Stock Market Valuations: BofA's Analysis And Why Investors Shouldn't Panic

Table of Contents

BofA's Key Findings on Current Stock Market Valuations

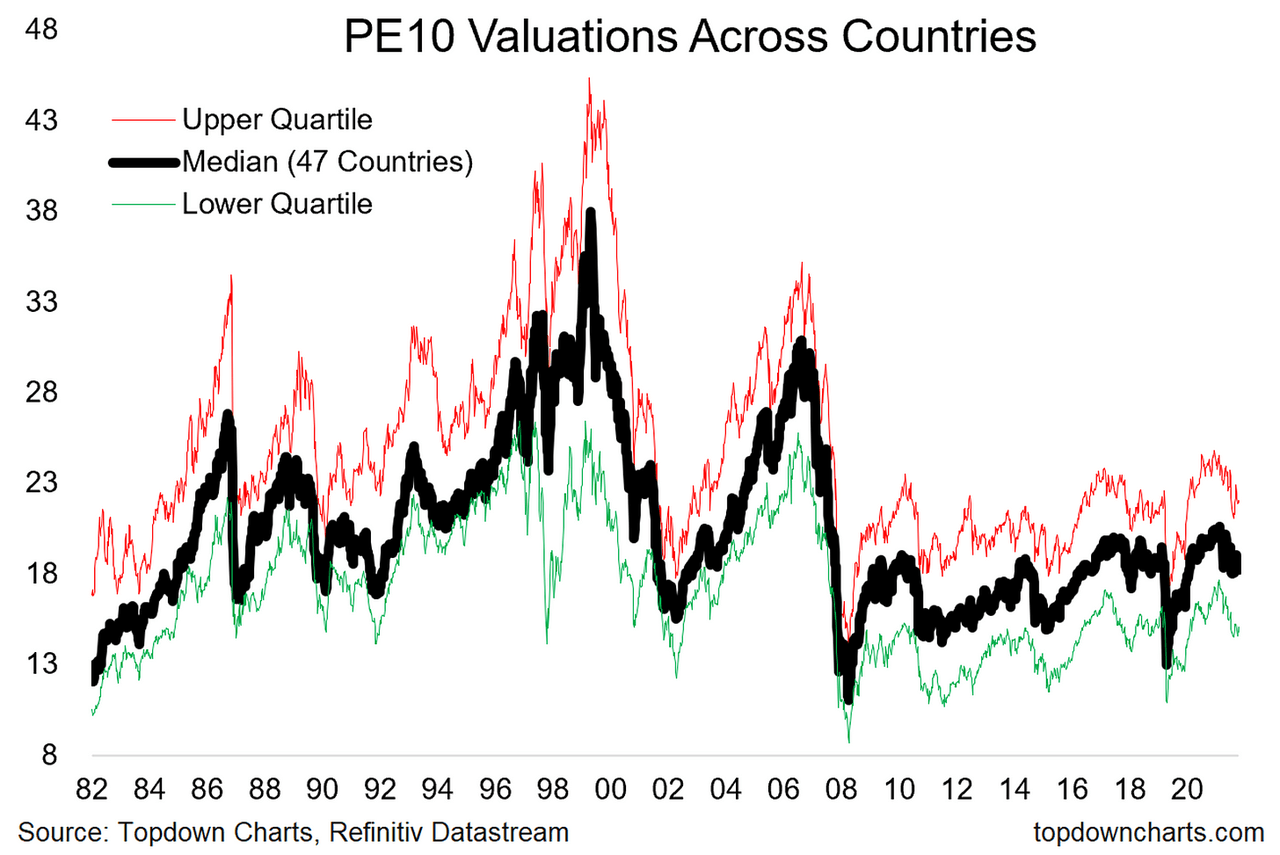

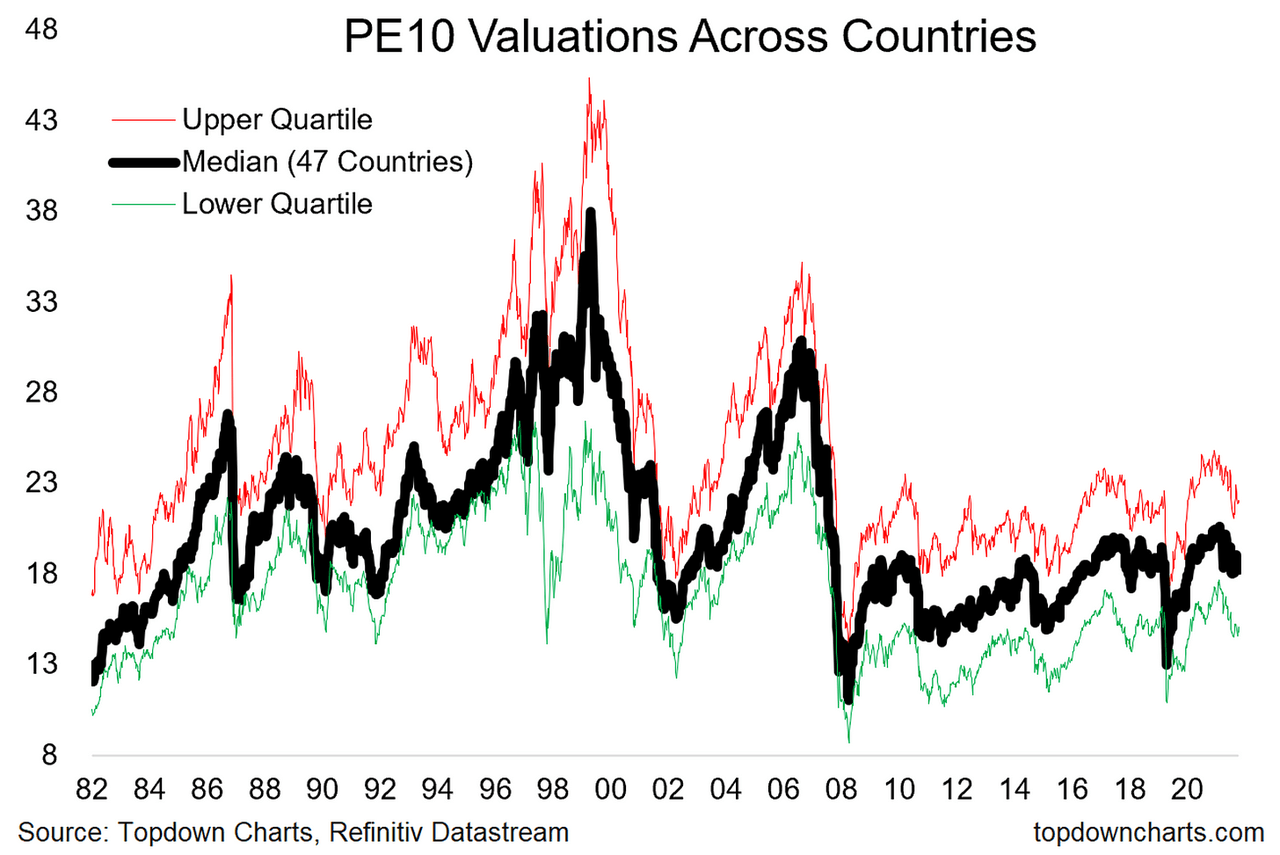

BofA regularly publishes reports analyzing stock market valuations, utilizing various key metrics to gauge market health. Their recent research, including reports like [insert specific report title and link if available], offers a nuanced perspective that challenges widespread panic. Key metrics employed by BofA include the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller P/E), and dividend yield. These indicators, when considered holistically, paint a more complex picture than many headlines suggest.

-

BofA finds that while valuations are elevated in some sectors, they are not historically unprecedented. While certain tech stocks or other growth-focused companies may appear expensive based on traditional P/E ratios, a broader analysis considering industry-specific factors and growth projections offers a more balanced viewpoint.

-

Their analysis suggests that current valuations are supported by strong corporate earnings and relatively low interest rates. This combination, while potentially unsustainable in the long run, provides a degree of support for current market levels. The ability of companies to generate profits, coupled with readily available credit, contributes to investor confidence, albeit cautiously.

-

BofA highlights specific sectors they consider undervalued or fairly valued. Their research identifies pockets of opportunity, suggesting that a blanket approach of market pessimism might miss significant investment potential. This highlights the importance of granular analysis rather than broad generalizations about stock market valuations.

