Stock Market Valuations: BofA Assures Investors Amidst High Prices

Table of Contents

BofA's Perspective on Current Stock Market Valuations

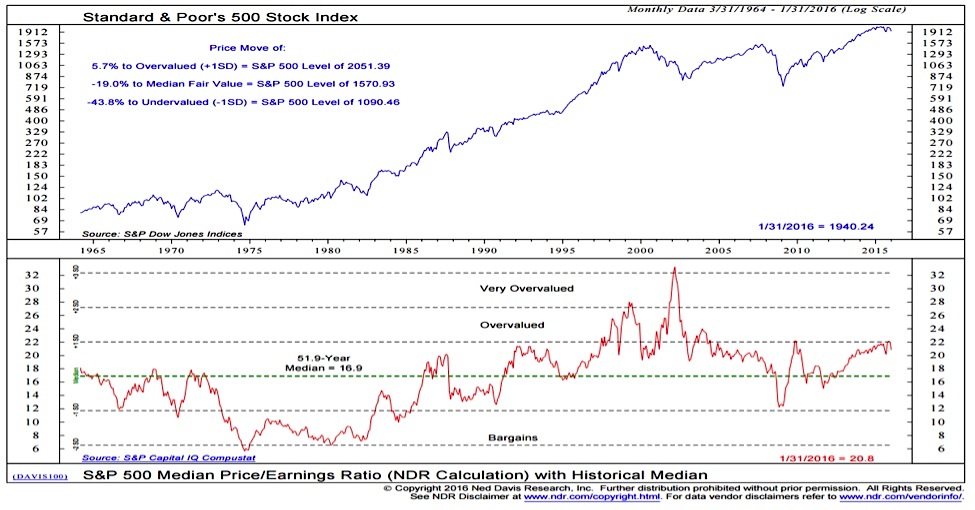

BofA's recent reports and analyses on stock valuations offer a nuanced perspective. While acknowledging elevated price-to-earnings (P/E) ratios and high market capitalization in certain sectors, their assessment isn't uniformly bearish. Their analysis often incorporates a range of economic indicators and future projections. For example, a recent BofA report might cite a specific P/E ratio of 25 for the S&P 500, comparing it to historical averages and projecting future earnings growth.

- BofA's Overall Stance: While acknowledging the high valuations, BofA's stance often leans towards cautious optimism. They emphasize the need for selectivity and diversification, rather than blanket pronouncements of a market crash.

- Overvalued and Undervalued Sectors: BofA frequently highlights specific sectors. For instance, they might suggest that certain technology stocks are overvalued compared to their projected future earnings, while identifying value opportunities within the energy or healthcare sectors. Their reports usually detail the rationale behind these assessments.

- Key Economic Indicators: BofA's analysis heavily relies on key economic indicators, including inflation rates, interest rate changes, consumer sentiment, and GDP growth projections. These indicators inform their projections for corporate earnings and overall market performance. They typically explain how these indicators are linked to their valuation assessments.

Understanding Current Market Conditions and Their Impact on Valuations

Macroeconomic factors significantly influence stock market valuations. Understanding these factors is crucial for making informed investment decisions.

- Interest Rates and Stock Valuations: Higher interest rates generally lead to lower stock valuations. This is because higher rates increase the cost of borrowing for companies, potentially reducing their profitability, and make bonds a more attractive alternative investment.

- Inflation's Impact: High inflation erodes purchasing power and can squeeze corporate profit margins. If inflation outpaces wage growth and consumer spending, it can negatively affect company earnings and lead to lower stock prices. BofA's analysts usually factor inflation expectations into their valuation models.

- Global Economic Growth: Strong global economic growth usually supports higher stock valuations. Conversely, a global economic slowdown or recession can significantly depress stock prices as corporate profits decline. BofA's international analysis and projections play a crucial role in assessing this impact.

Strategies for Investors Based on BofA's Assessment

Based on BofA's analysis, a well-informed investment strategy involves both caution and opportunity.

- Portfolio Diversification: Diversifying across different sectors, asset classes, and geographic regions is paramount. This reduces risk by avoiding overexposure to any single investment.

- Investment Approaches: BofA’s assessments can inform your investment approach. During periods of high valuations, a value investing strategy—focusing on undervalued companies—might be more appropriate than a pure growth investing strategy.

- Long-Term vs. Short-Term: A long-term investment horizon is generally recommended, especially in volatile markets. Short-term trading strategies carry greater risk, especially in a high-valuation environment.

Managing Risk in a High-Valuation Market

Navigating a market with high valuations demands a risk-management approach.

- Due Diligence: Thorough research is essential before investing in any stock. Understanding a company's fundamentals, competitive landscape, and management team helps mitigate risk.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. It reduces the risk of investing a large sum at a market peak.

- Profit Targets and Stop-Loss Orders: Setting realistic profit targets and stop-loss orders helps protect your investments from significant losses.

Alternative Investment Options Beyond Traditional Stocks

Beyond traditional stocks, other asset classes can diversify your portfolio and mitigate risk.

- Real Estate: Real estate can offer diversification benefits, but liquidity can be lower compared to stocks.

- Bonds: Bonds, particularly government bonds, are often considered safer investments during periods of market uncertainty, offering a less volatile alternative to stocks.

- Other Asset Classes: Commodities, alternative investments, and international markets offer further diversification possibilities, but each carries its own risk profile.

Conclusion

BofA's analysis of current stock market valuations highlights a need for cautious optimism and careful portfolio management. Their emphasis on diversification, thorough research, and a long-term investment approach provides valuable guidance. By understanding the macroeconomic factors impacting valuations and utilizing strategies like dollar-cost averaging and setting stop-loss orders, investors can navigate the complexities of the market. Understanding stock market valuations is crucial for making informed investment decisions. Stay informed about BofA's ongoing analysis and utilize their insights to refine your investment strategy. Don't hesitate to seek professional financial advice to navigate the complexities of stock market valuations and build a robust investment portfolio. Learn more about managing your investments amidst fluctuating stock market valuations.

Featured Posts

-

Breaking Arrest In Double Homicide Of Embassy Personnel

May 22, 2025

Breaking Arrest In Double Homicide Of Embassy Personnel

May 22, 2025 -

Actors And Writers Strike A Complete Shutdown Of Hollywood

May 22, 2025

Actors And Writers Strike A Complete Shutdown Of Hollywood

May 22, 2025 -

Potential Release Date For Dexter Resurrection Trailer Surfaces Online

May 22, 2025

Potential Release Date For Dexter Resurrection Trailer Surfaces Online

May 22, 2025 -

Core Weave Stock Soars Following Nvidias Strategic Investment

May 22, 2025

Core Weave Stock Soars Following Nvidias Strategic Investment

May 22, 2025 -

Core Weave Stock Price A Look At The Current Situation

May 22, 2025

Core Weave Stock Price A Look At The Current Situation

May 22, 2025