Stock Market Valuations: BofA's Reasons For Investor Calm

Table of Contents

BofA's Perspective on Current Stock Market Valuations

BofA generally holds a cautiously optimistic stance on current stock market valuations, neither outrightly declaring them high nor definitively low. Their analysis suggests a more nuanced picture, acknowledging the presence of both attractive and overvalued sectors. This assessment is based on a multi-faceted approach that incorporates various valuation metrics and considers the broader economic landscape.

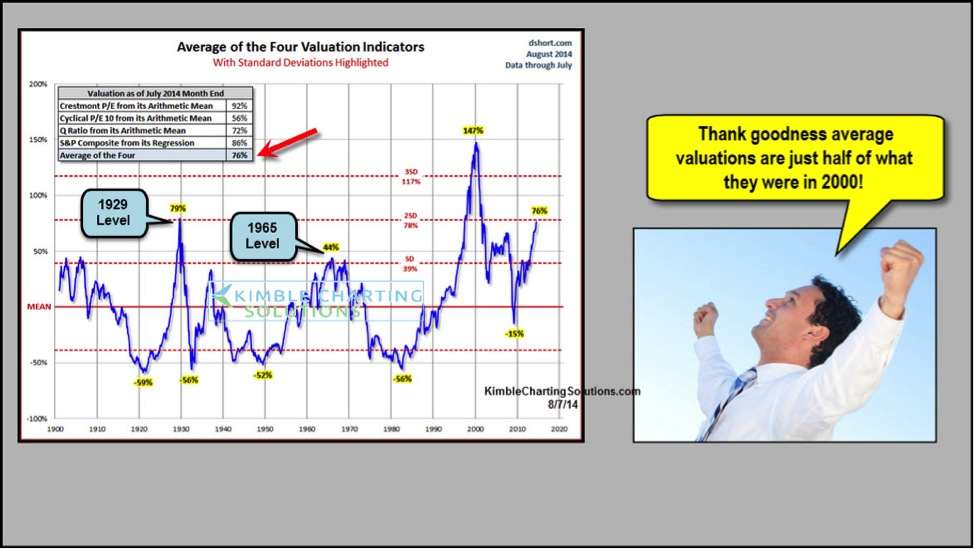

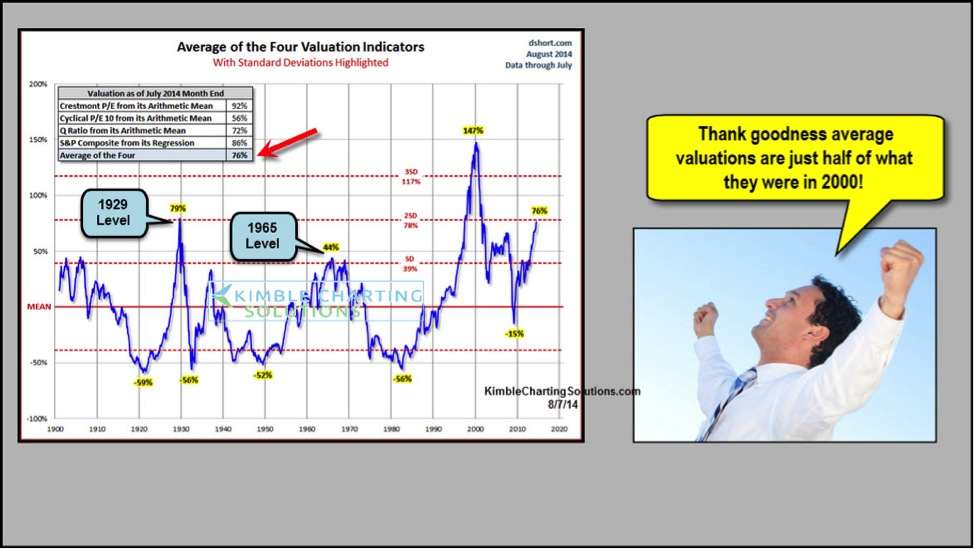

- Valuation Metrics: BofA's analysis utilizes a range of metrics, including price-to-earnings ratios (P/E ratios), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other fundamental valuation measures to assess the relative value of stocks across different sectors and indices. They consider historical averages and compare them to current levels to determine potential overvaluation or undervaluation.

- Sector-Specific Analysis: BofA's reports often highlight specific sectors they believe are particularly attractive based on their valuation metrics and growth prospects. Conversely, they may also identify sectors showing signs of overvaluation, advising investors to proceed with caution. For example, specific sectors might show strong earnings growth justifying higher valuations, while others might appear overpriced relative to their growth potential.

- Quantitative Data: BofA supports its conclusions with robust quantitative data derived from extensive research and modeling. These analyses provide a deeper understanding of the factors driving market movements and help investors make more informed decisions regarding asset allocation and stock selection, considering all aspects of stock market valuations. This data often includes detailed breakdowns of various economic indicators and their impact on market valuations.

The Role of Interest Rates in Shaping Stock Market Valuations

Interest rates play a crucial role in shaping stock market valuations, and BofA's analysis acknowledges this inverse relationship. Higher interest rates generally decrease stock valuations, as higher borrowing costs reduce corporate profitability and make alternative investments like bonds more attractive.

