Strategy's $555.8 Million Bitcoin Investment: Key Details And Implications

Table of Contents

Details of Strategy's Bitcoin Investment

Strategy's decision to allocate $555.8 million to Bitcoin signifies a bold move into the digital asset space. While the precise date of the investment requires further clarification from official sources, the announcement itself immediately impacted Bitcoin's price and overall market sentiment. The type of investment – whether a direct purchase, investment through a specialized fund, or a combination thereof – remains to be fully disclosed. Understanding Strategy's investment strategy and the precise nature of their Bitcoin holdings is crucial for analyzing the overall risk and reward profile. The percentage of Strategy's overall portfolio dedicated to Bitcoin is also a key indicator of their long-term commitment to this asset class. The company’s rationale, likely rooted in a belief in Bitcoin's long-term potential as a store of value and a hedge against inflation, is further justification for exploring their portfolio allocation strategies.

- Specific date of investment announcement: [Insert Date if available, otherwise state "To be confirmed"]

- Source of information: [Cite official press release, financial report, or reliable news source]

- Confirmation from Strategy or relevant parties: [State whether confirmation has been obtained and from whom]

Market Analysis: Bitcoin's Performance and Future Predictions

Analyzing Bitcoin's performance surrounding Strategy's $555.8 million investment is essential to understanding the context of this decision. At the time of the presumed investment, Bitcoin's price was [insert Bitcoin price at the time]. This figure, when compared to the current price of [insert current Bitcoin price] and the percentage change, provides insight into the immediate returns (or losses) on this substantial investment. The Bitcoin price chart would further illustrate the price movements in the period surrounding the investment.

Bitcoin price prediction remains a complex and contentious issue. Factors influencing Bitcoin's price are numerous and include:

- Regulation: Increasingly stringent regulatory frameworks in various jurisdictions can impact Bitcoin's price.

