to specific geopolitical events.

-

Data and Analysis Supporting Assessment: BofA likely utilizes data from various sources, including geopolitical risk indices and expert assessments, to support their analysis and quantify the influence of geopolitical factors on market valuations.

Conclusion

This article examined BofA's counterarguments to prevalent stock market valuation concerns. BofA's perspective highlights the importance of considering factors beyond simple P/E ratios, such as strong corporate earnings, the potential for future growth driven by technological innovation, and their assessment of inflationary pressures and geopolitical risks. While acknowledging the inherent uncertainties in the market, BofA's analysis offers a more nuanced view on current valuations. Understanding the complexities of stock market valuation is crucial for informed investment decisions. To delve deeper into BofA's research and gain a more comprehensive perspective on stock market valuation, visit [link to BofA's research or relevant financial news]. Stay informed about evolving market conditions and make well-researched investment choices.

Featured Posts

-

Dozens Of Cars Vandalized In Elizabeth City Apartment Complex Burglaries

May 10, 2025

Dozens Of Cars Vandalized In Elizabeth City Apartment Complex Burglaries

May 10, 2025 -

Growth Opportunities Pinpointing The Countrys Best Business Locations

May 10, 2025

Growth Opportunities Pinpointing The Countrys Best Business Locations

May 10, 2025 -

Wynne Evans Fights Back Fresh Evidence In Strictly Scandal Case

May 10, 2025

Wynne Evans Fights Back Fresh Evidence In Strictly Scandal Case

May 10, 2025 -

Fyraty Fy Qtr Tqyym Mstwah Me Alerby Bed Alahly

May 10, 2025

Fyraty Fy Qtr Tqyym Mstwah Me Alerby Bed Alahly

May 10, 2025 -

Us Militarys Greenland Ambitions Examining The Pentagons Northern Command Plan

May 10, 2025

Us Militarys Greenland Ambitions Examining The Pentagons Northern Command Plan

May 10, 2025