Student Loan Debt: A Financial Planner's Guide

Table of Contents

Understanding Your Student Loan Debt

Before tackling your student loan debt repayment strategy, you need a clear understanding of your debt landscape. This involves identifying the types of loans you have and calculating your total debt.

Types of Student Loans

Understanding the differences between federal and private student loans is crucial for effective repayment planning.

- Federal Loans: These loans are offered by the U.S. government and often come with more favorable terms than private loans. There are two main types:

- Subsidized Loans: The government pays the interest while you're in school and during grace periods.

- Unsubsidized Loans: Interest accrues from the time the loan is disbursed, even while you're in school. You'll need to pay this accumulated interest to avoid capitalization (adding it to your principal). Eligibility for federal loans is based on financial need and enrollment status.

- Private Loans: These loans come from banks, credit unions, or other private lenders. They typically have higher interest rates than federal loans and may have less flexible repayment options. Interest rates can be fixed or variable, impacting your monthly payments over time. Finding the best private lender requires careful comparison-shopping.

- Consolidation options: Consolidating multiple student loans into a single loan can simplify repayment, potentially lowering your monthly payment (though extending your repayment term). However, it might also result in a higher overall interest paid if you don't secure a lower interest rate.

Calculating Your Total Debt

Knowing your total student loan debt is the first step towards effective management. This includes the principal balance, accrued interest, and any applicable fees.

- Tools and resources for tracking debt: Use online student loan calculators and budgeting apps (like Mint, YNAB, or Personal Capital) to track your balances and payment progress accurately.

- Importance of accurate record-keeping: Keep all your loan documents organized. This includes loan agreements, statements, and payment confirmations. This documentation is essential for tracking progress, contacting lenders, and seeking assistance if needed.

Strategies for Repaying Student Loan Debt

Several strategies can help you effectively repay your student loans and minimize long-term costs.

Repayment Plans

Several federal student loan repayment plans are available, each with its own pros and cons:

- Standard Repayment: This plan typically involves fixed monthly payments over 10 years. It's the quickest way to repay your loans but may result in higher monthly payments.

- Income-Driven Repayment (IDR): These plans base your monthly payments on your income and family size. There are several IDR plans, including PAYE (Pay As You Earn), IBR (Income-Based Repayment), REPAYE (Revised Pay As You Earn), and income-sensitive repayment plans. While your monthly payments are lower, you might end up paying more in interest over the life of the loan.

- Extended Repayment: This plan stretches your repayment period to up to 25 years, reducing your monthly payments. However, this leads to a significantly higher total interest paid.

- Forbearance and Deferment: These options temporarily suspend or postpone your payments, but interest typically still accrues (except for subsidized federal loans during deferment). Overusing these options can lead to a larger total debt.

Budgeting and Debt Reduction Strategies

Effective budgeting is crucial for managing your student loan debt.

- Creating a realistic budget: Track your income and expenses meticulously. Identify areas where you can cut back to free up more money for debt repayment.

- Prioritizing debt repayment: Consider the snowball method (paying off the smallest debt first for motivation) or the avalanche method (paying off the debt with the highest interest rate first to save money).

- Exploring refinancing options: Refinancing your student loans, particularly private loans, might help you secure a lower interest rate and reduce your monthly payments. However, make sure to consider the terms and fees involved. Refinancing federal loans into private loans means losing access to federal protections and benefits.

Long-Term Financial Planning and Student Loan Debt

Successfully managing student loan debt is only one piece of the financial puzzle.

Building Credit After Graduation

Building a strong credit history is vital for future financial success.

- Responsible credit card usage: Use credit cards responsibly, paying your balance in full each month and keeping your credit utilization low. This helps build your credit score.

- Monitoring your credit report: Regularly check your credit report for any errors and to track your credit score's improvement.

Saving and Investing While Paying Down Debt

It's possible to save and invest while paying down student loan debt.

- Prioritize emergency savings: Build an emergency fund to cover unexpected expenses, preventing you from falling further into debt.

- Automate savings: Set up automatic transfers to your savings and investment accounts to make saving effortless.

- Invest for the long term: Start investing early, even with small amounts, to benefit from the power of compounding. Consider tax-advantaged accounts like 401(k)s and IRAs.

Seeking Professional Financial Advice

A financial advisor can provide personalized guidance based on your specific circumstances.

- Personalized financial plan: A financial advisor can help you create a tailored plan to manage your debt and achieve your long-term financial goals.

- Debt management strategies: They can provide valuable insights into debt reduction techniques.

Conclusion

Successfully managing your student loan debt requires a proactive approach and a clear understanding of your options. By utilizing the strategies outlined in this guide—from understanding the different types of student loans and repayment plans to developing a comprehensive budget and seeking professional advice—you can take control of your financial future. Remember, conquering your student loan debt is achievable with careful planning and a commitment to financial wellness. Don’t hesitate to seek professional help in developing a personalized student loan debt repayment strategy. Start planning your path to financial freedom today! Take the first step toward managing your student loan debt effectively.

