Student Loan Delinquency: Understanding The Credit Score Damage

Table of Contents

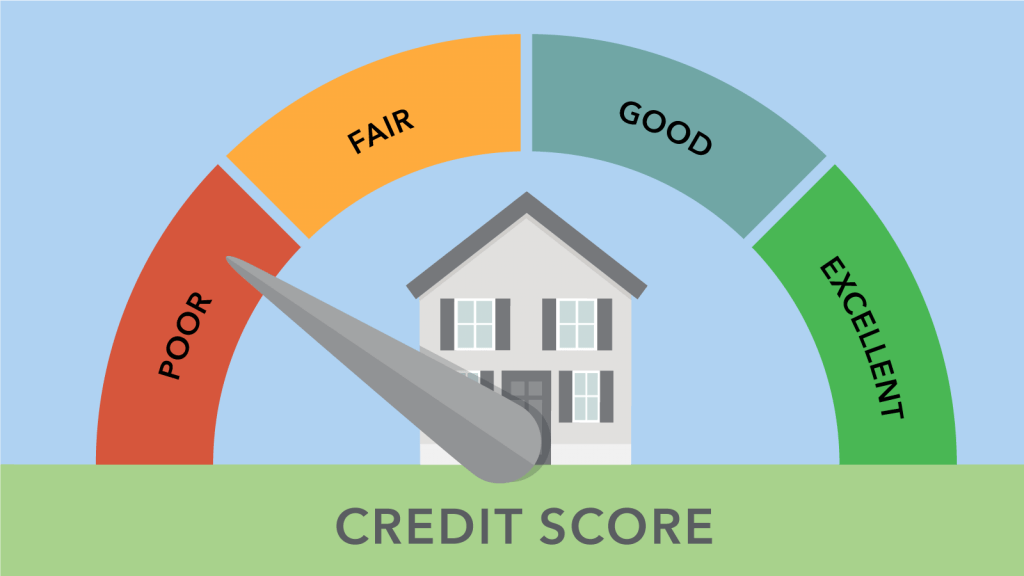

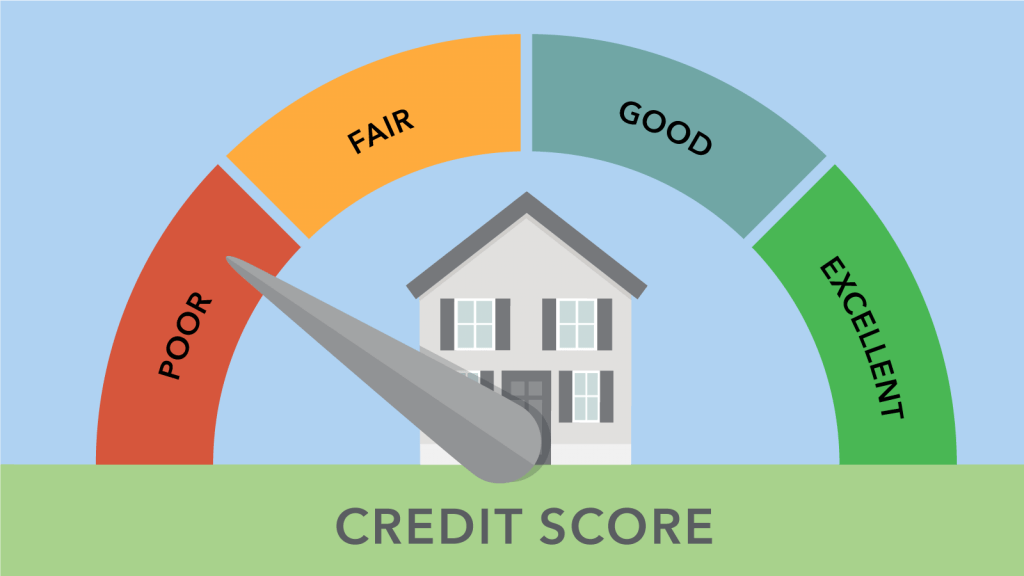

How Student Loan Delinquency Impacts Your Credit Score

Falling behind on your student loan payments has severe consequences for your credit score. Understanding how this happens is crucial to avoiding the negative repercussions.

The Mechanics of Reporting

Missed or late student loan payments are reported to the three major credit bureaus: Equifax, Experian, and TransUnion. These bureaus then use this information to calculate your credit score, a vital number lenders use to assess your creditworthiness.

