Strong Retail Sales Data Impacts Bank Of Canada's Rate Decision

Table of Contents

Robust Retail Sales Figures and Inflationary Pressures

Understanding the Connection

A direct correlation exists between increased consumer spending, reflected in robust retail sales figures, and inflationary pressures. Higher demand for goods and services naturally pushes prices upward. Strong retail sales data, while indicating a healthy economy, also signals the potential for overheating. This is a key factor the Bank of Canada considers when making interest rate decisions.

- Higher demand leads to increased prices for goods and services: When consumers spend more, businesses respond by increasing production, potentially leading to shortages and price increases.

- Strong retail sales indicate a healthy economy, but also potential for overheating: Sustained high consumer spending can drive inflation beyond the Bank of Canada's target, requiring intervention.

- Recent Statistics Canada data shows retail sales growth of X% in [Month, Year]: (Insert specific data with source citation, e.g., "Statistics Canada reported a 2.1% increase in retail sales in July 2024, exceeding expectations." [Insert link to source]). This growth was particularly strong in [mention specific sectors, e.g., "the automotive and furniture sectors"].

- Impact of various retail sectors: The composition of retail sales growth is crucial. Strong sales in durable goods (e.g., cars, appliances) suggest sustained consumer confidence, while growth in non-durable goods (e.g., food, clothing) might reflect rising prices rather than increased demand.

The Bank of Canada's Inflation Target

The Bank of Canada has an explicit inflation target, typically aiming for an average inflation rate of 2% over the medium term. Exceeding this target significantly influences the central bank's rate decisions.

- Current inflation rate: (Insert current inflation rate with source citation, e.g., "As of October 26, 2024, Canada's inflation rate stands at 3.1%." [Insert link to source]). This is above the Bank of Canada's target.

- Bank of Canada's mandate: The Bank of Canada's primary mandate is to maintain price stability, which directly relates to controlling inflation.

- Tolerance for inflation: While the Bank of Canada may tolerate some short-term deviations from its target, sustained high inflation necessitates policy adjustments to prevent it from becoming entrenched.

Analyzing the Bank of Canada's Potential Responses

Scenario 1: Interest Rate Hike

Given the strong retail sales data and persistent inflation, an interest rate increase is a distinct possibility.

- Magnitude of a potential rate hike: A rate hike could range from 0.25% to 0.50%, depending on the Bank's assessment of the economic situation.

- Impact on borrowing costs: Higher interest rates increase borrowing costs for consumers and businesses, potentially dampening spending and investment.

- Effects on economic growth and employment: While a rate hike aims to control inflation, it could also slow economic growth and potentially lead to job losses.

Scenario 2: Interest Rate Hold

Despite strong retail sales, the Bank of Canada might choose to hold interest rates steady.

- Factors leading to a hold: Global economic uncertainty, potential recessionary pressures, or concerns about the impact of previous rate hikes could lead to a hold decision.

- Risks and benefits of maintaining current rates: A hold could allow the economy to continue growing, but it also risks allowing inflation to become more entrenched.

- Consequences of a hold on inflation: Maintaining current rates might lead to further inflation if consumer spending remains robust.

Other Monetary Policy Tools

Besides interest rate changes, the Bank of Canada might use other monetary policy tools.

- Quantitative easing (QE) or quantitative tightening (QT): These involve the Bank buying or selling government bonds to influence the money supply.

- Forward guidance and communication strategies: The Bank might use clear communication to influence market expectations and guide economic behavior.

- Other policy adjustments: The Bank could adjust reserve requirements for banks or other policy levers.

Market Reactions and Future Implications

Impact on the Canadian Dollar

The Bank of Canada's interest rate decision significantly impacts the Canadian dollar's exchange rate.

- Relationship between interest rates and currency values: Higher interest rates typically attract foreign investment, strengthening the Canadian dollar.

- Effects on international trade and investment: A stronger dollar can make Canadian exports more expensive and imports cheaper, impacting trade balances.

Implications for Businesses and Consumers

The Bank of Canada's decision directly affects businesses and consumers.

- Impact on borrowing costs, investment decisions, and consumer spending: Higher interest rates increase borrowing costs, making it more expensive for businesses to invest and for consumers to borrow.

- Potential effects on employment and economic growth: While controlling inflation is crucial, higher interest rates can slow economic growth and potentially lead to job losses.