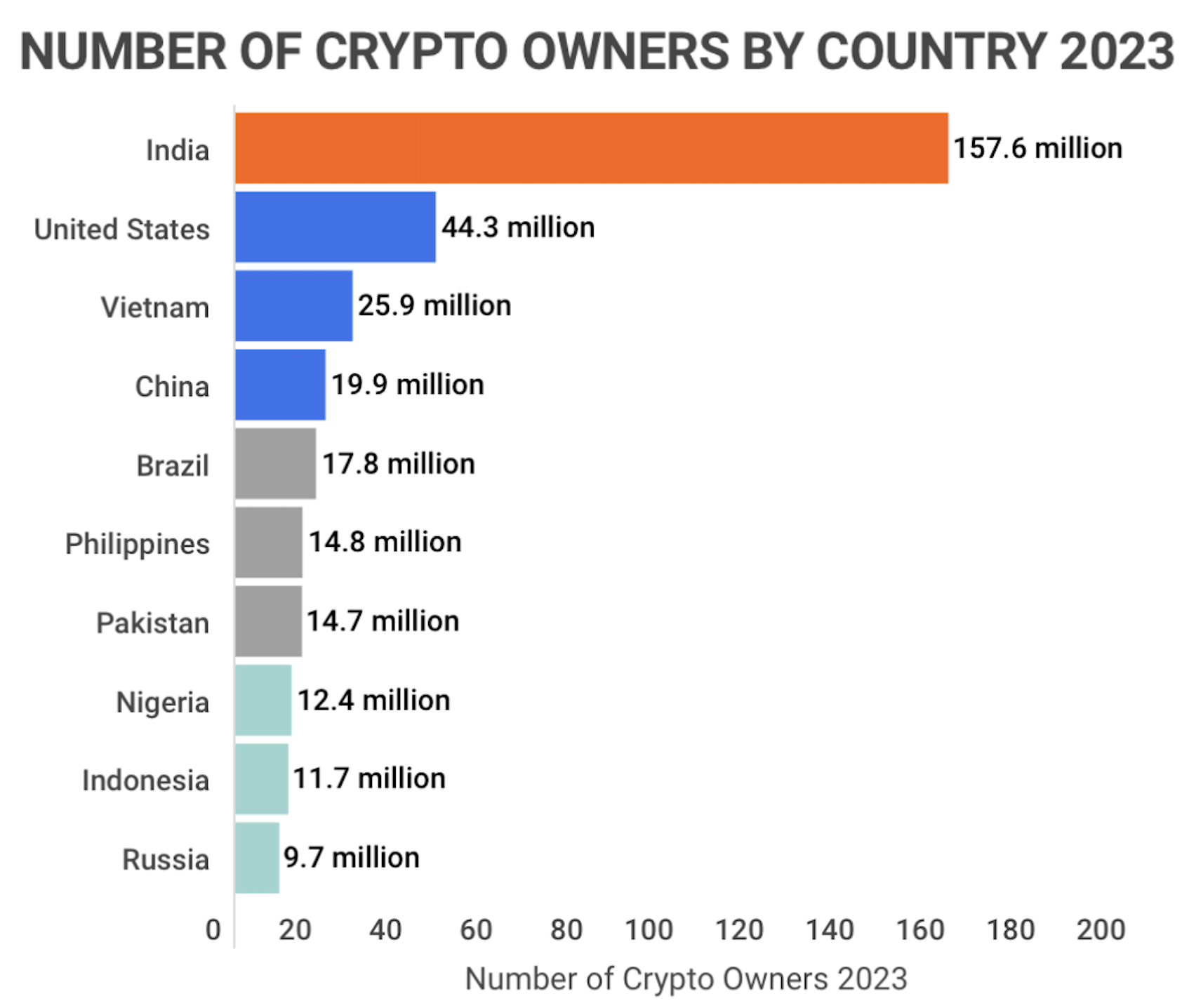

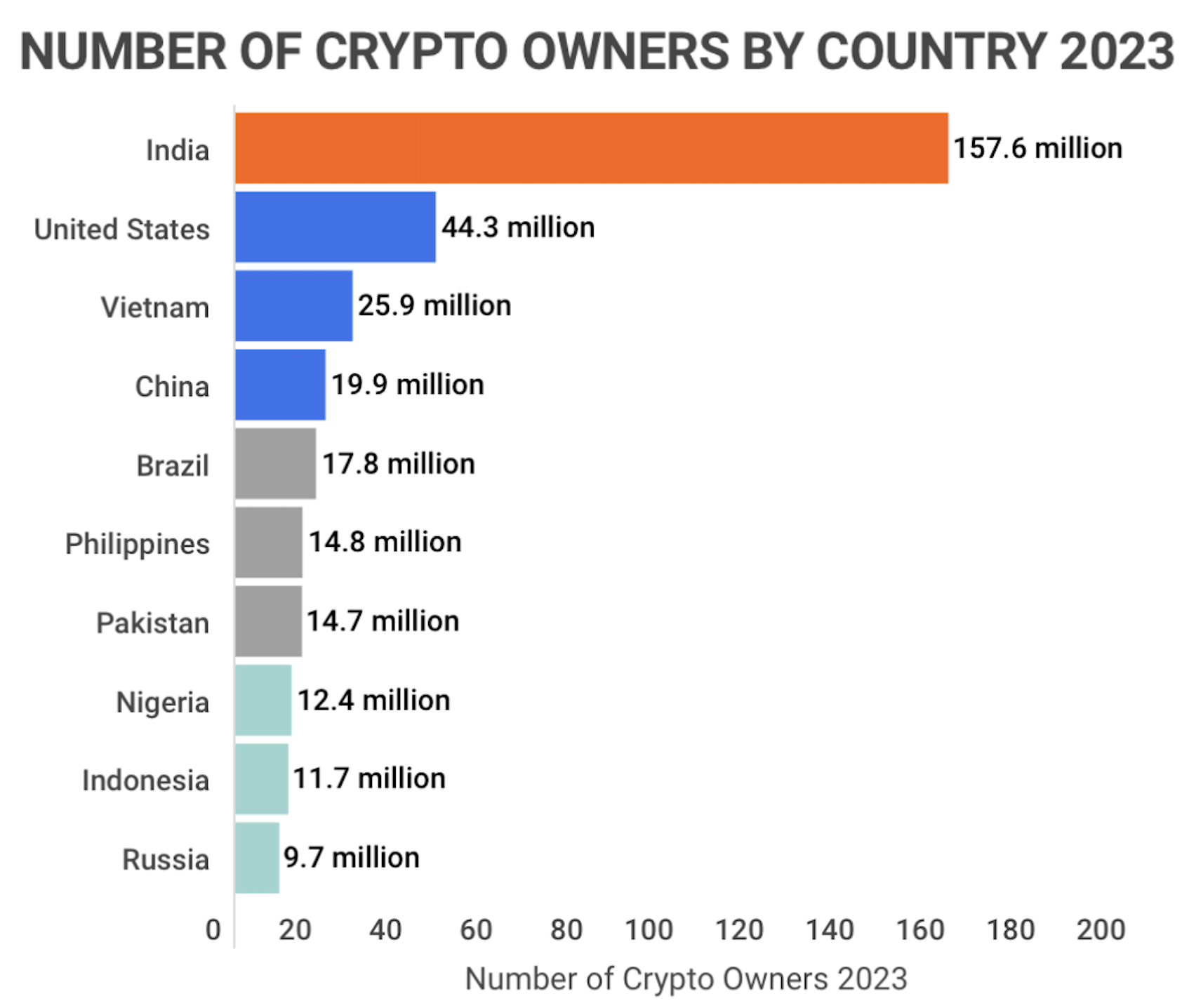

- Adoption: Widespread adoption by institutions and individuals fuels price appreciation.

- Market sentiment: Investor confidence and overall market sentiment are crucial drivers of Bitcoin's price volatility.

Experts offer varied cryptocurrency market analysis, with predictions ranging from continued price appreciation to potential corrections. Understanding this market volatility is key to assessing the long-term viability of Strategy's investment.

Implications for Strategy and the Broader Cryptocurrency Market

Strategy's substantial Bitcoin investment carries significant implications for the company and the broader cryptocurrency market. The potential impact on Strategy's financial performance is directly tied to Bitcoin's future price movements. A significant price appreciation would significantly boost their returns, while a downturn could lead to substantial losses.

For other institutional investors, Strategy's move serves as a potential precedent, potentially driving further institutional investment in Bitcoin and other cryptocurrencies. This influx of capital could lead to increased crypto adoption and a further rise in market capitalization. The impact on Bitcoin's Bitcoin dominance within the cryptocurrency ecosystem and the performance of altcoins is another area requiring close monitoring.

- Potential risks and rewards for Strategy: High potential returns but also significant downside risk due to Bitcoin's volatility.

- Influence on other companies considering similar investments: Could trigger a wave of institutional investments in the cryptocurrency market.

- Impact on overall market sentiment and investor confidence: A successful investment could boost confidence, while losses could dampen enthusiasm.

Risk Assessment of Strategy's Bitcoin Investment

Investing in Bitcoin involves inherent risks. Bitcoin risk encompasses several key areas:

- Volatility risk: Bitcoin's price is notoriously volatile, subject to significant price swings in short periods.