Featured Posts

-

Donald Tramp Ta Yogo Mati Biografiya Meri Enn Maklaud

May 17, 2025

Donald Tramp Ta Yogo Mati Biografiya Meri Enn Maklaud

May 17, 2025 -

Finding And Applying For Stem Scholarships A Resource For Local Students

May 17, 2025

Finding And Applying For Stem Scholarships A Resource For Local Students

May 17, 2025 -

Que Espera A Los Deudores De Prestamos Estudiantiles Con Trump De Nuevo En La Presidencia

May 17, 2025

Que Espera A Los Deudores De Prestamos Estudiantiles Con Trump De Nuevo En La Presidencia

May 17, 2025 -

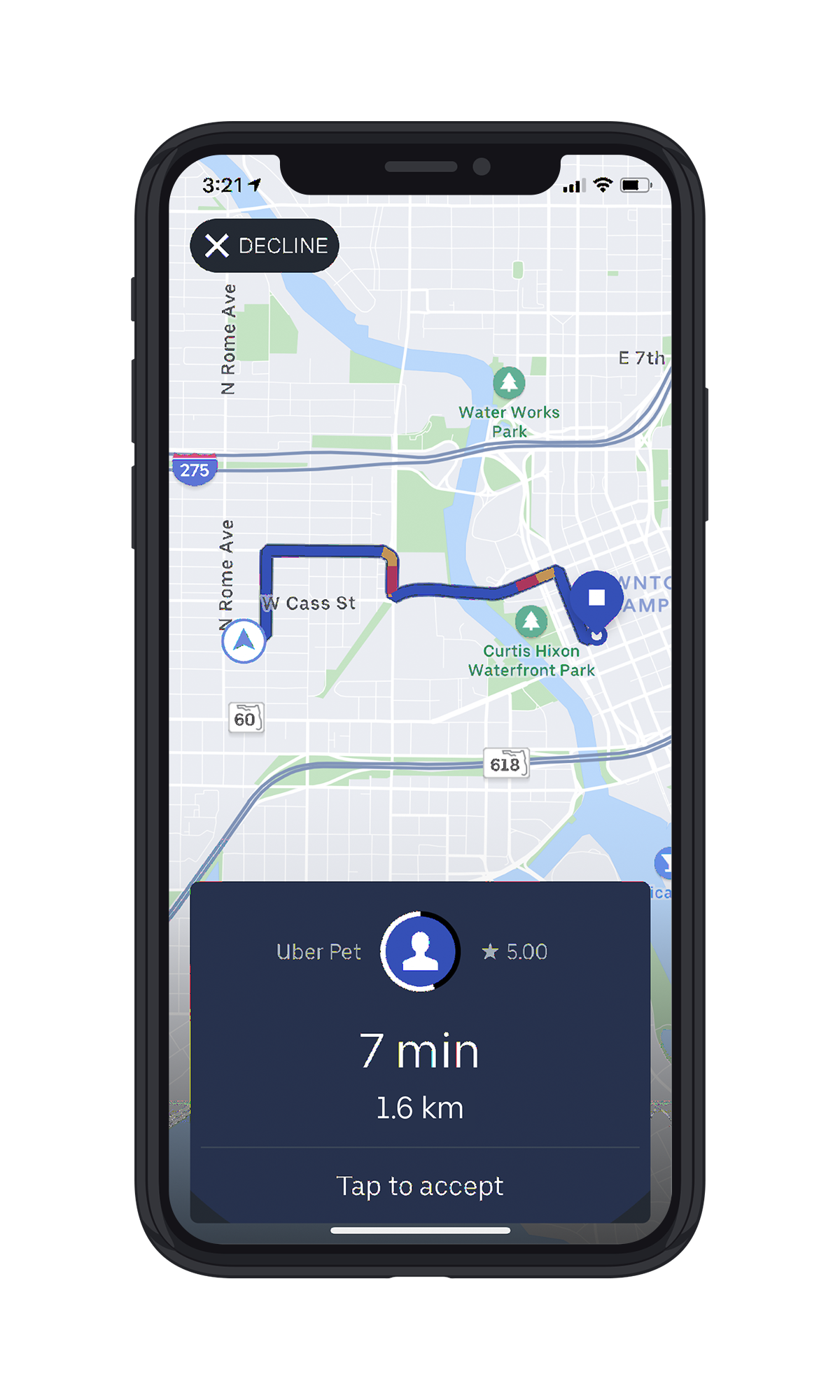

How Ubers New Pet Service Benefits Delhi And Mumbai Pet Owners

May 17, 2025

How Ubers New Pet Service Benefits Delhi And Mumbai Pet Owners

May 17, 2025 -

Student Loan Debt Relief Under Trump The Black Communitys Viewpoint

May 17, 2025

Student Loan Debt Relief Under Trump The Black Communitys Viewpoint

May 17, 2025