Stock Market Valuation Concerns: Why BofA Remains Optimistic

Table of Contents

BofA's Rationale: Strong Corporate Earnings and Positive Economic Indicators

BofA's optimism is rooted in two key pillars: robust corporate profitability and a positive macroeconomic outlook. These factors, they argue, support current valuations despite seemingly high multiples.

Robust Corporate Profitability

BofA contends that strong corporate earnings are a significant underpinning of current market valuations. This isn't simply a matter of overall growth; it's about sustained profitability across various sectors. For example, S&P 500 earnings growth projections for the coming year remain relatively positive, suggesting continued strength in corporate performance.

- Strong revenue growth across multiple sectors: Many companies are demonstrating impressive revenue growth, driven by both organic expansion and strategic acquisitions. This indicates underlying economic strength and consumer confidence.

- Improved profit margins due to efficiency gains: Companies have implemented cost-cutting measures and improved operational efficiency, leading to enhanced profit margins. This resilience in the face of inflationary pressures is a key factor in BofA's positive assessment.

- Resilience to economic headwinds: Despite global uncertainty, many companies have shown surprising resilience to economic headwinds, demonstrating adaptability and robust business models. This suggests a more robust underlying economic foundation than some market anxieties might suggest.

Positive Macroeconomic Outlook

BofA's positive assessment is further bolstered by their view of the overall economic climate. While acknowledging potential risks, they highlight several key indicators that suggest continued economic growth, potentially mitigating some of the concerns surrounding high valuations.

- Strong labor market mitigating recessionary risks: A robust labor market with low unemployment rates suggests sustained consumer spending and reduces the immediate threat of a significant recession.

- Sustained consumer demand: Despite inflationary pressures, consumer spending remains relatively strong in key sectors, indicating continued economic activity.

- Positive projections for GDP growth: BofA likely cites positive projections for GDP growth, suggesting a healthy and expanding economy, which can support higher stock valuations.

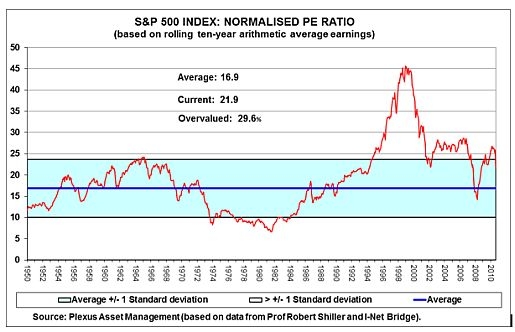

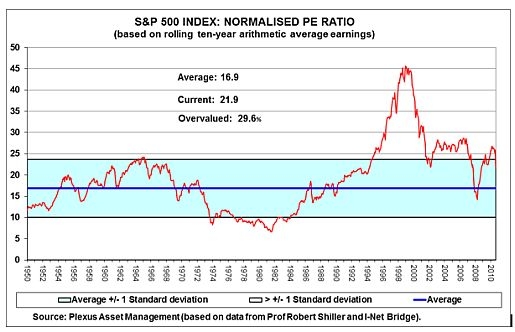

Addressing the Valuation Concerns: Why High P/E Ratios Aren't Necessarily a Red Flag

High Price-to-Earnings (P/E) ratios are a common source of stock market valuation concerns. However, BofA likely argues that these ratios don't necessarily paint the complete picture.

Low Interest Rates and Inflationary Pressures

Low interest rates and inflationary pressures significantly influence valuation metrics.

- Low discount rates justify higher price-to-earnings ratios: Low interest rates lead to lower discount rates used in valuation models. This, in turn, can justify higher P/E ratios, as future earnings are discounted less heavily.

- Inflation erodes the purchasing power of future earnings, making current earnings more valuable: Inflation reduces the real value of future earnings. Therefore, current earnings become more valuable relative to future ones, supporting higher valuations in the present.

Sector-Specific Analysis and Diversification

BofA's approach likely focuses on individual sectors rather than broad market indices.

- Opportunities in specific high-growth sectors: Certain sectors may offer attractive growth potential despite overall market valuations appearing high. Identifying these undervalued sectors is crucial to BofA's strategy.

- Reduced risk through strategic portfolio allocation: Diversification across various sectors and asset classes reduces overall portfolio risk. This strategy helps mitigate the impact of potential market corrections or underperformance in specific sectors.

- Focus on long-term growth potential: BofA’s optimistic outlook likely hinges on a long-term perspective, focusing on companies with strong growth prospects that can outpace market concerns over time.

Potential Risks and Counterarguments

While BofA maintains an optimistic outlook, it's crucial to acknowledge potential risks and counterarguments.

Inflationary Pressures and Interest Rate Hikes

Persistent inflation and subsequent interest rate hikes pose significant risks. Higher interest rates increase borrowing costs for companies, potentially impacting profitability and reducing investment. This could lead to lower earnings and subsequently lower stock valuations.

Geopolitical Uncertainty and Supply Chain Disruptions

Geopolitical instability and ongoing supply chain disruptions can negatively impact corporate earnings and market sentiment. These unpredictable events can introduce significant volatility and uncertainty, potentially undermining the positive outlook.

Potential for a Market Correction

Even with a positive outlook, the possibility of a market correction remains. Overvaluation in certain sectors or broader market factors could trigger a period of downward correction, impacting overall valuations.

Conclusion

BofA's optimism regarding stock market valuation concerns stems from strong corporate earnings, positive economic indicators, and a nuanced view of current valuations. They likely utilize a sector-specific approach to identify opportunities within what some perceive as an overvalued market. However, acknowledging potential risks like inflationary pressures, geopolitical uncertainty, and the possibility of a market correction is crucial. While understanding BofA's perspective provides valuable insight, remember that investing involves inherent risks. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to stock market valuation concerns.

Featured Posts

-

Your Guide To Buying Bbc Radio 1 Big Weekend 2025 Tickets

May 24, 2025

Your Guide To Buying Bbc Radio 1 Big Weekend 2025 Tickets

May 24, 2025 -

La Rental Market Exploited After Devastating Fires

May 24, 2025

La Rental Market Exploited After Devastating Fires

May 24, 2025 -

Essen Emotionale Geschichten Rund Um Das Uniklinikum

May 24, 2025

Essen Emotionale Geschichten Rund Um Das Uniklinikum

May 24, 2025 -

Glastonbury 2025 Lineup Is It The Best Yet Charli Xcx Neil Young And More

May 24, 2025

Glastonbury 2025 Lineup Is It The Best Yet Charli Xcx Neil Young And More

May 24, 2025 -

Jonathan Groff Just In Time Bobby Darin And The Raw Power Of Performance

May 24, 2025

Jonathan Groff Just In Time Bobby Darin And The Raw Power Of Performance

May 24, 2025