- Regulatory risk: Changing regulations worldwide could negatively impact Bitcoin's value and usability.

- Security risk: Security breaches and hacking incidents pose a threat to Bitcoin holdings.

Strategy's approach to mitigating these risks – whether through diversification, hedging strategies, or other means – remains unclear and would need to be evaluated separately. Transparency from Strategy regarding their risk mitigation strategies is crucial for assessing the long-term viability of their investment.

Conclusion: Assessing Strategy's Bold Bitcoin Move – The Long-Term Outlook

Strategy's $555.8 million Bitcoin investment is a significant development with far-reaching implications. The details of the investment, while still somewhat opaque, suggest a confident bet on Bitcoin's long-term potential. Our market analysis underscores the inherent volatility of Bitcoin, highlighting the potential for both substantial gains and losses. The impact on Strategy and the wider cryptocurrency market hinges on Bitcoin's future price trajectory. Understanding the associated risks is paramount for any investor considering a similar Bitcoin investment strategy.

Stay tuned for further updates on Strategy’s Bitcoin investment and learn more about navigating the complexities of cryptocurrency investments. Understanding cryptocurrency market trends and the future of Bitcoin will be crucial in coming years.

Featured Posts

-

A Chocolate Craving Inflation And A Global Sweet Treat Success Story

Apr 30, 2025

A Chocolate Craving Inflation And A Global Sweet Treat Success Story

Apr 30, 2025 -

Alraklyt Fy Swysra Rqm Qyasy Jdyd Yusjl

Apr 30, 2025

Alraklyt Fy Swysra Rqm Qyasy Jdyd Yusjl

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 6 Preview Things Get Fishy

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 6 Preview Things Get Fishy

Apr 30, 2025 -

Bet Mgm 150 Bonus Use Code Rotobg 150 For Nba Playoffs

Apr 30, 2025

Bet Mgm 150 Bonus Use Code Rotobg 150 For Nba Playoffs

Apr 30, 2025 -

Giai Bong Da Thanh Nien Sinh Vien Tran Dau Mo Man Vong Chung Ket Hap Dan

Apr 30, 2025

Giai Bong Da Thanh Nien Sinh Vien Tran Dau Mo Man Vong Chung Ket Hap Dan

Apr 30, 2025