Strategy's Bitcoin Purchase: $555.8 Million Investment Breakdown And Future Outlook

Table of Contents

The $555.8 Million Investment: A Detailed Breakdown

MicroStrategy's Bitcoin investment wasn't a single event; it was a strategic accumulation of Bitcoin over time. Understanding this timeline is crucial to grasping the full scope of MicroStrategy's Bitcoin strategy.

MicroStrategy's Bitcoin Acquisition Timeline:

The following chart illustrates MicroStrategy's Bitcoin acquisitions: (Insert chart here showing dates, amounts purchased, and price per Bitcoin for each purchase. Source should be cited.)

- Phase 1 (August 2020): Initial purchase of 21,454 Bitcoins at an average price of approximately $11,250 per Bitcoin.

- Phase 2 (September 2020 – December 2020): Further acquisitions, adding thousands more Bitcoins to their holdings as the price fluctuated.

- Phase 3 (January 2021 – Present): Continued strategic purchases, demonstrating unwavering commitment to their Bitcoin investment strategy.

MicroStrategy currently holds a significant number of Bitcoins (insert current number here), making them one of the largest corporate holders of Bitcoin globally.

Financial Implications of the Investment:

MicroStrategy's massive Bitcoin investment has significantly impacted its balance sheet. The volatility of Bitcoin introduces substantial risk to their financial performance. A sharp drop in Bitcoin's price could lead to significant impairment charges.

- Impact on Balance Sheet: The Bitcoin holdings are reported as an asset on MicroStrategy's balance sheet, subject to market fluctuations.

- Financial Risk: The inherent volatility of Bitcoin presents a considerable risk. A significant price decline could negatively impact the company's financial statements.

- Comparison to Traditional Investments: This strategy differs drastically from traditional investment approaches, which typically favor more stable, less volatile assets. This reflects a forward-thinking, albeit risky, strategy.

Market Reaction to MicroStrategy's Bitcoin Purchases:

MicroStrategy's announcements regarding their Bitcoin purchases have often triggered notable price movements in the Bitcoin market.

- Price Fluctuations: While not solely responsible for Bitcoin's price movements, MicroStrategy's large-scale purchases have been observed to influence market sentiment.

- Investor Sentiment: The reaction from investors and analysts has been mixed, with some praising the bold move and others expressing concern about the risk involved.

- Significant News & Events: Major news events surrounding MicroStrategy's Bitcoin strategy have often coincided with market volatility, creating an interconnected relationship.

MicroStrategy's Rationale Behind the Bitcoin Investment

MicroStrategy's decision to invest heavily in Bitcoin stems from a combination of factors, primarily focusing on long-term value preservation and strategic positioning.

Long-Term Vision and Bitcoin as a Hedge Against Inflation:

MicroStrategy's CEO, Michael Saylor, has publicly stated their belief in Bitcoin as a hedge against inflation and a superior store of value compared to fiat currencies.

- Store of Value: MicroStrategy views Bitcoin as a long-term store of value, potentially outperforming traditional assets in times of economic uncertainty.

- Inflation Hedge: The company sees Bitcoin as a way to protect its treasury from the effects of inflation, given Bitcoin's limited supply.

- Long-Term Potential: MicroStrategy's commitment reflects a strong belief in Bitcoin's long-term potential for growth and adoption.

Competitive Advantage and Corporate Strategy:

This investment is not just a financial strategy; it is a deliberate move to position MicroStrategy as a leader in the evolving technological landscape.

- Market Positioning: The Bitcoin investment has garnered significant attention, boosting MicroStrategy's brand visibility and attracting attention within the tech industry.

- Future Revenue Generation: While not a primary driver, there's potential for future revenue generation through services or products related to Bitcoin.

- Long-Term Strategic Goals: This decision aligns with a broader strategic vision that acknowledges the transformative potential of blockchain technology.

Future Outlook and Potential Scenarios for MicroStrategy's Bitcoin Holdings

Predicting the future of Bitcoin and its impact on MicroStrategy's investment is inherently challenging.

Bitcoin Price Volatility and Risk Assessment:

The volatile nature of Bitcoin remains a significant risk factor.

- Risks & Rewards: Holding Bitcoin carries substantial risk, but the potential for significant returns is equally substantial.

- Price Scenarios: Various price scenarios must be considered, analyzing their potential impact on MicroStrategy’s financial standing.

- Price Appreciation/Depreciation: The company's financial health is directly tied to Bitcoin's price performance.

Regulatory Landscape and Potential Impacts:

The regulatory environment surrounding cryptocurrencies is constantly evolving.

- Evolving Regulations: Changes in regulatory frameworks could significantly impact MicroStrategy's Bitcoin holdings.