- Negative impact on credit utilization: While student loans themselves don't directly impact your credit utilization ratio (the percentage of your available credit you're using), consistent late payments can negatively affect your overall creditworthiness, leading to a higher perceived risk.

- Significant drop in credit score (FICO score explained): Your FICO score, the most widely used credit scoring model, takes late payments very seriously. Even one missed payment can significantly lower your score, impacting your ability to secure future credit.

- Potential for collection accounts: Prolonged delinquency can lead to your loan being sent to collections, further damaging your credit report and score. Collection accounts remain on your credit report for seven years.

- Difficulty securing loans and credit cards in the future: A low credit score due to student loan delinquency makes it harder to get approved for mortgages, auto loans, credit cards, and other forms of credit.

- Higher interest rates on future borrowing: Lenders view borrowers with a history of delinquency as higher risk, resulting in higher interest rates on any future loans, increasing your overall borrowing costs.

Different scoring models weight late payments differently, but the impact is consistently negative. For example, a 30-day delinquency can drop your score by 30-50 points, while a 90-day delinquency can cause a far more substantial decrease.

Understanding Different Stages of Delinquency

Student loan delinquency is categorized into stages based on the number of days your payment is late. Understanding these stages is crucial to mitigating the damage.

30, 60, 90+ Days Late

- 30 Days Late: This is typically the first stage of delinquency. While it impacts your credit score, it's still possible to remedy the situation by making the missed payment promptly.

- 60 Days Late: At this point, the negative impact on your credit score intensifies. You might start receiving increasingly urgent calls from your loan servicer.

- 90+ Days Late: This is considered severe delinquency. Your loan may be referred to collections, leading to further damage to your credit report. Wage garnishment may also become a possibility depending on your loan type and location.

The longer you remain delinquent, the more severe the consequences become. Each stage represents an escalation in the negative impact on your credit score and your overall financial standing. The timeline and severity can vary slightly based on your loan servicer and loan type.

Preventing Student Loan Delinquency

Proactive financial management is key to avoiding student loan delinquency.

Budgeting and Financial Planning

Creating a realistic budget is paramount. This involves:

- Tracking income and expenses: Use budgeting apps or spreadsheets to monitor your finances closely.

- Prioritizing loan payments: Ensure your student loan payments are among your top priorities each month.

- Exploring income-driven repayment plans: Federal student loan programs offer income-driven repayment plans that adjust your monthly payments based on your income and family size.

- Seeking professional financial advice: A financial advisor can help you create a personalized plan to manage your student loan debt effectively.

Budgeting tools and resources are readily available online, providing templates and guidance to streamline the process.

Recovering from Student Loan Delinquency

Even if you're currently experiencing student loan delinquency, there are steps you can take to recover.

Rehabilitation and Consolidation Programs

Several government programs can assist borrowers in resolving delinquency.

- Loan rehabilitation programs: These programs allow you to bring your delinquent loans back into good standing by making a series of on-time payments.

- Loan consolidation options: Consolidating your loans into a single payment can simplify your repayment process and potentially lower your monthly payment.

- Contacting your loan servicer: Reach out to your loan servicer immediately to discuss your options and explore potential solutions.

- Negotiating with creditors: In some cases, you may be able to negotiate a modified repayment plan with your lender.

Each option has specific requirements, benefits, and drawbacks. Thoroughly researching and understanding these nuances is essential before making a decision.

Conclusion

Student loan delinquency can severely damage your credit score, making it difficult to secure future loans and impacting your financial well-being. Understanding the mechanics of reporting, the stages of delinquency, and the available recovery options is crucial for proactive management. Don't let student loan delinquency ruin your financial future. Take control of your debt today by exploring your repayment options and seeking professional help if needed. Visit the official government websites for information on student loan repayment assistance programs to learn more about preventing student loan default and managing your student loan debt effectively.