Factors Supporting BofA's Relatively Optimistic Outlook

BofA's relatively calm outlook is supported by several macroeconomic factors. These factors, while not guarantees of future performance, provide context for their assessment of current stock market valuations.

-

Strong corporate earnings growth projections: Many companies continue to report robust earnings, indicating underlying strength in the economy and supporting current market pricing.

-

Continued low interest rates (or potential for further rate cuts): Low borrowing costs incentivize investment and stimulate economic activity, positively impacting company performance and stock market valuations.

-

Government stimulus measures and their impact on the economy: While the long-term effects are still debated, government interventions can significantly influence economic growth and market sentiment.

-

Technological advancements driving growth in specific sectors: Innovation continues to disrupt industries, creating new opportunities and driving growth in specific sectors, thus influencing overall stock market valuations.

Addressing Investor Concerns and Common Misconceptions about Stock Market Valuations

Fear of missing out (FOMO) and the fear of a market crash are common investor anxieties, particularly during periods of market volatility. BofA's analysis helps to contextualize these fears.

-

Debunking the myth of perfectly timed market entries and exits: Trying to time the market perfectly is a fool's errand. History shows that consistent, long-term investing generally outperforms attempts at market timing.

-

Highlighting the long-term historical performance of the stock market: Despite short-term fluctuations, the stock market has historically delivered positive returns over the long term. This underscores the importance of a long-term investment horizon.

-

Explaining the importance of diversification and a long-term investment strategy: Diversifying your portfolio across different asset classes and maintaining a long-term perspective can help mitigate risk and weather short-term market corrections. This strategy is crucial when considering stock market valuations.

Alternative Perspectives and Considerations

It's essential to acknowledge that not all analysts share BofA's optimistic view. A balanced perspective necessitates considering alternative viewpoints and potential risks.

-

Mention other analysts who hold different perspectives on valuations: Some analysts may point to historically high valuations in certain sectors as a cause for concern.

-

Discuss potential risks such as inflation, geopolitical uncertainty, etc.: Macroeconomic risks, such as inflation or geopolitical instability, can significantly impact stock market valuations and overall market performance.

-

Explain how BofA's analysis might not apply equally to all market sectors or individual stocks: BofA's analysis provides a general overview, but individual stocks and sectors may perform differently based on their specific circumstances.

Conclusion: Navigating Stock Market Valuations – A Call to Action

BofA's analysis suggests that while stock market valuations may be elevated in some areas, they are not necessarily indicative of an imminent crash. Their findings emphasize the importance of considering supporting macroeconomic factors and avoiding emotional reactions to short-term market fluctuations. Instead of panic selling, investors should focus on maintaining a diversified portfolio and adopting a long-term investment strategy.

Don't let short-term market fluctuations dictate your long-term investment strategy. Understand stock market valuations through deeper research, including BofA's reports and other reputable sources, and develop a plan that aligns with your financial goals and risk tolerance. Remember, consistent investing and a well-diversified portfolio are key to navigating the complexities of stock market valuations and achieving your financial objectives.

Featured Posts

-

Yankees Defeat Brewers In Opening Day Victory Analysis Of Their Winning Strategy

Apr 23, 2025

Yankees Defeat Brewers In Opening Day Victory Analysis Of Their Winning Strategy

Apr 23, 2025 -

Christelle Le Hir A La Tete De La Vie Claire Et Du Synadis Bio

Apr 23, 2025

Christelle Le Hir A La Tete De La Vie Claire Et Du Synadis Bio

Apr 23, 2025 -

L Echo Du Monde Legislatives Allemandes J 6 Tout Ce Qu Il Faut Savoir

Apr 23, 2025

L Echo Du Monde Legislatives Allemandes J 6 Tout Ce Qu Il Faut Savoir

Apr 23, 2025 -

7 Nisan Pazartesi Tv De Yayinlanan Diziler

Apr 23, 2025

7 Nisan Pazartesi Tv De Yayinlanan Diziler

Apr 23, 2025 -

Real World Review My 77 Inch Lg C3 Oled Tv

Apr 23, 2025

Real World Review My 77 Inch Lg C3 Oled Tv

Apr 23, 2025