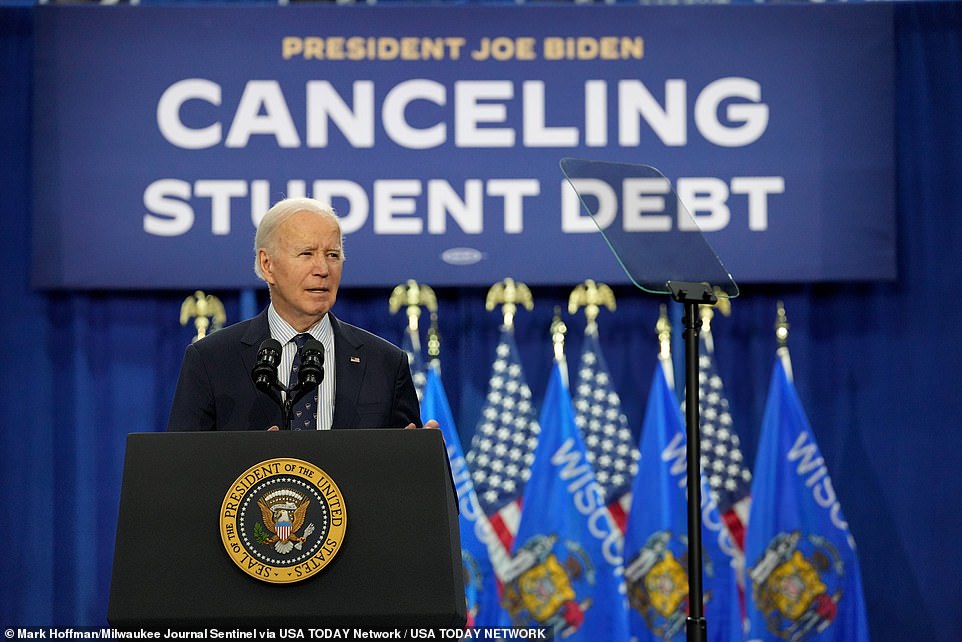

Student Loans: GOP's Proposed Changes To Pell Grants, Repayment, And More

Table of Contents

Proposed Changes to Pell Grants

The GOP's proposals regarding Pell Grants often focus on targeted reforms rather than broad expansions. This section will analyze specific suggestions, focusing on how these changes could impact student loan debt and access to higher education.

-

Increased Pell Grant eligibility requirements: Some proposals suggest increasing GPA requirements or stricter income thresholds for Pell Grant eligibility. This could reduce the number of students receiving aid, potentially exacerbating the student loan debt crisis for those excluded. Current data shows that [insert statistic on current Pell Grant recipients and demographics from a reputable source, e.g., National Center for Education Statistics]. This tightening of eligibility could disproportionately affect low-income students and first-generation college students.

-

Shifting Pell Grant funding towards specific high-demand fields of study: Proposals to direct Pell Grants towards STEM (Science, Technology, Engineering, and Mathematics) fields and skilled trades aim to address workforce shortages. However, this could leave students pursuing humanities or other fields with fewer financial resources, potentially increasing their reliance on student loans and overall student loan debt.

-

Linking Pell Grant amounts more directly to program costs: This approach could reduce funding for certain programs deemed excessively expensive, potentially forcing institutions to adjust their pricing structures. However, this could also limit access to higher education for students who require more expensive programs due to disability accommodations or other individual needs.

Student Loan Repayment Plan Reforms and Income-Driven Repayment (IDR)

The GOP has expressed concerns about the rising cost of student loan repayment and the effectiveness of current Income-Driven Repayment (IDR) plans. This section will explore proposed reforms and their potential impact on student loan borrowers.

-

Proposals to simplify or reform existing income-driven repayment plans: Simplifying IDR plans could reduce administrative burdens, but it might also lead to less tailored repayment options for individuals with varying financial circumstances. The current system, while complex, offers a degree of flexibility crucial for many borrowers.

-

Potential changes to loan forgiveness programs: Changes to loan forgiveness programs could significantly impact borrowers who rely on these options for debt relief. Reducing or eliminating such programs could lead to increased student loan debt burdens for millions of Americans. [Insert statistics on current loan forgiveness programs and their impact from a credible source].

-

Suggestions for stricter eligibility criteria for IDR plans: Stricter eligibility requirements could limit access to IDR plans for those who need them most, leading to higher default rates and increased financial strain on borrowers. This could particularly affect lower-income individuals and those in unstable employment situations.

Addressing the Underlying Cost of Higher Education

While addressing repayment is crucial, the GOP also acknowledges the need to address the root causes of high student loan debt. This section examines proposed solutions.

-

Proposals to increase transparency in college pricing and financial aid: Greater transparency could empower students to make informed decisions about college choices, potentially reducing the reliance on expensive institutions and high levels of student loan debt.

-

Potential incentives for colleges to control tuition increases: Incentivizing colleges to control tuition increases could help to curb the rising costs of higher education, reducing the need for substantial student loans. This could involve linking funding to tuition moderation or other performance-based metrics.

-

Support for vocational training and alternative pathways to employment: Promoting vocational training and alternative education pathways provides students with options beyond a four-year college degree, potentially reducing the financial burden of higher education and student loan debt.

Political and Economic Considerations

The GOP's student loan proposals must be considered within the larger political and economic landscape.

-

Impact on the national budget: The financial implications of these proposals on the national budget are significant. Changes to Pell Grants, loan forgiveness programs, and IDR plans all have substantial budgetary consequences. [Insert analysis of potential budgetary impact from a reputable source focusing on government spending and student loan programs].

-

Impact on the overall student loan debt crisis: The proposals' effect on the overall student loan debt crisis is a key consideration. Will they alleviate or exacerbate the issue?

-

Impact on the future of higher education accessibility: These proposals could significantly influence access to higher education, particularly for low-income and minority students.

Conclusion

The GOP's proposed changes to student loans represent a significant shift in the ongoing national conversation surrounding higher education financing. While the aim is often to improve efficiency and reduce the burden of student loan debt, the specifics of these proposals – regarding Pell Grants, repayment plans, and the cost of higher education – will have far-reaching consequences for students, institutions, and the economy as a whole. Understanding these proposed changes is crucial for anyone involved in, or affected by, the student loan system. Stay informed about further developments in the debate surrounding student loans and the ongoing efforts to reform student loan repayment plans. Actively engage in discussions surrounding Pell Grants and their accessibility to ensure the best possible outcomes for students.

Featured Posts

-

2024 Financial Report Publication Postponed A Valerio Therapeutics S A Update

May 17, 2025

2024 Financial Report Publication Postponed A Valerio Therapeutics S A Update

May 17, 2025 -

Comparing The Detroit Pistons And New York Knicks 2023 2024 Season Performance

May 17, 2025

Comparing The Detroit Pistons And New York Knicks 2023 2024 Season Performance

May 17, 2025 -

Find The Best Crypto Casinos In 2025 Compare Bitcoin Casinos And Claim Bonuses

May 17, 2025

Find The Best Crypto Casinos In 2025 Compare Bitcoin Casinos And Claim Bonuses

May 17, 2025 -

Assessing The Impact Jalen Brunsons Mavs Departure Compared To The Doncic Trade

May 17, 2025

Assessing The Impact Jalen Brunsons Mavs Departure Compared To The Doncic Trade

May 17, 2025 -

Alcaraz I Rune Finale Barcelone Puno Iznenadenja

May 17, 2025

Alcaraz I Rune Finale Barcelone Puno Iznenadenja

May 17, 2025