Featured Posts

-

Donald And Melania Trumps Relationship A Timeline And Analysis

May 17, 2025

Donald And Melania Trumps Relationship A Timeline And Analysis

May 17, 2025 -

Jalen Brunson Unhappy About Missing Cm Punk Seth Rollins Wwe Raw Match

May 17, 2025

Jalen Brunson Unhappy About Missing Cm Punk Seth Rollins Wwe Raw Match

May 17, 2025 -

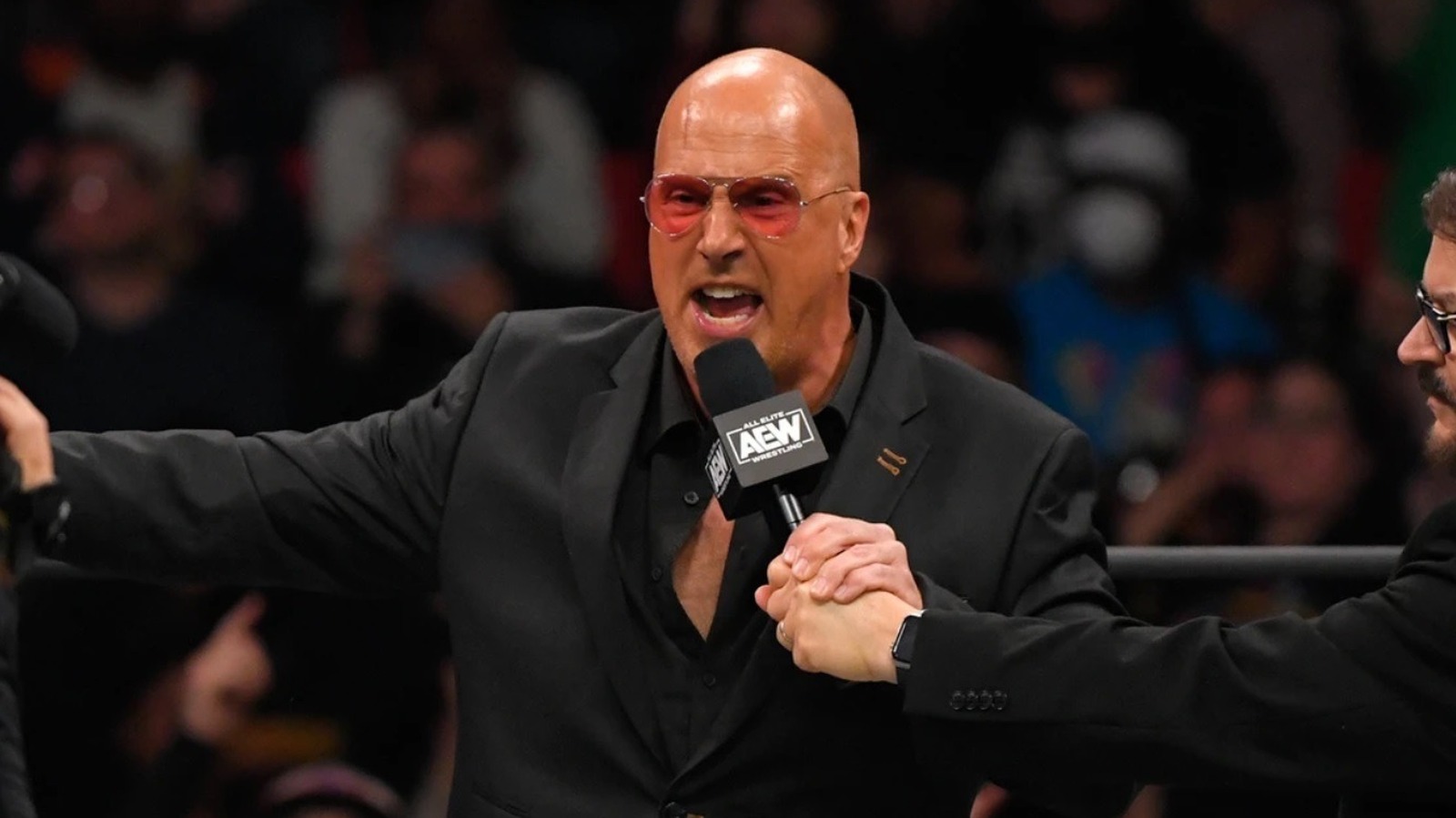

Josh Alexanders Aew Journey Don Callis Impact Wrestling And The Future

May 17, 2025

Josh Alexanders Aew Journey Don Callis Impact Wrestling And The Future

May 17, 2025 -

Understanding Reddits New Rules Restrictions On Violent Content Upvotes

May 17, 2025

Understanding Reddits New Rules Restrictions On Violent Content Upvotes

May 17, 2025 -

Los Angeles Palisades Fires A List Of Celebrities Whose Homes Were Damaged Or Destroyed

May 17, 2025

Los Angeles Palisades Fires A List Of Celebrities Whose Homes Were Damaged Or Destroyed

May 17, 2025