Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

BofA's Bullish Stance on Stock Market Valuations

BofA's recent reports paint a picture of cautious optimism regarding stock market valuations. Their analysts point to several key factors supporting their bullish outlook, dismissing concerns about overvaluation. They argue that current valuations, while potentially high in certain sectors, are justified by robust earnings growth and a long-term positive economic outlook.

- Specific examples of BofA's rationale: BofA highlights the resilience of corporate earnings in the face of inflationary pressures and supply chain disruptions. They note that many companies have successfully implemented pricing strategies to offset increased costs, maintaining healthy profit margins.

- Sectors BofA is bullish on: The bank's analysts express particular optimism about the technology, healthcare, and consumer staples sectors, citing their strong fundamentals and growth potential.

- Reference to relevant research reports: BofA's research frequently cites favorable P/E ratios (price-to-earnings ratios) in certain sectors, indicating that stocks are not excessively priced relative to their earnings. They also point to strong dividend yields in some sectors as a sign of stability and long-term value.

The Impact of Interest Rates on Stock Market Valuations

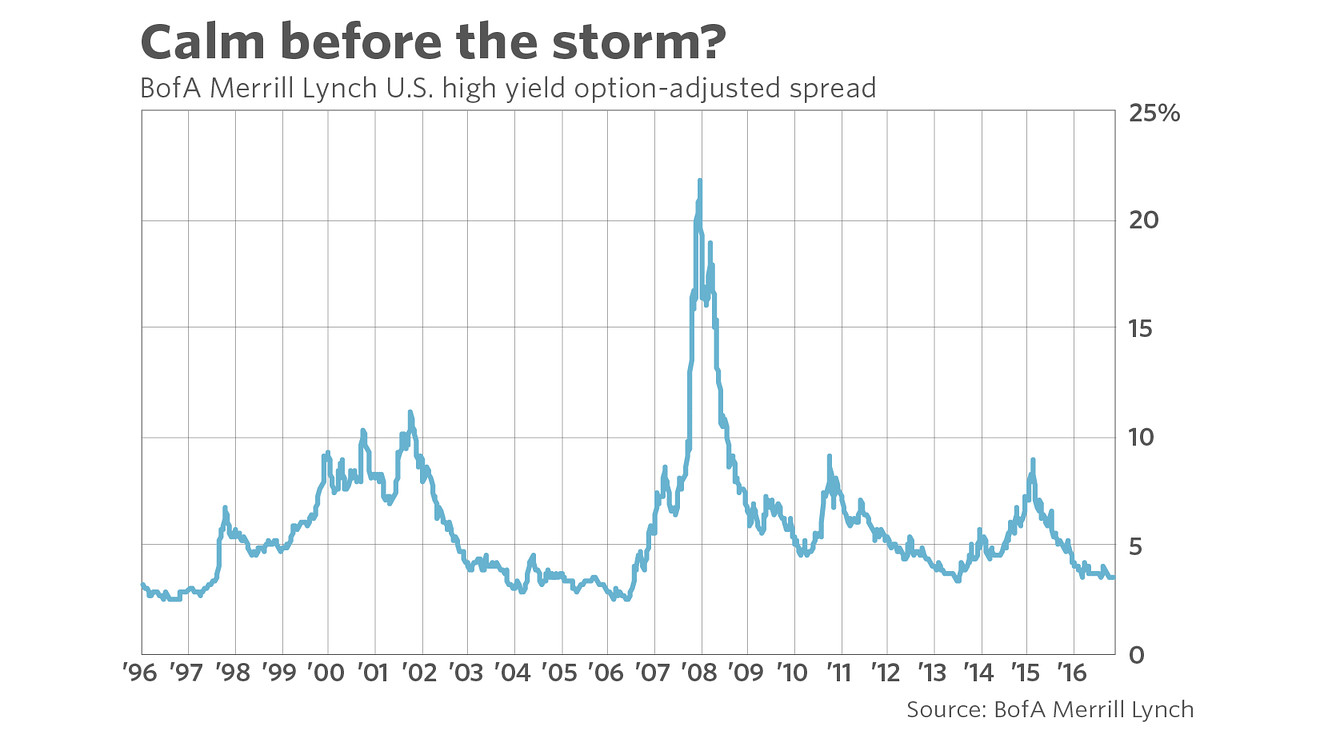

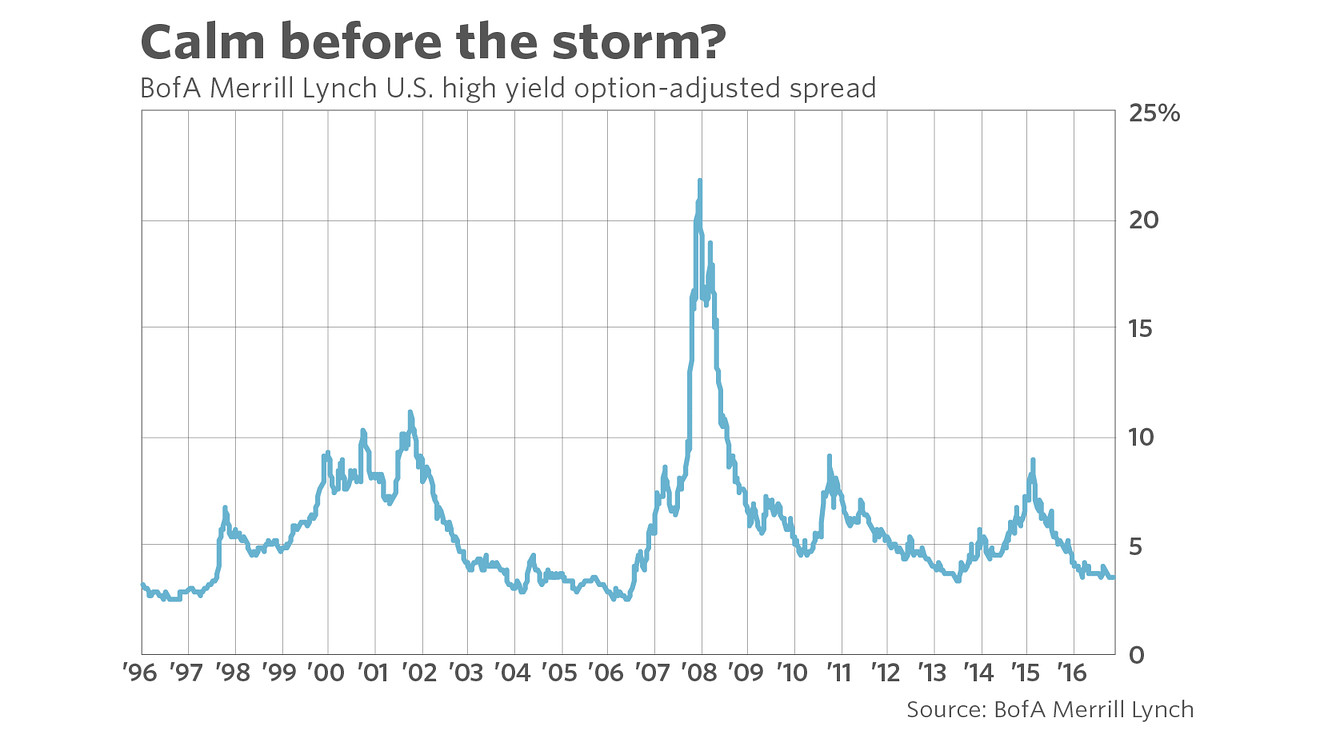

Interest rates play a crucial role in shaping stock market valuations. Higher interest rates typically lead to lower stock valuations because they increase the cost of borrowing for companies, reduce corporate earnings, and make bonds, a less risky investment, more attractive. Currently, while interest rates have risen, BofA believes the impact on stock valuations has been largely priced in.

- Inverse relationship between bond yields and stock valuations: Rising bond yields (which are directly related to interest rates) often attract investors away from stocks, putting downward pressure on stock prices. However, BofA's analysis suggests that the current level of interest rates is not prohibitive to stock market growth.

- Federal Reserve's monetary policy: The Federal Reserve's efforts to control inflation through interest rate hikes are a key factor influencing investor sentiment. While further rate hikes are possible, BofA anticipates a "soft landing" – a scenario where inflation is brought under control without triggering a significant economic downturn.

- Potential for a "soft landing": A soft landing would significantly reduce the risk to stock valuations, allowing corporate earnings to continue growing and supporting higher stock prices.

