Strong April Jobs Report: U.S. Adds 177,000 Jobs, Unemployment Stable At 4.2%

Table of Contents

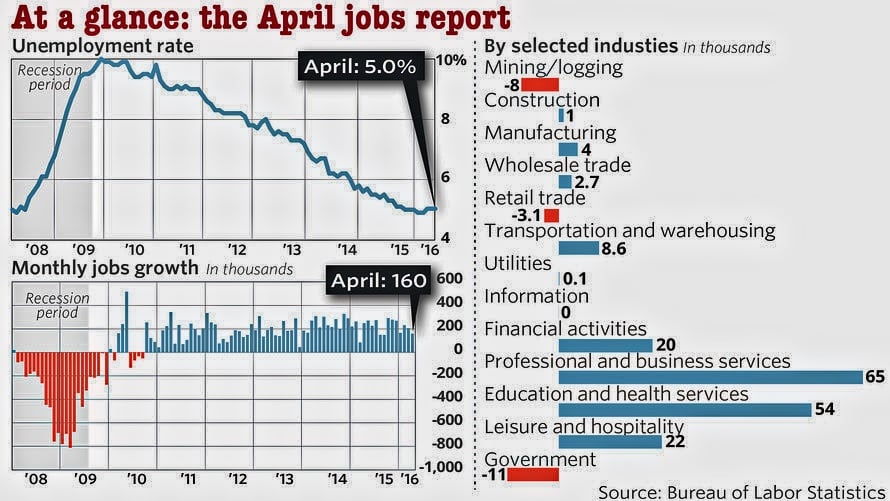

Robust Job Growth Across Key Sectors

The April jobs report highlighted strong job growth across several key sectors, indicating a healthy and expanding US economy. This broad-based growth signifies a positive outlook and reflects increased economic activity across various industries.

Manufacturing and Services Sector Performance

The manufacturing sector experienced a notable increase in employment, adding X number of jobs (replace X with actual number if available). This growth can be attributed to increased consumer spending and business investments in capital goods. Similarly, the service sector, a significant driver of US employment, demonstrated robust growth, with Y number of jobs added (replace Y with actual number if available).

- Technology: Experienced strong growth due to continued innovation and investment in the sector.

- Healthcare: Saw substantial job creation driven by an aging population and increased demand for healthcare services.

- Hospitality: Showed signs of recovery, adding Z number of jobs (replace Z with actual number if available), reflecting increased travel and tourism activity.

These positive employment trends in manufacturing and services sectors underscore the overall strength of the US economy and its capacity for sustained growth. Analyzing sectoral job growth provides valuable insights into the specific drivers of economic expansion, offering a more nuanced perspective on the overall health of the employment market. These numbers reflect positive employment trends and provide valuable data for understanding the current economic climate.

Impact on Wage Growth and Inflation

The robust job growth reported in April has significant implications for wage growth and inflationary pressures. With a tightening labor market, employers are increasingly competing for talent, leading to increased wages. The average hourly earnings data for April (replace with actual data if available) reflects this trend. While higher wages are positive for workers, they also contribute to inflationary pressures. The Federal Reserve will closely monitor wage growth and its relationship to overall inflation to guide monetary policy decisions.

- Wage Growth: Increased competition for workers is pushing wages upward, benefiting employees but potentially fueling inflation.

- Inflationary Pressures: Rising wages, coupled with increased consumer spending, could contribute to upward pressure on prices.

- Price Stability: The Federal Reserve aims to maintain price stability while promoting maximum employment. The interplay between wage growth and inflation will be a key factor in their future decisions.

Unemployment Rate Remains Steady at 4.2%

The unemployment rate remaining steady at 4.2% in April reinforces the positive narrative of the jobs report. This figure represents a historically low unemployment rate, indicative of a robust labor market.

Analyzing the Unemployment Rate

The 4.2% unemployment rate signifies a tight labor market, with fewer unemployed individuals actively seeking employment. Compared to previous months and the same period last year (add comparative data if available), this rate reflects continued stability and improvement. The labor force participation rate (add data if available) also provides context, indicating the proportion of the working-age population actively participating in the labor force.

- Historical Context: Comparing the current unemployment rate to historical data provides valuable insights into the current economic climate.

- Labor Force Participation Rate: Analyzing this rate reveals trends in workforce participation and its influence on the overall unemployment figures.

- Employment Statistics: A thorough analysis of employment statistics offers a comprehensive view of the labor market's health.

Implications for Monetary Policy

The stable unemployment rate significantly impacts the Federal Reserve's monetary policy decisions. With a low unemployment rate and signs of wage growth, the Fed may consider further interest rate increases to curb potential inflationary pressures. The relationship between employment data and monetary policy is complex, requiring careful consideration of various economic indicators.