- Impact of New Regulations: Future regulations could influence the tax implications, trading restrictions, or even the legal status of Bitcoin.

- Legal Challenges: The legal landscape remains uncertain, creating potential for future legal challenges or changes in legislation affecting Bitcoin ownership.

MicroStrategy's Future Plans Regarding Bitcoin:

MicroStrategy has consistently signaled its commitment to Bitcoin.

- Future Bitcoin Strategy: The company has hinted at further potential acquisitions, although no specific plans have been formally announced.

- Further Crypto Investments: While Bitcoin currently dominates their strategy, future diversification into other cryptocurrencies isn't impossible.

- Long-Term Vision: Their long-term vision suggests continued investment in Bitcoin as a core part of their treasury management strategy.

Conclusion: Assessing the Impact of MicroStrategy's Bitcoin Purchase

MicroStrategy's $555.8 million Bitcoin investment represents a bold and unprecedented move in corporate finance. This deep dive has revealed the complexity of their strategy, highlighting both the substantial risks and the potential rewards associated with this significant investment in Bitcoin. The future remains uncertain, but MicroStrategy's commitment to its Bitcoin holdings positions it at the forefront of the evolving cryptocurrency market. The long-term success of MicroStrategy’s Bitcoin strategy will depend on several intertwined factors, from Bitcoin's price volatility to the regulatory landscape.

What are your thoughts on MicroStrategy's bold Bitcoin strategy? Share your insights in the comments below! Stay tuned for further updates on MicroStrategy's Bitcoin investment and its impact on the market.

Featured Posts

-

Ai La Nha Vo Dich Dau Tien Cua Giai Bong Da Thanh Nien Sinh Vien Quoc Te

Apr 30, 2025

Ai La Nha Vo Dich Dau Tien Cua Giai Bong Da Thanh Nien Sinh Vien Quoc Te

Apr 30, 2025 -

From Other Shows To Coronation Street Daisy Midgeleys Acting Journey

Apr 30, 2025

From Other Shows To Coronation Street Daisy Midgeleys Acting Journey

Apr 30, 2025 -

Asthlak Alraklyt Ysl Ila Mstwa Qyasy Jdyd Fy Swysra

Apr 30, 2025

Asthlak Alraklyt Ysl Ila Mstwa Qyasy Jdyd Fy Swysra

Apr 30, 2025 -

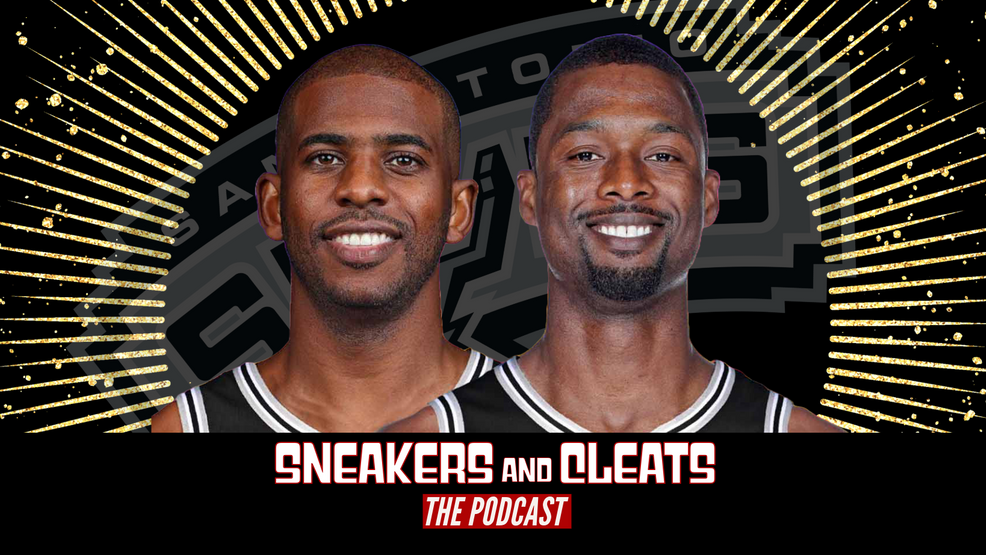

Were Chris Paul Harrison Barnes And Julian Champagnie In Every Spurs Game This Year

Apr 30, 2025

Were Chris Paul Harrison Barnes And Julian Champagnie In Every Spurs Game This Year

Apr 30, 2025 -

Churchill Downs Implements Emergency Protocols Amidst Storm Threat For Kentucky Derby

Apr 30, 2025

Churchill Downs Implements Emergency Protocols Amidst Storm Threat For Kentucky Derby

Apr 30, 2025