Earnings Growth and its Influence on Stock Market Valuations

Earnings growth is fundamental to justifying current stock market valuations. If companies consistently increase their earnings, higher stock prices become more sustainable. BofA's analysis indicates that projected earnings growth for the coming year remains positive, although at a more moderate pace than in previous years.

- Corporate earnings growth forecasts: BofA's forecasts suggest healthy earnings growth, particularly in certain resilient sectors. This growth, while possibly slower than in previous boom periods, is still sufficient to support current valuations.

- Impact of inflation and supply chain issues: While inflation and supply chain disruptions have undoubtedly impacted corporate earnings, many companies have shown remarkable adaptability, mitigating the negative effects.

- Impact of technological advancements: Technological innovation continues to drive efficiency and productivity improvements, contributing to long-term earnings growth for many companies.

Long-Term Economic Outlook and Stock Market Valuations

A long-term perspective is crucial when evaluating stock market valuations. While short-term economic fluctuations are inevitable, the historical resilience of the stock market suggests that long-term investors should not panic over temporary downturns. BofA emphasizes this long-term view, acknowledging potential risks but highlighting the overall positive trajectory of the global economy.

- Long-term economic growth projections: Despite near-term uncertainties, BofA points to long-term growth projections suggesting continued expansion of the global economy, driving corporate profits and supporting stock market growth.

- Potential risks and opportunities: Geopolitical risks and other global uncertainties are acknowledged, but BofA's analysis suggests that these factors are largely factored into current valuations.

- Historical market data demonstrating resilience: Historical data clearly demonstrates the stock market's ability to recover from even significant downturns. Long-term investors who ride out market cycles often see substantial returns.

Don't Let Stock Market Valuations Scare You

In summary, BofA's optimistic outlook on stock market valuations is rooted in several key factors: resilient corporate earnings, the potential for a soft landing, robust projected earnings growth, and a positive long-term economic outlook. While market volatility is normal, reacting impulsively to short-term fluctuations can be detrimental to long-term investment goals. Instead, focus on a well-diversified portfolio and a long-term investment strategy.

To make informed investment decisions regarding stock market valuations, consult with a qualified financial advisor. Conduct thorough research, considering factors beyond simply current market valuations. Remember, understanding stock market valuations is a continuous process, and staying informed is key. Further reading on topics like P/E ratios, dividend yields, and macroeconomic indicators can enhance your understanding of market dynamics.