Conclusion

Strong retail sales data significantly impacts the Bank of Canada's upcoming interest rate decision. The central bank must carefully weigh the risks of rising inflation against the potential negative consequences of higher interest rates. Potential scenarios include an interest rate hike to curb inflation or a hold decision to support economic growth, each with its own implications for the Canadian economy. Understanding these complexities is crucial for navigating the current economic climate. Stay informed about the Bank of Canada interest rate decision and its impact on your financial planning. Continue to monitor developments related to the Bank of Canada interest rate decision for up-to-date analysis and insights. Follow [Your Website/Source] for further information on the Bank of Canada interest rate decision and its effects on the Canadian economy.

Featured Posts

-

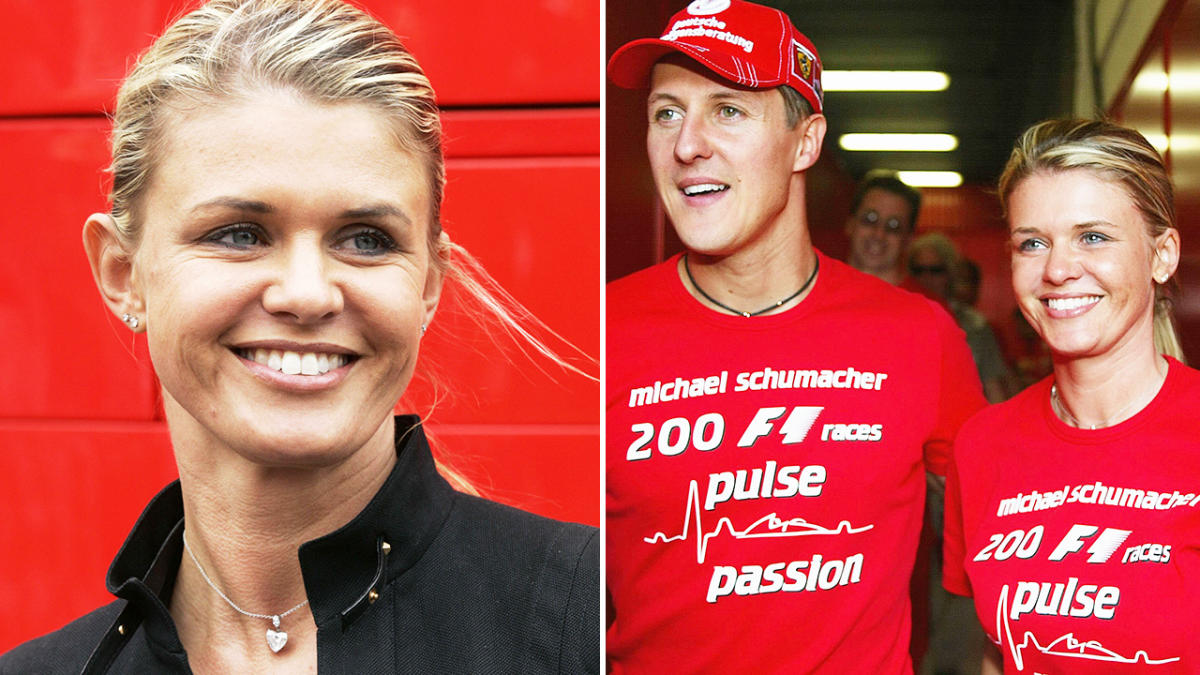

Michael Schumachers Ferrari A Piece Of F1 History Up For Auction In Monaco

May 26, 2025

Michael Schumachers Ferrari A Piece Of F1 History Up For Auction In Monaco

May 26, 2025 -

When Is The Saint On Itv 4 Full Tv Listings

May 26, 2025

When Is The Saint On Itv 4 Full Tv Listings

May 26, 2025 -

D C Region Prepares For Unprecedented Pride Season

May 26, 2025

D C Region Prepares For Unprecedented Pride Season

May 26, 2025 -

Iannuccis Shifting Style A Look At His Evolving Work

May 26, 2025

Iannuccis Shifting Style A Look At His Evolving Work

May 26, 2025 -

Paris Roubaix Spectator Who Threw Bottle At Van Der Poel Turns Himself In

May 26, 2025

Paris Roubaix Spectator Who Threw Bottle At Van Der Poel Turns Himself In

May 26, 2025