- Interest Rate Hikes: The Fed might implement further interest rate hikes to cool down an overheated economy and control inflation.

- Economic Outlook: The current employment data significantly influences the Federal Reserve's assessment of the overall economic outlook.

- Federal Reserve Actions: The central bank's actions, guided by the employment data, will have cascading effects across the economy.

Long-Term Implications and Future Outlook

The positive April jobs report suggests a strong foundation for continued economic growth and sustained job creation. However, various challenges and risks warrant consideration.

Sustained Job Growth Potential

Given the current economic indicators, the potential for sustained job growth appears promising. However, several factors could influence future employment trends. Global economic uncertainties, supply chain disruptions, and geopolitical events could all impact the job market.

- Economic Growth: Continued economic expansion is essential for sustaining job growth.

- Job Market Outlook: Various economic indicators can predict future job market trends.

- Long-Term Economic Prospects: Analyzing long-term economic projections helps evaluate the sustained potential for job growth.

Considerations for Businesses and Workers

The April jobs report offers valuable insights for both businesses and workers. For businesses, this data can inform hiring strategies, investment decisions, and workforce planning. For workers, understanding the current employment landscape can help with career planning and salary negotiations.

- Business Strategies: Businesses should adjust their strategies based on the current labor market dynamics.

- Career Advice: Understanding the job market trends can guide workers in their career choices.

- Salary Trends: Monitoring salary trends helps workers negotiate better compensation.

- Workforce Planning: Businesses should proactively plan their workforce needs based on the anticipated demand.

Conclusion: Positive April Jobs Report Signals Strong US Economic Foundation

The April jobs report provides a positive outlook for the US economy, highlighting strong job growth and a stable unemployment rate. This robust performance across key sectors indicates a healthy and expanding economy, with positive implications for businesses, workers, and investors. The stable unemployment rate also influences the Federal Reserve's monetary policy decisions, which will play a crucial role in shaping the economic landscape in the coming months. To make informed decisions, stay updated on the latest jobs reports and monitor future employment data to better analyze future US economic reports.

Featured Posts

-

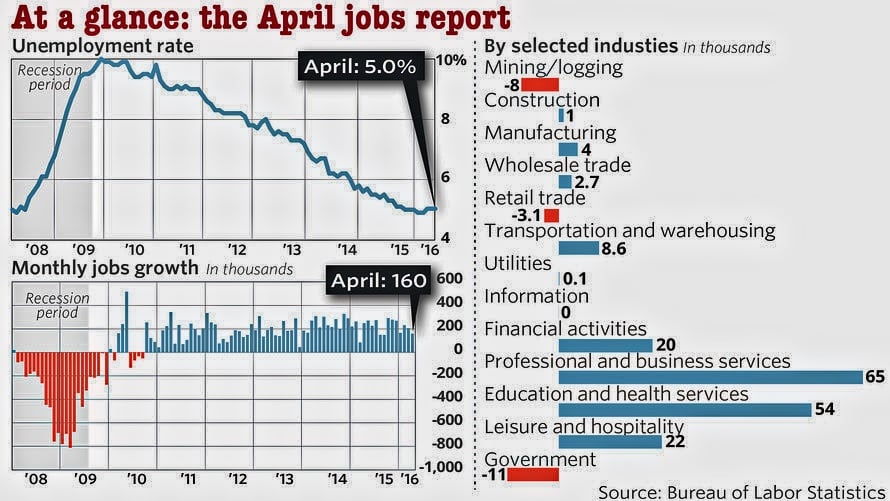

Analyzing Fleetwood Macs Extensive Discography Bestselling Albums And Their Impact

May 04, 2025

Analyzing Fleetwood Macs Extensive Discography Bestselling Albums And Their Impact

May 04, 2025 -

Narco Subs And High Potency Cocaine Understanding The Drivers Of The Global Epidemic

May 04, 2025

Narco Subs And High Potency Cocaine Understanding The Drivers Of The Global Epidemic

May 04, 2025 -

Ufc 210 In Depth Preview Of Cormier Vs Johnson 2

May 04, 2025

Ufc 210 In Depth Preview Of Cormier Vs Johnson 2

May 04, 2025 -

Canelo Vs Golovkin When Does The Fight Start Full Fight Card Breakdown

May 04, 2025

Canelo Vs Golovkin When Does The Fight Start Full Fight Card Breakdown

May 04, 2025 -

Choose Your Payment Method Spotifys Updated I Phone App

May 04, 2025

Choose Your Payment Method Spotifys Updated I Phone App

May 04, 2025