Featured Posts

-

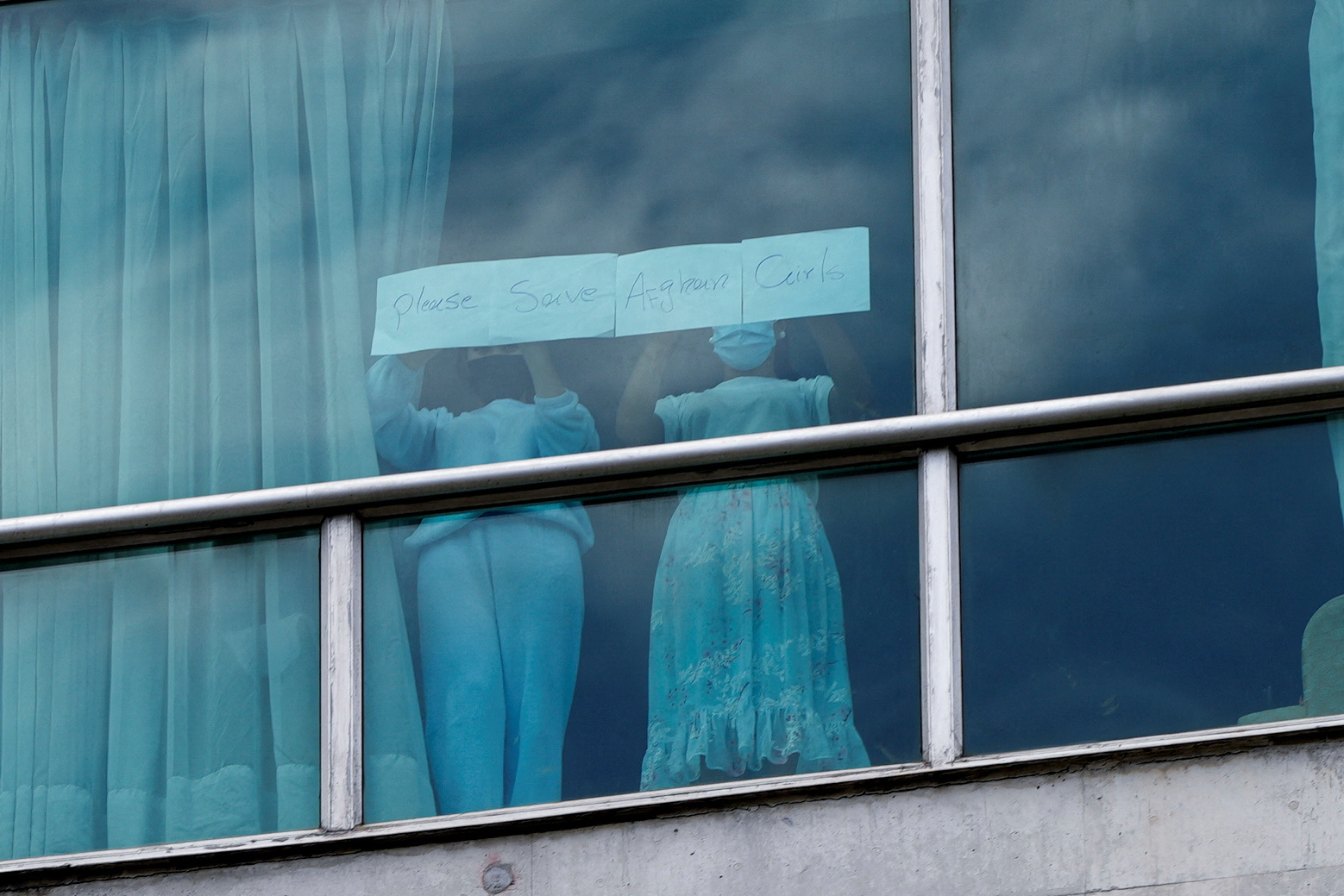

Coordinating The Return Of Deportees South Sudan And The Us Governments Strategy

Apr 22, 2025

Coordinating The Return Of Deportees South Sudan And The Us Governments Strategy

Apr 22, 2025 -

Microsoft Activision Deal Ftc Files Appeal

Apr 22, 2025

Microsoft Activision Deal Ftc Files Appeal

Apr 22, 2025 -

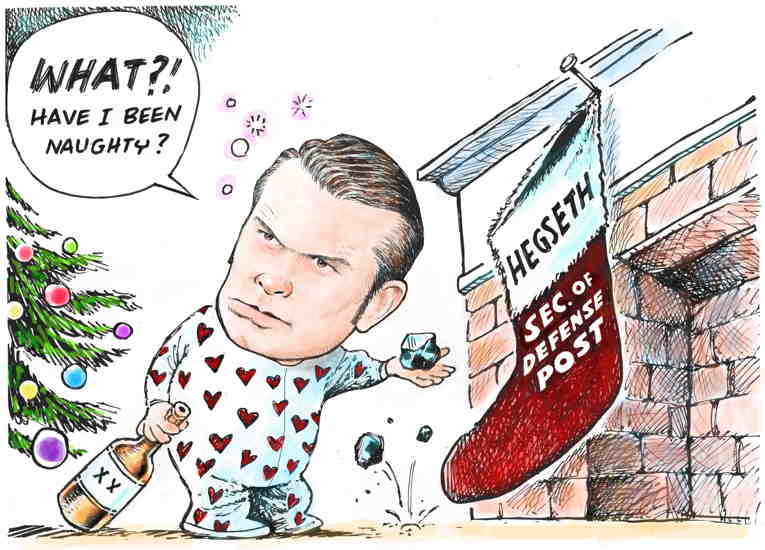

Hegseth Under Fire New Signal Chat And Pentagon Chaos Claims

Apr 22, 2025

Hegseth Under Fire New Signal Chat And Pentagon Chaos Claims

Apr 22, 2025 -

Identifying The Countrys Top New Business Opportunities A Geographic Overview

Apr 22, 2025

Identifying The Countrys Top New Business Opportunities A Geographic Overview

Apr 22, 2025 -

Is Blue Origins Failure Larger Than Katy Perrys Public Image Problems

Apr 22, 2025

Is Blue Origins Failure Larger Than Katy Perrys Public Image Problems

Apr 22, 2025