- Inverse Relationship: As interest rates rise, the opportunity cost of investing in stocks increases. Investors may shift their capital to higher-yielding fixed-income securities, leading to lower demand for equities and thus lower stock prices. This is a central tenet of understanding stock market valuations.

- Interest Rate Outlook: BofA’s predictions regarding future interest rate movements significantly impact their outlook on stock market valuations. Their forecasts, which are frequently updated, influence investor expectations and drive buying or selling decisions. A prediction of further rate hikes, for example, might lead to a more cautious approach to equity investments.

- Investor Behavior: BofA’s research suggests that investors actively factor interest rate expectations into their investment decisions. This includes adjusting portfolio allocations, seeking out higher-yielding equities, or adopting more defensive strategies in anticipation of higher rates. Understanding this behavior is vital for understanding the dynamics of stock market valuations in the current environment.

The Influence of Corporate Earnings on Investor Sentiment and Stock Market Valuations

Corporate earnings growth is a key driver of investor sentiment and stock market valuations. BofA meticulously analyzes corporate earnings reports and projections to understand their impact on market valuations.

- Earnings Projections: BofA regularly publishes projections for future corporate earnings, providing investors with crucial insights into the expected profitability of various companies and sectors. These projections influence investor confidence and ultimately affect stock prices.

- Sectoral Performance: BofA's analysis often breaks down earnings growth by sector, highlighting sectors exhibiting strong growth and those facing headwinds. This granular analysis helps investors identify potential investment opportunities and risks within specific sectors, a critical aspect of accurate stock market valuations.

- Price-to-Earnings Dynamics: The relationship between earnings growth and stock prices is central to understanding stock market valuations. Strong earnings growth usually supports higher valuations, while weak or declining earnings often put downward pressure on stock prices. BofA's analysis carefully weighs these dynamics to provide a holistic view.

The Impact of Recessionary Fears on Stock Market Valuations

Recessionary fears significantly impact investor behavior and stock market valuations. BofA’s assessment of recession probabilities plays a vital role in their overall market outlook.

- Recessionary Impact: The prospect of a recession typically leads to decreased investor confidence and lower stock prices as companies face reduced demand and profitability. Risk aversion increases, leading investors to seek safe haven assets.

- Recession Probability: BofA publishes its assessment of the probability of a recession, usually offering supporting data and rationale. This outlook directly impacts their evaluation of current stock market valuations, with higher recession probabilities generally implying lower valuations.

- Risk Pricing: Investors actively price in recessionary risks when evaluating stock market valuations. This involves adjusting their expectations for future earnings and discounting future cash flows to reflect the increased uncertainty associated with a potential economic downturn.

Geopolitical Factors and Their Impact on Stock Market Valuations

Geopolitical events exert a considerable influence on stock market valuations, and BofA carefully assesses their impact.

- Key Geopolitical Risks: BofA identifies and analyzes key geopolitical risks, such as wars, trade tensions, and political instability, highlighting their potential to disrupt markets and impact stock prices. These risks are incorporated into their valuation models.

- Market Reflection: The impact of geopolitical risks is reflected in current stock market valuations through increased volatility, shifts in investor sentiment, and changes in asset allocations. BofA’s analysis pinpoints how these events are reflected in market pricing.

- Investor Adaptation: BofA's research explores how investors are adapting their strategies to manage geopolitical uncertainty. This might involve diversifying portfolios, hedging against specific risks, or adjusting their investment horizons in response to evolving geopolitical landscapes.

Conclusion

BofA's analysis suggests that while market volatility persists, several factors contribute to the relatively calm investor response to current stock market valuations. These factors include a nuanced assessment of valuation metrics, the consideration of interest rate trajectories, the evaluation of corporate earnings growth, the assessment of recession probabilities, and the integration of geopolitical risks. Understanding these interwoven elements is crucial for forming a comprehensive view of current market dynamics. Reiterating the importance of understanding stock market valuations for informed investment decisions, it is crucial to monitor BofA’s research and analysis. Continue to monitor BofA’s research and analysis to make well-informed investment decisions based on a comprehensive understanding of the market landscape. Understanding stock market valuations, including their interplay with interest rates, earnings growth, and geopolitical factors, is crucial for navigating market volatility and achieving your financial goals.

Featured Posts

-

The Impact Of The Justice Departments School Desegregation Order Termination

May 03, 2025

The Impact Of The Justice Departments School Desegregation Order Termination

May 03, 2025 -

The Impact Of Alan Rodens Articles On The Spectators Readership

May 03, 2025

The Impact Of Alan Rodens Articles On The Spectators Readership

May 03, 2025 -

Strathdearn Community Project Reaches Milestone Tomatin Affordable Housing

May 03, 2025

Strathdearn Community Project Reaches Milestone Tomatin Affordable Housing

May 03, 2025 -

Une Rencontre Bouleversante Emmanuel Macron Et Les Victimes De L Armee Israelienne

May 03, 2025

Une Rencontre Bouleversante Emmanuel Macron Et Les Victimes De L Armee Israelienne

May 03, 2025 -

Play Station Beta Test Registration Requirements And Participation

May 03, 2025

Play Station Beta Test Registration Requirements And Participation

May 03, 2025